In a few years CalPERS retirees are expected to outnumber active workers, a national trend among public pension funds that makes them more vulnerable to big employer rate increases.

A mature pension fund for a growing number of retirees becomes much larger than the payroll. So if the pension fund has investment losses, an employer rate increase to help fill the hole takes a bigger bite from the payroll.

The growing number of retirees, partly due to aging baby boomers, is one reason a staff report last week argues that CalPERS has too much “risk” and should consider a number of options during a board workshop early next year.

Among the options listed are a more conservative investment allocation, a lower earnings forecast, an employer choice of asset allocations with different risk and expected returns, and workers sharing the risk through contributions, benefit design or cost sharing.

The staff report, the third of its kind in recent years, was praised by several board members for proposing in good economic times that CalPERS increase its preparation for bad times.

CalPERS employers and employees are contributing more money. Investments have had two strong years. Reform legislation will cut future costs. And a funding level that fell to 60 percent during the recession is back up to 77 percent.

Now the odds are better that the funding level won’t drop below what for some is a fuzzy red line — 50 percent of the projected assets needed to pay promised pensions.

At roughly that level, some think getting to 100 percent funding may become difficult if not impossible. Employer contribution rates would have to be raised to an impractical level, crowding out funding for other programs, and investments would have to yield unlikely returns.

Despite the improved odds, the staff report said the probability of the funding level dropping below the 50 percent red line during the next three decades is still about 30 percent, varying among plans.

“The probability of reaching any of the three low-funded status thresholds shown has been reduced,” said the report. “However, the probability of this occurring is still higher than staff is comfortable with.”

Still fresh in the CalPERS memory is a huge investment loss. The CalPERS investment portfolio valued at $260 billion in the fall of 2007 plunged to a low of about $160 billion in March 2009, before climbing back to $297.5 billion last week.

Even full funding is risky, Alan Milligan, the CalPERS chief actuary, told the board last week. CalPERS was 100 percent funded on June 30, 2007, he said, and two years later on June 30, 2009, CalPERS was only 60 percent funded.

“Being 100 percent funded isn’t necessarily the target,” Milligan said. “Being 100 percent funded at an acceptable level of risk should be the target.”

Adding to the CalPERS risk is the drop in the ratio of active workers to retirees from 2 to 1.5 in the last 10 years, increasing the size of the payroll bite if employer rates are raised after a big investment loss.

“So now we only have about one and a half active members’ payrolls to spread the risk associated with each retiree’s benefits instead of the two-to-one ratio of a decade ago,” said the staff report.

“An additional concern is that these ratios are also expected to continue dropping over the next decades until they reach a floor somewhere between 0.6 and 0.8 depending on the plan.”

Some steps that lower risk have already been taken, possibly limiting options available now. Through bargaining and pension reform legislation, most employees are paying more toward their pensions, usually several percentage points.

Employers are getting a much larger rate increase through a lower CalPERS annual earnings forecast dropped from 7.75 to 7.5 percent two years ago, a new actuarial method last year, and longer life expectancy adopted this year.

“For many plans, the contribution rates have never been as high as they are now,” said the staff report. The more than 3,000 state and local government agencies in the giant retirement system have more than 2,000 retirement plans.

More than 100 miscellaneous plans have CalPERS contribution rates of more than 30 percent of pay. More than 150 safety plans (police and firefighter) have rates of more than 40 percent of pay.

In addition, said the staff report, at the high end of employer contributions 70 plans currently have rates above 50 percent of pay. Eight of them are miscellaneous plans and 62 are safety plans.

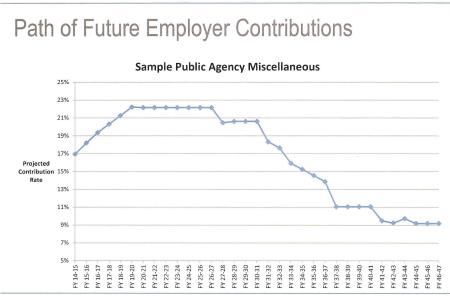

A chart with a simplified line shown the board last week (see below) projects rates for a typical miscellaneous plan increasing 5 percent of pay during the next five years, before leveling off for seven years and then steadily dropping for two decades.

“Ultimately, members and employers are in this together,” the staff report emphasized in boldface type.

The risk for employees is that if employers are unable to pay pension costs and terminate their CalPERS plans, the current low funding of the plans would result in deep pension cuts.

“Part of your job is to be Dr. Doom, and you do it well,” CalPERS board member J.J. Jelincic told Milligan, who presented the staff report also signed by the chief investment and financial officers.

Jelincic said the report should recognize the “trade-offs and balances” of the risky stock-based investment portfolio that can yield higher returns, lowering employer rates. He said a near zero-risk bond portfolio would have low returns that “kill the employer.”

Board member George Diehr, praising the objectivity of the “excellent” report, said Milligan is not Dr. Doom. He said the employee risk-sharing option should be in the “realm of actions,” even though it’s beyond board power and would require legislation.

Board member Priya Mathur, who also disagreed that the report is negative, said she supports “having a conversation” about how CalPERS can, without a spike in contributions, lower the risk of the pension fund.

“I think that is probably going to have some element of reducing the target rate of return, the discount rate, over time when it’s not so painful to do so,” she said.

Board member Bill Slaton, chairman of the finance committee that received the report, said the attendance of several board members who are not members of the committee shows the importance of the risk issue.

“I would give you the nomenclature of Dr. Realist,” Slaton told Milligan, “which is really why we are here — to make sure we are treating this with the appropriate care and caution and judgment.”

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at Calpensions.com. Posted 24 Nov 14

November 24, 2014 at 2:20 pm

This is not unexpected when you offer one year in retirement for each year worked.

And you don’t have rapid underlying population and government employment growth to alter the ratio, with a larger number number of current workers reflecting current population and tax base and a smaller number of existing retirees reflecting the less populated past.

None of this should make a difference if pensions are other retiree benefits are properly pre-funded. The ratio ought to be irrelevant.

But that never, ever happens. Generation Greed has taken a large part of the future from the generations to follow. The only questions are the distribution of the past guilt between unions that got retroactive pension increases and past taxpayers seeking lower taxes and getting them through pension underfunding. And the distribution of the pain, usually with the guilty beneficiaries exempted.

November 24, 2014 at 2:44 pm

“Employer contribution rates would have to be raised to an impractical level, crowding out funding for other programs, and investments would have to yield unlikely returns.”???

There are already employer contribution levels that equate to more than 50% of payroll for some local government safety employees. The basis for San Jose’s reform was that they could not afford to put cops on the street.

I certainly applaud the analysis and the proposals described in this posting, but we’re already there in some local pension funds and the unions are blocking efforts to find a fix. I hope they go along with some of these ideas for CalPERS. It would even be nice if they could agree to employee risk sharing at CalSTRS and back off their opposition to San Jose. I will not hold my breath, however.

November 24, 2014 at 4:35 pm

Quoting larrylittlefield …”None of this should make a difference if pensions are other retiree benefits are properly pre-funded. The ratio ought to be irrelevant.”

Mathematically, that’s correct, because it means that the pensions and retiree healthcare (i.e., deferred compensation) promises made to one cohort of employees are funded during the working careers of that same cohort.

BUT AS I HAVE SAID BEFORE:

Taxpayers must stay focused on the fact that “funding” requirements

FOLLOW from (and directly in proportion to) Plan “generosity”. Not being able to fully fund a very “generous” Plan is usually NOT due to a lack of political will, but due to the fact that the HUGE sums needed to do so are simply not available (while meeting a city’s essential service needs)….. with the ROOT CAUSE of this (incorrectly labeled) “funding problem” being directly traceable to grossly excessive pension/benefit “generosity”.

“Funding” problems are a CONSEQUENCE of that excessive

generosity, not a CAUSE of the financial pension mess many States and Cities now find themselves in.

To truly “fix” the problem, Taxpayers must address the REAL CAUSE (excessive “generosity”) and must demand either:

(a) a hard freeze (zero future growth) of all Public Sector DB pensions for the future service of all CURRENT workers. The current absurdly excessive DB Plans should be replaced (for future service) with a DC (401K-style) Plan with a Taxpayer %-of-pay “match” of 3%-5% of pay, just like Private Sector Taxpayers typically get from their employers, or

(b) If (a) above is not possible (after exploring ALL legal avenues and options to do so), then the pension accrual rate for the future service of all CURRENT Public Sector workers should be reduced by 50% for all non-safety workers and by 66% for all safety workers (with the most egregious pensions) …… and even AFTER such reductions, the resultant pensions would STILL be greater than the pensions granted 90+% of comparable Private Sector Taxpayers.

