New annual CalPERS reports no longer prominently display the pension debt of local governments as a percentage of pay, making it more difficult for the public to easily see the full employer pension cost.

An example of how the debt can get lost in the shuffle of the new policy happened last month when the California Public Employees Retirement System dropped its long-term earnings forecast from 7.5 percent to 7 percent.

To help fill the funding gap created by lower investment earnings, the annual rates paid to CalPERS by state and local government employers will gradually increase over the next eight years.

A California State Association of Counties report to its members about the new rate increase only included the CalPERS sample of higher employer rates for the “normal cost,” the amount paid for the pension earned during a year.

Not mentioned in the county report was the additional rate increase for the rapidly growing pension debt or “unfunded liability” from previous years, mostly caused by investment earnings (expected to pay two-thirds of future pensions) that were less than the forecast.

For many employers, the current CalPERS rate for the unfunded liability is higher than the rate for the normal cost. The need to pay down the unfunded liability, which grew to $139 billion this year, is the reason for the new round of CalPERS rate increases.

What tends to obscure or mask the debt in the new CalPERS reports is a change in the way rates are set and reported. The “normal cost” rate is still a percentage of pay. But now the unfunded liability rate is a dollar amount.

Instead of a total rate shown as a percentage of pay, a presentation to the CalPERS board last month and a CalPERS news release both showed the average rate increase for employers in two separate parts, each reported in a different way.

The average normal cost rate increase was reported in the traditional way as 1 percent to 3 percent of pay for most miscellaneous employees, 2 percent to 5 percent of pay for safety employees that include police and firefighters.

In addition, the CalPERS news release said, many employers “will see a 30 to 40 percent increase in their current unfunded accrued liability payments.” That’s the new way of reporting the pension debt using a dollar amount, not the percentage of pay.

Getting a total average rate increase by combining the two rates reported in different ways would be difficult. And with no comparison to pay, it’s not easy to see whether an unfunded liability rate shown as a dollar amount is relatively large or small.

The new CalPERS local government reports say the change was made to “address potential funding issues that could arise from a declining payroll or reduction in the number of active members,” leading to the underfunding of some of its more than 2,000 pension plans.

But a skeptic might also wonder if one of the side benefits for CalPERS, as rates paid by employers continue a decade-long rise, is less clarity about the size of the bite that pensions take from government budgets, reducing funding available for basic services.

“It’s all there,” said Wayne Davis, CalPERS public affairs chief. “We’re not trying to hide it.”

Costa Mesa is known for high CalPERS rates, a blocked attempt to outsource services, a fatal jump from the city hall roof by one of the workers facing layoffs, and a lawsuit against the police association for conspiring against two pension-reformer councilmen.

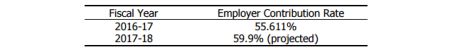

Before the change, the first page of the annual CalPERS valuation report for the Costa Mesa police plan on June 30, 2014, shows the employer contribution set for this fiscal year is 55.6 percent of pay and a projected 59.9 percent of pay next fiscal year.

The first page of the new CalPERS report for the Costa Mesa police plan as of June 30, 2015, shows an employer normal cost rate for next fiscal year of 20.2 percent of pay, an unfunded liability payment of $5.9 million, and an employee PEPRA rate of 11.5 percent.

If readers of the report didn’t know that CalPERS values transparency (see Pension and Investment Beliefs No. 8), they might suspect that the new report is intended, when given only a glance, to understate the total pension cost, while suggesting that employees pay half of it.

The PEPRA rate is paid by new employees hired after Jan. 1, 2013, when the Public Employees Pension Reform Act took effect. The rate paid by employees hired before PEPRA is 2 percent to 8 percent for miscellaneous, 7 percent to 9 percent for police and firefighters.

The decision to display only a smaller and less-alarming part of the rate in the new Costa Mesa valuation was not because the total wasn’t calculated. It’s in the report, shown as a percentage of pay. But it’s buried in the second of two small-print footnotes at the bottom of page 4.

Reporting pension costs as a percentage of pay is traditional for a reason: It makes costs easy to understand and compare. For example, the average employer contribution to the 401(k) retirement plans now common in the private sector is 3 percent of pay.

The average local government employer contribution to CalPERS for police and firefighter pension plans last year was 40 percent of pay and for the miscellaneous plans covering most employees 21 percent of pay.

Switching the rate for the unfunded liability to a dollar amount was a response to PEPRA changes that, among other things, allowed the debt payments for pooled and non-pooled plans to be “consistent” and expressed in the same way.

