CalPERS is encouraging government employers to make extra payments to reduce their pension debt or “unfunded liability” if budgets allow, saying millions can be saved in the long run.

Annual CalPERS reports to 1,581 local government agencies this fall began showing estimates of future savings when extra payments, going beyond the required amount, are made to the pension fund.

The Newport Beach city council approved a plan for extra payments to CalPERS last month that is expected to save $47 million over 30 years, compared to the standard payment plan.

Huntington Beach approved extra payments to CalPERS last fiscal year based on an analysis by an independent actuary, Bartel Associates, showing each additional $1 million contributed to CalPERS saves $5 million over 25 years.

CalPERS estimates that about 60 employers made 111 extra payments to CalPERS last fiscal year. The new “alternate amortization schedules” in the annual reports to local governments are a response to requests from employers.

“The message we want to get out to employers is that if they have the ability, the financial means, to pay off some of this unfunded liability, it’s a smart business move and can really benefit them over the long run,” Anne Stausboll, CalPERS chief executive officer, said last week.

CalPERS debt or unfunded liability ballooned after heavy investment losses during the recession. The pension fund lost about $100 billion, plunging from $260 billion to $160 billion before climbing to $294 billion last week.

Projected investment returns and employer-employee contributions covered 100 percent of future pension obligations in 2007, dropped to 60 percent two years later and recently increased to an estimated 77 percent.

To close the funding gap, a California Public Employees Retirement System employer rate increase of roughly 50 percent is being phased in over a half dozen years, squeezing funding available for other government programs.

A focus on paying down pension debt, amid worry about another stock market plunge before recovery from the last one, is a contrast to the headier days around 2000, when a booming stock market pushed the CalPERS funding level to about 135 percent.

A CalPERS-sponsored bill, SB 400 in 1999, gave state workers a large retroactive pension increase notable for a generous Highway Patrol formula, which became a bargaining benchmark for local police and firefighters.

In 2001 CalPERS offered to inflate the value of pension fund assets to help local governments provide pension increases authorized in a bill, AB 616, notable for a top formula (3 at 60) providing a pension of 120 percent of salary after 40 years of service.

In the late 1990s CalPERS took another step, in addition to the benefit increases, that would increase pension debt. Employers got a contribution “holiday” when their annual contributions to the pension fund were dropped to near zero.

Now to reduce future pension debt, Gov. Brown pushed legislation two years ago, AB 340, that bars employer contribution “holidays” and cuts pensions for new hires in CalPERS and 20 county retirement systems.

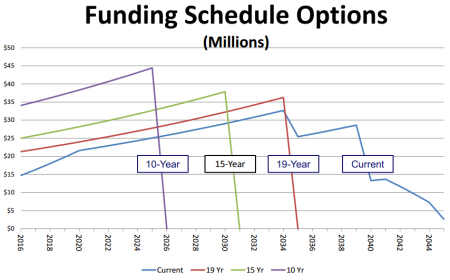

The Newport Beach city council chose the smallest extra CalPERS payment among three options presented by staff. The plan to pay off the unfunded liability in 19 years costs the city $6.6 million next year and a total of about $23 million over five years.

The council’s finance committee and staff recommended the 19-year option as a good balance between reducing standard long-term pension costs by $47 million, while still allowing some “opportunity” spending on services, programs and facilities.

In addition to Newport Beach and Huntington Beach, two other cities in the well-to-do parts of Orange County also reportedly have made extra CalPERS payments expected to yield savings in the long run.

Tustin approved a $4 million side fund payment last month, expected to save nearly $1 million over five years. An Irvine plan adopted last year to pay off the unfunded liability a decade early was expected to save about $33 million.

A city that would not seem to have money to spare, Vallejo, made a $6 million debt-reducing extra payment to CalPERS as it exited from a 3½-year bankruptcy, leaving pensions intact but cutting retiree health care and bond debt.

Market timing can be a problem while making extra CalPERS payments. A city still in bankruptcy, Stockton, issued a $125 million pension obligation bond in 2007 and gave the money to CalPERS just before its big losses in the 2008 market crash.

Newport Beach adopted a plan last year to pay off the unfunded liability earlier than the CalPERS standard of 30 years. But the savings were reduced by a CalPERS rate hike to cover an increase in the expected life span of retirees.

The new plan adopted by Newport Beach last month calls for “dollar cost averaging,” spreading the extra payment over a period of time to reduce the chances of investing at a market peak just before a big downturn.

In a rare wrinkle on extra pension payments, most Newport Beach city employees pay more toward their pensions than the usual CalPERS employee share, which has been roughly 8 to 10 percent of pay in recent years.

