The debt or “unfunded liability” state Controller John Chiang reported last week for state worker retiree health care, $72 billion, is larger than the unfunded liability for state worker pensions reported by CalPERS in April, $50 billion.

It’s a legislative legacy, a debt for state worker services received by one generation that lawmakers decided to let the next generations inherit.

More than two decades ago legislation created a pension-like investment fund in the state treasurer’s office to help pay for state worker retiree health care. But lawmakers never put money in the retiree health care fund.

Former Assemblyman Dave Elder, D-Long Beach, the author of the legislation (AB 1104 in 1991) said he tried to make a small payment of his own to the fund to publicize the inaction, hoping to create some political momentum.

Another action in 1991 led to what Gov. Brown, in a 12-point pension reform plan three years ago, called the “anomaly of retirees paying less for health care premiums than current employees.”

A cost-cutting move by the administration of former Gov. Pete Wilson began requiring active state workers to pay some of the cost of their health care. No change was made in the payment for health care promised when they retired.

State worker retiree health care still pays 100 percent of the premium of the fully vested retiree (the average cost of several of the largest health plans) and 90 percent of the premium for dependents.

For the health care of active workers, the state usually pays 80 or 85 percent of the premium for the worker, depending on labor contract bargaining, and 80 percent of the premium for dependents.

Brown’s 12-point plan also called for more enforcement of shifting some of the health care costs for eligible retirees to Medicare, the federal health insurance program for persons age 65 and older.

“Contrary to current practice, rules requiring all retirees to look to Medicare to the fullest extent possible when they become eligible will be fully enforced,” said the governor’s plan.

Now Brown, after a pension reform in 2012 and a teachers’ retirement system funding plan last year, is moving on to the state worker retiree health care debt, which the controller estimated has grown $7 billion since a report last March.

“And without action, it will continue to grow by billions of dollars,” a spokesman for Brown’s finance department, H.D. Palmer, said in a statement issued as the controller issued the new report.

“That’s why the governor will put forward a plan to address this unfunded liability — and sustain health benefits for retirees for the long term — when he submits his budget to the Legislature next month,” Palmer said.

Under the 12-point pension reform plan Brown issued in October 2011, state workers would have to work five more years to become eligible for state-paid health care after retirement.

Ten years of service is required to become eligible for retiree health care, which begins at 50 percent coverage and gradually increases to 100 percent after 20 years of service. Brown’s plan pushed the thresholds back to 15 years and 25 years.

But the pension reform eventually approved by the Legislature (AB 340 in 2012) did not include retiree health care. An Assembly analysis of the bill said retiree health care was dropped because unions “have shown a willingness to bargain” the issue.

The Highway Patrol, giving up pay raises for several years, contributes 3.9 percent of pay to the retiree health care investment fund with a state match of 2 percent of pay, said Pat McConahay, Human Resources spokeswoman.

Physicians, dentists and podiatrists (bargaining unit 12) and craft and maintenance (bargaining unit 16) contribute 0.5 percent of pay with no state match to the retiree health care investment fund.

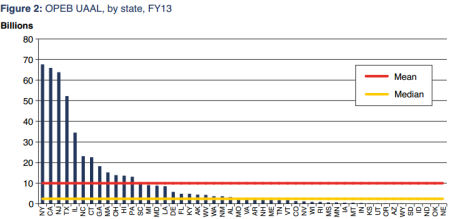

Like California, most states have contributed little or nothing to an investment fund to help pay for the retiree health care they have promised their employees, varying widely in generosity and duration.

The total state unfunded liability (“unfunded actuarial accrued liability”) for retiree health care (“other post-employment benefits”) in fiscal 2013 was nearly $498 billion, or 3.25 percent of national gross domestic product, according to a report issued this month.

More states are beginning to “prefund” retiree health care, setting aside money to invest and yield earnings, said the report by Alex Brown of the National Association of State Retirement Administrators and Joshua Franzel of the Center for State and Local Government Excellence.

Last fiscal year 33 states had set aside a total of $33 billion to “prefund” retiree health benefits, up from 18 states with prefunding in fiscal years 2009-11. Many pension systems expect to get two-thirds of their revenue from investment earnings, the rest from employer-employee contributions.

The growing retiree health care debt was a sleeper issue until the Governmental Accounting Standards Board adopted new rules a decade ago directing state and local governments to calculate and report their retiree health care unfunded liability.

Controller Chiang, elected state treasurer last month, issued the first California state worker calculation in 2007 — an estimated $47.8 billion owed for the retiree health care promised the current workers and retirees over the following 30 years.

Although the long-term debt, $72 billion in the estimate last week, continues to balloon, the cost of health care did not grow as rapidly as expected. Most of the recent debt increase is due to expected longer life spans: 2 years for men, 1.8 years for women.

The state is expected to pay $1.8 billion for retiree health care this fiscal year, nearly all from the general fund. Brown’s 12-point plan in 2011 said state worker retiree health care costs increased more than 60 percent in the previous five years.

In an annual “fiscal outlook” last month, nonpartisan Legislative Analyst Mac Taylor expects state retiree health care costs to grow at nearly the same rate during the next five years, going from $1.8 billion this fiscal year to $2.8 billion in fiscal 2019-20.

The analyst’s report urges the Legislature to “give strong consideration” to using a new debt payment fund created by voter approval of Proposition 2 last month to “pay state, CSU and/or UC retiree health liabilities,” beginning in a few years.

“Not setting aside funds for retiree health benefits earned during employees’ working lives violates a fundamental tenet of public finance — that costs should be paid in the year when they are incurred,” said Taylor’s report.

“The state’s current pay-as-you-go retiree health funding system is much more costly than if the state funded those benefits as they were earned. Accordingly, reducing and eventually addressing unfunded retiree health retirees of public entities could save taxpayers billions of dollars over the long term,” the report said.

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at Calpensions.com. Posted 22 Dec 14

December 22, 2014 at 2:33 pm

This is the penultimate bridge that the state needs to find way to cross on its road to long-term fiscal stability. I applaud the Brown administration for its success along the way to that goal and hope they can get across this barrier as well, leaving only the question of how to stem the projected growth in Medi-Cal costs.

The post inspired me to go back and look at my testimony before the Post-Employment Benefits Commission in 2007, which can be found here:

Click to access MichaelGenest-S-9-21-07.pdf

I think the testimony showed the way that we could have made big progress in those days when the unfunded liability was a “mere” $42 billion! It’s terrible that we basically did nothing, but not for lack of calling out what should have been done. I concluded my remarks this way:

“Given the state’s fiscal situation, I would hope that you will explore balanced options that include not just different funding approaches, but also reasonable cost control strategies.”

If the state had chosen to undertake the cost control strategies I outlined, I would have today, as a retiree, higher co-insurance, higher out-of-pocket costs and fewer benefits. I thought that would have been the right thing to do then, even though I knew that I would someday personally pay part of the price.

Perhaps Governor Brown’s proposal will also call for cost control, not just a better approach to funding. According to all the lawyers I’ve consulted (although I admit that they were all state government employees), the only way to reduce the costs of retiree health care is to also reduce the costs of current employees’ health care. That’s because the contribution the state is obligated to make for retirees is pegged to the average costs for current employees. Thus, cost-control will require sacrifices from both. Will the legislature and the government find the political will to call for such sacrifices? Or will they simply ask the state budget to pick up the costs?

December 22, 2014 at 5:38 pm

My former municipal employer capped its retiree, health benefit through the collective bargaining process, and the bulk of the current and future debt was transferred to the shoulders of retirees such as myself. Why can’t the State do the same regarding its retiree, health coverage. I understand that such would require sacrifices by future retirees, that they were not expecting–it would not be pretty. The only other way I could suggest would be to work with the medical insurance providers to lower their, respective, premiums.

I am responsible for every premium, increase and am currently paying $500+ out-of-pocket for the monthly, group ABC premiums that are only secondary to Medicare. The cap negates any coverage for my spouse, and I am responsible for that amount also. Since my employer devised this way to negate a large portion of its unfunded debt, about ten years ago when premiums were still reasonable, I wish it would do something about mine, by working with the insurer to find ways for lowering its premiums.

