A bill by state Sen. Steven Glazer, D-Orinda, giving new state workers the option new University of California workers received two years ago, a 401(k)-style plan rather than a pension, is opposed by unions and soon may be opposed by CalPERS.

More than a third of eligible new UC employees have chosen a 401(k)-style plan. Instead of a guaranteed lifetime monthly pension check, the 401(k) plan that replaced pensions in most of the private sector uses individual tax-deferred investments to build a retirement fund.

A 401(k) plan avoids pension debt, now a soaring cost for many governments. Employers only make a “defined contribution” to the retirement fund of an active employee. As critics point out, the risk of investment loss is shifted from the employer to the employee.

But as the UC example seems to show many employees, apparently not planning a full government career, prefer a portable investment plan they can control and take with them to a new job.

“This pension reform idea would be good for employees and provide a more stable fiscal foundation for the state,” Glazer said in a news release. “This new retirement plan would be especially attractive to millennials who do not intend to work for the state their entire lives.”

Orinda and two other cities in Glazer’s district, Lafayette and Danville, are among the few California cities that give employees 401(k)-style retirement plans, not pensions. The cities get police and fire services from the Contra Costa County Sheriff and fire districts.

“Most employees do not spend their entire career in state employment,” Glazer’s news release said. “Younger employees who work as long as 15 years for the state would likely be better off with their own retirement plan.”

Pension systems usually have a “break-even point,” the years of service needed before employee contributions begin to earn pension benefits that exceed the value of the same amount of money invested in an idealized 401(k) plan.

Two studies found different “break-even points” for CalSTRS, which has a back-loaded formula that increases pension amounts as teachers near retirement age. For teachers starting at age 25, an Urban Institute study said it was 24 years, a UC Berkeley study 20 years.

The first committee hearing on Glazer’s bill, SB 1149, originally scheduled for today, has been reset for April 23. More than a dozen unions have filed letters of opposition with the Senate Public Employment and Retirement Committee.

Many of the union opposition letters mention the shift of investment risk to employees, potential problems created by a five-year vesting period and a 401(k) employer contribution limited to the pension normal cost, and questions about investment fees and management.

One of the letters mentions a common worry among public pension supporters. Some reformers want to shift government employees to 401(k) plans, following the trend among private-sector businesses that eliminates pension debt.

A California Faculty Association letter said the bill “would promote 401(k)-style retirement plans over more state-run pension plans” and would set a “dangerous precedent” by allowing state employees to opt out of CalPERS.

“This legislation raises very strong concerns as it would weaken CalPERS by allowing individuals to opt-out and take state contributions out of the system,” said the faculty association letter.

When the CalPERS board was told last month that the staff was analyzing the Glazer bill, board member Theresa Taylor said: “It’s my understanding that as we pull employees out into another fund essentially what you are doing is weakening the pension fund.”

Taylor said she assumed that after the analysis CalPERS would be opposed to the Glazer bill. Mary Ann Ashley, CalPERS legislative affairs chief, briefly nodded her head in agreement.

“OK, that’s what I thought,” said Taylor.

Gov. Brown ran into a similar labor-CalPERS roadblock on a major cost-saver in his 12-point pension reform, a federal-style “hybrid” plan that combines a much smaller pension with a 401(k)-style plan.

“As a matter of fact when I read the PERS analysis they say if you close the system of defined benefit (pensions) and don’t let any more people in, then the system would become shaky,” Brown told a legislative hearing in 2011.

“Well, that tells you you’ve got a Ponzi scheme,” the governor said.

“Because if you have to keep bringing in new members then the current system itself is not in a sustainable position,” he said. “So I don’t accept that, and we don’t need to close it off, anyway. But we do have to make sure that this system is sustainable over the long term.”

In a Ponzi investment fraud, made famous by convicted Wall Street swindler Bernie Madoff, money used to pay investors returns on their accounts comes not from earnings but from new investors.

Passage of the rest of Brown’s pension reform led to the UC 401(k) option. The governor wanted a cap on UC pensions similar to the one his pension reform imposed on state and local government hired after Jan. 1, 2013, under his Public Employees Pension Reform Act.

UC officials said pensions aid in recruiting top talent, particularly when competing with private universities that offer higher salaries but a 401(k) plan. A UC task force proposed that a 401(k) plan supplement capped pensions and also be offered to new hires as a pension alternative.

Weakening the UC pension plan by diverting new members apparently was not an issue. A number of unions agreed to the 401(k) option, including 11,000 clerical workers represented by the Teamsters.

On leaving state government, employees can get a refund of their CalPERS contributions with interest or leave their money with CalPERS and collect a pension when they retire.

Glazer’s bill is more generous, giving a departing 401(k) member their contribution plus the matching employer contribution, with investment gains. The employee contribution is the same as the pension contribution for those under PEPRA.

The employer contribution is the same as would have been contributed for the pension “normal cost” if the employee did not have a 401(k). The “normal cost” presumably covers the cost of a pension earned during a year.

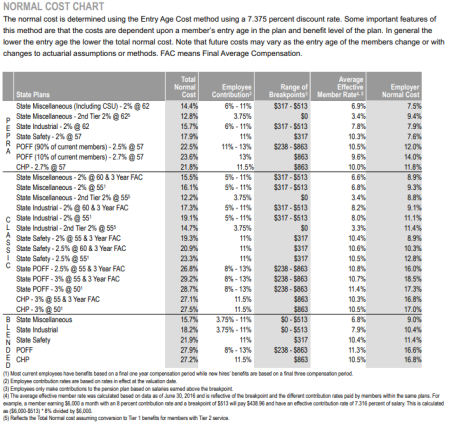

For “miscellaneous” state workers, the current average PEPRA employee rate is 6.9 percent of pay and the employer normal cost contribution is 7.5 percent (see CalPERS chart below). Private-sector employer 401(k) contributions have been averaging about 4.5 percent.

The “unfunded liability” payment, often higher than the normal cost, is only paid by the employer. It covers debt from previous years, mostly due to below-target investment earnings or a change in actuarial assumptions such as lowering the earnings forecast.

