A CalPERS report intended for policymakers, noting that a reform cuts $435 a month from the pensions of many new hires, suggests that a pay raise may be needed to “compete for quality employees.”

Gov. Brown pushed a cost-cutting pension reform through the Legislature two years ago, arguing voters needed assurance that a tax increase on the November 2012 ballot would not be eaten up by soaring retirement costs.

In the view of critics who say pensions are too generous and costly, diverting money from basic services, the reform did little to cut massive retirement debt. CalPERS estimated that in present-day dollars the reform would save $12 billion to $15 billion over 30 years.

The reform is limited to new hires because of the widely held view that a series of state court decisions, a key one in 1955, mean that pensions promised on the date of hire cannot be cut, unless offset by a new benefit of comparable value.

Last month CalPERS issued two reports, one for policymakers and one for new members, focused not on employer cost savings but on the gap between the pensions of workers hired before the reform took effect Jan. 1 last year, and those hired since then.

“To compete for quality employees, government employers may find they need to adjust salaries to make up for the reduction in retirement compensation,” said the report intended for policymakers.

The Public Employees Pension Reform Act (AB 340) cuts pensions for new hires in several ways, mainly by using a smaller percentage of final pay to multiply with years of service to set the pension amount.

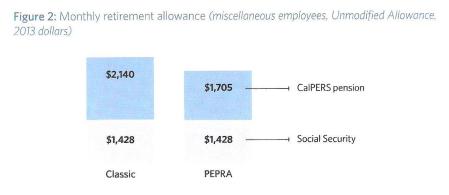

In the CalPERS policymaker report, the example is a worker with a starting salary of $46,000 who retires after 20 years at age 62. The pension for the pre-reform or “classic” worker is $2,140 a month, compared to $1,705 for the new hire — $435 less.

The policymaker report might look to some like an argument for higher salaries, particularly for new hires. The report said pensions are deferred compensation, and money contributed to CalPERS stretches dollars.

For every dollar contributed to CalPERS, said the report, government employers and employees receive an estimated $3, nearly twice the amount received from a dollar contributed to Social Security, $1.66.

CalPERS researchers using U.S. Census data found that employee compensation is a slightly smaller part of total state and local government spending in California than the national average, 30.92 percent compared to 30.98 percent.

Salaries were a lower percentage of total state and local government spending in California than the national average, 26.68 compared to 27.05, but retirement costs (pension and Social Security) were a little higher than average, 4.24 compared to 3.94 percent.

“While PEPRA is projected to decrease California state and local government retirement contributions in the long run, it also decreases employee compensation,” the report intended for policymakers concludes.

“Unless government employers adjust total compensation, this could impact their ability to attract and retain quality employees. To stay competitive and support employee retirement security, government employers may consider creative employee compensation strategies and provide employees with opportunities to enhance personal savings so they can meet their retirement goals.”

The finding that retirement costs are about 4 percent of total California government spending may surprise some local governments struggling with rising pension costs.

In San Diego and San Jose, where voters overwhelmingly approved cost-cutting pension reforms two years ago, retirement costs were 20 percent or more of the general fund that pays for most programs.

The rising cost of CalPERS pensions is a key issue in the current Stockton and San Bernardino bankruptcies and, to a lesser degree, in Vallejo which emerged from bankruptcy without cutting pension debt but still faces budget problems.

“We absolutely understand the challenges facing local governments, and frankly the state government, around a variety of different fiscal pressures,” said Ann Boynton, CalPERS deputy executive officer.

She said the report was not intended to address budget issues in specific local government budgets, but rather to show in the “macro context” how California compares with other states.

Stacie Walker, CalPERS retirement research and planning chief, said the report was not meant to take a “perspective one way or the other.” She said the report makes the point that the reform restricts “levers” negotiators can pull at the bargaining table.

In addition, said Walker, the other report intended for new members, who may tend to be on “autopilot” with the security of a pension, shows how much they need to save or how much longer they must work to regain losses under the pension reform.

“The hypothetical CalPERS PEPRA employee scenarios in this study demonstrate the need for these employees to save between $373 and $1,480 per month throughout their careers or work 2.5 to 5 years longer to retire with the same income as Classic employees,” said the report for new members.

The report intended for policymakers briefly mentions the possibility of new hires working longer to close the pension gap with pre-reform or “classic” members. But the example of a $435 monthly cut does not show the added years that would close the gap.