December 22, 2014 at 6:14 pm

I wonder what would happen if one were to add up all the bennies older generations got for themselves but refused to pay for, shifting the cost to younger generations who are poorer on average?

In any event, the crime took place not so much in 1991 but afterward. in the early 1990s California and the Northeast were in depressions, and fiscal ruses were enacted that might not have taken place earlier.

When the economy recovered, however, politicians just kept on taking from a common future they didn’t care about. The irresponsibility expanded to the federal level after 2000. Party on! And here they have left us.

One thing the public employee unions would insist on, if they actually represented workers and not grifters and retirees, is a separate tax surcharge to pay for the debts, pension and retiree health are costs from the past. So taxpayers will not compared their rising taxes with their deteriorating services and conclude that CURRENT workers are ripping them off.

December 22, 2014 at 6:40 pm

Note that while retirees themselves are currently covered 100% (for the lower-cost plans – good luck if you live in the boonies), dependents are not. Also, the plans (for state employees at least) for those 65+ are Medicare-Advantage plans that require Medicare signup, have higher copays than the “Basic” plans (those used for active workers and under-65), and have fewer free “preventative care” services – there’s a copay for nearly everything. Yes, it’s easy for plans to cost even more (I’ve seen people at Kaiser handing over $50 or more to see a doctor, NOT in the ER), but it isn’t free right now. Oh yes, Medicare isn’t free either – you have to sign up for both Parts A and B. Total monthly cost (Medicare + dependents) appears to be less than for the “Basic” plans, but not by a lot.

I suspect a recent cost driver is dependent coverage that is mandated by federal law for kids up to 26. That wasn’t the case more than a few years ago: they were dropped at 25, college graduation (bachelor’s degree), or 18/high school grad if no college, whichever occurred first. So the cost is higher now for dependents, unavoidably. Kids, though, don’t go to the doctor much unless they break something, so if the health care companies are charging a lot for them (they are) it’s pure profit.

December 22, 2014 at 6:45 pm

Unfortunately, as the state shifts money to fund health care, education will surely take another big hit. Funding Teacher Retirement comes to mind. I remember when Ca. was tied w/Iowa for No 1 in Education. As pensions, salaries and now health care ate away at revenues it is now tied with Mississippi near the bottom. Each generation passd on obligations to succeeding generations, raised every kind of tax(like prop 218, income and sales taxes)so except for the very rich, the quality of family life in Ca. has plunged. Brown was the main creator of this mess. His pension reform will continue to add to unfunded liabilities and attempting to fund health care w/o reform will put another nail in the lives of our young.

December 22, 2014 at 7:22 pm

Mike, I am a municipal retiree who is not covered 100%, and many non-state retirees are not covered 100%. I get a capped, medical premium stipend of $532/mo., which I was required to earn by working full-time for 25 or more years. Retirees who had 15-24 years’ service credit receive less than $200/mo and those with less than 15 years, get no medical coverage in retirement. If I elect cheap secondary coverage, such as Kaiser or other HMO’s on my employer’s list, I will be covered 100%. I have chosen the ABC secondary, PPO coverage, for personal reasons, and my premium is $1000+. The ABC premiums for myself and my spouse require 42% of my CalPERS, take-home amount.

December 22, 2014 at 7:26 pm

Further, in addition to the secondary medical insurance premiums, I also must pay the Part B, $100+ per month Medicare premium, out-of-pocket. That is so much for public retirees “slopping at the trough”–there is not much feed left, after the medical insurance premiums are paid.

December 22, 2014 at 8:49 pm

SeeSaw, that is a complicated question. Every state attorney who advised me said that employment with the state comes with an iron clad guarantee that from the moment an employee is hired, she would always be entitled to at least the level and terms of coverage that were in effect at that time. That is based on the Contracts Clause of the US Constitution and the fact that the state does not state in advance of hiring that such post-employment benefits may be changed going forward (although I think it’s a bad interpretation). Some cities and counties DO have such provisions. The UC system has that for retiree health care. But, CSUS, all state employers and some local employers don’t have it for pensions or for health care, so they are stuck. Even if they go through bankruptcy, the court can not force them to adjust those benefits unless they themselves propose to do so. None of our three recent bankrupt cities asked for that re pensions, although Stockton got to cut retiree health care in bankruptcy. Ed probably knows, but I’m not sure whether they had a clause in their hiring process allowing that or if they used the power of bankruptcy to get it. Note, that states are NOT permitted to use bankruptcy, although, I’ve heard some lawyers say that Congress could change that, so maybe the time will come.

By the way, in addition to being complicated does this make any sense at all? We could literally fire every state employee and thereby wipe out all or most of their (as yet un-accrued) post-employment benefits, but we can’t change the rate at which those benefits accrue going forward except for new hires. Seems crazy to me.

December 22, 2014 at 9:51 pm

Actually doesn’t seem crazy to me. As I understand, OPEBs as well as pensions can now be reduced in exchange for something of equal or lesser value. Whatever that means.

It’s not crazy because these are long term programs and they need more stability and predictability than annual income and expenses have. Imagine if Arnold Governor Schwarzenegger decreed a reduction in pensions by fiat, as he did the furloughs. Or if he had the political sway to get it past the legislature. And then, next administration found they couldn’t keep qualified workers, so they restored said pensions or OPEBs. Chaos.

Better to solve temporary problems with short range solutions, like furloughing fifteen percent of your employees (while simultaneously increasing the number of state workers by ten percent.)

As I understand, the judge in San Jose ruled the city could not reduce pension formulas, but they could (legally) achieve like savings by reducing current pay by a similar amount. Legally, not pragmatically, because either way, you can’t keep qualified employees

December 23, 2014 at 2:51 am

$72 Billion unfunded liability? Over 30 years? That averages to only $2.5 Billion per year. That is not an overly large expenditure compared to a $156 B total budget, in a state with a $2 Trillion GDP. Yes, I think it’s prudent to start paying down the liability but it appears the size of the problem is being exaggerated.

December 23, 2014 at 1:22 pm

Bring Back, that’s the discounted present value of liability. The annual nominal amounts get much higher than you’re saying in the out years.

December 24, 2014 at 1:05 am

M Genest — True, but the total budget and revenues will get higher in the out years as well. So it all depends on making guesses about future budgets, revenues, inflation vs healthcare inflation. It’s true that over the last several years healthcare costs have been climbing at a high rate, but it would be a mistake to extrapolate those high rates out 30 years.

December 24, 2014 at 11:39 pm

Responding to Bring Back the WPA …… The following is an accurate description of the “unfunded liability (technically called the UAAL):

“The unfunded actuarial accrued liability (UAAL) of the state’s pension systems — or the present value of benefits earned to date that are not covered by current plan assets “.

So, Mike Genest is correct, the $72 Million UAAL ALREADY reflected the “discounting” of future expected pension payouts for which there exists no assets.

We are “short” $72 Million in cash TODAY. And while the …..”total budget and revenues will get higher in the out years” … so will that $72 Million grow ANNUALLY, by the Official Plan investment assumption of 7.5%.

December 25, 2014 at 7:42 am

TL: don’t confuse the health care situation with pensions. While they share many details, the pensions have a funding plan. Its arguable whether it’s enough, depending on the plan, but the pension is actually being paid for. Health care is not, at least at the state and many (though not all) local agencies. That’s what worries me as a retiree … when (not if) it gets too expensive it’s easier politically (at least) to cut things off if it all comes out of the current budget. Fundamentally, it’s politicians kicking the can down the road expecting that either money will (keep) fall(ing) from the sky or they’ll be able to stiff the employees and retirees when it gets bad enough (if they think that far ahead).

SeeSaw: I understand that your plan is different. If I had stuck with a county my plan would have been better in some ways (easier to understand) and worse in others (more limits/exclusions, full coverage only with 20+ years which the state plan now is also, and with a pretty high deductible). The state plan is pretty good, all things considered, though there are some better ones (for the retiree) out there. The Basic plan (during employment) is better than the Medicare plan in some ways, but it does cost more and a few extra things are covered under Medicare that aren’t in the Basic. I just plan/budget for the higher out-of-pocket cost by saving the difference in monthly cost. We all agreed to the differences when we signed on with our various employers, and now have to live with them.

