A bill that started out as Gov. Brown’s proposal to restructure the CalPERS board emerged from the Legislature last week as a more modest change: a requirement that CalPERS board members receive 24 hours of education in pension fund operations.

A 12-point pension reform proposed by Brown in October 2011 called for more “independence and expertise” on the CalPERS board. The governor’s appointees would have doubled to six, matching the number of labor representatives.

“In the past, the lack of independence and financial sophistication on public retirement boards has contributed to unaffordable pension benefit increases,” said No. 11 of the governor’s 12-point plan.

The “unaffordable” pension increases were not identified. But the reference may have been to two bills backed by the powerful CalPERS board, which sets annual rates that must be paid by government employers in the giant retirement system.

When a booming stock market gave pension funds a surplus, a CalPERS sponsored bill, SB 400 in 1999, sharply boosted Highway Patrol pensions and authorized the same pension formula for local police, which many obtained through bargaining.

For state workers, SB 400 rolled back a pension cut given new hires earlier in the decade. Low pensions earned under the old plan could be boosted through a “buy back” with increased contributions. Retirees received a 1 to 6 percent pension increase.

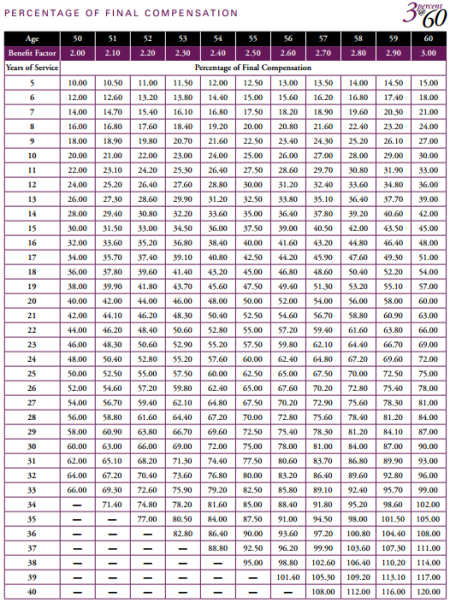

A second bill, AB 616 in 2001, authorized three escalating pension formulas for local governments in CalPERS and 20 county systems operating under a 1937 act. The top formula, “3 at 60,” provides 120 percent of pay after 40 years of service at age 60. (See table at bottom)

The CalPERS board, rejecting the advice of its chief actuary, encouraged local governments to boost pensions authorized under AB 616 by offering in 2001 to inflate the value of their pension fund investments to help cover the increased cost.

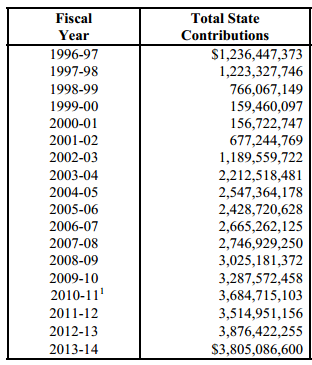

While boosting pensions, the CalPERS board sharply cut employer rates. The state CalPERS contribution was $1.2 billion in 1997, dropped to less than $160 million in 1999 and 2000, before rebounding after four low years to nearly $1.2 billion in 2002.

Now CalPERS is underfunded and has imposed three rate hikes in the last two years. The last valuation (as of June 30, 2012) showed CalPERS had about 70 percent of the projected assets needed to pay pension obligations over the next three decades.

What would the CalPERS funding level be if a more “independent and expert” board had not raised pensions and cut employer contributions as the funding level went above 100 percent during good economic times?

CalPERS has not done the calculation. But an example of the impact of spending down a brief pension fund surplus comes from the California State Teachers Retirement System, which also cut contributions and raised pension benefits around 2000.

If the boom-time changes had not been made and CalSTRS still operated as in 1990, the funding level would have been 88 percent instead of 67 percent, the CalSTRS actuary, Milliman, reported last year.

A huge CalSTRS rate increase signed by the governor last month, which will squeeze school funding with a $5 billion increase over the next seven years, could have been sharply reduced by better management, possibly even avoided.

The bill the Senate sent to the governor last week, AB 1163 by Assemblyman Marc Levine, D-San Rafael, requires the CalPERS board to adopt a policy that gives board members 24 hours of education every two years.

Among the topics that may be included, said the bill, are “fiduciary responsibilities, ethics, pension fund investments and program management, actuarial matters, pension funding, benefits administration.”

A similar policy for 20 county retirement systems operating under a 1937 act was enacted (AB 1519) two years ago. As it turns out, the CalPERS board already has a similar policy.

“We have recently adopted a board member training and education policy,” Danny Brown, a CalPERS lobbyist, told a Senate committee hearing on AB 1163 last month. “This bill is consistent with that.”

The bill originally contained Brown’s proposal to add two appointees of the governor, “independent” with “financial expertise,” to the 13-member CalPERS board and replace the Personnel Board representative with the governor’s finance director.

Levine, a freshman who defeated a union-backed candidate, introduced the bill on his own initiative. The proposal would have needed voter approval because of a labor-backed constitutional amendment in 1992 protecting CalPERS independence.

A legislative analysis of the reform based on Brown’s 12-point plan, AB 340 in 2012, said “the governor chose to drop the CalPERS board issue.” His modest state worker retiree health care cut was dropped by legislators, who said it should be bargained.

The analysis said the governor’s proposal to give new hires a “hybrid” plan, combining a smaller pension with a 401(k)-style investment plan, was replaced by a cap on the amount of pay used to calculate pensions.

For new hires, pensionable pay is capped at the maximum earnings amount taxed for Social Security, $117,000 this fiscal year, or at 120 percent of that amount if the retiree does not receive Social Security.

The failure to include a hybrid plan was mentioned by some critics when CalPERS estimated that the reform legislation would only save $12 billion to $15 billion over the next 30 years, when adjusted for inflation.

Public employee unions opposed the hybrid plan. With the 401(k)-like part of the plan, employees would share the risk of poor investment returns, which under a pension plan is only borne by the employer.

