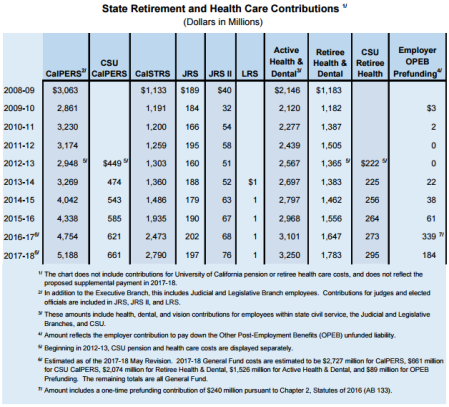

The payment to CalPERS for state worker pensions next year would double under a revised state budget proposed by Gov. Brown yesterday, going from nearly $6 billion to a total of about $12 billion.

If all goes as planned the extra $6 billion payment, borrowed from a state cash-flow fund, is estimated to save the state $11 billion over the next two decades by more rapidly paying down pension debt.

The California Public Employees Retirement System has been encouraging local governments, if they are able, to pay more than the required annual amount to save money in the long run.

About 15 percent of the local governments in CalPERS have contributed more than the required annual payment for their debt or “unfunded liability” in the last five years, a CalPERS spokeswoman, Amy Morgan, said yesterday.

As of last June, the CalPERS state worker plans only had 65 percent of the projected assets needed to pay future pensions. The debt, $59.6 billion, is mainly the result of investment earnings that were below the forecast, recently lowered from an average of 7.5 to 7 percent.

Brown had repeatedly urged the independent CalPERS board to lower its investment earnings forecast, a painful change that requires employers to increase contributions to fill the funding gap that presumably had been filled by earnings.

The governor joined with state Treasurer John Chiang, a member of the CalPERS board, in a plan to borrow $6 billion from the state Surplus Money Investment Fund, managed by the treasurer but separate from a similar local government fund.

Surplus money from numerous state funds is pooled and invested until it’s needed. To remain ready to return cash on demand, the fund said to be worth $50 billion is in short-term investments earning about 1 percent.

The $6 billion additional payment to CalPERS is expected, like other long-term pension fund investments, to earn 7 percent over the next two decades.

“Given that CalPERS has averaged an investment return of nearly 7 percent over the past 20 years, the additional interest earnings generated by the mega-payment represents a win-win for state workers and taxpayers,” Chiang said in a news release.

“For every dollar we will put in today, the unfunded liability will be reduced by $2 over the next 20 years,” he said.

State payments to CalPERS in the new fiscal year beginning July 1 are expected to be $5.8 billion, said the governor’s Finance department, growing to $9.2 billion by fiscal 2023-24. The extra $6 billion is expected to drop the payment to $8.6 billion in 2023.

If investments average 7 percent earnings and other assumptions remain unchanged, the extra $6 billion payment is expected to lower the state CalPERS contribution rate an average of 2.1 percent of pay below the current schedule.

For example, Finance said, in about five years “peak rates would drop from 38.4 percent to 35.7 percent for State Miscellaneous (non-safety) workers, and peak rates would drop from 69 percent to 63.9 percent for CHP officers.”

The $6 billion extra state payment to CalPERS potentially could be made in three or four installments next fiscal year, said a Finance fact sheet outlining the proposed supplemental pension payment.

Roughly half of the $6 billion loan, covering general fund costs, would be repaid by the Proposition 2 “rainy day” fund approved by voters in 2014 that can only be used to pay long-term debt.

The rest of the loan would be repaid by a number of state restricted special funds that can only be used for one purpose, such as transportation.

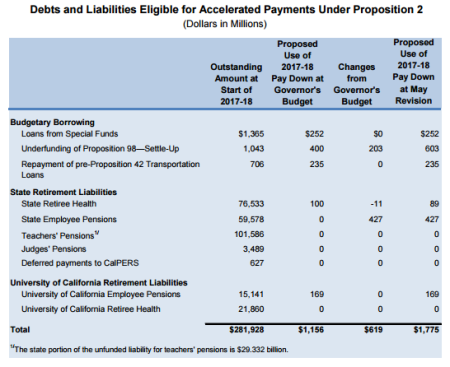

The chart shows a $427 million Proposition 2 payment to CalPERS next fiscal year for state worker pensions, the first installment. The plan is to pay off the loan as soon as possible but no later than 2030.

The Finance fact sheet also said the extra pension payment will not affect AB 55 infrastructure loans from the Surplus Money Investment Fund, which has about $50 billion in its investment portfolio.

State budgetary borrowing during the lean years is expected to be paid off in a few years, said the fact sheet, leaving “ample room” within the Proposition 2 requirement to repay the general fund portion of the extra pension payment.

Funds available to cover the cash-flow gap between tax receipts and spending during a fiscal year have been “historically high,” said the fact sheet. But if there is a severe economic downturn, the state can resume external borrowing, as happened in the past even in good years.

At a news conference yesterday, Michael Cohen, Brown’s Finance director, was asked about the risk of a large CalPERS investment loss after the state makes the $6 billion extra payment.