Newport Beach began negotiating increased employee pension contributions before the pension reform in 2012 that calls for an equal employer-employee split of the pension “normal cost,” excluding the debt or unfunded liability from previous years.

Many California cities went the other way, agreeing in labor negotiations to pay all of the employee pension contribution in what some call the “pension pickup” or more formally the “employer paid member contribution.”

A survey of San Francisco Bay Area local governments last year by the San Jose Mecury News found they spent more than $221 million the previous year paying “the employee share of 63,000 public workers’ pension contributions.”

The chart below shows how the Newport Beach employee contributions increase under current labor contracts. Lifeguards and firefighters have contracts negotiated before the city began its “sustainability” policy of increasing employee contributions.

“We have done better I would say than most agencies in Orange County in having labor peace, getting to a contract agreement and still having our employees pick up a fair share,” said Terri Cassidy, Newport Beach deputy city manager.

Last week four new members of the seven-member Newport Beach city council were sworn in and elected a new mayor, Edward Selich. The four new members became known as “Team Newport” during their campaign.

“The reform-minded slate emphasized fiscal conservatism and slammed the perceived overspending by city council members,” the Daily Pilot newspaper reported.

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at Calpensions.com. Posted 15 Dec 14

December 17, 2014 at 6:32 am

“CalPERS is encouraging government employers to make extra payments to reduce their pension debt or “unfunded liability” if budgets allow, saying millions can be saved in the long run.”

– of course millions can be saved but there are no guarantees. It is equally true that billions can be lost. What is guaranteed is that CalPERS is CURRENTLY charging our county’s, cities, and special districts 3-5 TIMES the original sticker price for these pension plans. Their stated rate, what taxpayers are expected to pay and city contracts acknowledge, is about 8% of payroll for general employees and 17% of payroll for Public Safety. Unfortunately taxpayers are paying 30-60 percent of payroll toward Public Employee Pensions, and that number increases very soon. How many people do you know have their employers contribute 30-60K toward their retirement (per 100K of salary)? Our tax dollars pay for that.

“Annual CalPERS reports to 1,581 local government agencies this fall began showing estimates of future savings when extra payments, going beyond the required amount, are made to the pension fund.”

– while I appreciate the shameless pan-handling efforts emanating from CalPERS, it is very difficult to take them seriously. How can this rogue organization promote a bogus savings plan when they have just gutted PERPA (Jerry Brown’s Pension Reform Plan), 99 different ways to COST TAXPAYERS BILLIONS while increasing potential payouts to already over generous pension plans. This organization continues to have PONZI written all over it

“CalPERS estimates that about 60 employers made 111 extra payments to CalPERS last fiscal year. The new “alternate amortization schedules” in the annual reports to local governments are a response to requests from employers.”

– A response from employers? No! The Employers paying attention, and looking out for the taxpayers, are questioning why CalPERS still exists in its present form. When is Jerry Brown going to follow up on his promise to install a Board of Administration which represents taxpayers? He, JB, understands the problem. He just hasn’t done anything yet.

“The message we want to get out to employers is that if they have the ability, the financial means, to pay off some of this unfunded liability, it’s a smart business move and can really benefit them over the long run,” Anne Stausboll, CalPERS chief executive officer, said last week.”

– this is the same CEO (Anne Stausboll), Board of Administration (Den of Thieves), that just gutted what was already a very weak pension reform effort from Jerry Brown. These people, CalPERS, have absolutely NO SHAME.

December 17, 2014 at 6:01 pm

JB can only propose, he cannot impose! The pension reform effort was anything but weak–there were 12 items that pension experts appointed by the Legislature’s reform committee spent ten months analyzing. The resulting PEPRA 2012, is a giant step toward pension reform. I don’t think anything has been gutted, but you are welcome, Captain, to put forth specific examples of where gutting has occurred. The BOA has a responsiblity to protect the interests of the CalPERS members, who happen to be the taxpayers too. Your whining is turning into a vendetta against CalPERS, Captain. You really should try to get a life!

December 17, 2014 at 9:12 pm

Captain,

“they have just gutted PERPA (Jerry Brown’s Pension Reform Plan), 99 different ways to COST TAXPAYERS BILLIONS while increasing potential payouts to already over generous pension plans.”

PEPRA was not gutted by CalPERS. There are still billions in savings being realized through PEPRA. The legislation specifically changed several key existing pension provisions, e.g. contribution rates, retirement age, retirement formulas, caps on pensionable income, use of OT and vacation buybacks etc.

1) The performance incentives (99 ways) were already allowed, and were not modified by the legislation. CalPERS interpretation of the law was that if the legislature had intended to end these enhancements, that would have (should have) been specified in the bill. It was not, and I have not yet seen the legislature claim the CalPERS interpretation is incorrect. Governor Brown objected to only one of the provisions, on the grounds that it is considered (by him) a permanent pension increase based on a temporary pay increase.