Brown’s proposed hybrid was intended, with Social Security, to replace 75 percent of salary after 35 years of service for most employees. For police and firefighters, the goal was replacement of 75 percent of salary after 30 years on the job.

The reform legislation covering CalPERS and the 20 county systems, but not big-city plans, imposes standard pension formulas on new hires that are lower than the generous formulas in SB 400 and AB 616. They encourage retirement at a later age.

For example, most state workers hired before the reform took effect on Jan. 1, 2013, have a “2 at 55” formula that replaces 50 percent of salary at age 63 with 20 years of service, 75 percent at 63 with 30 years and 100 percent at 63 with 40 years.

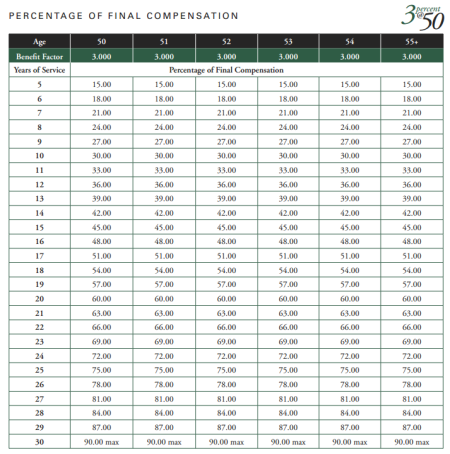

Most new state workers have a “2 at 62” formula that provides the same salary replacement with the same years of service, but not until the worker reaches age 67. (See tables below) Most state workers receive Social Security in addition to the CalPERS pension.

The “3 at 50” formula given the Highway Patrol by SB 400 is capped at 90 percent of salary at age 50 after 30 years of service. The formula was widely adopted by local police and firefighters and is often cited as an example of “unsustainable” pensions.

The top reform formula for new police is “2.7 at 57,” replacing after 30 years of service 60 percent of salary at age 50 and 81 percent at age 57. The new formula is uncapped and replaces 108 percent of salary at age 57 after 40 years of service.

Other parts of the reform legislation call for a 50-50 split of pension normal costs between employers and employees (employers still pay for all of the debt or unfunded liability), crack down on pension spiking and prohibit cuts in contributions during boom years.

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at Calpensions.com. Posted 7 Jul 14

July 7, 2014 at 11:20 am

ALL Gov’t pensions are ………… by ANY reasonable comparison to the retirement packages granted PRIVATE Sector workers by their employers….. an enormous Taxpayer ripoff and THEFT of YOUR wealth and income.

Dears Taxpayers … find a way to renege on these self-interested Public Sector pension & benefit promises granted by bought-off politicians who betrayed you.

July 7, 2014 at 2:23 pm

This article is very accurate and points correctly to the management of CalPERS being irresponsible, which is the dominant origin the $150 billion or so debt.

Among the terrible consequences of CalPERS mismanagement is the simple fact: 10,000’s of thousands of modest and honest CalPERS retirees are at risk of reduced payouts.

Other DB systems all over the United States, including many public ones and many private ones, weathered the financial crisis of 2009 just fine. They never mismanaged the payouts and contributions like CalPERS did.

DB pensions are notably more economical (lower fees, reduction of longevity risk) than the very corrupt DC systems, where fees are arbitrary and the risk pool is either 1 or 1/2 (if your spouse shares).

I never realized before this article that some State employees can retire at >100% of pay. A deal that never should have been made.

The private retirement system in the US was also terribly mismanaged, and is not worthy of any comparisons; read the Pulitzer-winning WSJ Ellen Schultz book:

http://www.retirementheist.com

July 7, 2014 at 4:02 pm

Notwithstanding spension’s protestations to the contrary, WIth 85% of the total workforce in this country, PRIVATE Sector total compensation (cash pay + pension + benefits) sets the :market rate” for compensation, NOT the Public Sector, and with near equal cash pay in the Public & Private Sectors, there is ZERO justification for the CURRENT structure of MULTIPLES greater PUBLIC Sector pensions.

And, while there are some positives to DB vs DC pensions, the inability to control politicians, makes DB Plan’s a BAD DEAL all the time!

July 7, 2014 at 4:05 pm

Until DB plans have a realistic limit on liability for employers, it is all blah, blah, blah. That limit must be absolute, e. g. not more than 10% of salary as an annual contribution rate and unfunded deficits must be reduced annually by reducing the highest retirement pay outs until the deficit is eliminated. As is, the DB system in Ca. for public workers is like paying protection to the mob. It is silly to discuss it as a two-sided issue.

When, if ever, is PERS going to make amends for its conduct in turning its retirement plans into a poorly run lottery. Until it makes amends it will never be credible. But for the artificial protection of the legislature and the courts, it would and should be treated like a RICO.

July 7, 2014 at 4:18 pm

The global financial crisis of 2008-2009 wiped out one-fourth of CalPERS’s portfolio. It had nothing to do with mismanagement by the Board–it had to do with the sub-prime housing market and fraud by many brokers on Wall Street. CalPERS has since made its losses up; as of July 3, 2014, the CalPERS portfolio is worth 301.4 billion dollars. There are no funding figures shown since 2012.

Brown’s pension reform proposal was just that–a proposal. The hybird plan was vetted by pension experts who reported that it was not possible for such to yield the retirement calculation expected by Brown. There was no need to add two more financial icons to the Board. Those types had already done enough damage.

What resulted with the passage of PEPRA of 2013 is not perfect. There is no such thing as satisfying everyone. Stand back and let things work before you get all hot and bothered. The DB pension systems in CA have kept millions of retirees in CA afloat–over 100 years for CalSTRS and 85 years for CalPERS.

(I suggest that every taxpayer rent the 2012 Oscar winning documentary film, “Inside Job”, and follow that up with the fictional, “Margin Call”.)