In the examples in both reports, the hypothetical member retires with 20 years of service, close to the average for CalPERS members. But if the hypothetical member worked 30 years, there would be no pension gap between classic members and new hires.

The widely used formula for classic members in the example, “2 at 55,” and the equivalent PEPRA formula, “2 at 62,” both replace 75 percent of the final salary after 30 years of service, not counting Social Security, according to CalPERS benefit tables.

A 30-year career is used in a national report issued last month by the Center for State and Local Government Excellence and the National Association of State Retirement Administrators, which also focuses on the impact of reform on worker pensions.

The national report looked at 24 of about 45 states that have enacted cost-cutting pension reforms in recent years. The California reform is estimated to have reduced the average benefit by 2.4 percent, well below the 7.5 percent average for states in the study.

Because PEPRA yields the same pension as the classic formula after 30 years of service, most of the 2.4 percent cut apparently results from a longer final pay period used to calculate the pension, a three-year average rather than one year.

Brown was not able to get legislative approval of one of the main parts of his pension reform, a federal-style “hybrid” plan for new hires combining a lower pension and a 401(k)-like individual investment plan.

“Hybrid plans adopted in five states produce a wide range of retirement incomes,” said the national report.

“The Rhode Island, Tennessee and Utah plans may increase retirement income, a fact that can be partially attributed to higher required contributions to their defined contribution plans. Georgia and Virginia have lower statutory contribution rates, and their hybrid plans may produce lower retirement incomes.”

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at Calpensions.com. Posted 5 May 14

May 5, 2014 at 12:55 pm

I have not seen a recent study comparing state government salaries to local government salaries in California, but when the old DPA did one in the middle of the last decade the results were crystal clear. The state pays far less for the same jobs in almost all categories. I think the exceptions may be CalFire and Corrections, but of course those are both mostly General Fund, so they matter to the budget more than, say Caltrans or other mostly non-GF funded departments.

But, does that comparison really matter? The way to tell is to see if the state actually has trouble filling positions. In fact, with the exception of a few specialized professions, far from having trouble getting applicants, there are long lines waiting for most state openings. To me, this means that we do not need to raise pay. But, maybe local governments need to cut it.

When we talk about the unfunded liabilities of our pension systems we often overlook the the effect of pay increases. Of course, over the last 14 years, there have not been many general pay raises for state employees. Yet, the average pay has grown due to bracket creep and “promotions”. One way to prevent further growth in unfounded liabilities would be to hold back on pay raises. Giving raises to offset pension reform, of course, goes in the opposite direction.

(I realize that this post will cause some of the regular commentators at Calpensions.com to post comments about the importance of the services provided by government employees. I don’t mean to demean those employees or to undervalue the services they provide. But, when taxpayers and voters think about government budgets, salaries should be considered in light of the long term labor market. Every sign is that we’ll have no trouble recruiting new hires to most state and local government positions, even if we reduce pay and benefits.)

May 5, 2014 at 1:21 pm

Proof pudding that CalPERS is simply an extension of CA’s Public Sector Unions.

CalPERS Board should have no more than one non-voting Union representative, just so their perspective can be heard. Those who PAY, the remainder should have ALL the interests of of CA’s Taxpayers as primary.

When is any comparison or discussion of fairness to the taxpaying non-public-Sector workers in this report ?

May 5, 2014 at 4:27 pm

According to the report this comparison is based on a starting salary in 2013 of 46K a year. In California? Come on no full time workers start at 46K in California.

Also, another seemingly ignored group of benefits are sick time, vacations and holidays – all paid. Amounting to an average of two months a year paid for not working – in the first 5 years. Vacation time increasing per year for number of years worked.

May 5, 2014 at 5:16 pm

There is no “union representative” on the CalPERS Board, TL The makeup of the Board does not contain a slot for a union representative. Three of the 13 Board members have belonged to unions in their active careers. The remainder of the Board are from management.

May 5, 2014 at 6:22 pm

Yes, something has to be done about the “screw the newbie, flee to Florida” (or in California I guess it is Arizona) cycle the politicians and unions are guilty of.

Those who benefitted from retroactive pension increases should not get raise increases until the pension funds are out of the hole. If they are already retired, their contribution to their retiree health care should be increased to reflect those retroactive pension deals.