Frankly, at one point in my career (well before the pension pot was sweetened) I was offered considerably more money for a non-state job, but looking at it (clearly a short-term one) it made more sense to stay with the state to keep building the pension despite the lower salary, as long as I could live on it. It got a little thin a couple of times (state pay is OK for Sac and good in some other inland areas, but not in the Bay Area), but it worked out.

December 25, 2014 at 4:47 pm

Good post, Mike. I don’t know why the pundits even address these medical insurance issues for employees and retirees because, as you say, all plans are different and not connected with the pensions. Yes, my own medical coverage was capped in the middle of the stream through the collective bargaining process. My reps (fellow employees–not union honchos) signed off on it without even consulting me. The stipend I get for medical insurance is money that must be used for one of the plans that my employer offers. If I want a cheaper rate with a different insurer, I can leave–without the stipend, and I can never return to the employer-covered benefit. What is so maddening is that the insurance is secondary only to Medicare and the insurer pays out pennies of the cost to supplement what Medicare pays and yet, because I am over age 65, the premium is higher than that for a younger, active employee who is fully covered. The private insurer, in my case, ABC, will not pay anything on a certain medical procedure, if Medicare refuses it–ABC only supplements what Medicare covers. The Part-D portion of my plan is $200/mo. The answer I get when questioning why the Part D is so high when the national average is $40, is that the situation is what it is because the ABC coverage is not recognized as a bona-fide Medicare supplement–it is full-on insurance. The employer’s attitude is, “If you don’t like it, go to Kaiser”–what most of my former colleagues have done.

Happy holidays to everyone out there!

December 25, 2014 at 5:53 pm

SeeSaw,

I admit I was curious and concerned why your insurance cost so much. I have been with Kaiser for over 40 years, now on Medicare Advantage. My only costs so far have been co-pays for visits and prescriptions. Personal reasons is personal, but my wife and I have been very happy with Kaiser.

Merry Christmas. It has been a pleasure reading your posts through the years.

December 25, 2014 at 8:23 pm

Yeah, that’s not helping.

http://m.youtube.com/watch?v=sUmBKO_q7MY

Chiang needs to seriously explain in layman’s terms the concept of an unfunded liability, both for pensions and healthcare, and how the discount rate applies.

From his website:$72 billion is “the present-day cost of providing retiree health benefits earned by current and future state retirees.” is too ambiguous.

“that year’s Budget Act (2014-2015) only provides $1.9 billion to cover just the actual costs of current retirees’ health and dental benefits.” Is relatively clear. May we assume into the future the actual present day cost ($1.9b) will be similar for future years, increasing gradually due to increasing number of retirees (baby boom and increased longevity), and for increased medical costs per retiree above inflation?

It would help….immensely… When Mr. Chiang quotes a $72 billion liability (at this point, apparently, the entire amount is “unfunded”) if he would give us a rough idea of the time period involved. For pensions, what Moody’s does is estimate the midpoint of the future payments stream. They select 13 years into the future, “This is a measure of the time-weighted average life of benefit payments.” Apparently the13-year duration is the median calculated from a sample of pension plans whose durations ranged from about 10 to 17 years.

If Mr. Chiang could say we expect to spend $72, in today’s dollars, for retiree healthcare over the next 13 years, we could have a common point of discussion. It makes a big difference if he is referring to either 10 years or 17 years, or to the 30 years that Bring Back the WPA referred to.

It makes no sense to argue about future costs when we all have wildly different amounts in mind. $72 billion over 30 years is not so bad. $72 billion over 10 years…..devastating.

THEN we can talk about inflation and discount rates.

How about it, John?

December 25, 2014 at 9:56 pm

MikeB,

Quote: “state pay is OK for Sac and good in some other inland areas, but not in the Bay Area”

This is a point that needs to be stressed. I have shamelessly (for my own nefarious reasons) recommended strongly that everyone concerned with public pension reform read Biggs and Richwine “Overpaid or Underpaid? A State by State Ranking of Public-Employee Compensation”

In this study they include only non safety state employees. They do not include local government employees because the vast number and difference of cash compensation and pension plans makes an “average” virtually meaningless. (And the data gathering would be daunting.) I could not tell from their methodology if they considered that state compensation is the same statewide. A state mechanic makes the same salary whether he works in Anaheim or Adelanto. Comparing his compensation to equivalent private sector workers in each area would give wildly different results.

When I worked in the Bay Area, every local government paid more than the state for similar positions, because their wages were determined by local private sector market equivalents. In the Central Valley, total compensation is usually much closer for state, local, and private sector. This makes “average” public/private pay comparisons like Biggs, et. al. more complicated. It also has a distorting effect on state hiring and promotions, with coastal employees applying for transfers to lower cost areas. For some occupations it’s like an instant 30% pay increase. Ask me how I know.

If you read Biggs and Richwine, as I strongly recommend, please read carefully, and reread, all the text and methodology before you get to the lazy reporter bait bar graphs that show California state workers have a 33% compensation advantage over private sector workers.

(Figure 13, page 74 if you’re with Washington Times or PRI)

Then we can debate “average differences” and the “logarithm of the average”.

December 26, 2014 at 1:37 am

Quoting SDouglas47 … “It makes no sense to argue about future costs when we all have wildly different amounts in mind. $72 billion over 30 years is not so bad. $72 billion over 10 years…..devastating. ”

When Chiang says … “the present-day cost of providing retiree health benefits earned by current and future state retirees.”, it’s not ambiguous at all.

It mean we are SHORT $72 Billion that we should have IN HAND TODAY (that we do not have). That $72 Billion represents today’s “present value” (i.e., the discounted cost) of the much large actual $ payouts (earned by current retirees and on actives service-to date) and expected to be paid in the future as claims arise.

$72 Billion owed TODAY.

Spin it all you want, but it will still be $72 Billion. An that’s $72 Billion that Taxpayers should refuse to pay, because THEY most- often get ZERO employer-sponsored retiree healthcare subsidies, and Public Sector workers/retirees and not “special” and deserving of a better deal … on the Taxpayers’ dime.

——————————————–

And re you last comment (timestamped December 25, 2014 at 9:56 pm), that’s quite telling of your very biased Public Sector mindset ……. that first you highly recommend that everyone to read the Biggs and Richwine study, and then (at the end) competently dismiss the study’s conclusion that non-safety California state workers have a 33% compensation advantage over private sector workers.

Why, because it conflicts with your agenda? Pathetic.

December 26, 2014 at 4:33 am

Thank you. That clears up everything.

Merry Christmas.

December 26, 2014 at 12:05 pm

You’re welcome ….. Glad I could help, the readers deserve it.

Happy new year.

December 27, 2014 at 5:48 pm

I read the consultant’s GASB report and it makes it clear what’s going on. To summarize:

– The $72 Bil is the present value of the current healthcare shortfall. Just like buying a house, you can pay it all now or amortize it over future years.

– The shortfall exists because the state only pays the cash flow needed to pay current claims (about $1.8B/year) and has no investment fund to help pay for future costs. This causes the unfunded liability to grow.

– The consultant used a 30 year amortization period and assumed 3% wage inflation to determine the annual payment to pay off the $72 Bil unfunded liability.

– Under the fully funded scenario, the state would need to double the amount paid from 1.8B/year to 3.7B/year to cover current costs plus payment to an investment trust fund to pay down the unfunded liability.

Like I said on 12/23 above, an increase of $2 Bil/year for retiree health care is not a huge crisis. Pension alarmists like to trumpet the $72 Bil number because it sounds worse than it is.

December 27, 2014 at 7:37 pm

WPA,

Thank you. The 30 years is what I was most curious about. It does make a difference.

