A quest to help workers save for retirement begun by Senate President Pro Tempore Kevin de Leon, D-Los Angeles, seven years ago may finally have entered the home stretch of a long journey.

Last month the state approved a $500,000 consultant contract, financed by donors, that the Secure Choice board, created by De Leon’s legislation, will use to recommend a state-run retirement savings plan for approval by the Legislature.

The goal is an “automatic IRA,” a payroll deduction of about 3 percent that goes into a tax-deferred savings plan, unless the worker opts out. An automatic deduction is said to be a proven way to boost savings. It’s easy and removed from daily budget pressures.

In California, more than half of private-sector workers, about 6.3 million, have a job that offers no retirement plan. Social Security alone often is inadequate, and now more retirement income is needed as life spans increase and health care costs grow.

The automatic IRA is part of a solution advocated last month by the Boston College Center for Retirement Research in “Falling Short: the Coming Retirement Crisis and What to Do About It,” and it’s also part of a national trend.

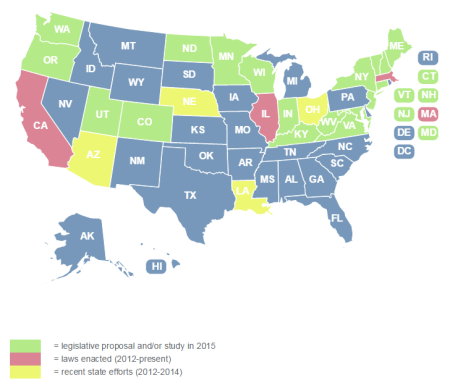

“Eight states — Illinois, Massachusetts, Oregon, Maryland, California, Minnesota, Connecticut, and Vermont — are in various stages of exploring ways to expand access to retirement plans,” said the Boston center report. “At the federal level, several proposals have been suggested, including auto IRAs.”

The Georgetown University Center for Retirement Initiatives sees an even broader trend. “Since 2012, at least 24 states have considered proposals to study or establish state-sponsored (retirement) plans,” said its website.

De Leon, who became the Senate leader last October, began his quest for a private-sector retirement savings plan while still in the Assembly, first introducing legislation in 2008.

He said his inspiration was his aunt, Francisca, a “second mother” during his childhood in San Diego, who gave him breakfast and dinner and worked as a housekeeper into her 70s.

“I send her a check on a monthly basis, and she receives her Social Security check,” De Leon told National Public Radio two years ago. “But it’s simply not enough for her to pay the rent, to put food on the table, to pay for her medication.”

The bill De Leon finally pushed through the Legislature, SB 1234 in 2012, got little or no support from Republicans and was opposed by employer, insurer, financial planner and taxpayer groups.

The bill created a nine-member Secure Choice board tasked with raising money for a market analysis to help design an automatic IRA, self-sustaining with no liability for employers or the state, that would be brought back to the Legislature for approval.

Half of the board’s $1 million fundraising goal was met by a matching grant from a surprising source: the Laura and John Arnold Foundation, financed by a Texas hedge fund billionaire vilified by labor for backing public pension reform.

The other half: SEIU state labor council, California Teachers Association and Ford Foundation $100,000 each, AARP $60,000, California Endowment and Rep. Ted Lieu $50,000 each, Pew Charitable Trusts $39,000, and Steve Westly $1,000.

Under the $500,000 contract executed April 23, the lead consultant for the market analysis and plan design, Overture Financial, will work with the UC Labor Center, Segal Consulting actuaries, and Mathew Greenwald and Associates market research.

Legal services are provided by K&L Gates under a $275,000 contract. State Treasurer John Chiang’s office recently hired Christina Elliot as Secure Choice acting executive director and Ruth Holton-Hodson as senior advisor to the Secure Choice staff.

“I think we have kind of turned the corner from talking about procurement and fund raising to beginning the work that we are going to be doing,” Grant Boyken, deputy state treasurer, told the Secure Choice board last week.

Overture Financial is expected to complete its study this fall. Then the Secure Choice board, after studying the options, may be ready to make a recommendation to the Legislature next year.

California was the first state with legislation on a Secure Choice program. But Illinois jumped ahead with legislation signed last January for a Secure Choice retirement savings program that could serve up to 2.3 million workers.

The Illinois program is automatic enrollment, with an employee opt out, for a payroll deduction of 3 percent that goes into a Roth IRA with five investment options: life-cycle target date, conservative, growth, annuity, and insured funds.

Legislation creating the California and Illinois Secure Choice programs requires exemption from regulation under the federal Employee Retirement Income Security Act (ERISA), which among other things could result in liability and fiduciary obligations for employers.

But some Department of Labor officials reportedly think that automatically enrolling employees in a retirement plan, even though it’s state run, is more “employer involvement” than allowed under the exemptions from ERISA regulation.

Sen. De Leon, Treasurer Chiang and a K&L Gates lawyer, David Morse, met in March with U.S. Labor Secretary Thomas Perez in Washington, D.C. to explain why the California Secure Choice program should be exempt from ERISA.

Morse told the Secure Choice board last week he thinks an exemption is “doable.” He mentioned a federal court decision that found ERISA did not apply to a San Francisco ordinance requiring employers to spend a certain amount on health care.

The term “Secure Choice,” now used in several states, may have originated with a proposal in 20ll from a trade association for public pension systems, the National Conference on Public Employee Retirement Systems.

In pension reform debates over switching to the 401(k)-style individual plans now common in the private sector, unions and other pension supporters sometimes argue that the solution is retirement security for everyone, not phasing out pensions.

The NCPERS proposal, “The Secure Choice Pensions: A Way Forward for Retirement Security in the Private Sector,” would guarantee minimum returns on program investments that would be managed by low-cost experienced professionals: public pension funds.

The study being done for California Secure Choice will look at ways to pool investments and guarantee minimum returns, possibly through insurance. But it’s not clear the two big state pension funds, if asked, would manage Secure Choice investments.

Boyken, the deputy state treasurer, told the board last week the California Public Employees Retirement System and the California State Teachers Retirement System may be “leery” as the IRS looks at the tax-exempt status of public pension funds.

“The idea of partnering with a plan that takes on private-sector workers, although they have never discussed it, I think that would be a pretty big hurdle for them,” Boyken said.

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at Calpensions.com. Posted 4 May 15

Leave a comment