2)”The Employers paying attention, and looking out for the taxpayers,” have the ability to reduce employee costs within CalPERS present framework. The nefarious “99 ways” are allowed, not required, by CalPERS interpretation. A local government may negotiate this provision, as well as others, such as retirement age, reduced health subsidies, lower pension formulas, and higher employee contributions (even including payments by employees of part of the unfunded liability. They “may” negotiate lower benefits, or lower wages, but many do not, not because “CalPERS is corrupt”, but because they will lose the ability to attract and retain a qualified workforce.

Handy for the local officials to have CalPERS to place the blame on, though.

…………………………

“already over generous pension plans.”

Is an opinion. Studies have consistently shown that public workers earn less in wages than equivalent private sector workers. They also show that even with the cost of the allegedly over generous pensions and benefits, many, if not most, public sector workers still earn less in total compensation than the private sector.

December 20, 2014 at 3:00 am

“CalPERS is encouraging government employers to make extra payments to reduce their pension debt or “unfunded liability” if budgets allow, saying millions can be saved in the long run.”

– What is guaranteed is that CalPERS is CURRENTLY charging our county’s, cities, and special districts 3-5 TIMES the original sticker price for these pension plans. Their stated rate, what taxpayers are expected to pay and city contracts acknowledge, is about 8% of payroll for general employees and 17% of payroll for Public Safety. Unfortunately taxpayers are paying 30-60 percent of payroll toward Public Employee Pensions, and that number increases very soon. How many people do you know have their employers contribute 30-60K toward their retirement (per 100K of salary)? Our tax dollars pay for that.

“Annual CalPERS reports to 1,581 local government agencies this fall began showing estimates of future savings when extra payments, going beyond the required amount, are made to the pension fund.”

– while I appreciate the shameless pan-handling efforts emanating from CalPERS, it is very difficult to take them seriously. How can this rogue organization promote a bogus savings plan when they have just gutted PERPA (Jerry Brown’s Pension Reform Plan), 99 different ways to COST TAXPAYERS BILLIONS while increasing potential payouts to already over generous pension plans. This organization continues to have PONZI written all over it

Sdouglas, I stand by every comment I’ve made. And I’ll add that CalPERS & the PUblic Employee Unions are the biggest impediment to much needed pension reform.

Beyond that we’ll have to agree to disagree. I reject your self serving arguments because I’ve seen the collusion & corruption first hand. Therefore, taking your arguments point by point is a waste of time.

The CalPERS Board of Administration is CORRUPT, CalPERS management isn’t doing anything to stop it, and our Governor is, so far, MIA on the subject of CalPERS re-introduction of “99” different ways to spike a pension (his Pension Reform Plan limited pensions to base pay). Apparently CalPERS, and yourself don’t give a **** about the governors wishes. They make their own rules, right? I understand that last part might change – I’ll keep my fingers crossed. This states taxpayers deserve much more representation that what you and your logically challenged pension plan defenders are offering.

December 20, 2014 at 10:30 pm

The governors’ “wishes” do not constitute law.

” They make their own rules, right? ”

They do make the rules, subject to legislation:

PEPRA…Oct 10, 2012 – 7522, et seq.

“the normal monthly rate of pay or base pay”

It would appear, from 7522.34. (c)(13), that there are some “normal monthly rate of pay” compensations that ARE pensionable, and some that are “nonpensionable pursuant to a memorandum of understanding.”

*********************************************************

7522.34. (a) “Pensionable compensation” of a new member of any

public retirement system means the normal monthly rate of pay or base

pay of the member paid in cash to similarly situated members of the

same group or class of employment for services rendered on a

full-time basis during normal working hours, pursuant to publicly

available pay schedules, subject to the limitations of subdivision

(c).

(c) Notwithstanding any other law, “pensionable compensation” of a

new member does not include the following:

(c)(13) (A) Any form of compensation identified that has been agreed

to be nonpensionable pursuant to a memorandum of understanding for

state employees bound by the memorandum of understanding. The state

employer subject to the memorandum of understanding shall inform the

retirement system of the excluded compensation and provide a copy of

the memorandum of understanding.

******************************************************

Example:

BARGAINING UNIT 12

CRAFT AND MAINTENANCE

11.8 Items Excluded from Compensation for Retirement Purposes

The following items are hereby excluded from compensation for purposes of retirement

contributions in accordance with provisions of Government Code section 20022.