…………

If I may editorialize:

“The growing retiree health care debt was a sleeper issue until the Governmental Accounting Standards Board adopted new rules………”

It has been said we are “passing on our debt to the next generation” or, as Mac Taylor says:

“Not setting aside funds for retiree health benefits earned during employees’ working lives violates a fundamental tenet of public finance — that costs should be paid in the year when they are incurred,”

However, as I understand, we are NOW paying ($1.8 billion) on a “pay as you go” basis, health care for the last generation of workers. As they paid for the generation before them, ad infinitum. And as the next generation will pay for our “past debts, from which they receive no benefit.”

“The thing that hath been, it is that which shall be; and that which is done is that which shall be done: and there is no new thing under the sun.”

There is a new thing, though. GASB has now required that this be disclosed as a debt, and quantified. It was always a debt, which was being paid “as you go”. And will still be paid, one way or the other. The only real advantage to pre funding is that it will actually reduce costs by allowing ROI to pick up some of the bill.

Thanks again, WPA. I would still like to see a layman’s explanation of the concept of the unfunded liability (from a knowledgeable and unbiased source.)

As a wise man once said: “It makes no sense to argue about future costs when we all have wildly different amounts in mind.”

December 27, 2014 at 9:06 pm

Bring Back the WPA,

Keep in mind that Medical care inflation is typically 2-3 time as great as the CPI.

You’ve got a greedy little vested finger in the pot if you think this benefit is affordable …. let alone reasonable and “just”, considering that it’s a VERY rare Private Sector employer that provides ANY currently accruing retiree healthcare benefits today.

December 27, 2014 at 10:48 pm

And whose fault is that, TL! My spouse’s private-sector health benefits were lost completely by the time he retired; my public-sector health benefits are not what I had planned on, either. Things are what they are–comparing the public and private sectors is comparing apples and oranges–a useless exercise. Just because any one person has a finger in any particular pot, does not make them greedyl–perhaps you should have been so lucky!

December 28, 2014 at 12:41 am

SDouglas: The point is that when we (the people in this case, i.e., the government) hire someone we should pay them. We should know what it costs to pay them. If we pretend that it costs less than it actually does, then we are kidding ourselves. So, when we promise a retirement benefit to the people we hire, we should pay each pay period (1) the salary, (2) the actuarially correct amount into the pension and retiree health accounts. If we do that, we won’t owe that person any more once they retire because the funds will have enough for them and they will get 100% of what they were promised. But, when we fool ourselves that we can put less into the funds for those future benefits, we’re creating a debt, a debt not accounted for. So, our trickery pushes costs on to future generations (bad and mean) or it sets up a bankruptcy that will deprive that retiree of all he was promised he’d get (bad and mean).

Your idea that “It makes no sense to argue about future costs when we all have wildly different amounts in mind” is not appropriate to this issue. Actuaries can make pretty good estimates, and as conditions change they can adjust those, so that we can know pretty well how much to put into these funds so that they don’t create an unfunded liability for future taxpayers. The problem with the calculation is that politicians make the actuaries use exaggerated estimates of future earnings so that the cost estimate comes out lower so that the politician doesn’t have to go to the taxpayer and ask for a tax increase to provide a higher compensation package. This is dishonest (bad and mean).

Bring back: your take on the $72 billion is right, except that it’s not like buying a house, it’s like renting one. But you really go wrong atl the end. One does not have to be a “pension alarmist” to appreciate that is a very bad number. Someone will have to pay for it, but if we had been honest, it would already have been paid for. So, it reflects past politicians pushing costs onto future taxpayers. That is wrong and it’s really $72 billion worth of wrong, so it’s actually shameful.

SeeSaw and Tough Love: I tend to agree that government workers generally are paid too much, but set that aside. Whatever the compensation package that they are promised should be accurately funded at the time they do their work. I’m sure you will both never agree on whether government employees are overcompensated. But, surely you would both agree that government funding should be both complete and honest. If it had been there would be no $72 billion unfunded liability.

December 28, 2014 at 3:23 am

And when we fool ourselves that the “real” cost of future pensions should be valued at the risk free rate, and fund them today on that basis, we end up overcharging today’s taxpayers, and overstating the total compensation of today’s workers.

The actuarially correct amount is obviously not all that easy to determine. “Actuaries can make pretty good estimates, and as conditions change they can adjust those”, but you couldn’t seriously expect them to anticipate the “greatest recession”, and if they tried to “adjust” to those conditions too quickly, it would have made matters worse.

I have no problem with properly prefunding pensions and health care. And gradually adjusting the actuarial assumptions so they do not unnecessarily shock the system.

I do have a problem with :

“An that’s $72 Billion that Taxpayers should refuse to pay, ”

and

“the pension accrual rate for the future service of all CURRENT Public Sector workers should be reduced by 50% for all non-safety workers and by 66% for all safety workers (with the most egregious pensions) ”

Everything in moderation. Nothing in excess. That’s why I am AKA “S Moderation Douglas”

December 28, 2014 at 3:51 am

Mike,

“It makes no sense to argue about future costs when we all have wildly different amounts in mind”

Wasn’t referring to the actuaries, or even the politicians. I was referring to people on this board (and others) who claim to have a simple solution to a complex problem.

On either side of the debate. Cool the epithets. Tame down the exaggerations. Stop the accusations.

Like: “Tackling the big debt that lawmakers let balloon”

Pay as you go was standard practice and not a problem before GASB pointed out the proper accounting, (and healthcare costs accelerated) and by that time the other stuff was hitting the fan. There were bigger fires to be put out. Lawmakers are by no means perfect. Let’s try to work with them instead of automatically castigating them.

We can’t do anything constructive if we can’t agree on the magnitude of the problem. No, $72 billion is not like a mortgage, and no, it is not a debt that has to be paid this year. And it is not the result of crooked politicians and union thugs.

December 28, 2014 at 6:59 am

SDouglas47 Says:

1) “Pay as you go was standard practice and not a problem before GASB pointed out the proper accounting”

– Really? It took GASB to point out the issue, in your opinion? Pay-As-You-Go has been a staple of bad fiscal management long before GASB weighed in on the issue.

2) “$72 billion is not like a mortgage, and no, it is not a debt that has to be paid this year.”

– Who said it had to be paid this year? It is a debt – a humongous debt. And the costs that comprise the said debt should have been paid as they were incurred. Instead, those dollars/deferred costs were spent on increased compensation which further exasperates the problem. There’s also the issue of interest costs associated with the said debt, and the compounding thereof.

3) “And it is not the result of crooked politicians and union thugs.”

– Lets call it the result of collusion between Unions & Politicians and their Co-Dependent & Symbiotic relationship, which COMPLETELY ignores the best interest of taxpayers.

December 28, 2014 at 9:53 am

SDouglas47 Says: “And when we fool ourselves that the “real” cost of future pensions should be valued at the risk free rate, and fund them today on that basis, we end up overcharging today’s taxpayers, and overstating the total compensation of today’s workers.”

What a boob. We’re already overcharging todays, tomorrows, and many future generations of taxpayers to fund these ridiculous pension schemes. You sound more & more like the outcast CalPERS Board Member known as J.J. Jelinic.

December 28, 2014 at 1:39 pm

This debt us the result of a “callous willingness to pass our debt to our children’s generation.” Comment provided by John Chiang.

December 28, 2014 at 1:49 pm

Actuaries have no business making guesses about future returns. They should stick with the risk-free rates, although nothing is truly risk free, of course.

December 28, 2014 at 3:10 pm

“And the costs that comprise the said debt should have been paid as they were incurred.”

In your opinion. I haven’t read the specific law. I was guaranteed that when I retired the state would continue to pay my healthcare costs. The costs were “earned” while I was working. The costs were not “incurred” until I actually retired.

As the article said, ” The growing retiree health care debt was a sleeper issue until the Governmental Accounting Standards Board adopted new rules a decade ago directing state and local governments to calculate and report their retiree health care unfunded liability.”

GASB said the governments had to calculate and report the liability. They never said the costs had to be paid in the year they were earned. Or did I miss something? They never said they had to be pre – funded. Did they?