State workers have had retirement plan choices in the past. A cost-cutting measure in 2004 to help pay off a never-issued pension bond proposed by former Gov. Arnold Schwarzenegger put the first two years of employee contributions into a 401(k)-style plan.

When the Alternate Retirement Program ended last Oct. 31, only 915 of the 57,405 participants had chosen to put the contributions into a Savings Plus Program 401(k), a supplemental program for state workers, said Amy Morgan, a CalPERS spokeswoman.

Most employees chose to put their contributions into their CalPERS pensions. But 40 percent (22,934) made no choice and their contributions defaulted into a Savings Plus 401(k) or 401(a). They have the option of purchasing two years of service credit for their pensions.

In 1984 legislation by former Assemblyman Dave Elder, D-Long Beach, gave most state workers the option of switching to a lower-paying pension that did not require an employee contribution, then 5 percent of pay.

“CalPERS found that 47 percent of new workers from 1984 to 1988 chose the lower pension tier, which did not require any payroll deductions from employees,” a Little Hoover Commision report said in 2011.

The optional lower pension formula “1.25 at 65” (1.25 percent of final pay for each year served at age 65), down from the previous “2 at 60,” was given to all new hires during a state budget crunch in 1991.

A massive CalPERS-sponsored pension increase during a high-tech stock market boom, SB 400 in 1999, gave most state workers a “2 at 55” pension. Now the PEPRA pension for new non-safety state employees is “2 at 62.”

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at Calpensions.com. Posted 9 Apr 18

April 9, 2018 at 2:28 am

Good idea.

At my suggestion, all the way back in 1979, San Diego gave employees a deferred comp program with a dollar for dollar match in exchange for leaving Social Security.

The Feds saw the danger to their Ponzi scheme and quickly passed a law forbidding such in the future.

In addition, we discontinued 2 percent COLA’s in favor of 13th check calculated by splitting income OVER predicted ROI, fifty fifty between retirees and the corpus of the fund.

In many cases that 13th exceeded their entire twelve months of benefits checks.

By pointing out then getting rid of all the moochers, including the city itself, all of which had been sucking the systems dry like a bunch of ticks, we were able to come close to full funding.

SDCERS would now be so were it not for Toni Adkins, who feathered her career by raiding SDCERS for her labor buddies thus securing her career at the expense of the people of San Diego.

That is exactly what happened AFTER Prop 20 became effective.

The state and local retirement systems starting accumulating so much money that greed took over and various politicians followed Adkins example and started augmenting retirement benefits that were not actuarially sound.

April 9, 2018 at 7:04 am

CALPERS needs to keep DEFINED BENEFITS to keep their jobs !

We’re constantly trying to put band aids over the wound, but the only way to heal the wound is to change Defined Benefits to Defined Contributions, like the rest of the world.

Since the public pension system is severely underfunded, city governments need to fund the retirements of former employees by taking money from government services as the increasing pension costs will likely continue to crowd out resources that otherwise would go to public assistance, recreation, libraries, health, public works, and in some cases public safety. Benefit costs are slowly crowding out the discretionary money available for states, districts, and schools to spend on other priorities.

“Defined retirement benefits” are creeping into budgets, especially when those benefits are underfunded. The unintended consequences are that it’s unfortunate that future generations, unable to vote today, will bear the costs of many enacted pension programs, entitlements and boondoggle projects, requiring the younger generations to pay higher taxes and work later into their lives to pay for these promises.

The international business world is intelligent enough to know that DEFINED BENEFITS, neither capped nor precisely quantifiable in advance financial disasters to any business, thus all businesses focus on the known, i.e., defined CONTRIBUTIONS alone.

Stealing from the young who have no votes, but silently shoulder the costs and bear the burden of unfunded promises of these programs to enrich the old seems to describe the Governments expansion of entitlement benefits and other government services, along with the taxes young people will have to pay to support them, mostly to subsidize older Americans.

Even before those young folks can vote, our Golden State schools are on track to force substantial budgetary cutbacks on core education spending, as public schools around California are bracing for a crisis driven by skyrocketing worker pension costs that are expected to force districts to divert billions of dollars away from education and other government services.

April 9, 2018 at 8:38 am

Letting folks opt into a 401k plan is a really a great idea.

CalPERS was created to be a servicing company for pension systems but has unfortunately morphed into an advocate for higher pension formulas based on their shoddy actuarial work which promised taxpayers that going to 3% at 50 years of age under SB400 would not cost taxpayers a dime. They were right about that, it is costing taxpayers billions of dollars every year.

And then they took their show on the road and convinced cities and counties they could also increase pensions with no significant increase in pension costs. Pension costs have more than tripled since then and now we can see in CalPERS own actuarial reports on line that pension costs for all their agencies are going to double over the next 7 years. This will of course cause huge cuts in services taxpayers deserve for their tax dollars.

CalPERS needs to be eliminated and pension funds need to be run by a board of directors that is not made up of pension recipients as is required for private sector pension funds under ERISA.

Enough of this Ponzi scheme.

April 9, 2018 at 9:00 am

This bill is a Trojan Horse! Public employees who leave service before or after vesting will receive a refund of their own DB contributions, which they can then take with them.

April 9, 2018 at 9:49 am

Ponzi Scheme is exactly right! If public employees don’t recognize that there is a very real possibility that CalPERS will go bust along with CalSTRS, then they need to wake up and smell the coffee. I would rather take my chances with a 401K that is MINE and I have control over than relying on CalPERS to manage my future. I’m sure many public employees can see that when the music stops they won’t have seat at the retirement table. Those who are pushing for the status quo are surely planning to retire sooner than later and ride off into the sunset while destroying the futures of new people who mistakenly join the system (scheme) late in the game.

April 9, 2018 at 10:44 am

CalPERS was founded in the early 30’s David Wren, and it is not going anywhere! Nothing could start killing it off sooner than allowing eligible employees to opt out in favor of DC plans only. Most public entities already offer DC plans to their employees to supplement the DB plans. If you were on a DC plan only, would you defer an amount out of your own paycheck that would provide you one to two million dollars when you retire? I personally saved $600/mo in my own 457 Plan–it supplements my CalPERS pension–it buys the groceries and pays some utility bills, but I could not sustain on it alone. Let’s not throw the baby out with the bath water!

