Swinging the blade for the third time, CalPERS may cut the pensions of five current and former employees of a water district serving the small town of Hayfork in Trinity County, a rugged area in the northwest part of the state with heavily forested mountains.

Trinity County Waterworks District No. 1, which wanted to negotiate an installment plan, does not intend to pay a $1.5 million CalPERS lump sum termination fee required by CalPERS, said Craig Hair, the district.manager.

A CalPERS committee was told last week that a $1.5 million bill was sent to the Trinity district in March, followed by a final collection letter earlier this month. A final demand letter will be sent soon.

CalPERS cut pensions for the first time last November, a 60 percent reduction for five former employees of Loyalton, a small northern Sierra town. In March CalPERS voted to cut the pensions of 200 employees of a disbanded job-training agency, LA Works, by 63 percent.

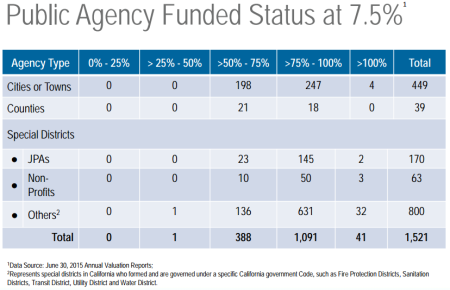

Now CalPERS wants to improve oversight and monitoring to reduce the risk of pension cuts. A staff report last week gave a broad overview of the funding status of the plans for 1,521 local employers or “public agencies.”

The latest data, as of June 30, 2015, is not current due to a two-year lag in actuarial valuations. Pension fund investment gains and losses since then are not reflected, nor is the drop in funding levels from lowering the earnings forecast from 7.5 to 7 percent last December.

The report shows the average funding level for the public agencies at 74.4 percent, well above the current 65 percent average for all CalPERS funds. But the snapshot shown in the report is not all gloom.

Two-thirds of the public agencies had 75 to 100 percent of the projected assets needed to pay future pension obligations. A surprising 41 of the public agencies, including four small cities, were more than 100 percent funded.

“Sort of what this reinforces is things look a little bit better than I think we thought — the presumptions that may have existed,” said Richard Costigan, chairman of the CalPERS finance committee.

After a decade, the California Public Employees Retirement System has not recovered from a huge investment loss during the financial crisis. It was 101 percent funded with a portfolio valued at $260 billion in 2007, before plunging to 61 percent funded with $160 billion in 2009.

CalPERS was 65 percent funded last week with a $321 billion portfolio. A bull market that began in 2009 may be nearing an end. Last year experts predicted CalPERS investments will earn 6.2 percent during the next decade, below the long-term 7 percent forecast.

Making recovery more difficult, CalPERS is a maturing pension system. Retirees are living longer and soon will outnumber active workers. Some investments must be sold to help pay pensions, cutting into earnings expected to pay nearly two-thirds of future pensions.

Because the investment fund is now much larger than the total payroll, the employer rate increases needed to replace investment losses must take a much larger bite from government budgets. (Employee rates do not increase to pay for debt or “unfunded liability.”)

Most employer rates doubled during the last decade, reaching an all-time high, and are scheduled to continue increasing for a half dozen years. The Highway Patrol rate, for example, is 54 percent of pay in the new fiscal year and projected to increase to 69 percent by 2023.

Half of CalPERS investments are in stocks and other assets at risk of major losses in a sharp economic downturn. A shift from stocks and growth investments in September reduced risk and recent gains. A long-term risk management plan will make gradual shifts over decades.

These are uneasy times for the giant pension system that covers half of all California state and local government workers. Experts have told CalPERS that dropping below 50 percent funding could be crippling, making recovery very difficult.

Public agencies only have 31 percent of the total active and retired CalPERS members, 1,856,554 last fiscal year. State workers also are 31 percent. The largest group, 38 percent, is the non-teaching employees of 1,496 school districts.

But by far, the 1,521 public agencies have the largest number of pension plans — and the widest range of funding levels, resulting in part from various workforce demographics and differences in pay and pension formulas bargained by unions.

Among other funding factors, said CalPERS, is what actuaries call “experience,” such as an unexpectedly large number of retirements. Employers joined CalPERS at different times in the past, giving their investments different histories of gains and losses.

Employers can make their annual payment in a lump sum or monthly installments. Employers also can choose to pay off their debt or unfunded liability over 30 years, 20 years, or 15 years. Other options can be discussed with the plan’s actuary.

The four cities that were fully funded two years ago do not seem to have a lot in common. Adelanto, known for having three prisons, contracts for police and firefighter services with San Bernardino County, which has its own retirement system.

Coalinga left CalPERS for two decades, then rejoined to aid recruiting and to lower costs. Orange Cove disbanded its police force in 1992, then restarted the police force in 2009. Tulelake, population 1,000, had a small reported payroll, $137,353.

The lone employer with less than 50 percent funding, the Southern Sonoma County Resource Conservation District, has a CalPERS plan with no active members and an annual unfunded liability payment of $51,801 next fiscal year.

In one of the first steps to improve oversight, the CalPERS board was told last week that audit teams looked at 59 public agency plans that have no active members, but are making their required payments to CalPERS.

CalPERS staff is expected to look in the future at another potential risk: Some of the 173 joint powers authorities and 63 non-profit agencies in CalPERS may have no taxing authority or revenue of their own.

The risk was revealed when the East San Gabriel Valley consortium, doing business as LA Works, closed after losing a large Los Angeles County job-training contract. The consortium is a joint powers authority with no revenue of its own.