Over the years, the costs of retiree healthcare will be what they will be. The actuaries can calculate and report the future costs to the best of their abilities, but that will not change the costs. There is no legal or moral imperative to pre fund the costs or to pay them when they are “earned” rather than when they are “due.” The only advantage to pre funding is that returns on investment can help offset the future costs…………..maybe.

………….

” – Lets call it the result of collusion between Unions & Politicians and their Co-Dependent & Symbiotic relationship, which COMPLETELY ignores the best interest of taxpayers.”

Let’s call that Captain’s *opinion*. The “deferred costs were spent on increased compensation” certainly never showed up in my paycheck, or in my pension. COLA s (for lack of a better term) have not kept up with CPI since before 1999. Not to mention no raises at all between 2007 and 2013. And not to mention forced furloughs. That was some union collusion. SB400 increased my pension by 3%, and inflation reduced it by 7%.

December 29, 2014 at 6:35 am

@ Captain, J.J. Jelincic is a very intelligent member of the CalPERS Board. He is an investment professional himself, and was re-elected to the Board by a large margin. He might be an outcast to you who evidently has no stake whatsoever in CalPERS. He is certainly no outcast to CalPERS and its members!

December 29, 2014 at 6:36 am

Responding to Michael C Genest’s comment time-stamped December 28, 2014 at 12:41 am …..

You connected all the dots correctly but it seems you may have missed the MOST IMPORTANT point…… that all the stakeholders WANT he true cost of the promised Public Sector pensions & benefits materially underestimated because they all BENEFIT from doing so:

The PUBLIC SECTOR WORKERS workers get promised pensions & benefits FAR more than what the State/City could afford to grant if was REQUIRED to fully fund each year’s accrual in the year granted. In addition, more money is available to give these workers annual raises.

The POLITICIANS (by underfunding the TRUE cost, they) have more money to spend on public services for their constituents, solidifying their voter base.

————————–

The beleaguered Taxpayer has always been the balancing item …. i.e., the “sucker” in the equation ………. which is why I support reneging on these unnecessary, unjust, and unaffordable Public Sector pension & benefit promises.

December 29, 2014 at 6:54 am

Quoting SDouglas47 ….. “Over the years, the costs of retiree healthcare will be what they will be. …… There is no legal or moral imperative to pre fund the costs or to pay them when they are “earned” rather than when they are “due.” The only advantage to pre funding is that returns on investment can help offset the future costs”.

After reading the above, it seems the person calling you a “boob” was right on the money.

Have you ever considered that THE TAXPAYERS WHO BENEFIT from specific Public Sector services rendered should pay for THOSE SERVICES, not some OTHER generation of Taxpayers. You have consistently argued that your pension & retiree healthcare is “deferred compensation” (earned WHILE YOU WERE WORKING). so shouldn’t the Taxpayers who benefited from your services WHILE YOU WERE WORKING pay for them, not a later generation that derived no benefit from your employment?

December 29, 2014 at 5:48 pm

Not necessarily. I earned it while I was working. It is a debt which is not due until I retire.

It’s a rolling debt. There’s no pragmatic difference, except that the payments are gradually increasing. What they are asking now is for this generation to pay for (pre-fund) retiree healthcare for those working now, plus paying for the previous generation.

So we get to pay twice. I don’t have a problem with that. It also reduces our future costs due the ROI.

I’m just saying it’s definitely not a legal problem. And not a moral one either. We have been funding this way for years, as have many other states.

And, in many ways, future generations do benefit from my employment.

December 29, 2014 at 6:46 pm

“Have you ever considered that THE TAXPAYERS WHO BENEFIT from specific Public Sector services rendered should pay for THOSE SERVICES, not some OTHER generation of Taxpayers. You have consistently argued that your pension & retiree healthcare is “deferred compensation” (earned WHILE YOU WERE WORKING). so shouldn’t the Taxpayers who benefited from your services WHILE YOU WERE WORKING pay for them, not a later generation that derived no benefit from your employment?”

Bravo! Tough Love. My thoughts exactly.

While I have appreciated some of SDouglas47’s comments in other threads, s/he seems to have a false view of what constitutes the population of the State of California. The taxpayers are not a static population, much less the children in the schools: the student body of 2014 will not be the student body of 2035, yet these yet-unborn children will have their education budgets somewhat depressed because of paying off these unfunded liabilities. The taxpayers of 2035 will include many of us who are taxpayers in 2014, but will also include others who don’t even live in California right now, but will find some of their tax monies going to pay work that was conducted in 2014.

That there is some “slop” in the system due to actuarial uncertainties is understood. But this $72 billion debt was planned to be pay-as-you-go and only the GASB accounting revisions have forced the issue into the light.

December 29, 2014 at 9:08 pm

Oh my.

S/he ( I ) have said I have no objection to prefunding retiree healthcare. It will have the advantage of reducing future costs by benefit of the returns on investment.

If you imagine, for the sake of discussion, actually investing those funds in “risk free” bonds so they earn no returns except enough to offset inflation, then today, this year, your “normal cost” will be roughly the same as the “pay as you go” costs we have today. So, for a few years we will have to pay double (pay as you go plus normal costs) until the “debt” is paid off. From that day forward we will only be paying “normal cost” (pre funding for “Taxpayers who benefited from your services WHILE YOU WERE WORKING pay for them,”)

Either way, we will be paying about $2 billion every year. And either way, the cost will gradually increase. There is no pragmatic difference, only a philosophical one.

Granted, again, if we prefund as Chiang, and others suggest, it will cost a little more today*, but save money in the long run,** due to ROI.

I am not arguing against prefunding retiree healthcare. I am saying there is no need for moral outrage. I agree totally with WPA :

“Yes, I think it’s prudent to start paying down the liability but it appears the size of the problem is being exaggerated.”

and:

“Like I said on 12/23 above, an increase of $2 Bil/year for retiree health care is not a huge crisis. Pension alarmists like to trumpet the $72 Bil number because it sounds worse than it is.”

_____________________________________

* “a little more today”…… if you consider $2+ billion “a little money”

** “save money in the long run”…… unless another 2007 type financial crisis wipes out our savings

December 29, 2014 at 9:15 pm

Berryessa Chillin’

“While I have appreciated some of SDouglas47’s comments in other threads,”

Thank you for that. I appreciate yours also.

It is “he”, by the way.

Happy New Year…….I wish you and all the other posters the best in the coming year.

December 29, 2014 at 10:31 pm

Quoting … ” I have no objection to prefunding retiree healthcare. It will have the advantage of reducing future costs by benefit of the returns on investment. ”

Oh I’m sure that YOU (as a Public Sector retiree feeding at the Taxpayers’ pockets) don’t.

How about we take a step back and only grant PUBLIC Sector workers the SAME employer-sponsored retiree healthcare benefits that PRIVATE Sector worker typically get today …. NOTHING.

Problem solved … nothing to “fund” or pay for.

December 30, 2014 at 12:44 am

After you get it changed in New Jersey, you’re welcome to come to California and start the process here.

Happy New Year

December 30, 2014 at 3:56 am

There is no law that salaries and benefits have to be the same for public-sector and private-sector emplloyees, TL or that the public sector employees must make the same everywhere and vice-versa. We are not a socialist country. This is a capitalist country–its probable that the public employees of Beverly Hills will have higher salaries and benefits than those of Pomona and it is also quite probable that the private sector employees of Beverly Hills receive more in salaries and benefits than the private sector employees in Covina. .

December 30, 2014 at 6:46 am

Nice try SeeSAW. If it weren’t for the collusion between the Public Sector Unions and the Politicians (distorting necessary, reasonable, just, and affordable Public Sector compensation), and LEGITIMATE market forces (supply & demand, etc.) drove worker compensation, THEN you would have a valid point.

December 30, 2014 at 6:50 am

Quoting SDouglas47 … “After you get it (retiree healthcare benefits) changed in New Jersey, you’re welcome to come to California and start the process here. ”

I’m doing my best to help make that happen, and given NJ’s dire financial circumstances, I’d guess that retiree healthcare promises are at the top of the list for material reductions … and quite soon.