SECTION TITLE

4.3 Footwear Allowance

4.8 Safety Incentive Award program – Caltrans and DWR

4.9 Department of General Services Incentive Award Program

4.10 DelMar

12.3 Class A & B Commercial Driver’s License Medical Examinations

12.4 Class A and/or B Driver’s License Fee Reimbursement

12.5 Agricultural Pest Control License

12.6 Tool Allowance

12.7 Uniform Reimbursement

12.8 Uniform Reimbursement – CDF

12.9 Uniform Reimbursement – DPR

12.10 Transportation Incentives

*********************************************************

There are several other specific exclusions in the MOU

Have you read or heard any member of the legislature contradict the CalPERS interpretation?

December 20, 2014 at 11:53 pm

Other county systems don’t seem to have difficulty understanding the “99 ways”.

MCERA (Marin County) forecasts a savings of $41 million over twenty years.

In the County Administrator’s report, Dec. 18, 2012, he states that PEPRA “restricts” the pay categories that are eligible to be pensionable, but MCERA will retain the authority to determine pensionable compensation WITHIN those restrictions.

“While the definition of “pensionable compensation” for new employees should result in additional savings, we are not able to estimate these savings at this time since 1937 Act systems statewide, including MCERA, are considering what pay types are applicable at the time of this staff report.”

……………………………..

CalSTRS savings under PEPRA are projected to be $22.7 billion over 30 years. CalPERS savings are projected to be $43 billion to $56 billion over 30 years.

MCERA projects $41 million over twenty years, plus additional savings contingent on what THEY DETERMINE to be pensionable within PEPRA restrictions.

NOT “gutted.”

Marin, and other counties dont yet know how much they will save. How, exactly, did Captain calculate that 99 different ways will cost taxpayers “BILLIONS”?

“99 ways to gut pensions” is a pathetic example of sloppy journalism and biased “reform” advocates.

Captain, of course, is free to disagree.

December 28, 2014 at 7:50 am

…And I do disagree, sdouglas. The so called savings you speak of pale in comparison to the already increased costs and/or the soon to be rapidly increasing costs for both the CalPERS & CalPERS pension plans. Both cities & school districts will soon feel the significant pain of what you call savings. In reality those so called savings are nothing more than a slight reduction in a single cost component while every other cost component of pensions is spiraling ever higher, and CalPERS has paved the way for cities to provide many additional add-on costs.

Your entire argument reminds me of a bad experience I once had while negotiating to buy a car. I didn’t end up buying the car because I didn’t like being force-fed everything from undercoating to financing to polyglycoat(?). I walked away from what, only initially, sounded like a good deal.

Like always the devil is in the details, and your argument lacks ’em.

December 28, 2014 at 9:00 am

Regarding your comments concerning the County Pension Systems (Act 37 pension plans), they are as Corrupt as CalPERS. Here is just one example:

“An eye-opening Contra Costa pension-spiking analysis shows that most public employees received significant salary increases during the year before they retired.

The study, prepared by staff of the Contra Costa County Employees Retirement Association and released last week, examined records for 3,881 government workers in that pension system who retired from 2004 to 2014.

Some findings were so surprising that even one of the most ardent defenders of the status quo on the nine-member association board joined trustees’ unanimous decision Wednesday to dig deeper into the numbers.

“I saw abuses that I didn’t think were there,” said Jerry Telles, who is elected by current retirees.”

– I can’t imagine how many ANGRY calls he’s received from those that endorsed his candidacy for the Pension Board. I applaud him for acknowledging the seriousness of the pension issue while others want to pretend it doesn’t exist

http://www.contracostatimes.com/daniel-borenstein/ci_27124830/daniel-borenstein-ubiquitous-contra-costa-pension-spiking-spreads

January 1, 2015 at 5:18 pm

“How can this rogue organization promote a bogus savings plan when they have just gutted PERPA (Jerry Brown’s Pension Reform Plan), 99 different ways to COST TAXPAYERS BILLIONS while increasing potential payouts to already over generous pension plans.”

“Rogue organization”??

Have you read or heard any member of the legislature contradict the CalPERS interpretation?

January 3, 2015 at 7:29 am

Captain Says:

…And I do disagree, smoderation douglas. The so called savings you speak of pale in comparison to the already increased costs and/or the soon to be rapidly increasing costs for both the CalPERS & CalPERS pension plans. Both cities & school districts will soon feel the significant pain of what you call savings. In reality those so called savings are nothing more than a slight reduction in a single cost component while every other cost component of pensions is spiraling ever higher, and CalPERS has paved the way for cities to provide many additional add-on costs.

Your entire argument reminds me of a bad experience I once had while negotiating to buy a car. I didn’t end up buying the car because I didn’t like being force-fed everything from undercoating to financing to polyglycoat(?). I walked away from what, only initially, sounded like a good deal.

Like always the devil is in the details, and your argument lacks ‘em.