November 24, 2014 at 5:30 pm

Taxpayers fund both salaries and pension contributions. That is why only a 2% a year salary increase should be allowed in calculating the base salary for the size of retirement benefits. Pre- PETRA safety members have a statutory 9% limit on their contribution rate, but I see them agreeing to 12% on the condition that they get an additional 3% raise to cover the contribution. Pension reform without salary reform(limiting salary increases for the purpose of setting salary base for retirement)is illusory.

November 24, 2014 at 7:36 pm

What’s not always clear in these articles is that CalPERS is, in a way, a holding company not a monolithic affair. While there are some basic rules that apply to everything, the terms of the retirement programs differ substantially between employee groups and state/local. Personal experience as probably a typical full-career state employee (30+ years) is that gross pay increased over that career (including promotions, additional duties, etc.) by 3-4x, while inflation over that time was 4-5x or more. Certainly, there was a time when state employees could easily purchase a house; not any more. There were a few short periods where pay increases were at or above the inflation rate, but on average they were below and sometimes well below. Perhaps that’s a reason why there is a lot of turnover in the lower ranks. The politicians chose to offset that from time to time with increased benefits of various types, including pensions.

Local employees routinely had both higher pay and better pension arrangements (even through CalPERS) than state, so it’s expected that funding problems would appear there first. In the local agency accounts, which AFAIK are not commingled with all the others.

All that said, I don’t understand why future pension accrual for active employees can’t be adjusted from time to time, at least as long as it doesn’t go below what was in effect at the time of hire. Yes, an reasonable argument can be made that pay needs to be increased to compensate, at least partially, and the smart employee would put most or all of the pay bump in a 401K (in fact, that should be the default rather than taking the cash). Over time and several adjustments, its possible that a substantial part of retirement savings would be through DC plans rather than through the legacy DB plans. And IMO it would be good if CalPERS could compete in that arena – if they think they could do a better job investing those accounts than Wall Street.

November 24, 2014 at 7:47 pm

Recommendations to CALPERS again have the effect of causing a problem. Moving to a more conservative investment asset allocation will reduce the average return on investments over the next 30 years. This is the wrong move. Maintaining the current, and the historic, asset allocation of 60% equities and 40% bonds, real estate, other is the best policy. This asset allocation has historically returned more than 8% through every 30 year period since such statistics have been kept. Furthermore, the current 60% equity asset allocation will earn more than the 7.5% assumption used by CALPERS. In short, it would be a mistake to lower the equity ratio in the investment portfolio. Reasonable risk should be the standard, not the lowest amount of risk possible.

November 24, 2014 at 9:57 pm

Responding to MJB ….. what a load of BS. Sounds like you are excluding COLAs, and promotions and only using annual “raises”.

Quoting …. “Personal experience as probably a typical full-career state employee (30+ years) is that gross pay increased over that career (including promotions, additional duties, etc.) by 3-4x, while inflation over that time was 4-5x or more.”

No way …… do the math !

Public Sector Unions are a CANCER on civilized society and should be outlawed. FDR had it right.

——————————–

And, your grossly excessive pensions & benefits are a heartbeat away from ending … notwithstanding legal issues and Court decrees. The MATH and REALITY always governs in the end-game, and there never was., isn’t now, and never will be sufficient funds to pay for even HALF of your absurd pension/benefit promises.

November 24, 2014 at 10:00 pm

Responding to Owen, Yes reasonable risk is appropriate WHEN THE INVESTOR ASSUMES THE RISK, but in Public Sector pensions, 100% of that risk is foisted upon the Taxpayers …….. so what you stated is self-serving BS.

November 24, 2014 at 10:33 pm

MJB is correct. CalPERS is a holding company. It does not make the laws or the rules. It just follows what is handed to it. It keeps and invests the funds and releases them according to the rules it is given. In the case of PEPRA, CalPERS was given, in the statute. the right to interpret the item where there is disagreement with the Governor. MJB, you are wrong about local wages being higher than state. I have many retired state-worker friends who had much higher wages and they also receive much higher pensions. Prior to SB400 the state did not have the 3% formula for miscellaneous workers, and it never did adopt such. I think all the detractors and others who think they know so much about CalPERS, should just let the investment managers and actuaries do their, respsective jobs!

TL, all the public workers and pensioners are taxpayers, just like you and they are funding the same plans as any other taxpayer, plus the fact that they did the work to earn these pensions !

November 25, 2014 at 12:01 am

Apparently Calpensions doesn’t like my browser. I seem to have two posts in limbo. I see TL is emotional and boorish, as usual. And wrong, as usual.

MJB, TL won’t believe this link, either, he won’t even acknowledge that state workers are paid 12 percent less than the private sector when the data comes straight from The Heritage Foundation.

https://www.google.com/url?sa=t&source=web&rct=j&ei=asRzVNXNHsrWoAT5hYDwBA&url=http://www.ct.gov/opm/lib/opm/Out_of_Balance.pdf&ved=0CCQQFjAC&usg=AFQjCNF7NzqKhGhC9VhPsLNJMThIx4RfKw&sig2=2O8XWZP8hGBFfhQNuYzF1g

November 25, 2014 at 2:05 am

SAWZ,

It seems to depend on the city. A state mechanic has the same base pay, no matter where he works in the state. But a mechanic working for San Francisco city/county has wages roughly commensurate with private sector mechanics. Much higher. But the state mechanic makes about the same as a Fresno city mechanic. Of course there are a lot of exceptions, as you noted.

The link I posted shows local governments closer to private sector, but I have seen studies that showed the opposite.

TL, MJB is absolutely correct. You really shouldn’t comment on something you know nothing about. I have no idea what you mean by “annual raises”. I hired on in an entry level position. In my first 6 years I was promoted twice, and stayed at that level for over 30 years. No “annual raises”. All I received was sporadic negotiated increases. Sometimes we went 3 or more years with no raise, then maybe caught up somewhat over the next contract. Automatic COLAs would have been awesome. That’s why we say “Powerful Public Employee Unions” is an oxymoron. We found out the first contract after unions were allowed, what we got was “collective begging”.

You need a real friend to be honest with you about your attitude. You’re going around the bend and you seem to be the last to know.

November 25, 2014 at 4:13 am

As long as we GUARANTEE pension payouts, the system will be gamed. There are just too many ways for the powerful government labor unions to pressure compliant politicians that the UNIONS elect to agree to give something away today (the pension guarantee) that won’t have to be paid for many years — after the employees are retired and the guilty politicians are long gone.

EVERY such government “defined benefit” plan is underfunded — promising benefits that ultimately it cannot deliver with the money put aside. It CANNOT be fixed. It’s true in every country that has one — around the globe.

The damage can be lessened, but such guaranteed plans cannot be fixed, nor can we count on them REMAINING fixed.

The only sensible solution is a defined CONTRIBUTION plan — where the pay-IN is contractually guaranteed, but the earned payOUT is not. Such is a 401k plan predominant in the private sector — or indeed individuals’ own IRA plans.

November 25, 2014 at 4:18 am

SDouglas47,

You’re correct in that I don’t believe it. Whiteness the following “demonstration” (blow the dash marks):

And don’t bother telling me that I chose “safety workers” with the most egregious pension. Sure I did, but even you previously admitted that you can find no error in this demonstration that I’ve posted before. What could justify such OUTRAGEOUS Safety pensions (they are OVERPAID on a “CASH PAY” basis alone !)…… with my demonstration CLEARLY showing that to receive a pension with the SAME value at retirement as that of the TYPICAL CA Police officer, a Private Sector worker retiring at the SAME age and with the SAME service would need to have a final salary almost 5 times (5 TIMES !) that of the Police officer.

And, while safety worker pensions ARE the most egregious, a similar workup for non-safety workers would show that a comparable Private Sector worker retiring at the SAME age and with the SAME service would need to have a final salary almost always 3 to 4 TIMES that of the non-safety Public Sector worker to get a pension of EQUAL value. Again, the same conclusion as above but just slightly less OUTRAGEOUS.