July 7, 2014 at 4:44 pm

Never, ever, ever, ever cite the increase in the size of PERS assets without citing the corresponding increase in it liabilities(PVB). Otherwise, it shows a lack of understanding of the pension mess. If you are interested, the increase in liabilities since 2009 is dramatic; more dramatic than the increase in the market value of assets(MVA). See-Saw, do you know why PERS liabilities increased so dramatically? Do you understand that periodic market crashes, clearly probabilities(2001 for another example) are not considered by PERS actuaries?Why not?

July 7, 2014 at 5:48 pm

I don’t know–you would have to ask them. I am neither an actuary or a professional investment manager. I trust that the principals know a lot more about what they are doing and why than I do–and that goes for all you other arm-chair experts too!

July 7, 2014 at 9:55 pm

As for the private sector setting the `market rate’ of pension benefits, I protest that concept. The captains of our private sector intentionally and maliciously shredded the private DB system. Ellen Schultz documented it. Although most private sector retirees haven’t fought very hard, a few have done an amazing job of taking their malicious current executives to task… my favorite was a retired engineer who took his former company (can’t remember the company precisely) to small claims court for a retiree health care revision, and won resoundingly. The corporate lawyers got thrashed by a `Judge Judy’ like small claims judge, and the decision could not be appealed, if memory serves.

Hundreds of public and private DB systems in the US have, however, been well managed and are not facing California’s problems. That there still exist many well-managed DB systems is a very inconvenient truth for everyone who seeks a wholesale liquidation of public DB systems. Those DB systems didn’t need public mandated limits & other junk. They were just well managed, unlike CalPERS, CalSTRS, and UCRS.

CalPERS and CalSTRS intentionally moved from bond-centric investments to more risky securities in the 1970’s. If their actuaries and professionals were any good, we would not be in the current mess of 60-70% funded ratios, nor have needs for huge employer (and employee) contributions to get out of the hole we are in.

July 7, 2014 at 11:25 pm

Spensions says, “Hundreds of public and private DB systems in the US have, however, been well managed and are not facing California’s problems. That there still exist many well-managed DB systems is a very inconvenient truth for everyone who seeks a wholesale liquidation of public DB systems. Those DB systems didn’t need public mandated limits & other junk. They were just well managed, unlike CalPERS, CalSTRS, and UCRS.”

While I’ll agree in part with your above comments taxpayers aren’t responsible for private sector DB plans (directly anyway) – and that is a distinction. In California the Public Employee Unions & CalPERS can care less about the taxpayers or their diminishing service levels – at a rapidly increasing cost. They act like MOBSTERS relying on their paid off politicians for protection. I’m a former Democrat for good reason!

Regarding a wholsale liquidation of the California Public Employee Union Pensions Plans, from a taxpayer perspective, what options do we have other than getting rid of them entirely? They, the UNIONS and CORRUPT CalPERS which is more than willing to flex their financial muscle for political purposes, and the CORRUPT CalPERS Board of Administration which uses it’s political influence (campaign contributions from their members & political clout) have proven they’re not trustworthy and nothing more than a bunch of HACKS.

Spension, back to your point: “”Hundreds of public and private DB systems in the US have, however, been well managed and are not facing California’s problems.”

Unfortunately for us here in California the Democrats are doing exactly what the unions want. The Unions own the democratic party.

How else do you explain this: “A bill that started out as Gov. Brown’s proposal to restructure the CalPERS board emerged from the Legislature last week as a more modest change: a requirement that CalPERS board members receive 24 hours of education in pension fund operations.”

– why even bother? You can’t change the culture of the CORRUPT PUBLIC EMPLOYEE UNION DOMINATED BOARD OF ADMINISTRATION (CalPERS) with what amounts to 12 hours of education per year (24 hours every two years).. These people were elected because they union reps. That is all they know.

What a JOKE!

July 7, 2014 at 11:46 pm

spension, you’re a joke … your FAVORITE case was resolved in “small claims court”, with damage-limits usually $5K or less. Big Woop !

And it’s not a “wholesale Liquidation of Public DB systems” BECAUSE they are DB, but BECAUSE the “generosity” of all PUBLIC Sector DB Plans is grossly excessive (vs ANY reaosnable metric). Successful DB Plans in the PRIVATE Sector rarely have benefit levels even HALF as generous as those in the Public Sector when properly factoring in BOTH the richness of the DB Plan “formula” AND the generosity of the Plan’s “provisions” such as very young full retirement ages and annual COLA increases …. found ONLY in PUBLIC Sector Plans.

July 7, 2014 at 11:51 pm

I’d like to say “thanks” to CalPERS for a job well done.

6/30/2009 $181 B Today $301 B

An impressive recovery. The financial managers at CalPERS deserve a lot of credit for keeping their eye on the ball despite the political hurricane being whipped up by various political hacks.

So much for 7.5% per year being a wildly unrealistic rate of return, eh Mister Crane?

July 8, 2014 at 12:28 am

This is not a technical problem. It is a moral problem, a problem of Generation Greed. The 1990s stock market bubble was not the cause. it was the rationalization.

July 8, 2014 at 1:16 am

Elliott James Says: “I’d like to say “thanks” to CalPERS for a job well done … So much for 7.5% per year being a wildly unrealistic rate of return, eh Mister Crane?”

You are Clueless, Mr. Elliott James. CalPERS hasn’t averaged 7.5% returns for over a decade. And even if they had, and they haven’t, it wouldn’t even cover all the retroactive pension benefit costs they’ve created.

CalPERS is a COMPLETE FAILURE and Taxpayers are stuck paying what amounts to a retroactive lifetime BONUS to PUBLIC EMPLOYEE UNION MEMBERS that have already been PAID IN FULL. Do you understand what that means? Hint: it equates to Hundreds of BILLIONS of DOLLARS for work that has already been performed.

CalPERS is CORRUPT! The CalPERS BOARD of ADMINISTRATION is VERY CORRUPT!

July 8, 2014 at 1:40 am

Captain you keep saying that the CalPERS Board are all union members and you have no proof; all you have is an opinion. The Board is composed of 13 members–three of them are former or current union members. The rest of them are career managers. CalPERS existed for almost 40 years before the public sector in CA was unionized.