Meanwhile, new hires should get higher cash pay to offset their diminished pensions and increased contributions.

So who should suffer because of the portion of the pension hole caused by taxpayer underfunding? Pay it now, and some of those who benefitted will at least be around to make SOME of the sacrifices. Put it off, and they will all be required to lower taxes and other places, or dead and gone.

May 5, 2014 at 9:14 pm

You don’t take sick time unless you are sick Sully. Would you prefer that the worker comes in sick? All the benefits you mention are cummulative. There is not two-weeks vacation available until the first year’s work is complete. Noone takes all that time off at once. The holiday pay–you are correct–of course, according to you, no one should have benefits of any kind–nothing like, “life is short”, or any thoughts like that. As far as starting salary is concerned, I doubt that many start at $46,000 which comes out to almost $29/hr. I worked for 40 years and was not making that much by the time I retired. Quit your generalizing and jealous emoting and get to work on your own existence, or lack of.

May 6, 2014 at 12:30 am

Quoting SeeSaw … “You don’t take sick time unless you are sick”

Now you do understood that we’re talking about PUBLIC Sector workers, right ?

May 6, 2014 at 2:33 am

SeeSaw said …….

“There is no “union representative” on the CalPERS Board, TL The makeup of the Board does not contain a slot for a union representative. Three of the 13 Board members have belonged to unions in their active careers. The remainder of the Board are from management.”

Baloney. In THIS article …..

http://unionwatch.org/expose-on-calpers-illuminates-collusion-between-big-labor-and-big-finance/

You will read the following:

“The following excerpt from Malanga’s article explains how today, the interests of CalPERS are completely intertwined with those of the public sector unions, by describing how the public sector unions now virtually control the CalPERS board of directors:

“Six of the board’s 13 members are chosen by government workers, and as union power grew in California, those six increasingly tended to be labor honchos. Two more members are statewide elected officials (California’s treasurer and controller), and another two are appointed by the governor.”

Since California’s treasurer, controller, and governor are all elected thanks to massive political contributions from public sector unions, this means that a supermajority of the CalPERS board, 10 of the 13 members, are likely if not certain to be pursuing the agenda of the unions. And as Malanga notes, the unions even thwarted current Gov. Brown’s recent attempt to include in his pension reform a plan to add two members with financial expertise to the CalPERS board.”

————————————————————————

Heck, the Unions are even against “financial expertise” on their Board. Perhaps they’d smell a few rats.

May 6, 2014 at 3:38 am

Yes, I do understand that we are talking about public workers. Sick leave is banked, so that when the employee is ill, it is used with approval of the supervisor. It is not automatically used, just because its there. Same with vacation pay–no public employee is using banked time to take two-months off every year–if they did that, that they would start at zero again. Further, my entity capped vacation accumulation and only allowed one-half cash out at retirement–a benefit I doubt is still effective since the economic collapse. One had to work a full 25 years to get a stipend for health care at my entity–my stipend covers one-half of my current premium and I pay the full premium for my spo

Tell me, TL, how do the six Board members chosen by the government workers tend to be labor honchos? Of course they come from the same entities, but they are all management–not union leaders. All articles that you link for reading come from the right-wing outlets that I have already seen–all with the same anti-public sector point of view. Try posting something from the other side some time.

With the diversity of careers you have on the CalPERS Board, there is plenty of financial expertise. We sure don’t need any Wall Street honchos–they already brought the country down.

May 6, 2014 at 3:44 am

I meant to say that my entity only allowed one-half cash-out of sick leave at retirement. We could cash out all of our unused vacation pay up to the cap. My full cash-out at retirement for unused vacation and sick leave pay was $23,000 of which I cleared $13,000–after a 40-year tenure.

Now, go put some more tears in your beer.

May 6, 2014 at 3:59 am

” In fact, with the exception of a few specialized professions, far from having trouble getting applicants, there are long lines waiting for most state openings. ”

Mike Genest,

Where do you get this information? It has not been my experience. At least, not qualified applicants.

May 6, 2014 at 4:18 am

“CalPERS researchers using U.S. Census data found that employee compensation is a slightly smaller part of total state and local government spending in California than the national average, 30.92 percent compared to 30.98 percent.”