These grossly excessive pensions are patently absurd, and no matter how you try to spin it (with hand-picked “studies” that support your agenda), these DB pensions need to end … and for the future service of all CURRENT workers.

—————————————————————

Even if you take (the now rare) Private sector worker who still has the old style (ala what Civil Servants have) Defined Benefit Pension, the “formula benefits” NEVER EVER approaches the Richness of what Police & Fireman get. The REAL costs are well hidden in the “details” as I will demonstrate ……..

A 30 year Private career worker just “might” get a pension annuity of 40-50% of base pay, with NO Post-retirement COLAs, and, if they retire at 55 (vs the more standard 60-65), a 25% “actuarial reduction” in benefits for starting to collect at this earlier age. Also, overtime is NEVER included in pensionable salary in the Private Sector.

So lets work up a comparison for a California Policeman or Fireman (with base salary of $100,000, $50,000 of overtime, 30 years on the job and now retiring at age 55, with a 3%x30 years = 90% of final pay pension), vs the Private Sector worker.

The Private sector worker gets a life annuity (with NO COLAs) of (we’ll use the higher 50% figure) 50% of $100,000 = $50,000 reduced to .75x$50,000 = $37,500 due to actuarial reduction associated with payment beginning at age 55. Using an actuarial table of Life Annuity factors, the Present Value (think of this as the up front money it would take to buy this payout annuity from an insurance company) is approximately $37,500 X 14.24 =$534,000. That’s it, there is nothing else.

The Policeman/Fireman get a life annuity (WITH COLA, the incremental cost of which we will address later) of 90% of ($100,000+$50,000 overtime) = $135,000 annually. With NO post-retirement COLAs, a similar calculation for the Policeman/ Fireman yields (noting that there is no reduction for payment beginning at age 55) $135,000 x 14.24 = $1,922,400.

So, so far (were aren’t done yet) the “Cost” of the Civil Servant’s pension is $1,922,400 vs $534,000 for the Private sector worker MAKING THE SAME PAY.

Now lets address the value of the COLA. The mathematics is quite complicated, but a life annuity of $135,000 to a 55 year old WITH post-retirement COLAs (with an assumed inflation adjustment of 3% per year) is roughly equal to a NON-CLOA life annuity of $169,800. Therefore, on a apples-to-apples comparison with the Private Sector worker (whose pension is NOT inflation adjusted via a COLA) the upfront cost of the Policeman/Fireman’s pension is $169,800 x 14.24 = $2,427,952 (since the 14.24 Life Annuity factor is applicable to a non-COLA-adjusted pension payout)

We aren’t done yet …… since we haven’t considered the ENORMOUS cost of (free or VERY heavily subsidized) RETIREE healthcare afforded to the Policeman/Fireman, but RARELY the Private Sector worker. This cost for someone age 55 (10 years before being eligible for Medicare) is truly HUGH. Rough estimates (with 8-10% inflation in medical costs) for Family coverage typically put this cost at approximately $500,000 (more if subsidized coverage continues post-Medicare age).

So far we have (for the SAME PAY)…..

COST of the Private Workers Retirement benefits = $534,000

Cost of the Policeman/Fireman’s Retirement benefits = $2,427,952 + $500,000 = $2,927,952.

In fairness, Policeman/Fireman contribute a percentage of pay toward their pension (but not retiree healthcare). I could work up an estimate based on assumed year-by-year pay over a career, but for brevity (and since I’m tired of writing), lets assume the accumulated value of these contributions at retirement is $500,000.

We are STILL left with a TAXPAYER FUNDED $2,927,952-$500,000 = $2,427,952 “cost” for the Public Servant vs a $534,000 EMPLOYER FUNDED “cost” for the Private Sector worker …… BOTH with the SAME PAY.

Another way to look at this is that TAXPAYER’S are FORCED to pay $2,427,952/$534,000 = 4.55 TIMES as much as the typical Private Sector employer is willing to pay in retirement benefits……… or alternatively …… TAXPAYERS are FORCED (via their TAXES) to provide a pension to Policeman/Fireman EQUAL IN VALUE (i.e., “cost”) to a Private Sector worker making 4.55 TIMES as much pay.

Isn’t it time for a change ?

November 25, 2014 at 6:25 am

“Won’t believe this link” was actually in reference to MJBs claim that state pay has been declining relative to inflation. The link I posted had nothing to do with pensions. It was cash pay only, tracking over twenty some years the *difference* between public and private pay. (Nationwide, and separately in several large states).

The purpose of that link is that you specifically continually deny that there is any meaningful disparity in public cash pay. The Heritage Foundation is not a “hand picked study”, and it agrees, at least in the case of cash wages, with the union thugs bought off studies, or whatever you imagined.

Another comment we commonly hear was that “sure, in the eighties” they were paid less, but now they make “as much or more” than the private sector. It’s been repeated so much, it is taken as gospel (“gospel” in the sense of ” I want to believe it, so it must be true”)

But……it ain’t. These historical figures show that, indeed, in the eighties, public workers earned much less than private. Then, late eighties to mid nineties, there was a brief “hump”, nationally, and echoed in many states, where public pay caught up with, or surpassed private. (Interesting hump, by the way, I’d like to find out more about that some day).

I digress. What goes up usually comes back down, as did public “cash” pay relative to private. This is what I said you, and others, would deny. The lower cash pay is real, and not just for the “very small percentage” you claim.

I’m afraid I’ve run out of time. Stay tuned tomorrow for your fireman fallacy.

November 25, 2014 at 6:53 am

Sorry SDouglas47 but that link takes us to a report prepared by 2 groups, a summary of their function/purpose (in their own words) posted below. Clearly their function/purpose is to support & promote Public Sector workers everywhere …. two of the many mouthpieces for the insatiably greedy Public Sector Unions/workers

Interestingly I could not find the word TAXPAYERS, who foot almost the entire bill for the grossly excessive pensions & benefits (as well as pay), anywhere.

———————————————————–

About the Center for State and Local Government Excellence

The Center for State and Local Government Excellence

helps state and local governments become knowledgeable

and competitive employers so they can attract and retain

a talented and committed workforce. The Center identifies

best practices and conducts research on competitive

employment practices, workforce development, pensions,

retiree health security, and financial planning. The Center

also brings state and local leaders together with respected

researchers and features the latest demographic data on

the aging work force, research studies, and news on health

care, recruitment, and succession planning on its web site,

http://www.slge.org.

————————————————————–

About the National Institute on Retirement Security

The National Institute on Retirement Security is a nonprofit

research institute established to contribute to informed

policymaking by fostering a deep understanding of the

value of retirement security to employees, employers, and

the economy as a whole. NIRS works to fulfill this mission

through research, education, and outreach programs that

are national in scope.

.

November 25, 2014 at 7:32 am

TL, if the safety worker earning $100,000 plus $50,000 overtime is a CalPERS retiree, the overtime does not go into the pension calculation.

November 25, 2014 at 2:18 pm

SeeSaw, Overtime IS included in most local CA Plans not administered through CalPERS…… and for discussion purposes, many pension systems elsewhere still include overtime in “pensionable compensation”.

EVERY system that allows it is wildly abused with end-of-career overtime funneled to those in the 1-3-year retirement window just to help “spike” their pensions. The Cities, the management, the Unions, the workers, ALL treat the TAXPAYERS as the sucker in the equation.

November 25, 2014 at 3:31 pm

Firemen, policeman, yes, I do have a minor objection to using them as an example. People reading these articles get the impression these are typical public pay and pensions. No wonder they’re pizzed.

My pension is under $50,000 and actually higher than most of the people I worked with. Perhaps some of the engineers I worked with, and my old Regional Manager, will attain the “average” $65 to $70k retirement. The Director of Caltrans makes about $150,000, I think. According to Biggs, he is probably underpaid.

……………..

The Fireman Fallacy:

1. “egregious pensions” and “OUTRAGEOUS Safety pensions (they are OVERPAID on a “CASH PAY” basis alone !)……”

Those are your opinions.

2. “but even you previously admitted that you can find no error in this demonstration”

Reading comprehension is your friend, TL. Or it should be. I said I found no error in your *math*. Big difference. As you surely have noticed,…………

Every…….

Single……

Time…….