July 8, 2014 at 3:28 am

SeeSaw Says: “Captain you keep saying that …”

CalPers is CORRUPT! The CalPERS Board of Administration, at least the union members which total six, are completely underqualified. They have absolutely no business making decisions that only impact taxpayers when taxpayers are essentially guaranteeing every penny these fools give-away. Unless the unions want to take responsibility for their own intentional CASH -GRABS we should, the governor should, GET RID OF THEM.

I’m all for the CalPERS Board of Administration, and CalPERS management – putting their reputation & members money at risk. While they seem to have plenty of conviction regarding future returns when it comes to gambling with taxpayer dollars – I don’t think they have the balls to put their members money where their mouth is.

I guess CalPERS has actually done that (GAMBLED) with their failed Long-term Disability program. Now the members are suing CalPERS. Should the members win the lawsuit the Taxpayers will be funding that CalPERS failure also.

IMO, CalPERS conviction in anything is nothing but lies & lip service.

Break CalPERS into little pieces.

July 8, 2014 at 4:22 am

Six members of the Board are elected by the plan members; three of the six are current or former union members. Their union activities, past or present, are irrelevant to their positions on the CalPERS Board. They are not actuaries or investment managers–they are just like any other Board that acts on the material presented to them by the people who do the work.

July 8, 2014 at 5:05 am

There are six members of the CalPERS Board elected by the plan-members: Feckner, Bilbrey, and Jellincic are active or former union officials. Jellincic is a professional investment manager. Both Bilbrey and Jellincic hold Masters Degrees in Business Administration and Finance; Mathuir is a Financial analyst and has a Masters Degree in Business Adminitration; George Dieher is a college faculty member who has an MBA and a PHD. Henry Jones was a school Administrator and the Chief Financial Officer of the LAUSD. He has a BA in Business Administration and Finance. Feckner took educational courses related to his Board activities and holds special certificates.

You don’t think these people are qualified to be on the CalPERS Board Captain? Well then, bring on your own candidates and let us know about their qualifications. They better be higher-up than what we have now.. While you are at it, find proof that all six are union affiliated.

July 8, 2014 at 5:37 am

” with near equal cash pay in the Public & Private Sectors,”

We keep seeing this copy and paste crappolla even though most researchers, including the American Enterprise Institute agree that it is not true. For California state workers, comparing equivalent workers, they found AVERAGE state workers had a pay deficit of twelve percent, and professionals and doctorates with up to thirty seven percent less.

Cash

Pay

According to Briggs and Richwine, it is not true that “ALL”

“Gov’t pensions are ………… by ANY reasonable comparison to the retirement packages granted PRIVATE Sector workers by their employers….. an enormous Taxpayer ripoff and THEFT of YOUR wealth and income.”

July 8, 2014 at 5:44 am

“If the boom-time changes had not been made and CalSTRS still operated as in 1990, the funding level would have been 88 percent instead of 67 percent, the CalSTRS actuary, Milliman, reported last year.

A huge CalSTRS rate increase signed by the governor last month, which will squeeze school funding with a $5 billion increase over the next seven years, could have been sharply reduced by better management, possibly even avoided”

For all the talk our governor has spewed about how his age somehow recuses himself of politics as usual his actions are nothing BUT politics as usual. I don’t get it. His 12 point pension plan eliminated retroactive pension benefits yet he signed off on retroactive pension benefits for the teachers union. Isn’t that illegal?

It is illegal to provide retroactive pension benefits under the governors own12 point pension plan? The additional 2.25% that is widely reported as additional teachers contributions toward their own pension plan is a farse. The governor apparently doesn’t think anyone will notice his hypocritical position. The additional Teacher contribution does absolutely nothing to pay toward/pay down the Teachers pension plan – NOTHING. It only applies toward the 2% annual COLA pension increase which isn’t part of the teachers contract. Because someone retiring in the next year (or the next several years) only pays for a small fraction of this lifetime benefit it IS A RETROACTIVE PENSION BENEFIT BY DEFINITION.

I do NOT understand how our Governor can claim to end retroactive pension benefits while at the same time approving them.

All this while, ” A huge CalSTRS rate increase signed by the governor last month, which will squeeze school funding with a $5 billion increase over the next seven years, could have been sharply reduced by better management, possibly even avoided”

I agree. What has been sold to the public is disgusting. It only makes sense if you consider that someone other than the taxpayers are in control of the Governor/Sacramento.

July 8, 2014 at 8:33 am

I knew that K-12 teachers are clueless about the stock market–their comments on LA Times blogs make that obvious. I had no idea that the same is true for CalPERS board members, if Brown wants them to take a 24-hr. “Pensions for dummies” course. It’s odd that CalPERS board members are as generous as they are with the pension checks when they must know that Prop 13 is still untouchable. Or maybe they think when schools start to look like landfills then voters will approve higher taxes “for the kids”. And seesaw, no, I don’t think those guys are qualified to be board members, except perhaps the investment manager. I have an accounting degree and there wasn’t a single class I took where they taught you what is a realistic discount rate for a pension fund. You would only know that if you had first-hand experience with a Schwab or Ameritrade account. And I would suggest the dvd “Rogue Trader” starring Ewan McGregor as the trader who brought down Barings. CalSTRS and most other public pensions funds are making those kinds of bets with taxpayer money because they are so desperate for yields.

July 8, 2014 at 10:48 am

SDouglas47,

Unlike you, I’m not riding this Public Sector pension & benefit “pig-fest”. Clearly, YOU have more “skin in the game” …. to lose (WHEN, not IF your pension & benefits are reduced).

Nothing you say (all of which is “cherry-picked” to support your greedy agenda) can be taken at face value.

July 8, 2014 at 2:32 pm

Captain: “CalPERS hasn’t averaged 7.5% returns for over a decade. …CalPERS is a COMPLETE FAILURE and Taxpayers are stuck paying what amounts to a retroactive lifetime BONUS to PUBLIC EMPLOYEE UNION MEMBERS”

——–

Annual investment returns have exceeded 10% for 8 out of the 10 years. Only one year, 2008, was negative at -27.8%. 2011 came in at +1.1%. See CalPERS’ “Facts At A Glance.”