“This change has been discussed with employers numerous times, including the last two Educational Forums, and appears to be widely accepted by employers,” a staff report to the CalPERS board said last April.

There appears to be no reason that CalPERS, while continuing to set unfunded liability rates in dollar amounts, could not resume reporting total rates as a percentage of pay in news releases and the face pages of valuation reports, unfogging the window of transparency.

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at Calpensions.com. Posted 2 Jan 17

January 2, 2017 at 3:55 pm

The solution would be for CalPERS to provide both the costs as a percentage of pay and as a dollar amount for both the normal costs and the unfunded liability cost.

Also remember that CalPERS assumes that salaries will increase 3% to 4% per year. So when they project out the pension costs over the following 8 years as they do in the 2015 actuarial reports the government agency actually needs to place an inflation factor on salaries to determine what their costs will total down the road.

CalPERS should do that math for them so they can see the train wreck that is headed their way.

I ran the past and future pension cost numbers for the city of Santa Rosa and this is what I came up with.

http://californiapolicycenter.org/california-cities-facing-huge-pension-increases-from-calpers/

January 2, 2017 at 4:21 pm

Here in Pacific Grove, the City staff, unions and council majority favor a high discount rate because it favors pension debt creation over annual pension costs. The cash is first used for salary increases which leads to disproportionately larger pension debt. Proof? Pacific Grove had 600% higher unfunded pension liability compared to any other agency in its group.

Reducing the discount rate favors eating budget cash over creating higher pension debt, so “any” reform is questionable and will be over-come simply by raising salaries higher.

Salary reduction is the only pension reform readily available to pension reformers. If the Marin MERCA case is upheld by the Supreme court, the reform will be vitiated and then some by salary increases. But it takes a reform legislative majority, and presently there is not a single majority in all of Ca., perhaps not even a sole legislative member ready to undertake this obvious reform.

January 2, 2017 at 11:24 pm

My financial planner suggests 6 to 6.25 percent for estimating my retirement income. it is stupid to be higher than that. It forces me to save. Of course, the govt employees are the privilged and do not have to do that…save for their own retirement.

January 3, 2017 at 5:05 am

Nobody (with a brain) is fooled.

Clearly CalPERS changed he presentation to obscure the already huge and still growing … and VERY VERY VERY clearly unfair to Taxpayers …. cost of Public Sector pensions.

January 3, 2017 at 5:48 pm

The CaLPERS report to Agencies includes a “Termination Cost” that is in fact a fair estimate of the financial condition of the agency pension plan at the market(real) discount rate. It is the only estimate of the unfunded liability that is reasonable.

January 3, 2017 at 6:14 pm

I run a small business with employees that get defined benefit pensions, albeit far more modest than what public employees get. Using the older methodology of reporting pension costs (i.e. percentages) is much easier to visualize than this convoluted new CalPERS scheme. Will the deceptions never cease?

January 5, 2017 at 10:36 pm

Tough Love… the guy who thinks that famous frauds in the private sector are more honest than cops and prosecutors…

“Tough Love Says:

January 6, 2014 at 5:22 pm

QuotingSpensions…..”Milken, Madoff, Boesky, Enron, etc show the level of ethics in your chosen profession, Tough Love. Why would anyone trust a single financial assertion by anyone in the private sector?”

Oh please …….no matter how bad some wall street actors are, they don’t hold a candle to the art of thievery mastered by the Public Sector Union/politician cabal.”

January 7, 2017 at 8:10 pm

spension,

I thought you dropped off the radar in shame after your 10/24 comment with outright lies.

Lest you think that I have forgotten ………

——————————————-

“Quoting spension in a comment to Tough Love and time-stamped October 31, 2016 at 9:02 in this link …..

“As you’ve said many times, the executives deserve to lift every dollar of their worker’s pension funds if they want, because, well capitalism.”

I repeat …….. SHOW the readers exactly where I stated that.

You are a liar …. and quite a desperate one at that.”

————————————————-

FYI … I will not post this again AFTER you very clearly acknowledge that the above statement was false AND that you “lied” by making it.

January 9, 2017 at 12:20 am

Here we go again… Tough Love clearly said leaders of the private sector like Milken, Madoff, Boesky, Enron etc were better than police officers and prosecutors. QED.

January 9, 2017 at 2:21 am

Quoting spension in a comment to Tough Love and time-stamped October 31, 2016 at 9:02 in this link …..

“As you’ve said many times, the executives deserve to lift every dollar of their worker’s pension funds if they want, because, well capitalism.”

I repeat …….. SHOW the readers exactly where I stated that.