December 30, 2014 at 5:13 pm

Healthcare promises have been broken for many years already and more healthcare promises will occur–so what’s the big deal with your participation in this debacle, TL? We have plenty experts in CA to work on these issues–its ok for you to stay in NJ and mind your own business.

December 30, 2014 at 8:27 pm

Just for fun … read this discussion of Present Value and various related accounting concepts: http://people.stern.nyu.edu/adamodar/pdfiles/cf2E/tools.pdf.

December 31, 2014 at 2:04 pm

Quoting Michael C. Genest:

” The point is that when we (the people in this case, i.e., the government) hire someone we should pay them. We should know what it costs to pay them. If we pretend that it costs less than it actually does, then we are kidding ourselves. So, when we promise a retirement benefit to the people we hire, we should pay each pay period (1) the salary, (2) the actuarially correct amount into the pension and retiree health accounts. ”

I just now recalled. Isn’t the retirement and healthcare for all of our military now on a pay as you go basis? Is it even financially possible to pre fund them? Even if we had the cash today, wouldn’t that much money crowd out a huge portion of the stock and bond market?

I’m sorry, I just don’t see this as a moral imperative. Again, I am not opposed to pre funding. It should save us money. But it isn’t necessary to censure the politicians and unions that got us to this point.

Can’t we all just get along?

December 31, 2014 at 4:53 pm

The Post Office is required by Congress to pre-fund all retirement benefits–it is going broke because of that requirement. It makes about as much sense as would requiring all homeowners to pre-fund their mortgages.

December 31, 2014 at 5:23 pm

SDouglas47,

Absolutely we can ….. as soon as the pensions & benefits of all NEW, CURRENT, and (to the extent necessary so as no to need more than minimal tax increases) RETIRED Public Sector workers stop bankrupting us …. by being reduced to a level no greater than that typically granted comparable Private Sector workers..

And, that is just about 1/4 – 1/3 of what Public Sector workers are now ROUTINELY promised.

December 31, 2014 at 5:51 pm

“Isn’t the retirement and healthcare for all of our military now on a pay as you go basis?”

As a military vet, I have to say that you are unfortunately correct. Once again, an injustice to future generations who have to pay for expenses for a war not conducted on their behalf. It is notable though that the military has drastically scaled back its once-free medical plans for current military dependents, vets, and vets’ families. For example, I have some service-related injuries (not wounds from combat) from my time in Afghanistan, and I have some modest out-of-pocket expenses paying for my VA treatments. That wouldn’t have happened 20 years ago.

December 31, 2014 at 6:22 pm

SeeSaw, you’re really struggling to try and make sense. The Post Office is going broke because of pre-funding? No, it’s going broke because it’s costs are too high, it’s innovation too low, demand for its services (at the going price) is too low. You would have the Post Office finance current expenses (i.e., retirement) to avoid going broke? That’s like refinancing your house to pay off your credit cards.

And, your analogy to mortgages is flat wrong. The costs of employing a person are like rent; the employer doesn’t buy that person and own her until she dies. The employer rents that person’s services in order to produce a good or service that is consumed (or sold, in the private sector) more or less contemporaneously. 30-60 years into the future the employer, if it still exists (virtually NO private sector firms last that long due to competition) will want to produce different goods and services to be sold or consumed under conditions that exist then. Setting it up so that the future employer still has to pay for the costs of the employee services it rented 30-60 years ago is a disastrous approach to financing a company or a government.

To explain the rent analogy a bit more, if I rent your services today, but decide to borrow money from my future expected revenues to pay for them, I’m creating a debt. In some circumstances, of course, creating a debt can make sense. But, you’ll never find a financial advisor who suggests borrowing money to pay your rent. It is flat out a stupid policy.

Look, yes we can all get along. First, we who have worked for government and were promised pensions and health care should get those as promised. And, except in the extremis of bankruptcy, we will. But, governments generally have created unfunded liabilities and those will hit the balance sheet, resulting in lower future services or higher taxes.

It is a fair argument what to do about that. As long as the true costs of government employees is reflected in governmental budgets, I for one am willing to let the democratic process decide what to do to deal with those costs, and other costs. As a voter and advocate, I support cutting government costs. Perhaps you support raising taxes. That’s a fair argument to have. However, it is simply dishonest and stupid to engage in phony budgeting for current costs and we should all agree that it needs to end. We can do that, by the way, without impacting your or my standard of living.

December 31, 2014 at 7:56 pm

Quoting Michael C Genes …

” First, we who have worked for government and were promised pensions and health care should get those as promised.”

No, NOT if those (ALWAYS grossly excessive, unnecessary, unjust, and unaffordable) “promises” were “negotiated” in COLLUSION between the Public Sector Unions and our elected officials (trading favorable votes on pay, pensions, and benefits for campaign contributions and election support) … as virtually all are …. and with NOBODY that that “negotiating table” rightfully looking out for Taxpayers’ best interests.

——————————————–

Quoting Michael C Genes …

“And, except in the extremis of bankruptcy, we will. ”

While States cannot file for bankrupt, they can (and some certainly WILL) become insolvent with many bills going unpaid …. including Public Sector pensions & benefits.

As for Cities and Municipalities, many WILL wind up in Bankruptcy Court SPECIFICALLY because of their affordable Public Sector Pension & Benefit promises.

——————————————

“Denial” is not a solution …. nor is a wish and a prayer.

December 31, 2014 at 8:35 pm

M. Genest: “However, it is simply dishonest and stupid to engage in phony budgeting…”

It’s a good thing your former boss Schwarzenegger never engaged in phony budget gimmicks (cough, cough). You know, like borrowing billions from cities and counties without their permission, delaying paychecks into the next fiscal year, paying corrections officers minimum wage, etc. Nope, good thing Arnold never played shell games to make the budget look better (cough, cough)

December 31, 2014 at 10:43 pm

You’re sarcasm is well placed. I’ve never pretended that we didn’t use gimmicks. Even when I was there I made it clear that many things we did were desperation moves, or worse. So did he. Anyway, who understands sin better than a sinner?

Sent from my iPhone

>

January 1, 2015 at 1:39 am

Not just trough feeders and vets, either. Doesn’t the federal government have huge debts for defense contracts that the “next generation” will be paying for?

There’s icing on this cake:

“What happens is this: the defense contractors are hugely profitable. Nevertheless, they have clauses in their contracts requiring that the government pay additional reimbursements to fund pensions when they become underfunded (for example, when there are market downturns). The Government Accounting Office said that, in 2009, the federal government “reimbursed $750 million in contractor pension costs, more than double the amount it had reimbursed the previous year and significantly more than it had budgeted for.” One company, Lockheed Martin, received reimbursements of more than $3 billion from American taxpayers over the last 5 years.”

……………

“Why are taxpayers subsidizing pensions for private corporation employees?”

teri.bernstein 11/29/2011

January 1, 2015 at 1:58 am

Get a clue TL. There is no move afoot to cut public pensions down to the size of pensions in the private sector. It is apples and oranges and will stay as such. I doubt that Mr. G. was represented by any union, since he had a top financial position in GAS’s inner circle. What blather are you going to use if and when Chuck Reed gets his 28 million from one or a few billionaires around the country? Won’t be any quid pro quo arrangements going on there will there!

Mr. G: I respect the fact that you are a professional finance manager. I have read many times and seen it reported many times on the various media that the biggest problem the P.O. is dealing with is the fact that it is required by Congress to fund all present and future liability–now. That is something that other DB pension plans do not do..

January 1, 2015 at 2:31 am

Indeed, those were desperate times, given how the global bank meltdown tanked the economy. Today the economy is much better — wait, what’s this — a few minutes of Googling reveals that the 14/15 budget still has $13B of gimmicks including payroll deferral, delayed payments to locals, and special fund borrowing. I’m disappointed. I believed Brown and his “balanced” budget. Oh well, as they say, there’s nothing new under the sun…

January 3, 2015 at 4:06 am

SeeSaw Says: @ Captain, J.J. Jelincic is a very intelligent member of the CalPERS Board. He is an investment professional himself, and was re-elected to the Board by a large margin **(were taxpayers allowed to vote?)**.