On the benefit side, just about everybody concedes that the benefit increases made in 1999 were not actuarially sound. But I wasn’t talking about benefits. I was talking only about the investment side, where they have taken the fund 181 B to 301 B in 5 years. That doesn’t sound like a “complete failure” to me. Can’t you concede that the investment managers at CalPERS have done a good job?

July 8, 2014 at 6:27 pm

Elliot, CalPERS investment “history” is not really relevant. Few investment professionals believe a long-term rate assumption in excess of 6% is reasonable (INCLUDING Warren Buffet and Moody’s). Given the huge CalPERS unfunded liability if re-valued using that 6%, the CURRENT benefit structure is CLEARLY unsupportable and grossly unfair to Taxpayers who backstop Plan shortfalls.

July 8, 2014 at 7:19 pm

Tough Love… the small claims decision was a rare case where one determined guy outsmarted the much richer Corporate Executives & Attorneys. Small $ but great principle.

I know you avert your eyes to all the misdeeds of the private sector by choice. I don’t.

You also ignore the fact that many ***PUBLIC*** DB plans are just fine outside of California. Not every public DB plan gets as far in debt as the CalXXRS ones.

Captain, Unions are just playing the American game, pressing their case, just like Corporate Executives & attorneys do. Criminal behavior is rampant, and rarely prosecuted. A retroactive pension increase is bad, and $10 million bonuses for AIG executives (paid for with taxpayer funds) who drove their company into the ground are bad too.

July 8, 2014 at 7:43 pm

Spension, I think you need to take into account the fact that CA probably has more public employees than the entire populations of some of those states that are “just fine”, compared to CA’s DB plans. I am the member of a CA DB plan and its working pretty good.

July 8, 2014 at 8:05 pm

For the last 22 years, CalPERS has averaged 8.5% return. Also, seldomly referenced is the fact that on June 30, 2007 at the onset of the recession, the CalPERS Miscellaneous Plan was 102% funded. The drop in funded status of 40% was due to paper investment losses. Now, the market value of CalPERS assets has rebounded to $301 Billion with a “B.” Pension benefits didn’t increase during the recession. Had people the assumptions not changed, the funded status would be much, much higher than it now is. Most people don’t seem to understand that 2/3 of the pension costs are funded through investment earnings NOT employer contributions. Focus more attention on the performance of the money managers.

To those that say CalPERS benefits are so generous, the average annual pension is $31,548. This information is readily available and verifiable on CalPERS website in the publication “facts at a glance.”

To the person that said that CalPERS benefits are so generous, I wonder if he can pay his mortgage and survive on an annual income of $31,548.

To those that point to the total unfunded liabilities that remain in the system, I ask, “how much do you owe on your mortgage?” Do you have the cash to pay off your mortgage today? Why not? It’s because the bank lends the money to you anticipating that you will have future income over the next 30 years to fund your monthly mortgage payments.

That is the same concept that underlies pension funding. Pension costs are amortized over an employees’ anticipated working life of 30 years. The funding of that pension benefit is paid from future revenues over the next 30 years to fund the benefit. Strangely, none of the pundits add in the anticipated future revenues to their unfunded liability sound bites – because by doing so, it would completely debunk their argument.

Quite believing these know-nothing naysayers and understand the facts for yourself.

July 8, 2014 at 8:51 pm

To “Get the facts Says”,

The under $31,548K “average” is understated not only because it includes short-career workers, but also because it includes:

(1) short career workers

(2) part time workers

(3) those who retired years (some decades) ago with much smaller salaries, and lower (than current) pension formulas

(3) survivors of deceased pensioners with 50% survivorship annuities

CalPERS is fully aware of the distortion of presenting such figures. It also knows that the MUCH more relevant “average” is that of recent (e.g., 2013) full-time, full-career (30+ year) retirees. But as THIS average would likely be about $70K, it knows that it wouldn’t support their Union-supporting agenda.

And your mortgage analogy is all wrong. With pensions, having an unfunded liability (which is the mathematical present value of the cost of PAST service benefits ALREADY accrued) is akin to having paid only a PORTION of mortgage payments due IN PAST MONTHS ! It has nothing to due with payment due in the future on the outstanding balance.

July 8, 2014 at 9:15 pm

Amen!!!!

July 8, 2014 at 9:57 pm

The fact that there are people retired on CalPERS in the groups you outline does not change the relevant fact that they are receiving those small pensions. Your relevant “average” is way off–you are using a cherry-picked group. You must factor in all the annuitants, regardless of length of service or pension amount, in order to get a true average. My service credit was 36.4 years and I am not close to $70K.

July 9, 2014 at 12:10 am

The question of the day–Why is a resident of New Jersey obsessed with bringing down a defined-benefit pension plan in CA?

July 9, 2014 at 1:18 am

More irony……

There are THOUSANDS of state workers retiring THIS year who will receive thirty two thousand per year, or less, after “full” careers of thirty years or more.

Not part timers. Not part career. Not survivors.

…………………………

These, generally, are the people that all the studies say have a total compensation HIGHER than their private sector equivalents.

Some of $100,000 plus pensions, particularly those going to professionals and PHDs, are for persons who make MUCH less in total compensation than their private sector peers.

(MUCH less total compensation means including the cost of all benefits, including all pension costs)

The American Enterprise Institute, 2014:

“Nevertheless, a significant compensation penalty exists for both professional and doctoral degree holders. It is worth considering how government may continue to attract better educated employees despite a seeming compensation penalty. “

July 9, 2014 at 2:33 am

SDouglas47, Are all the safety workers (MANY with $100+K pensions) PHD’s …. or just GROSSLY overcompensate ?

And how about those “lifeguard” with the huge pay & pensions which made headlines last year ?

July 9, 2014 at 3:41 am

“Safety employees” were not included in the AEI study.

The $100,000 “lifeguards” ?