April 9, 2018 at 11:26 am

SeeSaw. Given the state of funding for your plan, you must be one of the people who will retire before the music stops. Also, the idea that I must pay for your unfunded retirement with money that should be going to my self-funded retirement is hard to take. You have a guarantee that I will pay for the mismanagement of CalPERS. I didn’t make the deal, so I am unfortunately among many people being chased out of this beautiful s***hole. It’s not fair.

April 9, 2018 at 11:30 am

there is only one difference between “defined contribution” and defined benefit. That being when the companies that have taken your money from a 401 or 457 defied contribution ponzi, decide to keep your money, they declare bankruptcy or simply close shop. You loose they win. In the defined benefit retirement program, the business must continue to be profitable and continue to hire employees so they continue to pay into retirement program fund.

Defined benefit = good for workers

Defined contribution = good for banks/stock shysters

April 9, 2018 at 12:20 pm

I do not know of a single DB city or county that will reduce pensions after the Ca. supreme court reaffirms that pension plans that are financially under water may reduce pensions w/o off-sets. The Allen case that required off-sets for any reduction was a case where the Kern court had found that a city charter provision had created “vested” pension rights and both Kern and Allen said that the case was specifically NOT one where the city claimed financial hardship that endangered the plan, so off-sets were required for any reduction in benefits.

In Allen, citing Kern, the court said:”An employee’s VESTED contractual pension rights may be modified prior to retirement for the purpose of keeping a pension system flexible to permit adjustments in accord with changing conditions and at the same time maintain the integrity of the system.”

The Allen court then went on to add: “…there is no evidence or claim that the (illegal) changes enacted bear any material relation to the integrity of the system or successful operation of the pension system..(citing Kern)” So off-sets were required.

The state brief in the Marin case made the same point that I just made. And it researched the rule prior to adopting PEPRA which explicitly repealed certain vested rights.

BTW, in the Marin case now before the supreme court, everyone “assumed” that the CERCLA employees had “vested” contractual pension rights. No one raised the issue(how convenient) and in fact there is no evidence that the Marin BOS intended to grant “vested” contractual pension rights when it created the pension system. Whether a city or count has granted “vested” contractual pension rights is for each and every city to decide(Ca. constitution). This type of legislation by legal malpractice is simply maddening, but goes on all of the time, as does the agency practice of not raising issues favorable to taxpayers and losing cases on purpose. Examples of such practices are Pacific Grove, the counties of Marin and Sonoma and many of their cities and agencies(and many other agencies).

April 9, 2018 at 2:42 pm

Ive been retired for ten years, David Wren. Whatever you sell or whatever service you provide for a living, keep in mind that there are public employees in the mix who are buying whatver you sell with the money they earned serving you!

April 9, 2018 at 4:51 pm

SeeSaw,

Would the spending in circulation be less if say 1/2 of your pension (the 1/2 which was never necessary, reasonable, just, fair to Taxpayers, or affordable) had never been granted, and the dollars saved by taxpayers (by NOT having to pay for that 1/2 share) were instead spent by THOSE taxpayers ?

April 9, 2018 at 5:04 pm

The current state setup is, effectively, a “hybrid” system with a bias toward the traditional pension. Unless somebody works 40+ years for the state, retiring after 65, they won’t get a full pension, and few people these days do that – either they start working for the state too late are they leave before accumulating enough service credit. Even if they do work long enough, it’s likely that their pension won’t be enough in the long run – up to 2% COLA doesn’t work if inflation (as is likely, historically) is more than that. State employees can use the Savings Plus 401K to try to build a fund to supplement their pension. For those hired since the formula was reduced, they really need that supplement. For those with the old pension, they’ll need it, too, for some inflation protection.

April 9, 2018 at 5:59 pm

MikeB,

This Blog centers upon CA pensions.and CA pensions are a GREAT DEAL more generous than you are suggesting.

The richest of course are those of Safety workers (mainly Police & Fire) with a COLA-increased 90% of final pay pension after only 30 years, and they USUALLY retire in their early-mid 50s.

That makes their pension just about 6 TIMES (yes, 6 TIMES) greater in value-upon-retirement than those typically granted Private Sector workers who retire at the SAME age, with the SAME pay, and the SAME years of service. Did you think a 90% of pay COLA-increased pension starting in the early-mid 50s with ZERO reduction for being able to begin collecting it at such a young age comes cheap?

Of course it a bit less rich for CA’s non-safety employees (who can often begin collecting an unreduced pension at 55 or 60). Their full-career pensions “only” have a value upon retirement that is TYPICALLY 4 TIMES greater than those typically granted Private Sector workers who retire at the SAME age, with the SAME pay, and the SAME years of service.

—————————————-

I’m guessing from your comment that you are a Public Sector worker or retiree trying to make such pensions appear far less generous than they really are.

They are in fact LUDICROUSLY excessive by every and any reasonable metric.

April 9, 2018 at 9:56 pm

More moot math.

It is invalid to compare pensions outside the context of total compensation.

Don’t be invalid.

As it is now, so has it always been.

Lower educated, low skilled public workers earn more than equivalent private sector workers, primarily due to their pensions and retiree healthcare.

More highly educated, professional public workers, even with their higher pensions, earn much less than private sector equivalents.

Between these two extremes are thousands of public workers who, even with their higher pensions and benefits, earn total compensation roughly equal to the private sector.

It is common knowledge, verified by the BLS, that public workers receive a higher percentage of their compensation as pensions and benefits, rather than wages.

Your math is a weak attempt to make public compensation appear higher than it is.

April 10, 2018 at 12:33 am

S Moderation Douglas,

This is a California Blog, and per the AEI Study, in CA, (for all NON-Safety workers taken together*) Public Sector workers have a 23% of pay “Total Compensation” (wages + pensions + benefits) ADVANTAGE ….. and assuredly even higher if Safety workers with far higher than average pay and the richest pensions had not been excluded from the AEI Study.