I see you post this farce, I point out to you and anyone reading that the “math” is irrelevant because the basic premise is all wrong. You cannot see the forest for the trees.

Which brings us to the other problem with using safety workers for comparison. There is no valid comparison unless you identify a private sector worker with the same “human capital”. Please, dont embarras yourself by describing these professionals as “GED” types.

SAME, SAME, SAME.

Two workers with the same pay, same length of service, same age at retirement. But one has a much larger (4 1/2 times?) pension value. You forgot one “same”. If they are each equally qualified attorneys, or IT administrators, or medical researchers, sure, time for a change.

But,

If one is an auto mechanic, and the other is a CPA who has the SAME salary as an auto mechanic because he is deferring more of his compensation, then good for him. Turns out he’s not such a greedy basturd after all.

…………..

Here is my math, two equivalent persons:

State worker with Masters degree:

Salary………………………$62,834

Benefits……………………$27,625

Total compensation….$109,056

Private sector with Masters:

Salary………………………$82,319

Benefits……………………$30,622

Total compensation….$112,942

Math says the state worker makes 24 percent less in cash pay than his equivalent private sector counterpart, and 3 percent less in total compensation.

Please note that “benefits” includes the cost of paid time off, healthcare, retiree healthcare, and pension costs computed at the risk free rate. Not “one of my hand picked studies.”

The public worker probably has a much better pension, maybe even 3 or 4 multiples of the private sector. But if that private sector MA puts a big hunk of the 20 grand extra take home into his IRA and 401(k), he too can be comfortably retired. It’s his choice. Enjoy it now, or enjoy it in retirement. The public sector worker, by the nature of his job, WILL defer more of his present compensation until retirement.

The name of the game is “roughly equal total compensation.”

November 25, 2014 at 3:32 pm

So, what makes my math better?

2. It compares similar workers.

3. It is near the average salary for public sector workers.

4. It’s a larger sample. Master’s degree (and higher) are about 30+% of state workers, as opposed to the $100,000 club examples.

5. These are actual averages from nationwide data, not a hypothetical “demonstration.”

1. It’s not my math, and it’s not from a hand picked study that supports my agenda. It is straight from the American Enterprise Institute for Public Policy Research.

specifically, table 4, page 60,

https://www.google.com/url?sa=t&source=web&rct=j&ei=QEl0VNi3LI6yoQTFvIHQAw&url=http://www.aei.org/publication/overpaid-or-underpaid-a-state-by-state-ranking-of-public-employee-compensation/&ved=0CBwQFjAA&usg=AFQjCNGAK2QV3lGZZ2CevV8ei0S1832b0g&sig2=5UQAbOM593kClv1mdETDHA

Please read the entire report carefully. Then go back and read it again.

Ñh

November 25, 2014 at 4:24 pm

“two of the many mouthpieces for the insatiably greedy Public Sector Unions/workers”

Yee are so predictable, TL. One of my posts that ended up in internet purgatory told MJB just that.

TL would not believe it because it has those satanic initials “CSLGE” and “NIRS”.

Come into the light, my child. It’s just employment data. It comes from the same sources used by the American Enterprise Institute for Public Policy Research.

“The American Enterprise Institute for Public Policy Research is a private, conservative, not-for-profit institution dedicated to research and education on issues of government, politics, economics and social welfare.”

Today, this year, 2014, AEI data says that the average state worker is underpaid by 12 percent. Do you deny and reject that conclusion because it happens to concur with results of “two of the many mouthpieces for the insatiably greedy Public Sector Unions/workers” ???

Guilt by association?

AEI also says that the highest educated public workers are underpaid in wages by 38 percent and by 17 percent in total compensation. Even though the evil mouthpieces never published those facts, is the AEI data tainted because it came from the same sources?

The same comprehensive sources used by ALL serious economic research?

Or do you prefer the anecdotal route: All public sector workers are greatly overpaid and have egregious benefits and pensions because “I know this guy……………” (Insert the latest alleged public sector overpaid scapegoat.)

Isn’t it time for a change ?

November 25, 2014 at 4:31 pm

“SeeSaw, Overtime IS included in most local CA Plans not administered through CalPERS…… ”

“most” ?? As in more than half ?

Did you actually look that up? Or are you shooting from the lip………again?

Gospel according to TL: It must be true because I want it to be true.

November 25, 2014 at 5:05 pm

You are good — lumping all masters programs together to compare with. Well played! Dishonest, but well played.

A masters earner in the STEM fields is often paid more in the private sector, but a masters in the other fields (the masters that most government employees hold) are paid MORE in government than the private sector — in both cash and benefits.

Moreover, the benefits for government employees are grossly understated, as the retiree health care and pensions are not adequately funded by the money being put aside by government. Indeed, most retiree health care plans (when provided) are some form of “pay-go,” a euphemism for a Ponzi scheme.

November 25, 2014 at 5:37 pm

Responding to SDouglas47 ….

It’s interesting how (in reference to my above detailed mathematical demonstration of how grossly excessive CA Public Sector pensions are) YOU AGREE that you previously stated ..”I found no error in your *math*.”, but you still call my demonstration a “farce”.

Certainly sounds like you have have an agenda to challenge ANYTHING that substantiates the grossly excessive compensation granted Public Sector workers EVERYWHERE …. primarily via GROSSLY EXCESSIVE pensions & benefits.

————————————————–

Also, I’ve noticed your many comments about Public Sector workers with Masters degrees, as thought that AUTOCRATICALLY should imply that higher pay is justified. Since I have family (thank God, not immediate family) who work in the Public Sector, I’m hardly impressed.

In the PRIVATE Sector, higher pay and promotions rarely come solely from the attainment of a masters degree. It comes from a consistent demonstration of high caliber, high quality of valuable work and contribution to the organization. I have have personally witnessed Public Sector pay advances attributable to the attainment of a Masters that had virtually no connection the the person’s job. As they say, only-in-the-Public-Sector, where the Taxpayer is looked at as the sucker in the equation and all parties (the workers, the Unions, “management”, the elected officials, the “power brokers”, etc.) with a finger in the Taxpayers’ pockets look for all avenues to advance the group’s compensation, whether justifiable or not.

And I’d love to see someone weed out all those with mail-order Masters and PHDs (not accredited by well recognized academic accrediting organizations) BOTH in the Public and Private Sectors … and recover any pay increases attributable to such.

November 25, 2014 at 5:47 pm

CalPERS retirees do not get to add overtime to the salary-amount when calculating pension! The employee got paid for the extra hours, when said employee was on the payroll! Or, if overtime was banked, it can be cashed out at the time of retirement. It is a wonder you ever had time to work for your own living, TL–you have spent so much time and are such an authority on the work histories of others!

November 25, 2014 at 5:48 pm

Responding to SDouglas’s comment starting with …”So, what makes my math better?”

Really? I don’t see here and have NEVER seen any mathematical workup from you ….. just verbiage and commentary, mostly quoting the few studies that support your agenda ……… as were the 2 CLEARLY pro-Public Sector groups that published the report linked to in your earlier comment above.

November 25, 2014 at 8:38 pm

Richard,

I didn’t lump anyone. I am relying on the research skills of Andrew Biggs and Jason Richwine.

I cannot attest to this particular table, but in the entire report, they seem to be diligent in their comparisons. The human capital method they use has been the gold standard since the 70s, as I understand. They use a large database and can factor in education, age, gender, marital status, race, etc.

” (the masters that most government employees hold) ” ??

I wonder, Richard, since I have an inquiring mind, if you have some empirical evidence for that statement, or if that is some invention based on personal prejudice. It’s moot, anyway, unless you question the methods of Biggs/Richwine. We can’t redo the whole study. If you can’t rely on AEI for objective data, where does that leave us?

Did you even read the link I posted ? Government employee benefits are the main distinction between this study and the satanic emanations spewing from the alphabet demons, CSLGE and NIRS. Biggs/Richwine use the risk free rate to value pensions AND retiree healthcare.

Interesting anecdote there, I had never seen this technique before. As expected, they do not just accept the ARC as the present benefit cost, they recalculate using risk free rate, so the “benefit” listed as 18% of pay may actually be 36%. In their method, they also discount the employers cost of Social Security. The 6.2% employer payment is not considered a dollar for dollar benefit for the private sector worker. It is calculated as about a 2+% benefit, because the worker commonly receives less in SS than he pays in. Therefore 4% of the employers share is considered a “tax”, not a benefit.

