Bond insurers who walked away from mediation last year before Stockton filed for bankruptcy are at the table this summer. A deal could avoid a precedent-setting legal showdown on whether public pensions can be cut in bankruptcy.

Attorneys for the city and bond insurers told U.S. Bankruptcy Judge Christopher Klein last week that mediation, presided over by Judge Elizabeth Perris, is an “uphill battle.”

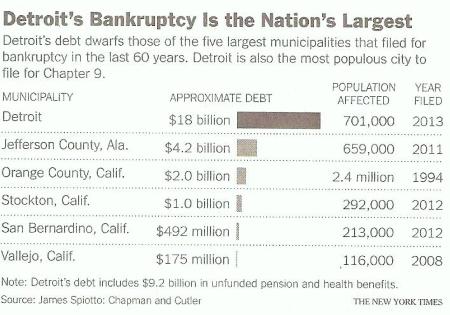

But the brief update hearing was held on the day that Stockton, which had been the largest city to file for bankruptcy, was bigfooted by the bankruptcy filing of a much larger city known around the world, Detroit.

Now will the big national bond insurers, who lost the first round when Stockton was ruled eligible for bankruptcy in April, decide the main battle has shifted to Detroit and cut a deal with Stockton, where they have less exposure and a weaker hand?

In Detroit, city officials propose cutting the pensions of current workers and retirees. A state judge quickly ruled after the bankruptcy filing that pensions are protected by the state constitution, triggering an appeal that may yield a precedent-setting ruling.

In Stockton, city officials do not want to cut pensions, saying they are needed to recruit and retain workers, particularly police. Bond insurers facing major losses under the city’s plan argue that pensions should be treated like ordinary debt.

Bond insurer losses in the bankruptcy presumably would be reduced if the city spreads the pain, getting more of the savings needed for solvency by cutting pension debt owed to the California Public Employees Retirement System.

Judge Klein told the bond insurers the pension issue may be raised in a ruling on whether creditors are treated fairly by the city’s proposal for a “plan of adjustment” to cut debt, expected in September.

“The city is drafting both a cram-down plan and a consensus plan — hope to use the consensus plan, not the cram-down plan,” Marc Levinson, an attorney for Stockton, told the judge last week.

A “cram down” is legal jargon for a plan that cuts payments to creditors without their consent. Stockton announced a deal in February with one bond insurer, Ambac, to trim $21.6 million in debt payments for a housing project.

Two bond insurers backing larger Stockton debt payments, Assured Guaranty and National Public Finance Guarantee, are the leaders of a bondholder group, Capital Market Creditors, that unsuccessfully opposed Stockton’s eligibility for bankruptcy.

The two bond insurers have major financial exposure in Detroit, according to their websites, more than the losses they face in the bankruptcy Stockton filed in June of last year.

Assured Guaranty insured $1.8 billion worth of Detroit revenue bonds and $321 million in general obligation bonds. National Public Finance insured $2.4 billion worth of Detroit revenue bonds and $101 million in general obligation bonds.

Stockton, on the other hand, is proposing to eliminate $197.5 million in general fund payments on bonds during the next 25 years, leaving insurers to make payments preventing losses for bondholders.

The two bond insurers, using expert witnesses and numerous document requests, made a lengthy effort to block Stockton’s eligibility for bankruptcy, which some thought was their best chance of avoiding deep cuts in bond payments.

National Public Finance cited court rulings saying eligibility should be regarded with a “jaded eye,” because the court has only limited control of the debtor once eligibility is approved.

The city proposes the debt-cutting plan of adjustment, not the creditors. The court can approve or reject the plan proposed by the city. But the court cannot impose a plan or tell the city how to spend its money.

Last year the two bond insurers walked out of mediation required by state law before a non-emergency bankruptcy filing. They said the city refused to cut the debt owed its largest creditor, CalPERS, about $323 million.

But during their time-consuming opposition to eligibility, the bond insurers never presented a method for cutting pension debt. Stockton argued that a cut could terminate its CalPERS payment, triggering a $1 billion payment due immediately.

In addition, Stockton contended that CalPERS is only a “conduit” and that the debt is owed to current workers and retirees. The city argues that the elimination of generous retiree health care promised employees is the retiree share of debt reduction.

The Stockton plan is similar to the Vallejo bankruptcy, where bond payments and retiree health care were cut. But during its 3½-year bankruptcy, Vallejo negotiated an agreement on its plan of adjustment, avoiding a cram down.

Stockton did avoid having dueling tax measures on the November ballot. The city council voted unanimously this month to place a ¾-cent sales tax increase on the ballot, yielding an estimated $28 million a year if a majority of voters approve.

Most of the money, 65 percent, is intended for more police and other steps to reduce crime. The rest could be used to help the city exit from bankruptcy and regain solvency. Whether the city might sweeten its offer to bond insurers is not clear.

Mayor Anthony Silva, who ousted an incumbent in the election last fall, had backed a “Safe Streets” sales-tax initiative limited to hiring more police. Opponents, including a majority of the city council, said the initiative would prolong bankruptcy.

A developer backing the initiative, Alan Barkett, said during a debate on the two initiatives in May that the city should use bankruptcy to address the high cost of pensions that threaten the long-term solvency of the city.

CalPERS supported Stockton’s eligibility for bankruptcy but is the leading opponent of eligibility for San Bernardino, which filed for bankruptcy last August, automatically staying debt collection.

San Bernardino made an emergency filing, avoiding mediation, and took the unprecedented step of skipping its payments to CalPERS last fiscal year, about $14 million, before resuming this month.