Quarterly payments would provide some time to react to a market change, Cohen said. But retirement systems are long-term investors with an investment strategy over 20 to 30 years.

“Yes, it’s possible that the stock market takes a nose dive in year two or three,” Cohen said. “But we have, like I say, another 17 years to make the money back.

“Compared to the cash-flow earnings that we are making now, we have a lot of margin for error. Even if they only gain 5 percent over the next 20 years, we would still be about 4 percent ahead.”

The Finance chart (above) on Proposition 2 payments shows the state has a long-term debt of $282 billion, nearly all from retirement unfunded liability.

“These retirement liabilities have grown by $51 billion in the last year alone due to poor investment returns and the adoption of more realistic assumptions about future earnings,” said the Finance revised budget proposal.

The California State Teachers Retirement System has a much larger unfunded liability, $101.6 billion, than the CalPERS state worker plans. The nonpartisan Legislative Analyst’s Office suggested last week that the Proposition 2 fund could be used to reduce the CalSTRS debt.

But the chart footnote saying the state share of the CalSTRS unfunded liability is $29.3 billion suggests Finance continues to believe most of the debt obligation remains with school districts and teachers.

The chart also shows the debt for retiree health care promised state workers, $76.5 billion, is larger than the state worker CalPERS pension debt, $59.6 billion. Similarly, the UC retiree health care debt, $21.9 billion, is greater than the UC pension debt, $15.1 billion.

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at Calpensions.com. Posted 12 May 17

May 12, 2017 at 11:41 am

A pension bond by any other name…but how can you use “cash-flow” money to make a long term loan? And, does this violate the debt limit, since the General Fund is on the hook to cover shortfalls in the state pmif?

May 12, 2017 at 2:41 pm

Jerry Brown is a thief. I have a better idea using compounding. Any pension over $60,000 gets cut to $60,000.

May 12, 2017 at 2:44 pm

Or to put Chaing’s statement another way, every dollar in current unfunded liabilities will eventually cost taxpayers 3 dollars.

May 12, 2017 at 2:49 pm

I wish Vegas would handicap Brown’s throwing more fuel on the fire. Without a lid on salaries and the maximum size of pensions, costs and pension deficits will grow, not decline.

Also, mathematicians have proven that market “volatility” will cause state and local DB plans to cost more and create large deficits. Without limits, more revenue is financial suicide.

May 12, 2017 at 6:12 pm

Quoting …….

“the extra $6 billion payment, borrowed from a state cash-flow fund, is estimated to save the state $11 billion over the next two decades by more rapidly paying down pension debt”

Isn’t the magic of the phony Public Sector accounting/assumptions wonderful ?

You see, that “savings” is the interest generated on the incremental Plan assets …. assuming the PLAN-RATE of about 7% WILL be achieved.

If the Plan can REALLY count on and expect a 7% compound annual return, why is it that the State cannot similarly invest NOW-UNNEEDED assets and generate the SAME 7% return?

What the Plan earns should be no different that what the State will earn (on unneeded money invested outside the Plan), and for every $1 MORE that the Plan will earn (from this shift in assets to the Plans) there is $1 LESS that the money will earn if left where it is (but NOT spent) to generate investment earnings.

*******************************

Not all of CA’s Taxpayers are as stupid as CA’s Politicians would like to believe.

May 14, 2017 at 5:00 pm

Smart move by Brown. Paying more in up front helps buy more time while non-PEPRA employees retire and are backfilled by new employees under PEPRA. Down the road when all employees are under PEPRA Calpers will be fully sustainable.

May 15, 2017 at 12:41 am

Balony,

Safety worker pensions remain “grossly excessive”, and with non-safety worker pensions still much better than those of the Fortune 500 companies.

There is ZERO justification for such rich pensions …. with 80% to 90% of Total Plan Costs paid NOT by the workers, but by CA’s taxpayers

May 15, 2017 at 4:18 pm

“.. with non-safety worker pensions still much better than those of the Fortune 500 companies.”

The pay is much better with Fortune 500 companies than for non-safety public workers.

It is called “deferred compensation”. Pay me now or pay me later.

May 15, 2017 at 8:05 pm

SMD,

No, for most workers in such companies there is little difference in cash pay (some more, some less) and certainly RARELY less (for those that indeed do get less) by an amount that justifies the HUGE HUGE advantage that CA Public Sector workers have in pension & benefits.

May 18, 2017 at 5:11 am

It varies by state. California, New Jersey, Illimois, Connecticut, etc., have higher pensions. But overall, nationwide, there is little difference in ,,,total compensation…for about the middle third of public workers. The lower third of public workers make about the same cash wages as the private sector, but much better benefits. The top third of public workers earn much less in wages, and pensions and benefits are not enough to compensate for the lower wages.

All the studies verifying this were done before the many pension reforms of the last 5 to 8 years.

August 20, 2017 at 11:10 pm

Jerry Brown and the gov worker unions created Collective Barging decades ago. That Caused the problem we have today. The California tax payers are getting ripped off.