– That tells me absolutely nothing. Mr. Mendel, what do you think? Isn’t it probable that California’s state and local government spending far exceeds that of other states because we have (A) a very large budget and/or (B) more outstanding bond debt than any other state in the union which allows for even more spending? That is why CalPERS is using those numbers – they’re the only numbers CalPERS can find to support and/or justify their conclusion. IMO, CalPERS started with the conclusion and looked for ways to justify it. The CalPERS paper is so preposterous it’s the only outcome that makes sense.

Why does CalPERS not use:

* pension cost as a percent of payroll?

* pension cost as a percentage of the General Fund?

CalPERS has those numbers at their finger tips.

– MAYBE EVERYONE ELSE MISSED IT BUT (according to this CalPERS Document):

“To determine the monetary value of CalPERS DB plan and

Social Security benefits, this study:

Uses scenario assumptions to calculate total:

»» Normal cost contributions

»» Projected retirement distributions

• Brings total contributions and projected retirement distribution to 2013 dollars11

• Divides the total retirement distribution by the total contribution”

– AM I MISSING SOMETHING, or did this CalPERS (GABAGE IN – GARBAGE OUT) document fail to include, in the calculations, Unfunded Liabilities (RETROACTIVE PENSION BENEFITS & UNFUNDED LIABILITIES)? I think they have.

Apparently CalPERS chose to ignore UNFUNDED LIABILITIES (**Uses scenario assumptions to calculate total: Normal cost contributions **) which COMPLETELY IGNORES the Unfunded Liability while choosing to only include the Normal Cost in their calculations, and then divide by the entire state budget. I’m sure the employee comparison was the best they could find to support their BS.

GRADE: CalPERS gets an F for content. CalPERS gets a C for creativity. CalPERS gets an F for transparency. Recommendation: stick this report where it belongs – in the shredder!

CalPERS is Corrupt! The CalPERS Board of Administration is CROOKED!

May 6, 2014 at 4:34 am

SeeSaw,

You are correct about the $46,000.

It’s refreshing to see an “example” using this more reasonable salary. Sully and others see the $100,000 figures so often, they think it’s normal.

The average state pay is $68-70k, although I knew very few who made that much. In CalTRANS, that would be a maintenance superintendent, typically with 20 years experience, supervising three to four dozen workers and with a multi million dollar budget. And they make NO overtime.

$46,000 a year (or less) would be the ones people love to hate…those CalTRANS maintenance guys and the DMV clerks.

May 6, 2014 at 4:46 am

” The widely used formula for classic members in the example, “2 at 55,” and the equivalent PEPRA formula, “2 at 62,” both replace 75 percent of the final salary after 30 years of service, not counting Social Security, according to CalPERS benefit tables.”

I don’t always agree with Ed Mendel, but I thought he was smarter than this. The crucial factor is retirement age. Under the “old” formula, if a worker starts at 20 and retires at 50 (30 years service), his pension will be about 33%, not 75%.

The 75% for 30 years is only if they retire at maximum age, approximately 63 to 66.

This is how gross misunderstandings get started.

May 6, 2014 at 4:49 am

Malanga may not be entirely unbiased.

“Powerful Public Employee Unions” is an oxymoron.

May 6, 2014 at 4:58 am

Sully,

When the BLS compiles data for the “Employee Cost of Employee Compensation, the INCLUDE the cost to the employer of salary, health care, pension costs, AND the cost of sick leave, holidays, and vacations.

Using this data, several studies show that CA state workers make less in salary than *equivalent* private sector workers, and with the benefits they are ” roughly equal”.

May 6, 2014 at 5:14 am

Zack Scrivner says (in a Reason Foundation interview conducted by Larry Gilroy):

“I should also mention that one of the arguments you tend to hear from the unions is that we won’t be able to hire qualified people if you reform pensions because we won’t be able to compete. Well, the year after Measure D passed and after I had become a Kern County supervisor, the Bakersfield city manager told me that they had just completed their first police recruitment since Measure D and that they had 1,000 applicants. So much for the argument that pension reform was going to discourage people from applying for the job. People want to be cops because they want to be cops, and people want to be firefighters because they want to be firefighters. You obviously have to have a pay and benefits package that will allow you to recruit and retain, but you don’t need to make people millionaires when they retire, and that’s essentially what “3% at 50” does….

