Tight pension management helped San Francisco get an upgrade this month to Moody’s highest general obligation bond rating, something many might not expect in a city known for liberal-leaning politics.

A distinctive feature of the San Francisco system — requiring voter approval of pension increases — was adopted by more conservative voters for the San Diego pension system in 2006 and the Orange County pension system in 2008.

The San Francisco public pension system was regarded as a well-funded model, the recipient of good management awards that had gone eight years with no annual payments from the city.

It was a sharp contrast to the lingering scar of an Orange County bankruptcy in 1994 and a multi-year “Enron by the sea” pension scandal in San Diego, which in 2006 featured indictments of five city officials and an SEC sanction for faulty retirement debt bond bond disclosures.

Now San Francisco is the epicenter of a high-tech boom generating high household income, property values, tax revenue and presumably bondholder security. Moody’s also praises its retirement debt management.

“The upgrade to Aaa (from Aa1) reflects the material strengthening of San Francisco’s credit, underscored by its effective management of pension and retiree health liabilities, particularly in contrast to other large cities,” said the new Moody’s bond rating.

Moody’s Investor Service has been a leading critic of public pensions, using its own lower bond-based earnings forecast to calculate debt and its own “tread water” analysis to calculate whether employer-employee contributions are high enough to pay down debt.

The new rating said the upgrade reflecting the long-term strengthening of the city’s economy, tax base and socioeconomic profile could have been “negated” without proper debt management.

San Francisco Mayor Mark Farrell said in a statement the upgrade to Moody’s highest credit rating “justifiably” recognizes the city for its effort to “become a national model of responsible fiscal governance.”

Moody’s mentions two factors: a retiree health reform that takes longer to earn benefits and aims for full pre-funding, and pensions with higher employee payments and lower police and firefighter formulas than one widely adopted after a CalPERS-sponsored bill, SB 400 in 1999.

The upgrade makes no comparisons. But the San Francisco pension system takes a smaller bite out of the general fund than some other big-city retirement systems, leaving more money for basic services and programs.

“Over the last decade, the City’s General Fund expenditures related to employer (pension) contribution has gone from 2.5% of General Fund spending to over 7% of General Fund spending,” an update of the San Francisco five-year financial plan said in December.

San Jose retirement costs are nearly 23 percent of the general fund this fiscal year, up from 6.5 percent in fiscal 2001-02. Los Angeles spends about 20 percent of its general fund on pension and retiree health care, up from 5 percent in 2002.

San Francisco voters approved a retiree health care reform, Proposition B in 2008, that increased the generous vesting period from five years (some of which could be served at other employers) to a sliding scale beginning at 10 years and increasing coverage until 20 years.

The reform began pre-funding retiree health care, setting aside money to invest like pension funds. New hires contribute 2 percent of their pay and employers 1 percent. Employees hired before the reform began contributing in 2016 and will reach 1 percent of pay next fiscal year.

San Francisco will be decades covering a retiree health care debt or unfunded liability estimated at $4 billion in 2008.

“For fiscal year 2014, the City’s pay-as-you-go expense was $160.7 million and contributions to the Retiree Health Care Trust fund were $5.9 million,” Controller Ben Rosenfield said in a 2015 report.

The San Francisco Employees Retirement System combines police and firefighters with other or “miscellaneous” employees, unlike some large cities, and has a low employer rate reduced by raising employee rates.

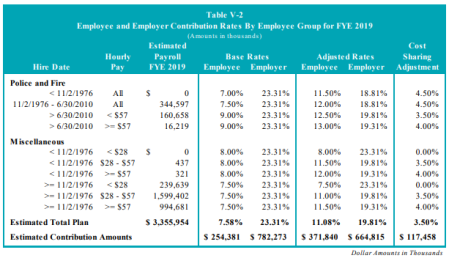

A cost-sharing provision approved by voters, Proposition C in 2011, requires employees to pay part of the net employer contribution rate, depending on pay level and employee group. (see chart)

An anticipated decline in employer rates “was reversed significantly starting in 2016 due to the loss of the supplemental COLA lawsuit, employees living longer, and lower than expected investment returns in 2015 and 2016,” said the five-year financial plan update.

An appeals court overturned part of Proposition C that ended higher payments to retirees when investments have “excess earnings.” A retiree group successfully sued to overturn part of a measure backed by all 11 county supervisors, business and labor, and 69 percent of voters.

The San Francisco contribution rates, 11.08 percent of pay for employees and 19.81 percent for employees, are still far below the rates for the two troubled San Jose retirement systems.

The San Jose Federated City Employees Retirement System rates for employees are 15.36% of pay (pension 6.60%, retiree health 8.76%) and for employers 103.45% of pay (pension 94.04%, retiree health 9.41%).

The San Jose Police and Fire Department Retirement Plan rates for employees are 21.12% of pay (pension 11.38%, retiree health 9.74%) and for employers 106.68% of pay (pension 96.06%, retiree health 10.62%).

Last June the San Francisco system had 86 percent of the projected assets needed to pay future obligations, using a 7.5 percent earnings forecast to discount future costs, according to an annual actuarial report.

The funding level would be lower, and contribution rates higher, if the system used a 7 percent discount rate like the California Public Employees Retirement System and the California State Teachers Retirement System.

And also last June, a San Francisco Civil Grand Jury report concluded that most of the debt of the system, which has been underfunded for more than a decade, was approved by the voters who in theory are a safeguard.

“There are several causes for the underfunding of the Retirement System, but the main underlying cause is the retroactive retirement benefit increases implemented by voter-approved propositions between 1996 and 2008,” said the report.

Last week state Sen. John Moorlach, R-Costa Mesa, known for issuing a warning before the Orange County bankruptcy, issued a report on the “financial soundness” of the state’s 482 cities, saying some face insolvency mainly due to pension debt.

Dividing their “unrestricted net position” in annual financial reports by their population, he ranked San Francisco at 474 with a negative UNP per capita of $2,929. He said San Francisco, a combined city and county, also ranked near the bottom in his similar study of the 58 counties in 2010.

Asked for a response, Moody’s said San Francisco is a large issuer of general obligation bonds repaid with voter-approved property tax revenue, the UNP may mask revenue programs like building inspection that pay pension costs, and a per-capita metric may miss revenue not paid directly to the city from businesses, commuters, and tourists.

“Long-term projections indicate that expenditure growth will outpace revenue growth,” said the Moody’s upgrade, “but this is mitigated by the city/county’s demonstrated record of conservative budgeting and financial management practices.

“Here in particular, the charter amendments governing pension and health care benefits and funding are critical tools that should enable San Francisco to maintain its currently very strong credit position.”

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at Calpensions.com. Posted 19 Mar 18

March 19, 2018 at 4:08 pm

Leave it to Ed to write a story that makes the govt. pension mess appear to have a solution by rational policies, when, in fact it is a govt. sponsored criminal enterprise that has rooked citizens out of over a trillion dollars to date.

BTW, a high rating on a given bond issuance is not a testimony to financially sound government financial policies. In fact, the San Fran Health Ins. and pension costs are beyond salvation.

As to high bond ratings, let us not forget perfect ratings for Mortgage Backed Securities(aka Collateral Debt Obligations) that went bottoms up in the 2007-8 financial crash.

Have you been to SF lately, it is like a third world city of crime, drug addition, and homeless citizens.

The pension mess will never be resolved if we ignore the criminal nature of its genesis and ratification by unions and govt. agencies.