Seesaw, I respectfully disagree. In response to the Milligan report (the CalPERS Actuary), which included The staff report, the third of its kind in recent years, was praised by several board members for proposing in good economic times that CalPERS increase its preparation for bad times.

Here is what CalPERS Board Member J.J Jelincic had to say in response to that report:

“Part of your job is to be Dr. Doom, and you do it well,” CalPERS board member J.J. Jelincic told Milligan, who presented the staff report also signed by the chief investment and financial officers.”

****”Jelincic said the report should recognize the “trade-offs and balances” of the risky stock-based investment portfolio that can yield higher returns, lowering employer rates.”****

– So Jelenicc likes the risky returns that are completely backfilled with taxpayer dollars. His comments are not surprising given his history. His mission seems to be focused on keeping taxpayers on the hook for every dollar possible.

How do you defend the Jelincic comment, Seesaw? This is hardly Jelinicic’s first issue with staff recommendations. He seems to oppose every effort of CalPERS staff to reduce even the amount of wine Board Members can consume at the expense of potential CalPERS clients, let alone even modest reforms.

A Professional? Hardly!

What do other Board Members have to say:

Board member George Diehr, praising the objectivity of the “excellent” report, said Milligan is not Dr. Doom.

Board member Priya Mathur, who also disagreed that the report is negative, said she supports “having a conversation” about how CalPERS can, without a spike in contributions, lower the risk of the pension fund.

Board member Bill Slaton, chairman of the finance committee that received the report, said the attendance of several board members who are not members of the committee shows the importance of the risk issue.

“I would give you the nomenclature of Dr. Realist,” Slaton told Milligan, “which is really why we are here — to make sure we are treating this with the appropriate care and caution and judgment.”

January 3, 2015 at 4:42 am

SDouglas47 Says:

December 28, 2014 at 3:10 pm

“And the costs that comprise the said debt should have been paid as they were incurred….In your opinion.”

Yes, but it isn’t just in my opinion.

January 3, 2015 at 7:13 pm

I too applaud the Brown admin

Great stewardship of this important issue and no matter what anyone says

Gov b has made a lot of tough budget calls

It’s working

Folks that don’t see that are expecting non reality

bort

January 4, 2015 at 7:20 am

Of course the public was not allowed to vote on CalPERS Board members, Captain. The people who are stakeholders in the plan are the ones who select the Board. Why would any member of CalPERS want anyone on the Board who is not there to protect their interests in a fiduciary manner! As far as J.J. Jelencic’s comments go–you are seeing disagreement between Board members. That is why the Board consists of more than one member.

January 4, 2015 at 9:51 pm

Oops, SeeSaw I think you just hoisted yourself on your own petard! Of course, if the CalPERS fund had no ability to come back to the tax payers for any UAAL, then I think I’d agree with you. However, state pensions are a non-recourse obligation and if the money in the fund ever comes up short the taxpayer will have no choice but to pay it. Given that, we could do either of two things. We could put a taxpayer representative not the Board, or maybe even pack the board with same. Or, we could turn state pensions (going forward only of course since the US Constitution Contract Clause would never let us do it for current retirees) into “hybrids”, meaning they would attempt to provide a set retirement, but if the money turned up short the pensions would automatically be reduced.

January 5, 2015 at 4:36 am

Of course, talk is cheap for you–you are secure in the fact that your retirement has occurred–and you should feel secure. What if a reformer came along with a plan to take back some of your pension? How much of your own $130,000 public pension would you be willing to give back for the greater good? Why should the current workers, not yet retired, be the targets? That question aside–the Governor’s hybrid proposal in the fall of 2011 was studied for 10 months by pension experts working for the Legislature’s reform committee. The results of their study concluded that the proposed hybrid plan could not guarantee future retirees sustainable pensions. I’m sorry I cannot remember the exact percentages since its been a few years, but it was less than 30% of final salary. Thankfully, the Legislature turned down that particular item in Brown’s 12-point pension-reform proposal. In any final analysis, taxes are a necessary evil if we want to live in a decent society. I suggest that those who are so livid about retirees who are actually sustainable move to a state where they can pay less in taxes and where they can feel equal to everyone.

January 5, 2015 at 5:47 am

Government Employees are taxpayers. Somewhere around 1/3 of every check I got went to federal & state taxes – more like 1/2 when social security & medicare & retirement were included.

If the administration members of the PERS board do their job, a dose of “for the taxpayers” will occur. But note that the “risky” approach (using acceptable risk, not “betting the ranch” on something) has, over the long term, substantially reduced what employers (the taxpayers) might have had to pay for pensions even given some bad periods. Unfortunately, we recently had a very bad period that we’re still climbing out of (you have to double your money to break even after losing 1/2 … then there’s what you would have earned on the original amount that you were counting on), so higher payments are needed to pick up the slack for a while. If you’re smart, you do the same thing in your 401K. PERS IMO has bent over backward (perhaps not even protecting its members adequately) to minimize the hurt for employers during the catch-up period.

I’m not going to defend the activities and views of individual board members. If they make a circus out of the place, they’re not doing their jobs, plain and simple, and those who voted for them might want to consider an alternative next time around. Their job is, for the benefit of the members, to manage funds in a way that will cover retirement needs when they occur, and to charge employers and active members what’s necessary (no more, no less) to accomplish that. It’s a serious business and a balancing act, not a political party. Yes, there’s a lot of money floating around at PERS, and people may be tempted to live it up on the company dime as corporate types do. Again, if that’s happening, those responsible need to be disciplined, regardless of level in the organization. PERS is NOT Joe Corporation operated for the primary benefit of the CEO and if there’s anything left the stockholders. It’s also not the Union Hall.

January 5, 2015 at 5:56 am

Seesaw: every “hybrid” pension proposal I’ve seen has been code word for “cut pay by cutting retirement benefits while raising employee costs.” That’s pretty much how the federal system worked out, and now it’s being cut further. No time to go to work for the fed, and frankly I don’t recommend that people plan on a career at the state either given the recent changes unless they think it will be Really Long. So it’s no surprise that a critical review of the Brown proposal worked out as it did.

January 6, 2015 at 3:08 pm

Quoting SeeSaw … “That question aside–the Governor’s hybrid proposal in the fall of 2011 was studied for 10 months by pension experts working for the Legislature’s reform committee. The results of their study concluded that the proposed hybrid plan could not guarantee future retirees sustainable pensions.”

Guarantee ? Do Private Sector workers have a “guarantee”, especially with Social Security TYPICALLY 1/3 as generous as even the poorest pension formulas?

What makes only PUBLIC Sector workers so “special” that they (but not their Private Sector counterparts) deserve a “guarantee” as to retirement security?

January 8, 2015 at 5:06 am

John Moore Says: December 22, 2014 at 6:45 pm

“Unfortunately, as the state shifts money to fund health care, education will surely take another big hit. Funding Teacher Retirement comes to mind. I remember when Ca. was tied w/Iowa for No 1 in Education. As pensions, salaries and now health care ate away at revenues it is now tied with Mississippi near the bottom. Each generation passed on obligations to succeeding generations, raised every kind of tax(like prop 218, income and sales taxes)so except for the very rich, the quality of family life in Ca. has plunged. Brown was the main creator of this mess. His pension reform will continue to add to unfunded liabilities and attempting to fund health care w/o reform will put another nail in the lives of our young.”

John Moore, I think you hit the nail on the head. The increased funding to cover the unfunded liabilities of teachers/CalSTRS pension plans should be the final nail in the coffin. We are looking at significant reductions in classroom dollars, programs, and increases in class size. The taxpayers threshold for accepting lousy fiscal management & increased taxes/parcel taxes/bonds, to fund pension & healthcare plans which are excessive, should come under much overdue scrutiny. And CalSTRS has allowed their fund to be pilfered much in the same way CalPERS has been corrupted.