As in Stockton, San Bernardino officials say they do not want to cut pensions, but they do want to refinance pension debt. CalPERS does not want to refinance the missed annual payments, apparently fearing other struggling cities might skip their payments.

Some observers say U.S. Bankruptcy Judge Meredith Jury, who seemed skeptical of another CalPERS request for more city financial information last week, may be moving toward a ruling on San Bernardino’s eligibility next month.

In Vallejo, still struggling with a $5 million budget deficit and high labor costs, a city manager hired after the bankruptcy has some advice for Detroit, an on-line Michigan magazine, Bridge, reported last week.

Dan Keen told the magazine his postcard to Detroit would be short, if not sweet: “My advice for city considering this jump is get everything you can during bankruptcy, because when you come back out of bankruptcy, it’s going to be even harder.”

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at https://calpensions.com/ Posted 22 Jul 13

July 23, 2013 at 1:09 am

That advise (to get EVERYTHING within the bankruptcy) is good advice indeed. And one item they MUST demand is a hard freeze to the existing DB Plans for ALL (yes ALL) workers (INCLUDING safety and judges).

Replace it with SS for everyone and 3%-5% ofpay in a 401K-style DC plan. THAT’s what Private Sector workers get, Public Sector workers are deserving of an EQUAL pension … but NOT a better one (on the Taxpayers’ dime).

July 23, 2013 at 1:22 pm

Certainly pension benefits need to be reduced, but DC plans are much more expensive than DB plans (for the same benefits in retirement), as discussed many times on this board.

In addition, the fees on DC plans are on average extraordinarily high, and subsidize the corrupt US financial industry. Typically fees are 1-3% of the base funds in a DC plan, regardless of whether the investments earn money. DB plans in California have fees at the level of 0.2-0.5%.

DC plans are a terrible financial choice… I know, that is where my retirement funds are. A much better choise is a modest DB plan.

July 23, 2013 at 2:32 pm

If my pay was equivalent to what private workers make, including their various perks, I would be OK with what you propose. I will take the money now over future promised benefits.

July 23, 2013 at 10:49 pm

The HUGE “Moral Hazard” of our elected officials betraying the taxpayers and unfairly favoring Public Sector workers (in exchange for campaign contributions and election support) is ONLY effective with Defined Benefit Plans. The same games can’t be played with Defined Contribution (401k-style) pension Plans because ALL promises have to be paid for IMMEDIATELY

This hazard is so great that it FAR outweighs the few relatively minor advantages of DB Plans … significantly exaggerated by spension (likely benefiting personally or through a family member from such Plans and not wanting them changed).

July 28, 2013 at 9:03 am

spension Says: “Certainly pension benefits need to be reduced, but DC plans are much more expensive than DB plans (for the same benefits in retirement), as discussed many times on this board.”

Spension, I agree that pension benefits need to be reduced (DB). As far as DC plans are concerned I could care less if they’re more expensive as long as they aren’t costing me money. The unions have sucked the life out of their own Defined Benefit plans, which is costing every taxpayer in this state a tremendous amount of money and, at this point, I see NO reason at all to support your argument that the PONZI Scheme should – in your words, continue because it saves money. It doesn’t save me money!

As far as i can tell the only people that are saving money by the continuation of this fraud are the very same people that created it and are benefiting from it! It not only isn’t saving me a red cent – but it’ is costing money that I could apply to my own retirement account which doesn’t have a ridiculous guarantee of 7.5% – 8% earnings over my lifetime.

Grow -up Spension. Or maybe your name is really David Lowie.

July 28, 2013 at 9:08 am

“As far as DC plans are concerned I could care less if they’re more expensive as long as they aren’t costing me money.”

What I mean by that is I could care less if they’re more expensive as long as they aren’t costing me money beyond the overly generous contribution taxpayers are already making. Claiming DC plans are more costly is an insult you seem more willing to regurgitate. I think that statement is complete BULL!

July 28, 2013 at 9:26 pm

Ho hum, the usual innumerate, inaccurate, and irrelevant screeds from Captain, and Tough Love.

Let’s see… Wall Street benefits big time from the DC industry… in the billions per year. Shilling for Wall Street much, Captan and TL?

I’m the only one who as ever offered a practical way to reduce DB benefits… Sovereign Default. It is bankruptcy for a State.

And indeed the fight between bond insurers and pensioners was entirely predictable and foreseen by myself over a year ago.

Hilarious to see only the unions called greedy and fraudulent by Captain & TL. As if Wall Street were paragons of virtue, the holy virgins themselves. Frankly the bond insurers are equal to the unions in my moral rating. And billionaires on Wall Street, or bondholders in China? I’d like to see them get a 95% haircut.

Pensioners with low $/service year deserve the smallest haircut.

As I’ve said many times, I’m in DC plans. That is why I know how rotten they are… remember, the entity that forms them (the State, or the Company) can dip right into DC plans and call that money grab `fees’. Totally rotten system. But, I guess, that kind of fraud never gets commented on by Tough Love and Captain… some kinds of fraud are just fine with you guys. Only fraud by unions bugs you.

BTW, it is really state actuaries who caved. It is entirely predictable that everyone tries to influence politics to get money… unions, the private sector, religious institutions… but it is the dull, baldheaded numbers guys that are supposed to put their foot down. Nice thing by Jeremy Gold today…

http://www.npr.org/2013/07/28/206310510/overpromised-on-pensions

Oh my goodness, real information by an actual expert! Tough Love and Captain’s heads will explode, like the penguin on the TV set!