You are a liar …. and quite a pathetic one at that.”

————————————————-

FYI … I will not post this again AFTER you very clearly acknowledge that the above statement was false AND that you “lied” by making it.

January 9, 2017 at 2:46 am

spension ……….. you never cease to amaze me in how you twist words and lie.

Just above you stated………

———————————

“Tough Love clearly said leaders of the private sector like Milken, Madoff, Boesky, Enron etc were better than police officers and prosecutors. QED.”

———————————-

Really, what’s wrong with your head?

The exact exchange of comments was in a comment exchange between you and I at THIS link:

and time-stamped January 6, 2014 at 5:22PM

as foillows:

You stated ……………. ”Milken, Madoff, Boesky, Enron, etc show the level of ethics in your chosen profession, Tough Love. Why would anyone trust a single financial assertion by anyone in the private sector?”

I responded ……… “Oh please …….no matter how bad some wall street actors are, they don’t hold a candle to the art of thievery mastered by the Public Sector Union/politician cabal.”

——————————————-

How does my response above get twisted into what you claimed I stated?

What’s wrong with your head ?”

===============================================

===============================================

Ed Mendel,

I realize that a wide birth need be given commentary in online blogs such as this, but when one repeatedly libels and defames posters with outright lies the blog-owner/administrator must consider if it appropriate to continue to allow it.

Do you condone the continued posting of such lies?

January 9, 2017 at 3:07 am

January 9, 2017 at 3:19 am

Tough Love, your lies, libel, and insults are the only reasons I began posting on this and other sites years ago, and continue to do so.

Sad as it is, you are, as far as the internet is concerned, my raison d’être.

Okay, maybe you share that “honor” with SurfPuppy and his alter egos.

January 9, 2017 at 6:41 am

And it’s “berth”.

Just sayin’.

January 9, 2017 at 7:19 am

SMD,

No, I do not knowingly make false statements and, as spension does, make assertions that I stated very specific things that I clearly did not say.

Much of my own commentary is “opinion” or mathematical demonstrations that require assumptions (always subject to disagreement). No one gets everything 100% complete or correct, but that’s way different than the outright lying that spension is guilty of.

———————————————————-

Spension has stated just above that I stated:

““Tough Love clearly said leaders of the private sector like Milken, Madoff, Boesky, Enron etc were better than police officers and prosecutors. ”

And in another comment stated that I stated:

““As you’ve said many times, the executives deserve to lift every dollar of their worker’s pension funds if they want, because, well capitalism.”

BOTH are clear and specific assertions and outright lies. I have and will continue to call him out on those lies until he admits he lied.

If he didn’t, it would be quite easy to prove otherwise …. just link us to the commentary where I made those statements.

=================================

=================================

Mr. Mendel,

Even in a blog-setting, outright (libelous and slanderous) lying should not be tolerated. If spension cannot provide links to where I made such statements, he should (without satisfactory exculpatory explanation) be barred from commenting on this blog (both under the name spension or under any other name coming from the IP address(s) that he/she now uses).

January 9, 2017 at 11:10 am

Tough Love; often in error, never in doubt.

Your math is based on assumptions…. even when actual verifiable data is easily available. And your assumptions are wrong. Remember the New Jersey teamsters?

Your opinions are based on assumptions. Also often greatly exaggerated or completely incorrect.

Por ejemplo

How many times did you claim that SB400 was “50% added benefits” before you were caught and tried to weasel out of it?

More importantly, how many times after you knew, did you knowingly repeat that “false statement”?

(Okay, you’re certainly not alone in that misstatement.)

And why do you still continually claim that public and private sector workers have “(on average) near equal cash pay in comparable jobs…”, when every major study says that ain’t so?

Spension is fine. We want to hear what he or she has to contribute. You do more damage to your own credibility than Spension ever has. Ban your own self.

January 9, 2017 at 5:37 pm

Or should I say, ban your own self… again?

January 9, 2017 at 5:38 pm

SMD,

I have made comments comparing Private Sector pensions to Public Sector pensions that were not accurate for Multi-employer Union private sector pensions. I acknowledged that error pointing out that when I speak of Private Sector pensions, I am referring to Corporate single-employer pensions. If If forgot to point that out in every future comment, consider yourself notified that I am talking about single-employer Private Sector pensions.

Virtually all math associated with pension funding relies on assumptions. No amount of verifiable data will change that.

I have never made that statement that the pension increase via CA’s SB400 was 50% across the Board. I recall THAT being an argument between you and SurfPuppy. I have frequently pointed out the outrageousness of SB400’s RETROACTIVE application to PAST service credits, something you shy away from because there was no reasonable justification to implement it that way.