The battle of competing interests over school dollars is just getting started and I‘m not sure who‘s representing the students. Hopefully, when my fellow parents discover what’s happening with their school district funding a new level of concerned citizens will emerge. I can’t wait for the “Soccer Moms” to embrace this issue.

January 8, 2015 at 6:46 am

Captain, While I agree with you, it’s going to take one heck of a ground-swell to overcome (a) the huge political influence of the Public Sector Unions, and (b) the legal structure built to protect all aspects of Public Sector pensions & benefits making material reform exceedingly difficult (i.e., the crap about replacing anything taken away with something of equal or better value).

While rallying the socket moms is interesting, it’s easier to rally high school and college kids to a worthy cause. Teach them how THEIR future is being stolen from them and get THEM to organize Constitutional change and to vote out the pathetic Democratic establishment owned buy the Unions.

January 10, 2015 at 12:51 am

Michael C Genest Says:

January 4, 2015 at 9:51 pm

“Oops, SeeSaw I think you just hoisted yourself on your own petard! Of course, if the CalPERS fund had no ability to come back to the tax payers for any UAAL, then I think I’d agree with you. However, state pensions are a non-recourse obligation and if the money in the fund ever comes up short the taxpayer will have no choice but to pay it. Given that, we could do either of two things. We could put a taxpayer representative not the Board, or maybe even pack the board with same. Or, we could turn state pensions (going forward only of course since the US Constitution Contract Clause would never let us do it for current retirees) into “hybrids”, meaning they would attempt to provide a set retirement, but if the money turned up short the pensions would automatically be reduced.”

Seesaw, other than your comment to Mike G. that, ” How much of your own $130,000 public pension would you be willing to give back for the greater good?”, what logically argument do you have to offer?

Seesawsaw says: “That question aside–the Governor’s hybrid proposal in the fall of 2011 was studied for 10 months by pension experts working for the Legislature’s reform committee.”

– And who were the committee members, SeeSaw?

Seesaw says: “The results of their study concluded that the proposed hybrid plan could not guarantee future retirees sustainable pensions.”

– Seesaw, were there any committee members removed from the committee? Was it only one member? And how is it that a HYBRID plan couldn’t guarrantee a sustainable pension? That statement offends even my own low-level I.Q.

Seesaw says: “Thankfully, the Legislature turned down that particular item in Brown’s 12-point pension-reform proposal.”

– So, Seesaw, your petard extends well beyond your own comments that taxpayers have no business voting on anything they’re stuck paying for, and includes the CalPERS/UNIONS ability to completely ignore/reject Governor Brown’s 12 point Pension Reform Plan – because you don’t like it. Did I get that right? Yes I did!

So Taxpayers approved Prop 30 based on the promise of Pension Reforms and you’ve thumbed your nose at it all. Was this a pre-planned collusional effort on the part of the unions and the governor? By that I mean did the governor promise to ignore 98 ways for Pension Reform to be increased once prop 30 passed (he only objected to one)? And then PUBLIC EMPLOYEE UNIONS decided they wanted what amounts to “one of the largest pension enhancers” so they ignored the governors lone challenge?

Is CalPERS so powerful that even the Governor of the State of California isn’t willing to take them on? If so, we need to break CalPERS into several little pieces.

CalPERS is Corrupt!

January 10, 2015 at 2:51 am

Captain, I believe you are confusing SeeSaw with someone else … at least pension-wise. Even with retiring in her 70s and with 36+ years of service, with a roughly $50K final salary (if I recall her correctly), and having retired only a few years ago, her gross annual pension is likely about $40K, not $130K.

January 10, 2015 at 4:44 am

TL, I do not believe anything that comes from SeeSaw. But what you are referring to is Seesaw’s claim that Michael C Genest should be happy because:

SeeSaw Says:

January 5, 2015 at 4:36 am

‘Of course, talk is cheap for you–you are secure in the fact that your retirement has occurred–and you should feel secure. What if a reformer came along with a plan to take back some of your pension? How much of your own $130,000 public pension would you be willing to give back for the greater good? (Seesaws words – not mine)”.

What surprises me is that we don’t have a flood of retiree’s asking for fiscal/pension sanity. After all, the stability of their own plans is dependent on the proper management of CalPERS. I like Mike G. If I were a retiree w/pension I would also be challenging the kind of people that are willing to bankrupt the system, destroy city budgets, and ruin DB plans for the sake of their own ego’s.

January 10, 2015 at 7:49 am

Captain, I think the retirees keep quite because:

(a) “they got theirs” now … a bird in the hand ….

(b) make waves, and the actives (which control the Unions) might throw the retirees under the bus

(c) they come from a period where the Taxpayers have always had to pony up, and they likely don’t understand the severity of the issue

(d) they see “no big deal” in the Detroit settlements, not realizing that w/o the “Grand Bargain” to protect the DIA’s artwork, they likely would have lost at least 25% of their pensions

(e)some likely believe that if everything else fails, the Feds will ride to the rescue with a bailout … you know, that “too big to fail crap”. I guess they forgot that Republicans now control Congress

January 10, 2015 at 3:17 pm

Thank you, Captain. Being liked is NOT something a current or former finance director should seek or expect, but it’s nice anyway. I agree that other retirees should speak up.

TL, yep, I got mine. And, you’re right that other retirees aren’t speaking out on this for a variety of reasons. I’ve been warned by business partners to leave it alone lest my comments scare away potential clients. I’ve been warned on a personal level that I will look callous and hypocritical for such commentary. But, the fact is, I’ve been fighting for pension, health care and compensation realism for a couple of decades. I did so within the system and I will continue to do so.

When SB 400 was pending and my budget staff wrote analyses saying it would be “free”, I made them re-write that to indicate that there is no such thing as a “free lunch” (still nearly every Republican voted “aye” anyway). When state executive salaries (including mine) were raised I insisted that we add a provision requiring a 3-year phase-in for PERS’ability (I retired a couple of months before my phase-in was completed so this cost me a little money). As stated above, when asked to testify to a commission that my boss, the governor, said should “keep the promise” (meaning, no cost control) I still told them they needed to add cost control to the mix.

Perhaps some, like SeeSaw will still say I’m hypocritical. But, I’m not arguing for cuts for others to save my own bacon. I’m arguing and have argued for accuracy in characterizing costs and for realism in promising benefits. If there are health care costs shifted to current retirees like me, as Brown’s new budget seems to suggest, I will support them. But, I certainly understand that my pension is generous and many retirees have much, much less while many in the private sector have none. I’ve never been an advocate for “equality of outcomes” or income redistribution, but I certainly think any changes should fall less on the lower income folks than not the upper income.

January 10, 2015 at 4:18 pm

Mr. Genest, You sound conflicted, acknowledging that you likely get a bit too much, but you can’t quite get to …. we (Public Sector workers) really deserve EQUAL to our Private Sector counterparts, but not more …. at ALL income levels, meaning that if retirement “security” can’t be achieved, so-be-it, join those of us in the Private Sector. We (private Sector Taxpayers) should not be paying higher taxes so that comparable Public Sector workers can get “more”. And that also including the enormously costly retiree healthcare promises that is all but gone as a private Sector employer-sponsored benefit.

It’s not a matter of income re-distribution, but of basic fairness.

————————————

For what it’s worth, I believe a great deal of the Public Sector excesses (in pension & benefits) will be reversed, some via negotiation, some via bankruptcy, and some via there simply being no money to cut the checks.

Reality and the MATH always governs in the endgame.

January 10, 2015 at 10:20 pm

No, I’m not conflicted. There are two issues here. One is property rights, the other is governmental finance. As to the pensions of retirees (and in California, current employees’ future benefits), those are property rights by law. If you bought your house in 2007 and I bought the one next door in 2009, I would owe you nothing and we would both own our property, although you would have every right to rue your bad luck. A deal’s a deal as long as it was made legally. Those of us who work for government or have done so had a deal and under that deal we own the rights to our benefits as calculated under its terms. I would no more suggest a retiree give up some or all of his/her pension, whatever it may be (as long as it was legal) than I would I would pay you for having purchased a house identical to mine, but at a much higher price. Fair? Who knows, but that is not the question.