* while the split of workers by income group is interesting, what FINANCIALLY IMPACTS the Taxpayers is the net Public/Private Sector Total Compensation differential …………….FROM ALL WORKERS TAKEN TOGETHER.

Dear Taxpayers ……….. how much MORE would YOU have for YOUR retirement needs if YOU had an additional 23% of pay to save and invest in every year of YOUR career……$500K, $1 Million, perhaps $2 Million for some ?

Well THAT is a valid estimate of how much Taxpayers are unnecessarily and unjustly OVER-COMPENSATING each and every full-career CA Public Sector worker.

April 10, 2018 at 12:40 am

S Moderation Douglas,

Take a look at this new OCRegister article Titled ……… Split roll proposal isn’t about schools or communities. It’s about pensions.

Are THEY lying too? Or perhaps is it you ?

April 10, 2018 at 1:00 am

“LUDICROUSLY excessive” is excessively LUDICROUS.

One of the most conservative studies confirms that, in nationwide data, those public workers with advanced degrees earn 18-20 percent less than the private sector. Even when the value of pensions and benefits are included. Those with Bachelor’s and Masters degrees earn roughly equal total compensation.

That is 60 percent of the public sector workers; either “roughly equal” with, or paid less than the private sector.

Not overpaid. Not greedy. Certainly not LUDICROUSLY excessive.

Quoting Juvenal 451…

”…you are just wrong about the comparison of public sector and private sector total compensation (except at the level which requires no education–sorry for giving them benefits other than Medi-Cal).) ”

April 10, 2018 at 7:51 am

The correct calculation for the cost of public employment must include unfunded pension and medical ins. deficits. In a few years that expense will exceed base salaries.

April 10, 2018 at 9:04 am

S Moderation Douglas,

See, there you go again……………

You KNOW that it’s the Public/Private Sector “Total Compensation” (wages + pensions + benefits) differential …..FROM ALL WORKERS TAKEN TOGETHER AS A GROUP ….. that financially impacts the Taxpayers.

But because you have NO ANSWER to the HUGE (23% of pay) Public Sector Total Compensation ADVANTAGE in CA, you repeatedly divert the discussion to comparisons by income-level “segment”. While interesting information, from the FINANCIAL IMPACT standpoint to Taxpayers ONLY the net differential from ALL WORKER TAKEN TOGETHER matters.

April 10, 2018 at 10:17 am

Everyone mathematical knows that DC plans are way, way more costly than DB pensions. The reason is that DB pensions eliminate longevity risk by pooling. In a DC plan, everyone must save enough for the chance they survive well into their 90’s. In a DB plan, the law of large numbers guarantees that not everyone will survive into their 90’s.

DC Plans are well known to be terribly corrupt… the investment industry uses them as a piggy bank for lifting of fees. See https://www.nytimes.com/2014/02/02/business/a-long-fight-to-get-what-was-theirs-in-a-401-k.html … Shankar Iyer, said “I got most of my money but I lost quite a bit,” Mr. Iyer said. “It is interesting to note that the fees I ended up paying exceed what Penn Specialty Chemicals contributed on my account. I have learned never to trust a 401(k).”

The “father of the 401(k)”, Ted Benna, said:

“I helped open the door for Wall Street to make even more money than they were already making,” Benna told The Wall Street Journal. “That is one thing I do regret.”

https://www.csmonitor.com/Business/2017/0104/Why-Father-of-the-401-k-says-he-regrets-pushing-the-retirement-plan

The problem with public DB plans has been bad math committed by the men who got all manly, competitive, and fought for every-higher payouts. Mostly these men are safety employees… they base their hunger for more payout on US military pensions, which allow a DB pension at… age 37! And the US military pension system is $913.6 billion behind on its obligations… page 22 of :

Click to access FY2017_MRF_AFR_Final.pdf

None of the DB-bashers every utter a peep about the horrible debt of the US military pension system… they are wussies.

Retirement benefits for actual public school teachers in California aren’t much different than comps in the private sector.. detailed in Figure 6C of the http://www.stoputla.com/collateral/FixPensions_Chapter_1.pdf .

Everyone knows that there was a coordinated effort by executives in the private sector to grab rank-and-file pension funds and take the assets… all documented by Pulitzer Prize winner Ellen E. Schultz in:

http://www.retirementheist.com. That corruption is why retirement benefits in the private sector have become so low.

April 10, 2018 at 10:37 am

Spension,

While DB pension can work in the PRIVATE Sector because on one side of the bargaining table is ownership/management truly looking out to protect the Company’s best interests.D

DB Plan CANNOT work in the PUBLIC Sector because NOBODY at the bargaining table is looking out for the best interests of the Taxpayers. The Unions and Elected Officials COLLUDE to grant Public Sector pensions that are ALWAYS MULTIPLES greater in “value upon retirement” than those typically granted comparable Private Sector workers who retire at the SAME age, with the SAME wages, and the SAME years of service …… and leaving the betrayed and beleaguered Taxpayers to pay for it.

April 10, 2018 at 12:09 pm

TL… as to your first point, the demise of the DB system in the private sector proves you aren’t right. Management in the private sector has simply proven itself to be solely interested in draining the rank and file’s pension funds, and proven in http://www.retirementheist.com. It is corruption by the captains of the private sector that is the true source of taxpayer anxiety.

As for the public sector… what Union is it that is responsible for the $913.6 billion debt in US military pension system? You are afraid to answer that. I think you are saying that the US military is corrupt.

April 10, 2018 at 12:17 pm

Quoting spension…………

“As for the public sector… what Union is it that is responsible for the $913.6 billion debt in US military pension system? You are afraid to answer that. I think you are saying that the US military is corrupt.”

That’s called ignoring the point, which is ………….