The four cities that formed the consortium (Asuza, Covina, Glendora, and West Covina) declined to make a $406,345 CalPERS payment covering two fiscal years or pay a $19.4 million fee to terminate the plan and avoid pension cuts.

The 63 percent cut in the pensions of 200 former LA Works employees is scheduled to begin in July. The CalPERS board was told last week that the Trinity County Waterworks pensions may come up for action in July.

The Trinity district manager, Hair, said he is the only staff member remaining after four staff members left. Finding adequate replacements was difficult, he said, so he and three employees of his general contracting business are working for the district under a county contract.

Hair said the district does not plan to borrow $1.5 million to pay the CalPERS termination fee and avoid pension cuts. He said he thought installment payments or an alternative solution could be negotiated.

“I would never have gone down this road if we hadn’t been given misinformation,” Hair said.

If there is no solution and CalPERS cuts the pensions of the five Trinity district members, Trinity County or the district may follow the example of Loyalton and use its own funds to restore the pension cuts.

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at Calpensions.com. Posted 23 May 17

May 22, 2017 at 2:20 pm

So the headline is CalPERS may cut retirement checks for water district retirees.

As the administrator that is the course of action. The water district and apparently many other cities, counties and special districts have made the conscience decision to short their payments to CalPERS as contracted for retirement benefits offered to their employees when they were hired per contracts.

These retirees are usually not informed until a default occurs and have little recourse to get on their past employers to make good on their contract. As retirees it is assumed their contracts are expired.

It appears retirees have become so much “dirt under the fingernails” of these deadbeat employers. They know the retiree has little they can do to change the outcome.

Shame on the cities, counties and special districts who use their workers in this manner and on the attorneys who help them do this.

Shame on the unions who represented them while working for not ensuring the contract included verbiage to protect them when they retire.

It would be helpful if CalPERS put the retirees in the loop as soon as a late payment or no payment is made to allow the affected members to begin to “show up” and make their case at the very beginning.

May 22, 2017 at 5:23 pm

Greed monger unions are to blame for stacking the fall. Retirement free-loaders in the truest sense.

May 22, 2017 at 8:12 pm

Jennifer should consider the point that CalPERS specified the contributions assuming they would continue indefinitely. That was a bait-and-switch immoral act, because it promised benefits beyond the funds requested.

May 23, 2017 at 2:11 am

Jennifer leaves out an important fact: Calpers is controlled by public employees and retirees. Their unions negotiated these unsustainable benefits. Most public officials are part-time, and rely on input from staff and Unions when negotiating benefits. The pension benefits weren’t “promised” by officials. The unions used various tactics to “negotiate” overly expensive benefits using actuarial cost estimates provided by a pension fund unions control. Calpers is one of the only public pension funds in the nation whose chief actuary is on its staff. Others use INDEPENDENT actuaries to calculate costs.

May 23, 2017 at 5:27 pm

Pray tell–how does a retiree control CalPERS? IMO the most important fact that is left out of all these articles describing the financial problems of CalPERS is that a financial collapse of global proportions occurred in 2008–it was not caused by public employees nor was it foreseen in 1999 and 2001 by anyone other than those on the inside of Wall Street. Jennifer’s post is true.

May 23, 2017 at 7:04 pm

The current financial situation is a monster of CalPERS own creation (thanks for nothing Bill Crist, Gray Davis): a factor of overly-generous benefits and reckless investing. Fact is, stock downturns happen. Yet CalPERS is free from blame and equally free to demand more money. And while I certainly don’t condone what some cities and agencies are doing to their retirees, I also don’t blame them for wanting to get out of CalPERS. It’s too risky to stay in. What stops the CalPERS triumvirate of unions, the CalPERS board of directors, and majority Democrats from royally mucking things up … AGAIN?

May 23, 2017 at 8:03 pm

Water district isn’t trying hard enough. They have about 550 customers. $1.5 million financed through a bond over say 20 years works out to less than $15 per month per customer.

Headline should read, “Deadbeat water district throws employees and retirees under the bus.” It’s not that they can’t pay, they don’t want to.

May 24, 2017 at 4:44 am

CalPERSon, please explain why CalPERS failed to charge the right price for the benefits being delivered? If termination is based on 3% interest rates. why tell the taxpayers that 7.5% is used?

May 24, 2017 at 4:47 pm

@Robert Mitchell — Hair did not say the 3% is a factor in not paying the termination fee. 3% makes sense because under termination the funds have to be liquid over an unknown shorter time frame, whereas fully participating agencies can have their funds invested for the long term, allowing the 7.5% to develop.

No, the issue here is the water district is unwilling to raise their rates to pay for rightfully earned pay and benefits. It’s a utility. The rates they charge are supposed to reflect their true costs. They are using contracting out to duck out of their obligations. Ethically and morally wrong, hopefully somebody sues them.

May 25, 2017 at 4:19 pm

From the Waterwork’s last audit report: it only cost them $14,000/year when they were in PERS. Despite this affordable cost, “The District has terminated its contract with PERS effective … with the 2016-17 fiscal year… and it is the District’s intent to fully

fund the balance at that time.”

Now they are reneging on what they said at audit and are throwing employees and retirees under the bus.

It should be illegal for a utility district to walk away from their pension obligations. A utility has the power to set rates based on actual costs. The only valid reason for not paying pensions should be default or bankruptcy. Abandoning pension obligations as a discretionary business decision should be illegal.

These guys are deadbeats. Hope they get taken to court.