………………………..

“Those whose salaries are in question point out that they hold management roles, have decades of service and are considered public safety employees under the fire department, the same as fire captains and battalion chiefs. The full-time guards train more than 200 seasonal lifeguards who make between $16 and $22 an hour (and) run a junior lifeguard program that brings in $1 million a year.”

………………………….

Like Mike Genest said: We could have made more on the outside.

July 9, 2014 at 4:44 am

Get off your high horse, TL! A 19-year old, “lifeguard”, lost his life in Newport Beach yesterday trying to save a swimmer that had been caught in a riptide. That, “lifeguard”, was not one of those with the huge pay and pensions to which you refer. You just believe crap, TL. The “lifeguards” with the high pay and pensions are the managers and the ones who command the boats–they do not sit in the high chairs looking for people in trouble. You need to get over yourself, TL! And by the way, go out and find some rank and file safety workers with 100K pensions. That should take up so much of your time, that you won’t have have any more to verbally harrass public workers in a state that you don’t even live in.

July 9, 2014 at 4:58 am

The Board members don’t have to be investment managers, S & L. CalPERS has employees to do that.

July 9, 2014 at 11:40 am

The Board of any major corporation in America has more intelligence, and experience relevant to IT’s business in a single fingernail than all of CalPERS Board members have (together) in running a pension plan with $300 Billion of assets.

July 9, 2014 at 3:32 pm

And, what Study can you cite to show that your opinion is a fact? I think you are a little jealous, TL. You’d love to get your hands on that 300 billion wouldn’t you.

July 9, 2014 at 4:41 pm

LOL!!!!!!

I have always assumed “board of directors” is largely a political plum.

TL is often wrong, but never uncertain.

July 9, 2014 at 7:56 pm

“Tough Love says” – You sir, are an idiot. An “average pension is an average of all those vested retirees. It is NOT understated. The average is THE average. What you don’t know is that the entry age into public service for police officers is 29 and the entry age for all non-safety workers is 33. So, their pension benefit IS much lower than what you believe and represent.

The mortgage analogy IS correct because the term “unfunded actuarially accrued liabilities” refers to an expected FUTURE benefit, but of course, you know that don’t you.

Wow, the lengths some people will go to to fill the unknowing unsuspecting innocents’ heads with garbage. Tough Love – you need some tough love starting with learning how to tell the truth.

July 9, 2014 at 8:32 pm

To Get The Facts Says,

I suggest you take a basic course in finance …. You clearly know way to little for me to teach you here.

July 9, 2014 at 9:13 pm

TL–what these union people need to do is open an account with Charles Schwab or Ameritrade with $2500. They can buy IBM, AAPL, T, XOM, or bond funds like VBM and find out for themselves how hard it is to make their accounts grow at a Madoff 8% per year, every year. A one-year CD pays zero interest–that should make union people wonder what kinds of risky bets their fund managers are investing in to achieve Madoff returns.

July 9, 2014 at 9:19 pm

Get the Facts–so if we apply your reasoning to college tuition we could say that the average tuition for UC over the last 35 years is $3000 per year. (UC tuition was less than $1000 per year in 1980). That’s little consolation to a prospective student who can’t afford UC’s current tuition of $4500 per quarter.

July 9, 2014 at 9:23 pm

“Tough Love” – I have 28 years of experience in public finance, 18 years of experience as a pension fund administrator, and I have prepared actuarial studies, asset liability/asset allocation studies, manager search RFPs, quarterly and annual performance reports, and I do teach finance. So, close your trap with your off base comments.

July 9, 2014 at 10:02 pm

Get The Facts said,

“The funding of that pension benefit is paid from future revenues over the next 30 years to fund the benefit. Strangely, none of the pundits add in the anticipated future revenues to their unfunded liability sound bites – because by doing so, it would completely debunk their argument.”

Not true, CalPERS includes a 7.5% expected investment return.

http://www.calpers.ca.gov/index.jsp?bc=/about/newsroom/news/demographic-assumptions.xml

The unfunded liability as of today, about $4,053 per California resident, is net of expected investment return.

Seesaw said “Spension, I think you need to take into account the fact that CA probably has more public employees than the entire populations of some of those states that are “just fine”, compared to CA’s DB plans. I am the member of a CA DB plan and its working pretty good”

I think other public pension programs *on a per retiree & vested employee basis* are in better shape than CalPERS or CalSTRS. I’ve posted lists in the past on this forum of the names of both public and private DB pension systems that are doing better, per retiree & vested employee. It is not a question of size.

CalPERS & CalSTRS just messed up; they forgot to factor in the volatility of stock market (& more risky) investments. So, they over promised and/or under collected contributions and now the residents of California are left holding the bag. Sorry about that.

July 9, 2014 at 10:38 pm

Quoting “Get the Facts says” …. “The mortgage analogy IS correct because the term “unfunded actuarially accrued liabilities” refers to an expected FUTURE benefit,”

Wrong (Mr. finance teacher). It’s not the “expected FUTURE benefit” itself, it’s the mathematical PRESENT VALUE of that expected future benefit, meaning it’s the CASH you are supposed to have IN HAND NOW … to be able to fulfill those promised future payouts.

God help your students.

July 9, 2014 at 10:52 pm

They are not holding the bag in CA any more than you are holding the bag in your state, Spension. The pension funding comes from property taxes. Mine are $498/year. How much are your’s, Spension?

July 10, 2014 at 12:53 am

Wrong again, Tough Love – you sure are slick at mixing up facts with the mythological world you live in. Expected future benefit means exactly that. Its expected to be paid in the future. A present value determined for reporting presentation purposes does not mean that there should be an expectation that there should be “cash in hand” to fund that liability as of the report date. Again, those liabilities are expected to be paid from a future revenue stream which has to be considered to fairly represent the presentation.

July 10, 2014 at 1:32 am

Here’s something you don’t see often:

“Retirees received a 1 to 6 percent pension increase.” (SB400)

I’ve said many times that SB400 increased my pension by 3%. It was NOT a 50% increase in pensions.