“DB Plan CANNOT work in the PUBLIC Sector because NOBODY at the bargaining table is looking out for the best interests of the Taxpayers. The Unions and Elected Officials COLLUDE to grant Public Sector pensions that are ALWAYS MULTIPLES greater in “value upon retirement” than those typically granted comparable Private Sector workers who retire at the SAME age, with the SAME wages, and the SAME years of service …… and leaving the betrayed and beleaguered Taxpayers to pay for it.”

April 10, 2018 at 2:42 pm

Yes, TL, your failure to identify which Union or which Elected Officials are responsible for the $913.6 billion military pension debt is called ignoring the point.

April 10, 2018 at 3:15 pm

spension ………..

I never raised any question or discussion of Military pensions, you did.

I just pointed out WHY DB Plan can work in the PRIVATE Sector but DON’T WORK in the PUBLIC Sector.

If you don’t want to comment on that, that’s fine, but changing the subject to Military pensions (because that’s one of you pet peeves), and chiding me not not being drawn into YOUR preferred discussion is ridiculous. Grow up.

April 10, 2018 at 3:52 pm

Uh… your emotional hysterics again… you say “DB Plan CANNOT work in the PUBLIC Sector”…. military pensions are a *subset* of the PUBLIC sector. So when you say “I never raised any question or discussion of Military pensions,” it is another one of your porkpies. Or maybe you are just illogical like most men.

More logic… when you say “WHY DB Plan can work in the PRIVATE Sector “… you are the one who points out that the Private sector has gone largely to DC plans.

April 10, 2018 at 4:09 pm

Spension,

Just so there is no confusion, when I speak of Public Sector pension Plans, I am speaking of State & Local Public Sector Plans, NOT Federal workers Plans and certainly NOT Military pensions.

April 11, 2018 at 4:27 am

Mr. Love @ 9:04 am…

It is not just “interesting information”; it is vital information to know that hundreds of thousands of state and local (and federal) workers are =not= overcompensated. Even with what =you= call LUDICROUSLY excessive pensions, for thousands of public workers, those pensions and benefits merely compensate for lower wages, bringing total compensation roughly equal with the private sector. For thousands more, P & B are =not= sufficient to compensate for the lower wages, and they earn less than their private sector peers.

Overall, hundreds of thousands of public workers are =not= greedy, trough sucking parasites. Ironically, you may find that a full career attorney with a $100,000 pension is =underpaid=, while a retired janitor with his $35,000 pension is =overcompensated=.

According to your “23% study”, it is those lowest paid, less educated public workers who are driving that 23 percent higher average.

You are correct. That is interesting information.

And vital.

Beware the Flaw of averages.

April 11, 2018 at 5:49 am

Mr. Love @ 12:40 am…

“Are THEY lying too? Or perhaps is it you ?”

Two entirely different subjects. I can see why you are so easily confused.

One is whether pensions are “fair”; the other is whether pensions are “affordable”. They are entirely different questions. For effective pension reform it is vital to know the distinction.

For an example, look at the New York State pension system. The pay and pensions of NY state workers are among the highest in the nation. Their assets took the same hit as CalPERS and other public pensions in 2008-2009. Today they are near one hundred percent funded and paying far less in annual contributions than California.

The rapid increases in pension “costs” in California today are for the unfunded liabilities in large part due to 2008-2009 market losses. Negative amortization is the evil step-sister of the “magic of compounded interest.”

For an example of actual pension reform, not =just= reduction, see

http://pensionpulse.blogspot.ca/2018/04/on-making-otpp-young-again.html

Yes, some reduction is involved, including reduced COLAs when assets drop below a predetermined level, and contributions are somewhat higher due to lower discount rates.

——————————–

There are very prudent pension reforms needed. To get the right answers, you need to ask the right questions.

April 11, 2018 at 9:33 am

No S. Moderation Douglas, that the Public/Private Sector “Total Compensation” (wages + pensions+ benefits) differential is not the came for all income level is “interesting” information, but what financially impacts the taxpayers is the sum the the differentials for ALL (yes ALL) workers taken TOGETHER, and per the AEI Study in CA (and NJ, my home State), it equated to a level annual 23%-of-pay PUBLIC Sector ADVANTAGE.

—————————————–

Dear Taxpayers ……….. how much MORE would YOU have for YOUR retirement needs if YOU had an additional 23% of pay to save and invest in every year of YOUR career……$500K, $1 Million, perhaps $2 Million for some ?

Well THAT is a valid estimate of how much Taxpayers are unnecessarily and unjustly OVER-COMPENSATING each and every full-career CA Public Sector worker.

April 11, 2018 at 9:40 am

Quoting S. Moderation Douglas ……….

“Two entirely different subjects. I can see why you are so easily confused. One is whether pensions are “fair”; the other is whether pensions are “affordable”.”

I’m certainly not confused and indeed know the difference betwenn “fair” and “affordable”.

It’s the Public Sector workers/retirees (like you) that ….while avoiding the discussion of “fair” at all costs ………. think all that’s necessary is “affordable”. I don’t. There are some wealthy communities that can “afford” the ludicrously excessive PUBLIC Sector pensions in Place today in CA (and many other places), but few individuals like to see their money used in foolish ways, and unnecessarily over-compensating their Public Sector workers is assuredly high on that list.

April 11, 2018 at 11:07 am

When the rubber hits the road, and you absolutely have to decrease compensation; and you have attorneys and doctors, and engineers who are already earning twenty percent less than they could earn in the private sector (even with the value of their higher pensions considered), and you have janitors, clerks, and laborers earning twenty percent more than the private sector, who will you cut?

“Nevertheless, a significant total compensation penalty remains for both professional and doctoral degree holders. It is worth considering how government may continue to attract better-educated employees despite a seeming compensation penalty. ”

Andrew Biggs

——————————

“…annual 23%-of-pay PUBLIC Sector ADVANTAGE.”

“Well THAT is a valid estimate of how much Taxpayers are unnecessarily and unjustly OVER-COMPENSATING each and every full-career CA Public Sector worker.”