I have stated that public and private sector workers have “(on average) near equal cash pay in comparable jobs”. I should take a look at the most recent studies to see the latest relationships.

Since you point that out, how come YOU often point to lower Public Sector “cash pay” in responses to comments pointing out the FAR greater Public Sector “Total Compensation” (pay + benefits + pensions) in a manner that such explains-away the latter …. when you clearly know that the far greater Public Sector Total Compensation INCORPORATES the impact of the lower Public Sector cash pay? Clearly you are trying to mislead the readers when you do so.

Why do you wave-off study results that conclude that the value of the far greater Public Sector job security is worth about 10% of pay? Many in the Private Sector suffer INVOLUNTARY termination/layoff periods totaling 1 year per decade, when such involuntary termination is far far rarer in the Public Sector. ….. even for the demonstrably incompetent.

And why you have zero effective response to the patently ludicrous total Compensation granted CA’s Safety workers, you (while being a retired light-bulb changer, not a safety worker) can offer no answer excepting … what’s a Cop worth?.

—————————————–

spension’s comments that make false derogatory blanket statements that some said “xxx” when they did not …… are not “fine”……… nor should they be allowed.

January 9, 2017 at 8:20 pm

Hole e carp!

That’s exactly what I meant by “weasel”.

Posted by Tough Love on November 25, 2015 at 1:35 pm (Burypensions)

dot, dot, dot

“Just more BS because the workers at those PRIVATE firms do not OVERCOMPENSATE their workers …. and those PRIVATE-Firm-workers that build our roads and firetrucks most definitely do NOT get Defined Benefit Pensions (of ANY type, let alone the grossly excessive ones routinely granted ALL “PUBLIC” Sector workers), employer-subsidized retiree healthcare, or “Platinum+” healthcare coverage while “active”.

……………………

Not a general statement on private pensions… Very specific, and incorrect.

Just a little research would have shown that those workers do make as much or more than equivalent public workers and most definitely do have defined benefit pensions.

——————————————–

Tough Love 21 September, 2012, 10:19 (calwatchdog)

Mark, Another perspective on SB400:

When CalPERS stated that the SB400 increases would not cost anything, those with a modicum of common sense knew how absurd that statement was.

OF COURSE, the 50% added benefits had a “cost”, it’s just that they were projecting that (with great self-interest) investment returns would cover that cost.

Weasel.

“those with a modicum of common sense” see nothing but “50% added benefits”.

not that those benefits applied to only a very specific subset of retirees: safety workers who actually retire AT age 50.

Often in error, never in doubt.

January 9, 2017 at 11:29 pm

SMD,

You are simply bringing up what I ALREADY pointed out above …. that my comments relating to PRIVATE Sector pensions were NOT meant to include Multi-employeer Unions Plans, only single-employer Corporate Plans. My “error” is limited to not making that clearer when I made that comment.

While I know a great deal about single-employer Corporate Plans (and have thoroughly educated myself about Public Sector Plans after realizing how ludicrously generous and hence costly they are), I do not know a great deal about Multi-employer Union Plans ….. other than on apples-to-apples basis (taking into account not just the formula, but the generosity of Plan provisions as well) , they are far less generous that Public Sector Plans.

——————————-

SMD,

If you can, SHOW ME where I stated that SB400 was a 50% across the board increase applicable to everyone. In fact, I seem to recall commentating the YOU were correct (as amazing as that seems) when SurfPuppy was insisting that it was an across the board increase. How convenient of you to forget that.

January 9, 2017 at 11:47 pm

SMD, Following up to my above response to you ……

Google is so cool ! With a very few strokes I was able to find my comment to you that you were correct ……. although “SurfPuppy” was using the handle “Rex the Wonder Dog” at that time.

You can find it at this link:

http://californiapolicycenter.org/calpers-created-ticking-time-bomb/

And here is my full comment …

” Tough Love says:

November 30, 2015 at 4:34 PM

SMD, You are correct, and few seem to understand that the 2%@50 formula was not really “fixed” at 2%, but with the 2% rising if you retied older (than 50) or stayed longer (than 20 years). That being said, CA’s making these pension changes “retroactive” (i.e., applicable to PAST service) was an unconscionable THEFT of Private Sector Taxpayer wealth.

And the reaction of Taxpayers must be to refuse to pay for it.”

================================

You see I DON’T lie (not that I never make an error).

spension clearly does

January 10, 2017 at 1:42 am