Some of the names the “experts” called me for that statement, I’m hurt.

July 10, 2014 at 4:12 am

SD47, my retroactive pension increase from 2% to 3% yielded me about 13% over what I would have gotten without it, because the previous formula would have jumped to 2.418% at age 63. I was 72 when I retired–really jumped the gun to feed at that trough, didn’t I? People don’t realize that pension upgrades in CA have been retroactive throughout the history of the DB pension plans. That is the way the legislature set up the Plans. CalPERS is just the messenger.

July 10, 2014 at 11:59 am

SeeSaw, Ok, so for doing exactly that, the Legislature is a CANCER, just like CalPERS (for many reasons) and just like the insatiably greedy Public Sectro Unions.

July 10, 2014 at 7:14 pm

SeeSaw, it was not the California legislature that set up what are being termed here as “retroactive adjustments.” The basic plan design of defined benefit pension plans used in all 50 states and most developed countries includes such provisions.

What “Tough Love” fails to acknowledge is that pension benefit improvements were collectively bargained for in good faith by management and labor at the bargaining table. In fact, when pension improvements were granted by employers, in most cases, their pension was overfunded and management encouraged labor to take the pension benefit improvement in lieu of a wage increase, which, in many cases, labor did.

Management would ask their actuary to determine the value of a benefit formula change, say from 2% (multiplier) of final average compensation for each year of service to 3% with a normal retirement age of 60 for miscellaneous employees and 50 for safety members. The actuary expresses the cost of the benefit change (with retroactive adjustments for all employees as the term is used in this thread) as a percent of pay, say 3.5% of pay. So, management would offer the pension improvement equivalent to a 3.5% wage increase in lieu of giving the wage increase to take advantage of the overfunded status of their pension obligations.

Now, with PEPRA, those benefits collectively bargained for, have been legislated away by the State legislature. All of those wage increases foregone by employees in exchange for the benefit improvements are lost. Where is the fairness in this process?

July 10, 2014 at 9:09 pm

Quoting Get the Facts says …” What “Tough Love” fails to acknowledge is that pension benefit improvements were collectively bargained for in good faith by management and labor at the bargaining table.”

Good faith my butt. Nobody at that “bargaining table” was appropriately representing TAXPAYER interests.

July 10, 2014 at 9:13 pm

Quoting Get the Facts says …” Expected future benefit means exactly that. Its expected to be paid in the future. A present value determined for reporting presentation purposes does not mean that there should be an expectation that there should be “cash in hand” to fund that liability as of the report date.”

Baloney. That present value is INDEED a measure of what should be in hand RIGHT NOW. Do you consider financial reporting a joke? When you “report” that unfunded liability, it’s because you have less in hand RIGHT NOW than what should be there.

July 10, 2014 at 9:48 pm

Wow, Tough Love. You are just one of those people that insist on getting the last word even if you have nothing worthy to say. Just a grumpy old know-nothing yelling, “get off my lawn.” Good for you.

“Better to remain silent and be thought a fool than to speak out and remove all doubt.” – Abraham Lincoln. Sage words for you TL. You should listen to Honest Abe more often. You might learn something. Now, get off my lawn.

July 11, 2014 at 12:02 am

“They are not holding the bag in CA any more than you are holding the bag in your state, Spension. The pension funding comes from property taxes. Mine are $498/year. How much are your’s, Spension?”

My State is California. As I’ve posted on this board on numerous occasions, I’ve looked up what my kindergarten and other elementary school teachers get in pensions from the service in California. Darned little… $50K or so for 40 years of service, if my memory serves me correctly.

As for my property taxes, upwards of $5,000/year. But I believe my California income taxes are also used to fund State contributions to CalPERS and CalSTRS.

I’ve seen no convincing refutation that the best estimate of the CalPERS shortfall, estimated in 2014 dollars, including projected future investment gains, including best actuarial projections of future pensions for current vested employees, etc, is $4,053 per California residents.

Sure, future `revenue streams’ will cover that. California residents who pay taxes are the principal origin of those depersonalized `revenue streams’; of course employees in CalPERS will provide maybe 1/3 of that figure.

You really can’t hide what we are asking taxpaying residents to chip in a lot of money. That is just for CalPERS; CalSTRS needs a impersonalized `revenue stream’ too… that is just an Orwellian dissembling phrase for getting residents to chip in more.

Now sure, maybe CalPERS investments will zoom up and California residents will need to contribute less. But could easily go the other way too, residents might have to contribute even more. Predictions are difficult, particularly about the future.

July 11, 2014 at 12:36 am

Get The Facts Says, Do you think that bullying me makes you right and I wrong?

What I stated in my past few comments is accurate.

Yes, something (cash payouts) can be due on a date in the future, but it’s value today (i. e., it’s “Present Value”) is easily estimable (by discounting for interest to represent the time value of money, and if applicable, other contingencies such as survivorship to each payout date), and when those promised cash flows are for PAST service already rendered, that present value ABSOLUTELY represents assets that should be IN HAND TODAY. That’s called proper pension funding.

If any of your “students” are reading this, I suggest you go to your department chairperson and ask for their opinion. .When (not if) you find out that your teacher is wrong, I suggest you carefully consider whether sharing that with “Get The Facts Says” is a good idea …. as he/she appears quite stubborn.

July 11, 2014 at 10:16 pm

SeeSaw Says: “You don’t think these people are qualified to be on the CalPERS Board Captain? Well then, bring on your own candidates and let us know about their qualifications. They better be higher-up than what we have now.. While you are at it, find proof that all six are union affiliated.”

No, Seesaw, I do not think they’re qualified to be independent Board members of a pension system that abuses taxpayers.

To your point that I should “bring on your own candidates and let us know about their qualifications”, that isn’t even possible because the unions have control over the number of elected representatives comprising the board. I think you know that – but you continue to provide a hissy-fit anyway. To be honest, SeeSaw, I have very little respect for your broken-record argument.

CalPERS is Corrupt! The CalPERS Board of Administration is Corrupt!