Mr. Love

——————————

No, taxpayers are not OVER-COMPENSATING… “each and every full-career” CA Public Sector worker. “…

per the AEI Study in CA…”, hundreds of thousands of public workers earn compensation less than or equal to the private sector. Average/schmaverage, it makes no sense logically, morally, or financially, to reduce the pay or pensions of those who are already under or equally compensated.

S Moderation Douglas

April 11, 2018 at 11:46 am

S. Moderation Douglas

THIS is a TRUE picture of what going on in CA.

View at Medium.com

The OVER-COMPENSATION of Public Sector workers is palpable.

April 11, 2018 at 1:00 pm

Yup… David Crane specifically picks on Teachers… like my 6th grade teacher, worked 41 years, gets $60K a year.

He totally fails to mention the enormous payouts to LA County police, prison dentists, other male administrators.

Just another misogynistic screed, all emotion, no rational, logical, mathematical, thoughtful thinking… David Crane is exactly the type of person who got us into this mess.

April 11, 2018 at 3:02 pm

Quoting S. Moderation Douglas …………… “When the rubber hits the road, and you absolutely have to decrease compensation; and you have attorneys and doctors, and engineers who are already earning twenty percent less than they could earn in the private sector (even with the value of their higher pensions considered)”

What a hoot ………. with PUBLIC Sector professionals typically working 35-40 hours/wk, and PRIVATE SECTOR professionals ROUTINELY working 50-60 hours/wk (sometimes 70-80 in busy seasons for certain professionals) ……… Public Sector professionals don’t DESERVE equal compensation.

April 11, 2018 at 4:25 pm

That is =part= of what’s going on in California, and most other states. I think David Crane is an advocate of DB pensions, but with better governance. When is the best time to plant a tree? … Twenty years ago. Second best time, is now. D. Crane believes the same thing about reducing the discount rate, and other pension reforms.

I wouldn’t object to ERISA like controls on public sector pensions (ERISA light). I believe they were left out originally because of questions about state sovereignty. States could be encouraged to accept limits in exchange for continued tax deferral.

————————————-

“The OVER-COMPENSATION of Public Sector workers”… is grossly exaggerated for shock value.

April 11, 2018 at 5:17 pm

What a hoot… “with PUBLIC Sector professionals typically working 35-40 hours/wk”… not a single public school teacher I know works less than 70 hours a week… of course they do take a second job in the summer… helps pay for all the supplies they purchase for their classes during the year.

As for their post-retirement benefits being “multiples” higher than the private sector… another hoot… figures 6B and 6C of http://www.stoputla.com/collateral/FixPensions_Chapter_1.pdf tell a totally different story.

Which means Crane is a fabulist. So is TL.

April 11, 2018 at 6:38 pm

Quoting S. Moderation Douglas ………….

“The OVER-COMPENSATION of Public Sector workers”… is grossly exaggerated for shock value.”

Really, with a (per the AEI Study) level annual 23%-of-pay Public Sector “Total Compensation” ADVANTAGE in CA ?

Exaggerated NO. Outrageous, YES.

April 11, 2018 at 6:50 pm

@S Moderation Douglas “…and contributions are somewhat higher due to lower discount rates.” SOMEWHAT higher?! https://www.calpers.ca.gov/page/employers/actuarial-services/employer-contributions/public-agency-actuarial-valuation-reports

April 11, 2018 at 9:58 pm

The exaggerated part is that, in many cases, the retired attorney with the $150,000 pension is actually =undercompensated= (per the AEI Study), while the clerk with the $35,000 pension is =overcompensated= (per the AEI Study); the alleged 23% public sector compensation advantage is driven by the workers at the lowest education/lowest pay level. But that headline doesn’t sell the papers.

The compensation differential at different income levels is “interesting” information, but it’s just not as sensational when the overcompensation is at the lower level… (per the AEI Study)

April 12, 2018 at 12:21 am

S. Moderation Douglas,

(a) It DOESN’T MATTER because as we BOTH know, what financially impacts the Taxpayers is the net Public/Private Sector differential for ALL (yes ALL) worker taken together. And when THAT is done, it’s the PUBLIC Sector that has a 23%-of-pay “Total Compensation” (wages + pensions + benefits) ADVANTAGE, and

(b) Your attorney example doesn’t account for the huge difference in how may hours they usually work. While Public Sector Professionals typically put in the standard 35-40 hours/week, it’s routine for Private Sector Professionals to put in 50 to 60 hours. If you work fewer hours, you DESERVE less, and getting such does NOT constitute being “compensated” less.

April 12, 2018 at 1:08 pm

It’s not rocket surgery, Mr. Love.

Biggs and Richwine wrote an eighty page paper, and apparently the only thing they got right was the 23 percent average compensation advantage? What are the odds?

“Hours worked” is one of the standard factors considered in wage comparison studies*. Mr. Biggs is a PhD who worked in both the private and public sector. He and professional economists used their combined professional experience and thousands of data points to arrive at their conclusions. You used anecdotal evidence. You are entitled to your opinion.

—————————————

Quoting Mr. Love…

“It DOESN’T MATTER because as we BOTH know, what financially impacts the Taxpayers is the net Public/Private Sector differential for ALL (yes ALL) worker taken together.”

Don’t embarrass yourself. That sentence is meaningless. The compression of wages in the public sector is recognized not just in CA and NJ, but in every other state and in most, if not all OECD countries. From a Canadian study…

“Those working in lower paid occupations—such as cleaning, food preparation, clerks—are generally better paid in the public sector than in the private sector.”

“Higher paid occupations—such as managers, lawyers and accountants—tend to be paid considerably less in the public sector than in the private sector.”

—————————————————

The higher “average” compensation in the public sector, if it exists at all, is almost entirely driven by the compensation of those in the lower paid occupations. If you want to reduce the “financial impact on the taxpayers”, that is where the reductions need to come from. As Willie Sutton said, “Because that’s where the money is.”

*wage comparison studies…

AEI study, page 58, figure 1, gives the overall average weekly hours worked in both sectors…

and we BOTH know, what financially impacts the Taxpayers is the average Public/Private Sector …”hours worked”… differential for ALL (yes ALL) worker taken together.”