Which is to say, in this study, I think it would be fair to say government benefits are not “grossly understated”.

November 25, 2014 at 9:26 pm

I must admit, I am surprised by the responses from Messieurs Tough Love and RichardRyder. Not what I expected.

Today, and nearly a dozen times in the past few months, on this and/or other boards, for my own nefarious reasons, I have linked probably the most right wing study comparing public and private compensation. All I’ve heard back is whining about the ones I didn’t cite:

“Clearly their function/purpose is to support & promote Public Sector workers everywhere …. two of the many mouthpieces for the insatiably greedy Public Sector Unions/workers”

I thought, surely, someone would actually read the study, or at least skim through the pictures, and say “Excuse me, Mr. SDouglas47, sir,……YOUR study says California state workers have a 33 percent compensation advantage over private sector workers, when adding in the value of job security”. (figure 13, page 74).

Then we could actually go back and have a constructive debate about some of the other fine points of the study. Oh, well.

I know another nasty little secret that I have never heard from TL or RR or any of the other so called reformers that is very beneficial to some public workers. I can’t divulge it, or it will be attributed to ALL public sector workers who, as we now know, can all retire at 50 with a pension higher than their final salaries, and free healthcare (Cadillac) for life. It shall remain my secret. (It’s not the 72 virgins we get in heaven, that cat is already out of the bag.)

November 25, 2014 at 11:13 pm

Oh, Tough Love.

I just don’t know how to explain it to you. It is not your math that is bad, it is your logic.

Your example is a farce because it is entirely built on a false premise.

You have two people who make the same pay and retire at the same age, with the same years of service, right?

But one of those has a pension worth much more (4.5 times more). His total compensation is MUCH higher. Okay, I get that.

What I am saying is, if he is a Doctor, and the other worker a postal clerk, his total compensation SHOULD be higher. He is simply deferring present pay till retirement. That’s where your logic falls apart.

No matter how elegant and complicated the *math* is, if the basic premise is wrong, the answer will be wrong.

Garbage

In

Garbage

Out

………………

“many comments about Public Sector workers with Masters degrees,” ?

I was quoting from the veritable right wing bible of salary studies. Which you apparently don’t have time to read, judging from your comments.

Direct your concerns to Andrew G. Biggs, resident scholar at the American Enterprise Institute:

andrew.biggs@aei.org

Or to Jason Richwine, “former” Heritage Foundation staffer

http://www.washingtonpost.com/blogs/wonkblog/wp/2013/08/09/jason-richwine-doesnt-understand-why-people-are-mad-at-him/

……………….

And, nice job chasing MJB away. He (or she, sorry, MJB) seemed to be new here and made some reasonable remarks. Did you make it down to the part where MJB agrees with you, about reducing future pension accrual for active employees ?

Or were you too busy ranting about salary increases that he has personal experience with and about which you know only enough to be reliably mistaken ? Are you determined to shoot yourself in the foot ?

One of the advantages of these boards is the opportunity to learn new things. When we discussed “NO raises in over five years”, someone argued that we were still getting step raises. Until that time, I had no knowledge of step raises. A little research found it is common for teachers to have step or column raises virtually every year, in addition to whatever COLAs they might negotiate. I also found that some local governments have longevity increases, as in a typical 2.5% raise after 20 years, and another 2.5% after 30.

Neither of these types of raise are typical for California state workers, if that’s what you were referring to. We don’t all get step raises we don’t all retire at 50, we don’t all get $100,000 a year. Most of the people I worked with had the same gross pay in 2012 that they had in 2007. No COLAs, no step raises. Which means that, because of increased insurance costs and increased pension contributions, the net checks are much smaller than 2007.

It almost appears that you were implying MJB was a liar. If I were you, I would apologize, just in case.

(Disclaimer: I never got a longevity increase, but on my 25 year anniversary, I did get a frameable certificate signed by Arnold Governor Schwarzenegger, and a gold (plate) watch.) The value of neither one of these was used to spike my pension.

November 25, 2014 at 11:35 pm

“Public Sector Unions are a CANCER on civilized society and should be outlawed. FDR had it right.”

Actually, he cautioned against strikes or other militant action, but I don’t think he said they should be outlawed :

“The desire of Government employees for fair and adequate pay, reasonable hours of work, safe and suitable working conditions, development of opportunities for advancement, facilities for fair and impartial consideration and review of grievances, and other objectives of a proper employee relations policy, is basically no different from that of employees in private industry. Organization on their part to present their views on such matters is both natural and logical, but meticulous attention should be paid to the special relationships and obligations of public servants to the public itself and to the Government.”

And I’m pretty sure he never said they were a CANCER on civilized society.

November 26, 2014 at 2:19 am

You beat me to it, SD47.

TL, FDR was President over 80 years ago–don’t you know that the world changes, day by day?

November 26, 2014 at 2:28 am

In my 40th year, I got a thousand-dollar longevity gift from a special program my employer had enacted for all long-term employees, that year only. Well, shoot, it didn’t get added to my pension either, SD! Now, my former employer is not giving full-time salaries and benefits to new hires. Yes, the world changes every day–and TL is still a public-sector hater. Where in the “book of words”, does it say that different people, working in different sectors of the economy, doing similar work, should get exactly the same pay?

November 26, 2014 at 6:16 pm

SD47, thanks for the link to the AEI report. I have learned some things by reading the substantial information there. It does give a fuller understanding of private vs. public sector pay relationships, which are certainly more complex than simply the “public sector employees are overpaid and underworked” jeremiad one often hears.

That being said, I think TL’s point that pensions are still excessive is valid. This is, after all, the “Calpensions” blog. Our politicians put off the day of reckoning for compensation in the future with these large pension formulas. It would work IF the pensions were properly funded, but unfortunately our irresponsible political leaders and (until recently) CalPERS enablers have put us in a big fiscal hole. If we had modest pensions, then the politicians would be forced to pay public servants according to the private sector, which would force them to make hard decisions in the present (i.e. while they are in office) about which services to provide and not provide. The recent fiscal history of California is a sad tale of what happens when politicians have the opportunity to promise the moon when they don’t have to pay for it, thanks to enabling financial “professionals” such as CalPERS.

I have served a significant part of my life in the military, so I’m very familiar with elaborate pay scales disconnected from the private sector and a generous pension being used as a sweetener to keep people in even though they could earn a lot more in the private sector. The military, too, faces the equivalent of unfunded pensions, being strictly pay-as-you-go. This has put the DOD budget under stress for many years.

November 26, 2014 at 9:04 pm

401(k) plans are notorious for high fees and manipulation by the company that arranges them. See:

They are no substitute for a carefully financed, modest, defined benefit pension, which most public entities in the US (not California) have arranged. And 401(k)s were ***NEVER*** supposed to be the sole source of job-related post-retirement income… the private pension system in the US was wrecked by corruption in the private sector, as documented by this Pulitzer-prize winning journalist:

http://www.retirementheist.com

Even in California, a large number of public retirees (my California elementary school teachers, who worked for 30-40 years, and get pensions in the $50K/year range, for example) don’t get the inflated pensions that some safety officers, the officials in the city of Bell, prison dentists, etc get.

Those who hate all public entities point to the excesses in the public sector, but overlook the huge fees and corruption in the 401(k) business. They also overlook the incredible inflation of post-employment compensation in the upper tiers of the private sector, much of which is fueled by public sector money: healthcare executives, the armaments industry, and of course, Wall Street itself, which is utter dependent on welfare from the Fed.

Seems to me we have to stick with DB for public pensions but really stomp on the excesses. 3% at 50 was completely greed-driven (and based on military pension arguments, where retirement at 37 is allowed). As I’ve always said, if those who get 3% at 50 won’t agree to a reduction, use bankruptcy & sovereign default to force the issue.

But also make sure Wall Street gets at least as big a haircut as the high-pensioners get, and also don’t cut small pensioners like my elementary school teachers.

November 26, 2014 at 10:31 pm

Spension, When the 3%@50 becomes no greater than 1.5%@60 (with no COLA increases) which would mimic the MOST GENEROUS tier of Private Sector pensions, then we can talk.

I noticed that you carefully didn’t suggest a specific reduction from the clearly excessive 3% @50 … perhaps intentionally.