July 11, 2014 at 11:12 pm

spension Says: July 11, 2014 at 12:02 am

“As for my property taxes, upwards of $5,000/year. But I believe my California income taxes are also used to fund State contributions to CalPERS and CalSTRS.

I’ve seen no convincing refutation that the best estimate of the CalPERS shortfall, estimated in 2014 dollars, including projected future investment gains, including best actuarial projections of future pensions for current vested employees, etc, is $4,053 per California residents.”

The $4,053 number you sight is a gross underestimation of the dollars 10’s of millions of Californians are expected to pay toward the retirement benefits of hundreds of thousands of public employee union members (the shape of a pyramid is taking form).

The grossly underestimated CalPERS unfunded liability, which leads to increased taxpayer pension contributions and/or diminished service levels has yet to be calculated in an honest or meaningful way. The inflated discount rate of 7.5% which is used to mislead the public and will ultimately increase taxpayer cost substantially.

The same problem applies to the county funds. While CalPERS is busy using lies to justify their existence, discount rate, Corrupt Board of Administration, and unfunded liabilities, the county pensions are doing the same. It is literally one for all and for one in the pension system world.

My point is that the unfunded pension costs include the cost at the state level, the county level, the city level, and the special district level – and the CalSTRS level. When you add them all up (pension costs), and special districts seem to be able to include the increase pension cost in the form of fees, they are much more significant than the $4,053 dollars you’re claiming.

Note: Just about every tax you pay is going to pay toward exorbinant pensions, at least in part. And that part is getting much larger.

CalPERS is CORRUPT!

July 11, 2014 at 11:15 pm

“Get The Facts Says:

July 10, 2014 at 7:14 pm

SeeSaw, it was not the California legislature that set up what are being termed here as “retroactive adjustments.” The basic plan design of defined benefit pension plans used in all 50 states and most developed countries includes such provisions.

What “Tough Love” fails to acknowledge is that pension benefit improvements were collectively bargained for in good faith by management and labor at the bargaining table. In fact, when pension improvements were granted by employers, in most cases, their pension was overfunded and management encouraged labor to take the pension benefit improvement in lieu of a wage increase, which, in many cases, labor did. ”

Complete BULL CRAP. Why do the unions keep perpetuating these lies.

July 12, 2014 at 12:14 am

I participate in the Board elections, Captain. I have no connection to any unions and when I was working, the CalPERS Board elections were never even mentioned in the few meetings that I attended every year. We were individually on our own where voting for the CalPERS Board was concerned. As for you calling my argument a broken record, what do you think your continuing argument is? “CalPERS is Corrupt”, “CalPERS is Corrupt”. I’m still waiting for you to give proof, and I certainly have no respect either for your point of view. So likewise, Captain–sit there and have your ongoing snit-fit.

July 12, 2014 at 1:00 am

SeeSaw Says: “I participate in the Board elections, Captain.”

SeeSaw, I’ve watched recent CalPERS board elections and I find that the union nominated members electable qualifications have more to do with being a UNION President, Union VP, or just plain anti-management. Nothing these people represent has much, if anything, to do with the complicated fiscal management of one of the WORLDS LARGEST PENSION FUNDS.

Board Member Michael Bilbrey was an assistant book store cordinator for the Glendale community college district – until he was promoted (and a UNION VP). The Board president was a glass installer for the Sonoma County School District (and a UNION President) before being promoted to President of the Board of one of the worlds largest pension funds.

SeeSaw, J.J. Jeellnic, another Board of Administration member has been censured on at least one occassion for inappropriatte behavior.

These people have no business representing the finaciall dealings of taxpayers, especially when it representins 300 billion dollars in assetts, and these clowns don’t have a clue.

July 12, 2014 at 1:41 am

SeeSaw Says:” As for you calling my argument a broken record, what do you think your continuing argument is? “CalPERS is Corrupt”, “CalPERS is Corrupt”. I’m still waiting for you to give proof, and I certainly have no respect either for your point of view. So likewise, Captain–sit there and have your ongoing snit-fit.”

– I guess we can start here, SeeSaw: ” A Former CalPERS CEO Is Finally Pleading Guilty to Conspiracy Charges, So Let’s Take Stock of the Damage He Did”

It isn’t just the former CEO of CalPERS that is Corrupt. It is also A Former Board Member of CalPERS, as well as the Culture of CalPERS, that is in in Question/CORRUPT. Here is how the article about CalPERS CORRUPTION starts – AND IT IS NIETHER THE BEGINNING OR ENDING OF THE CalPERS CORRUPTION STORY/CORRUPTION:

“For years, CalPERS—the largest public pension fund in the country— was a hotbed of backdoor scheming, shady dealings and outright fraud.

That was thanks to two long-time friends, Fred Buenrostro and Alfred J.R. Villalobos, who we now know (well, allegedly) profited greatly from greasing the wheels on billions of dollars of CalPERS investments from behind the scenes in 2007-2008, and probably years before.

Buenrostro was CalPERS’ CEO from 2002-2008, and Villalobos sat on the fund’s Board from 1993-1995….

The True Cost?

This isn’t nearly the first time corruption and fraud has made its way in the public pension system, and it won’t be the last. That’s why its important to assign some numbers to these news stories—if only so we can appreciate the tangible costs that this type of cronyism incurs to the system, its members and taxpayers on the whole.”

Read the rest here: http://pension360.org/a-former-calpers-ceo-is-finally-pleading-guilty-to-conspiracy-charges-so-lets-take-stock-of-the-damage-he-did/

July 12, 2014 at 7:11 am

There is no need for you to send me links to stories I have already read. This saga is playing out. It was a conspiracy by a few dishonest individuals for individual gain and they are being punished in a court of law. CalPERS itself was scammed–it was not the scammer.

July 12, 2014 at 7:15 am

We are talking about CalPERS here. CalPERS is not a union. Just because you keep wailing and whining that CalPERS is union dominated and corrupt, does not make it true–you are just someone crying in your beer–sob, sob.