April 12, 2018 at 1:15 pm

Quoting S. Moderation Douglas …………….

“It DOESN’T MATTER because as we BOTH know, what financially impacts the Taxpayers is the net Public/Private Sector differential for ALL (yes ALL) worker taken together.”

Don’t embarrass yourself. That sentence is meaningless.

———————————————————-

No S. Moderation Douglas it’s not “meaningless” to the Private Sector Taxpayers who are being forced (via excessive taxation) to pay for it.

And if the situation were reversed with PRIVATE sector workers having that 23%-of-pay Total Compensation ADVANTAGE, Public Sector Union/workers would assuredly be screaming bloody murder for compensation INCREASES to erase that advantage…… and they wouldn’t give one hoot how that advantage breaks-down by income level.

April 12, 2018 at 2:31 pm

And I guarantee that if government were run “like a private business”, a manager would look at his payroll and, finding that he was paying above market wages for a third of his workers, below market compensation for another third, and fair market wages for the rest, he would reduce or replace the over-market workers and thank his lucky stars for the others.

It DOES MATTER.

If the manager reduces the cost of the above-market group of workers, his total payroll will be reduced. His average pay per worker will be reduced, and he will still be able to attract and retain qualified workers.

Win/win.

April 12, 2018 at 3:37 pm

Nothing has changed…………..

“No S. Moderation Douglas it’s not “meaningless” to the Private Sector Taxpayers who are being forced (via excessive taxation) to pay for it.

And if the situation were reversed with PRIVATE sector workers having that 23%-of-pay Total Compensation ADVANTAGE, Public Sector Union/workers would assuredly be screaming bloody murder for compensation INCREASES to erase that advantage…… and they wouldn’t give one hoot how that advantage breaks-down by income level.”

April 12, 2018 at 5:56 pm

A public sector janitor, engineer, and doctor walk into a bar. The doctor tells the janitor, “You’re picking up the tab. You are the only one here who is overpaid.”

—————————————–

Tough Love Says:

June 28, 2017 at 11:53 pm

“We’re all entitled to our own opinions, and I see ZERO justification for paying a lower-echelon Public Sector worker more in “Total Compensation” than what the identical job would pay in the Private Sector. And if that compensation is insufficient to meet basic needs it should be addressed through the Social Services system …..just as it is now for Private Sector workers in such situations.”

—————————————–

Do it, Mr. Love, do it for the taxpayers, and I guarantee your alleged 23% advantage will disappear.

April 12, 2018 at 6:21 pm

S Moderation Douglas,

And the Janitor replies to the Doctor ………. You’re move “overpaid” that I”. My kid’s doctor complains that he workers 70-80 Hours/wk to pay for the HUGE costs of his Private Practice … staff, liability Insurance, rent, supplies, etc, while YOU, the Public Sector Doctor, leave sharply at 4:30 PM and have NO work-related bills to pay….so stop BSing me.

April 12, 2018 at 7:54 pm

You’re move “overpaid” that I”. ?

Goodnight, Gracie

April 12, 2018 at 8:44 pm

S/b ………… You’re more “overpaid” than I”.

Probably a good idea to reread my posts before submitting.

April 13, 2018 at 9:43 am

S. Moderation Douglas,

Does the Police compensation in Berkeley CA sound reasonable or LUDICROUSLY excessive?

http://www.dailycal.org/2018/04/12/real-berkeley-police-department-crisis-lack-reform/

April 13, 2018 at 10:35 am

Follow-up to my above comment (to S. Moderation Douglas) and quoting from the embedded link:

“According to data compiled by Transparent California, 117 Berkeley police officers — more than half of the entire police force — took home $200,000 or more in pay and benefits in 2016. Seventeen Berkeley police officers received pay and benefits that exceeded $300,000, while the average pay and benefits for a Berkeley police officer was $198,156.”

And yet …………

“Berkeley Police Association, or BPA — complains about a perceived lack of financial resources and accuses Berkeley City Council of not making its officers a priority. “

April 13, 2018 at 11:42 am

Alex Li, while not a journalism student, should nevertheless learn to check more than one source for information. In fact, a worthwhile project might be for the Daily Californian to do an in-depth study of the information on Transparent California, and the accuracy of their press releases.

Start with their disclaimer and work backwards.

April 13, 2018 at 5:13 pm

S. Moderation Douglas,

When one doesn’t agree with the conclusions of a report or study, without that complainer doing ANY WORK OF THEIR OWN, it pretty easy for THEM to say…………

“He/She should nevertheless learn to check more than one source for information. In fact, a worthwhile project might be for the ABC Newspaper to do an in-depth study of the information on XYZ database, and the accuracy of their press releases.”

Isn’t that what you just did? How about YOU doing what you suggested that THEY should do ? After all, YOU are the complainer.

April 13, 2018 at 6:15 pm

I believe that the reason that most contributors to PT no longer allow comments is because of the abuse of this repetitive song and dance.

April 13, 2018 at 7:32 pm

John Moore,

I can make it very simple with no song & dance………..

There are NO “solutions” to the pension mess infecting many of Americas’s States & Cities that do not include (just as one NECESSARY Step of many others) a VERY significant (think AT LEAST 50%) reduction in the VALUE of future service pension accruals ……. via a combination of (a) formula-factor reductions (b) increases in the minimum age at which one can begin collecting an unreduced pension (c) elimination/reduction of COLA increases, and (d) implementation of actuarial correct early retirement reduction factors.

Another NECESSARY step is phase-out of all retiree healthcare subsidies ……… recognizing that employer-sponsiored retiree healthcare subsidies are all but GONE in the Private Sector.

——————-

It’s WAY past time for Private Sector Taxpayers to stop being the “sucker” in the equation.

April 13, 2018 at 7:40 pm

And not to be misunderstood ………… the NECESSARY pension reductions I identified above should apply to all CURRENT workers, and the NECESSARY Healthcare changes should apply to all CURRENT and FUTURE retirees.