November 27, 2014 at 5:58 am

3%@50 is already gone. The replacement formula is 2.7@57. Good news, the 90% cap is gone. A cop can now retire with 100% or more. No need to reduce formulas going forward for legacy employees, you can keep pensions down by keeping COLAs below CPI for the next 20 years.

November 27, 2014 at 8:33 am

spension Says: 401(k) plans are notorious for high fees and manipulation by the company that arranges them. See:

Why do you keep making the this same ridiculous claim, Spension? If you want to talk about high fees I can’t think of anything higher, or more ridiculous, than what CalPERS is currently charging – or about to charge. I can only surmise that your fee argument is one-sided and viewed through your own very biased lens.

CalPERS’ Bankruptcy Deals ‘Haven’t Solved Funding Problems’: Arrangements with San Bernardino, Stockton, and Vallejo will lead to more financial strain, ratings agency Moody’s argues.

Read the article. Of the California cities that have filed bankruptcy, which are compared in this article, Vallejo is the most screwed up thanks to … and paying the most. A police captain earning 200K per year in compensation will soon have an additional $142,000 per year added to his/her employee cost/pension fund, in order to satisfy the CalPERS required employee contribution. The additional 72% of payroll applies to every public safety employee.

The 72 % of payroll/cost is well above the 18% of payroll that CalPErs charges as an annual base for a 3@50 pension formula. The difference between the 72% of payroll about to be charged, and the 18% CalPErs considers the fair cost is 54% of payroll. In other words – based on this ridiculous CalPERS formula Vallejo will pay an additional $54,000 per every 100K of payroll, above and beyond the “NORMAL COST“. Vallejo can’t afford it.

Taxpayers are getting screwed! This article compares the three Ca bankrupt cities and what they pay toward pensions. While Vallejo is the only city to exit bankruptcy these numbers help to confirm that Vallejo will be right back in Bankruptcy:

http://www.ai-cio.com/channel/REGULATION,_LEGAL/CalPERS__Bankruptcy_Deals__Haven_t_Solved_Funding_Problems_.html

I can’t think of any 401k plan that charges fees like these.

November 27, 2014 at 8:40 am

And, spension, I can’t think of any company that contributes even 40%, let alone 72%, of payroll toward their employees pension. If there are any examples out there I’m pretty sure the entities no longer exist.

November 27, 2014 at 2:34 pm

Quoting SDouglas …. “3%@50 is already gone. ”

Just more of your disingenuous commentary.

Clearly you know that workers hired prior to the recent CA pension changes will continue to accrue pensions on the 3@50 formula for the balance of their careers … which for some will exceed 30 MORE years….. making any substantive saving near impossible for decades.

Taxpayers have always been, and STILL ARE financially “mugged” by the insatiably greedy Public Sector Unions/workers and our self-serving legislators and Court Justices.

—————————————–

Notwithstanding those impediments to REAL change, I believe the MATH and REALITY will be throwing you a very unsettling curve-ball.

November 27, 2014 at 7:06 pm

” for legacy employees, you can keep pensions down by keeping COLAs below CPI for the next 20 years.”

November 27, 2014 at 7:15 pm

If it makes you feel better, any thing more than a minor reduction in my pension would be a very unsettling curve ball. We are meeting living expenses now, and have maybe a years living expenses in IRAs, from my wife’s private sector job. All things considered, I think before we get hit, there will be major economic turmoil that leaves everyone (almost) up the proverbial creek.

You should not wish for that to occur.

November 29, 2014 at 5:08 am

Continuing to cry over split milk solves nothing, TL. The 3% at 50 is gone–many entities purged that formula from their budgets, for new hires, via collective bargaining, five years prior to PEPRA. What was, is, and that will continue–nothing you can do about it! Now, my former employer is not even giving new hires full-time work–another way they are saving on pensions, and another degradation of people trying to make a living!

November 29, 2014 at 9:23 am

The reason your employer is not hiring full time is related to the funding of pension obligations. That is not a sarcastic comment, but an fact based observation. We should expect to see more of that.

November 30, 2014 at 12:25 am

Responding to Stuart Mill’s comment …

And to taker your comment (and the consequences of a very-difficult-to-reform CA pension structure) to the next logical step, expect a great deal of outsourcing as we can less-and-less afford pensioned/benefited Public Sector “employees”) due to the financial life being sucked out of our Cities & Towns by the insatiably greedy Public Sector Unions & workers … and their Union-bought-off political enablers.

November 30, 2014 at 1:43 am

Tough Love, we’ve been through this before. As a percentage of total, the CalXXRS fees are in the 0.2% ballpark (I posted the specific numbers long ago). 401(k) fees are in the 3% ballpark.

Then the principal is 100’s of billions, a few percent adds up to many, many billions per year.

The CalXXRS problems are not due to exorbitant fees, but due to overly generous payout formulas, (except for UCRS, which total neglected to make *any* employer contributions for almost 20 years) and those formulas are not across-the-board… my elementary school teachers certainly do not get generous pensions, although they worked for 30+ years. Would be fun for you to report on what your California Elementary School teachers get in retirement, TL, that is, if you even live in California.

The illegalities of CalPERS you cite pale in comparison to what Ellen Schultz (the Pulitzer Winner) documents in the private sector:

http://www.retirementheist.com

Not that I defend CalPERS. Yes I’m in favor of reducing the actual payouts to those vested or retired on 3%@50, ASAP. If there is not voluntary agreement by those with the big payouts, start sovereign default proceedings. I think the municipal bankruptcies underway have a hope of solving some pension debt… but my concern is that the low pensions per service year will get cut equally to Wall Street. That would be wrong.

In my neck of the woods, there was a guy who retired after 28 years at age 51, getting the 3% at 50. He campaigned on reducing pension debt here, in a local race. What was fun to watch was all the pension hawks who supported him, and who argued for pension reductions, stridently defend his outsized pension!

November 30, 2014 at 3:52 am

It is related to the fact that there was a global economic collapse caused by Wall Street in 2008, SM. Without the collapse, there would be no inability to fund full-time employees.

November 30, 2014 at 3:56 am

Of course there are not going to be voluntary reductions, Spension–nor should there be. The pensions were earned and paid legally. You cannot reduce what has already been legally established. Forget the silly talk about sovereign defaults–it is not going to happen!

November 30, 2014 at 2:35 pm

Re: 2008. Of course Wall Street will try to grab every cent. It is up to a ethical government to regulate, not conspire with them. That is wrong. The government unions do the same thing, try to grab every cent.. Humans are economic. Again, it is up to ethical people in government and business to do what is right, not conspire with them for personal greed. Seesaw, can you agree with this?

November 30, 2014 at 5:02 pm

Same old same old, SeeSaw. The PERS systems knew the risks when they changed (in the 1970’s, I think) their guidelines to allow investment outside of non-volatile bonds. The 2008 crash was by no means unique: there were other collapses in 1791, 1792, 1796, 1819, 1837, 1857, 1869, 1893, 1896, 1901, 1907, 1929, and 1937. Serious downturns that I remember myself in 1974 and 2000, in addition to 2008.

The PERS systems failed to account for and model the well-understood volatility in the securities markets. They failed, and let benefit payouts creep up during up-market times, or they reduced contributions during up-market times, even though the data is clear: up-markets eventually are followed by down-markets. With respect to employer/government contributions, the PERS systems took on a `heads we win, tails you lose’ philosophy.

Sovereign default is legal and has happened about 10 times in US history. It is really the only check/balance on the mathematical ignorance that took over the PERS systems. Yes, unsustainably high pensions are legally guaranteed, due the mathematical ignorance I describe above.

Yes, if payouts are made, all other pressing matters of public infrastructure, from safety to transportation to health to education, might go bankrupt. Lots of nations in the world have rotten public infrastructure. The demands for pension payout could lower our public infrastructure to the levels of Mexico or Guyana or Sierra Leone. I don’t think that should happen.

November 30, 2014 at 11:54 pm

SM, I cannot agree that the DB pensions are the result of personal greed–I never went to work in the public sector for a pension. I went to work at a job–period. At the union meetings I attended, elected officials were never in the picture. The focus was always on staying the same or gaining a little–but not losing ground. There is nothing greedy in that type of focus when trying to support a family and doing it according to the rules..