April 14, 2018 at 7:30 am

Of course Tough Love is totally in favor of not a single cut in the lavish pensions funded through taxpayers and deficits for one class of public workers: Federal public workers, including the $200K+ compensation in retirement including a vast array of perks for military pensioners.

Perhaps that is Tough Love’s love letter for them doing so well in the Iraq and Afghan wars.

April 14, 2018 at 12:26 pm

To Tough Love @ 5:13 pm…

Where to begin? First… “Lies, damned lies, and statistics”

“…teachers in the Berkeley Unified School District only took home an average of $79,634 in pay and benefits in 2016.”

If that average came from Transparent California, I’m sure they can justify it, and I won’t dig through their data to refute it. But… doesn’t that low number raise some red flags? A typical top scale salary for Berkeley teachers is well over $79,000.

https://transparentcalifornia.com/salaries/2016/school-districts/alameda/berkeley-unified/?page=1

http://publicpay.ca.gov/Reports/PositionDetail.aspx?employeeid=18590529

If that “average” came from TC, it must include part time, summer, and substitute teachers. “True-ish”, perhaps, but misleading.

Also, note on the GCC website, that “defined benefit plan contribution” is approximately 10-12 percent of wages. It is important. More on that later.*

——————————————————

“In 2016, the highest-paid police officer in Berkeley received $359,412 in pay and benefits.”

Actually a police Captain, for what it’s worth. There is a substantial difference between salaries of management (Captain, Lieutenant, Sergeant) and actual patrol officers.

Lest any reader infer that actual street level patrol officers typically earn anywhere near $359k.

Don’t misunderstand, Berkeley and other Bay Area police do have pay and benefits apparently better than school teachers, on average, and that is a fair topic for discussion.

“teachers in the Berkeley Unified School District only took home an average of $79,634 in pay and benefits in 2016.”

“while the average pay and benefits for a Berkeley police officer was $198,156.”

These are typical of Transparent California number crunching. We don’t know in either case if these averages include upper management and/or part time workers. We do know that “average pay” for police officers typically includes much more overtime than most other occupations, public or private. It is the nature of the occupation, and often a deliberate decision by city administration because it is cheaper to pay overtime than to hire more police. To use this higher OT to imply the officers are “overpaid” is naive at best and disengenuous at worst.

Disclaimer? In my job, I have occasionally worked with police, including Berkeley Police. I am not, nor ever have been a LEO. No one in my family is in law enforcement. None of my friends are in law enforcement. My interest in this topic is that I see blatant misrepresentation, and I think it should be pointed out. Transparent California (NPRI) is a “non-partisan” think tank, but they do have an agenda.

———————————————-

* “defined benefit plan contribution”

As noted above, the contributions for teachers is about 10-12 percent of wages, as noted in the GCC website.

Contributions for Berkeley Police are typically 50-60 percent of wages. Why?

First and foremost, “normal contributions” for police are higher mainly due to earlier retirement ages. According to CalPERS, the normal cost for Berkeley miscellaneous employees is about 12 percent of wages (similar to the teachers contribution normal costs.)

For police, the normal contribution is 22 percent.

https://www.calpers.ca.gov/page/employers/actuarial-services/employer-contributions/public-agency-contributions

So what? According to GCC and Transparent California, “defined benefit contributions” are closer to 60 percent of wages. That “extra” 38 percent is payment toward the unfunded liabilities, and most pension experts believe it should -not- be counted as “pay and benefits” in the current year. Why is it included by TC, and repeated in this article as “the average pay and benefits for a Berkeley police officer” ($198,156)?

Short answer, the bigger the number, the better, according to TCs agenda. Longer answer…

“Government jurisdictions in California do not maintain payroll and pension records in a uniform fashion. As such, and to help make the data easier to comprehend, we have consolidated some compensation categories.”

And…

“For pensions, all values reflect the actual monetary value of benefits received during the respective year reported.”

(Transparent California disclaimer)

————————————–

The actual salary range for Berkeley police officer (non supervisory), is $94,000 to $117,000. What I would call regular “take home pay” excluding OT and after 12 percent pension deduction and 25 percent income tax deduction would be closer to $55,000-$75,000.

—————————————

Transparent California often issues press releases that intentionally exaggerate the difference between public compensation and the private compensation of equivalent private sector employees. And on the surface, they have the sheen of believability.

Such is my opinion, anyway. I still invite any reporter to do an in depth study of their methods, as well as the source of their funding.

April 14, 2018 at 2:04 pm

John Moore,

Perhaps, but my money is on this…

“We value open and honest dialogue, but the proliferation of hate speech, anonymous trolling and personal attacks have created a commenting environment that is not conducive to respectful thought exchange and sharing of viewpoints. Rather than eliminating comments entirely, we have made this feature a benefit for our subscribers.”

The Press Democrat was once a very good source of pension information, and had -some- very useful comments. Along with a growing number of repetitive, vile, insulting, and even threatening commenters.

Many of my posts have been repetitive, and too long, and I am trying to control that. Might as well, because most readers will skip over the longer comments anyway.

And “off topic” posts often crop up in answer to other blatantly untrue comments. This 58 comment thread went off topic at about post number 13, and turned in to back and forth repetition from there on. At least we have mostly avoided “hate speech, anonymous trolling and personal attacks”.

I shall try to contain myself in the future. With thanks and apologies to Ed Mendel, who has had many excellent and informative articles. We appreciate the forum.

April 14, 2018 at 3:29 pm

S. Moderation Douglas,

You appear to respect the work of Andrew Biggs. Here’s something he said very recently:

——————————————————————

Now, not everyone who studies teacher pay sees a compensation crisis.

“I don’t believe they’re undercompensated at all,” says Andrew Biggs, who studies retirement issues at the American Enterprise Institute.

Biggs says all this talk of teachers being underpaid ignores many of the other benefits they get. Like summers off, he says. And the big one: pensions.

“The reality is that teacher pensions are a lot more expensive,” Biggs says, “and they’re also a lot more generous than people think they are.”

—————————————————————-

Source…… http://en.brinkwire.com/260617/walkouts-and-teacher-pay-how-did-we-get-here/