I do believe in being ethical. The problem of immigration is not the immigrants–it was and is the American citizens who took advantage of the cheap labor being offered for their needs. I am proud to say that the public sector did not take that same advantage.

November 30, 2014 at 11:59 pm

Spension I agree that the infrastructure is in need of repair. Before that can take place, there must be funding by the taxpayers. The work cannot be done until there are employees–their pensions are the last thing that is paid. I don’t care whether or not sovereign default has occured numerous times–it is not right, would never be right, and is not going to happen!!!!

December 1, 2014 at 2:53 am

@spension: “If there is not voluntary agreement by those with the big payouts, start sovereign default proceedings.”

Default? How can the State default when the overall financial picture, which includes pensions, is improving?

Bloomberg Nov 13: “California’s credit standing has improved more than any other U.S. state in the past two years amid Democratic Governor Jerry Brown’s push for measures to bolster its finances. The most-populous state has won four upgrades from the biggest credit-rating companies since the start of 2013, including last week’s one-step boost from S&P to A+, the fifth-highest level.”

Tell ya what. When California has a huge deficit and gets cut to BBB- then maybe default is a slim possibility. But for now it’s so far off the table to be laughable.

December 1, 2014 at 6:19 am

Improving is not improved, BBWPA. The pension systems are, what, $100’s of billions in debt, the employer contributions upwards of 20% are causing cuts in all kinds of vital public infrastructure (note the UC issues, as one example, lately; another is the embarrassing capture of the PUC by PG&E).

Sure, we can fund pensions and destroy all the other once-great public infrastructure in this state. I don’t like that solution. I prefer sovereign default, because it is the *only* way forward if the 3%@50 crowd, the prison dentists, the public hospital bigwigs, etc, don’t compromise.

December 1, 2014 at 7:46 pm

I believe Spension focuses on “Sovereign Default” as a pre-condition to MATERIALLY reducing (or better yet ending the current grossly excessive) Public Sector DB pensions because he/she KNOWS full well that it’s a non-starter and will never happen.

That’s just what Spension wants, DELAY, resulting in more and more grossly excessive DB pension accruals. As the delay of reform goes on and on, more pension accruals move from the non-yet-accrued FUTURE Service bucket, to the already-accrued PAST service bucket …. with MUCH greater protections from reduction or change.

I believe that’s EXACTLY what Spension wants. Witness his/her idiotic “focus” on maintaining the current DB pensions (vs switching the DC Plans because DC plan fees may be 1%-2% higher). Big whoop when a switch to DC Plans would likely FORCE a 10%-20% of pay reduction in the promised pension generosity … because (a) it would be VERY Clear (in a DC, but NOT a DB Plan ) that any more is patently unreasonable vs what Private Sector workers typically get in retirement benefits from their own employers, and (b) the TRUE cost of a DC Plan benefit accrual i.e., the annual contribution) MUST be fully funded in the year accrued, and not underestimated and pushed off onto future Taxpayers as is ROUTINE in virtually every Public Sector DB Plan….. INCLUDING those “well-managed” (another favorite Spension diversion tactic).

December 1, 2014 at 9:31 pm

Delay, what? Tough Love, I say reduce the pensions but just in a way that is practical. You push for `material reduction’ with no practical plan whatsoever. I suppose you are arguing for a reduction by City Councils, Supervisors, and the State Legislature. Those will all results in lawsuits and delays that pale in comparison to just getting on with the practical steps: request voluntary reduction, and then if that is turned down, go for the most expedient route, directly to sovereign default. Don’t take the route of Tough Love’s delaying tactic of intermediate steps.

DC plans are expensive, corrupt, and were never intended to be *anyone’s* sole source of post-employment income. Tough facts but facts none the less, Tough Love. Investment bank regularly charge the cost of their Kentucky Derby trips to the `fees’ in the DC plans they maintain.

Many of the DB plans in the US are well managed. They tend to promise modest benefits and didn’t claim huge gains from the stock market.

The private sector ruined their DB system (with a few notable exceptions), as documented in by a Wall Street Journal reporter, a recipient of the Pulitzer Prize:

http://www.retirementheist.com

December 1, 2014 at 11:45 pm

Spension ……….. just MORE of your calls for delay, instead of ACTION. The DB plans should end. THAT’s the key to MAJOR savings.

December 2, 2014 at 12:10 am

Spension, There is no mechanism to pursue “Sovereign Default” (i.g., Bankruptcy) for a STATE (unlike a City). And the City has to ALREADY be insolvent and prove it to the satisfaction of a judge.

WHY should the myriads of Cities and towns, not yet broke, buy certainly on the way due to these untouchable and grossly excessive pension and benefit promises be forced to CONTINUE to grant FUTURE service accruals at this excessive rate (pushing them over the edge) when fairness and logic shows that preemptive action …. i.e., ending these DB Plans …. is needed immediately?

Clearly you are a charlatan and don’t support change.

December 3, 2014 at 12:34 am

You are completely Orwellian… you call for delaying tactics and call that action. I call for action and you call that delay. In your world 0 is 1 and 1 is 0. Sorry, Tough Love.

There are plenty of well run DB plans in the Country. You ignore that. It proves that all you are after is a slice of the $ billions in corrupt management fees that investment professionals like you want to abscond with.

I’m a she, not a he/she, btw. Another one of your lowbrow insults.

December 3, 2014 at 3:00 am

“Well Run” does NOT mean properly funded. Using the new GASB methodology, NJ’s “official” State funding ratio of 50%-55% dropped to 33%. Roughly the same % drop will apply across the board to all other Plans, as the current “official” assumptions & methodology is bogus and grossly understates the TRUE cost of current Public Sector DB Plan promises. Under that new GASB methodology it will be a rare PUBLIC Sector Plan indeed that is not grossly underfunded.

You can lie and distort all you want …. but that won’t change the facts.

December 3, 2014 at 3:23 pm

The fact is that you will make a lot of money if the public retirement system is turned over the the privately corrupt DC system, and that is the only reason you post here. Your lies and distortions, all in favor of lining your own pocket, are famous on this board.

You are so low you call me he/she. You barely deserve to be called a primate.

How the private sector’s avarice destroyed most (but not all) private DB plans is extremely well documented by Ellen Schultz, a Wall Street Journal Pulitzer winner:

http://www.retirementheist.com

NJ is not the only one of the 1000 or so public DB plans in the US. There are modest public sector funds all over the US that are doing just fine, and certainly a whole lot better than the US investment banking system, which needed at $23 trillion bailout (according to the Special Inspector General for TARP). Don’t mention the distortion that the $700 billon was paid back… the big money was in all sorts of hidden Fed loans and support kept out of the public eye. And the employees of Goldman-Sachs etc are on record as saying the US taxpayer was their stooge.

Here are some of the public DB systems that weathered the 2008 crisis way better than the frauds of Wall Street:

Click to access lessons-pensions.pdf

December 4, 2014 at 1:03 am

Quoting Spension …”The fact is that you will make a lot of money if the public retirement system is turned over the the privately corrupt DC system, and that is the only reason you post here. “.

The truth … I will not make not even one dine from fees or commissions (in in any other way) from any shift of DB to DC Public Sector pensions. I post solely as a VERY knowledgeable taxpayer, pissed-off at the enormity of the financial “mugging” perpetrated upon Private Sector taxpayers by the insatiably greedy Public Sector Unions/workers and enabled by their bought-off legislators.

SO …… not that that’s off the table, what the next BS excuse on your list ENDLESSLY fighting the BEST option avaiable, to freeze all Public Sector DB Plans for the future service of all CURRENT and shift all workers to a DC Plan EQUAL in generosity to those typically granted Private Sector Taxpayers.

December 4, 2014 at 2:06 am

There’s a lot of labor union disinformation being spewed about in this thread about how expensive defined contribution (individual 401k-type) plans are, and how “Wall St.” will make billions. Such plans CAN be expensive, but a few simple limitations in a plan eliminates literally 90% or more of the supposedly excess costs.

1. No buying of individual stocks, bonds, options, etc. Mutual funds only.

2. Limit options to no-load mutual funds only.

3. No 12b-1 back loaded funds.

These three limitations are available NOW to any private company that chooses to set up a 401k plan. Many no load mutual fund companies offer this plan. This is not theory, this is reality.

4. No MANAGED mutual funds allowed — use only index funds (there are scores to choose from) — with a limitation as to the annual costs in the fund. The investment studies show these index funds almost always outperform managed funds over time — certainly so when the costs are included.

This index fund limitation is a MAJOR savings factor. In my self-managed IRA fund I use only index funds. One levies a 1 tenth of 1% TOTAL fee, another is one TWENTIETH of 1%. Good luck finding a managed pension fund with that low a management cost. And just to be clear, that’s TOTAL cost — transaction AND management cost, including evil profit.

A fund as big as public pensions can handle the admin internally — either charging the fund or not. Currently government doesn’t charge defined BENEFIT funds for such administration. Or the fund administration can be contracted out for taxpayer savings — not that our union trolls believe the private sector could do it better and cheaper.

Moreover, a CalPERS size operation could beat down the tiny index fund fees even further. But such savings would be minuscule in the greater scheme of things.

Labor union talking point are just BS — but they know to stick to the disinformation script. Most probably believe it — after all, that’s what the union bosses tell ’em. Few even have a personal IRA — why bother when you’re gonna get a 90% pension — which will net a larger paycheck than when you were working?

I guess the union bosses and their “think tanks” figure no one will actually CHECK how a 401k plan can be run efficiently.

I did. Start with my IRA. I’ll teach you.

December 4, 2014 at 5:51 pm

I have only DC plans, am not a public employee, and I have managed to get my DC plans into low-fee funds, mostly Vanguard.

The perils of DC plans are by no means just a `labor union’ concern. I personally had one of legacy DC plans in a crazy provider who charged me 4%, and that account actually lost money over 10 years.

Generally we know that most private investment banks will find every loophole to grab fees… that is why Vanguard exists. Indeed there is a full court press on the part of the investment bank industry to get public pension funds transferred to their control.

The fees in CalPERS etc are well documented and actually charged to the fund, and are at the Vanguard level. Of course there are exceptions, like the nutty private equity forays that CalPERS has done.

December 4, 2014 at 6:27 pm

spension — your concerns are groundless. Yes, the government COULD pick some absurdly high cost “4%” program (I doubt such a high cost 401k plan could be found today) — and then face withering condemnation by both taxpayers AND the labor unions. Ain’t gonna happen.

The evil “Wall St.” firms may WANT “the pension funds transferred to their control,” but Vanguard ET AL plus public scrutiny will see to it that it doesn’t. For once the workers, the labor unions, the politicians, the public and a major portion of the financial industry would all be on the same side.

December 5, 2014 at 1:41 am

Yes, RichardRider, the overwhelming opinion pre-2008 was that collateralized debt obligations were not risky, and Moody’s and Standard & Poors even rated those instruments with their highest ratings

I’m sure back then you would have said, if I expressed concern about default, `ain’t gonna happen’.

I haven’t seen an effective withering condemnation of those agencies… last I checked they are still in business and get respect. A similar process could easily end up with public pensions getting destroyed by the private sector only one big mistake and it is all over.

Read Ellen Schultz `The Retirement Heist’ for templates of how it *did* happen to the private sector DB system.

I’m not saying CalXXRS are OK. I do think there are plenty of solid, sleepy, conservative public DB pensions in the US that don’t go the same route as the weird California RS’s.

December 6, 2014 at 3:25 pm

spension Says: “I’m not saying CalXXRS are OK. I do think there are plenty of solid, sleepy, conservative public DB pensions in the US that don’t go the same route as the weird California RS’s.”

Spension, I’m sure there are several DB plans that are both conservative and OK, outside of California. Unfortunately the CalXXrs plans are anything but solid, sleepy, or conservative. I don’t understand why you continue to defend both CalPERS & CalSTRS when you seemingly understand the hypocrisy, flaws, and corruption of both (CalXXRs).

Aren’t we discussing the California Public Employee Pension plans? If so, why aren’t you challenging the CalXXRs plans to lead their own reform efforts in order to keep from sinking DB plans everywhere?

December 6, 2014 at 11:46 pm

Well, I think you and Tough Love are the ones that equate CalXXRS with **ALL DB PLANS**. I’m saying you oversimplify.

CallXXRS went bad not primarily because they were DB plans but primarily because the financial management didn’t understand arithmetic: that up times in the market cannot be used as an excuse to raise benefits and/or reduce contributions, because, the down time (like 2008 etc) is inevitable.

Were the CalXXRS run like they were up to about 1970, we’d not be in this mess.

The call to eliminate DB entirely is wrong for at least 2 reasons:

1)DC plans are run by largely corrupt investment banks (Vanguard is a notable exception) who abscond with 1/2 to 2/3 of the investment profits. Guys like Tough Love claim, `well, a few percent is no big deal’. But yearly profits are typically only 5% for balanced funds, so taking 2 or 3% for fees wipes out the profits. Vanguard and the CalXXRS do keep their fees below 0.2%.

2)Lots of solid reliable DB plans to exist, and that is what California should seek to restore.

December 7, 2014 at 6:24 am

Quoting Spension …..”Guys like Tough Love claim, `well, a few percent is no big deal’”

That is quite a bit misleading.

I said that in the context that it’s not a big deal when, if Public Sector pensions were switched to DC plans, because of the transparency of the cost of DC Plans (UNLIKE DB Plans), the DC plans would be FAR FAR less generous than the current DB Plans …. resulting in very material (and very just, fair and needed) savings to the Taxpayers.

December 8, 2014 at 6:18 am

Misleading? There is no transparency at all in the costs of DC plans. The managers hide all kinds of fees for marketing, trips to the Kentucky Derby for their inlays, etc, in the fees & costs of DC plans. DC plans are well known to be terribly corrupt, on average.

Misleading? A huge number of DB plans in the US are doing just find. The problem is not DB plans, Tough Love, but the unreasonable benefits granted in the CalXXXRS.

That you cannot distinguish a good DB plan proves that you just want to line your pocket with fees corruptly taken by the awful management of the DC plans you advocate.

December 9, 2014 at 12:21 am

Spension, are you serious. Are you really going to opine about fees that cost .2-2%, while calPERS is charging their customers (TAXPAYERS) over 50% of in many cases? As far as I’m concerned, You Don’t Have an Argument worth considering.

December 9, 2014 at 1:51 am

Spension, I’ll bet you didn’t miss my earlier response to the same nonsense, so I’ll repeat it:

“I will not make even one dine from fees or commissions (in in any other way) from any shift of DB to DC Public Sector pensions. I post solely as a VERY knowledgeable taxpayer, pissed-off at the enormity of the financial “mugging” perpetrated upon Private Sector taxpayers by the insatiably greedy Public Sector Unions/workers and enabled by their bought-off legislators.”

Your advocating for a continuation of the current grossly excessive Public Sector DB Plans (incredibly unfair to the Private Taxpayers called upon to pay for 89-90% of the total cost), makes you either a fool, and idiot, or a charlatan.

December 9, 2014 at 4:36 am

“Part of your job is to be Dr. Doom, and you do it well,” CalPERS board member J.J. Jelincic told Milligan, who presented the staff report also signed by the chief investment and financial officers.

Jelincic said the report should recognize the “trade-offs and balances” of the risky stock-based investment portfolio that can yield higher returns, lowering employer rates.”

J.J. Jelinic represents everything that is wrong with the CalPERS Board of Administration. This GAMBLER is willing to bet every TAXPAYER Dollar in the hope he hits BIG. If not, he knows TAXPAYERS will have to cover his bets/losses.

December 9, 2014 at 6:32 pm

Captain wrote… `Spension, are you serious. Are you really going to opine about fees that cost .2-2%, while calPERS is charging their customers (TAXPAYERS) over 50% of in many cases? As far as I’m concerned, You Don’t Have an Argument worth considering.’

Documentation of CalPERS management costs…. typically (and sadly, they are driven up by private equity investments) up to 0.6% these days. If they managed more sensibly, they’d be in the 0.3% range like Vanguard:

Click to access item06b-01.pdf

As I’ve said hundreds of times, most recently above, “the unreasonable benefits granted in the CalXXXRS.” are the source of the high ***CONTRIBUTIONS*** CalPERS takes from the employer (the taxpayers through the state).

FEES are not CONTRIBUTIONS. FEES in DC plans are incredibly high, and make transfer of pension assets to DC plans a very bad idea.