We have a big issue that we still need to address here at the county within our own retirement plan—the Kern County Employees’ Retirement System—with a provision called the supplemental retirement benefit reserve (SRBR). We’re one of only three counties that adopted SRBR back in the 1980s (there are many counties and large cities that have Supplemental Retirement Benefits that provide these benefits in one of three different forms) . If your retirement plan performs above the expected rate of return—which for us is 7.75%—then about 40% of the excess earnings gets siphoned off into that SRBR fund. What that does is provide for additional cost of living increases over and above the normal rate, which I believe is 2% a year. The retirement board can make a determination from year to year on whether or not they want to allocate a supplemental cost of living increase. But the effect of SRBR is this: in good years, 40% of excess earnings are siphoned off, and it doesn’t go in to bolster the main pension fund. But in bad years where you perform below the rate of return, the SRBR isn’t affected at all. The result of that is that the SRBR is currently 170% funded, yet the regular retirement fund that goes to pay the benefits to retirees every month is only funded at 61%, and it’s projected to drop. But the SEIU—our main union—will not agree to let us shift funds from the SRBR to the main fund. So we would have to go to Sacramento to change that, and SEIU won’t support it unless we give them a pay raise, and we can’t afford to do that right now. So the struggle goes on.”

Zack Scrivner is Kern County’s Second District Supervisor, proudly serving the communities of Bakersfield, Boron, Caliente, California City, Mojave, Rosamond and Tehachapi. Elected to the Board in 2010, Zack served as Chairman of the Board in 2012, and represents the Board of Supervisors on Kern Council of Governments, Kern Land Agency Formation Commission (Chairman 2013), and the Kern Economic Development Corporation. Before his election to the Board of Supervisors, Zack served six years on the Bakersfield City Council, representing Ward 7.

– See more at: http://reason.org/news/show/pension-reform-bakersfield-kern#sthash.uKA8qh7f.dpuf

TL & others concerned about pensions, this is a great article that speaks to both the current CalPERS claim of needing to pay more to recruit and issues with pension plans and the unions that control them, as well as what can be expected going forward. I love this article! http://reason.org/news/show/pension-reform-bakersfield-kern

May 6, 2014 at 6:17 am

From the Reason Foundation article: “We have a big issue that we still need to address here at the county within our own retirement plan—the Kern County Employees’ Retirement System

If your retirement plan performs above the expected rate of return—which for us is 7.75%—then about 40% of the excess earnings gets siphoned off into that SRBR fund (Supplemental Retiremint Benefit Reserve -which is really stealing from the TWR (Taxpayer Wallet Reserve)) … What that does is provide for additional cost of living increases over and above the normal rate, which I believe is 2% a year… the effect of SRBR is this: in good years, 40% of excess earnings are siphoned off, and it doesn’t go in to bolster the main pension fund. But in bad years where you perform below the rate of return, the SRBR isn’t affected at all. The result of that is that the SRBR is currently 170% funded, yet the regular retirement fund that goes to pay the benefits to retirees every month is only funded at 61%, and it’s projected to drop.”

– Zack Scrivner

http://reason.org/news/show/pension-reform-bakersfield-kern

May 6, 2014 at 3:05 pm

According to the article, “The widely used formula for classic members in the example, “2 at 55,” and the equivalent PEPRA formula, “2 at 62,” both replace 75 percent of the final salary after 30 years of service, not counting Social Security, according to CalPERS benefit tables.”

There is a difference, however. If you let your eye wander up to the header of the column, the 2@55 formula reaches this level at age 63. If you are under the 2@62, that column header reads 67. Since most people do not delay their career by 4 years, it does not make sense to compare the two.

May 6, 2014 at 3:20 pm

Sully and SDouglas47,

A good number of state employees started their career as an Office Assistant which currently has a starting salary of $24,888. DMV clerks are most likely to be Motor Vehicle Assistants who currently start at $29,412.

May 6, 2014 at 3:32 pm

SDouglas47: in response to your question I have to admit that information on waiting lines for state jobs is entirely anecdotal. For example, I recall an article in the Bee in which it was reported that lines ran around the block for some fairly low-level jobs. I personally recall a candidate for a statistical/analytical job who had a masters from a major college in statistics and had worked back east as a statistician, but who started his career in state government in CA as an office tech.

By the way, the person who did the hiring went instead for his long-time secretary who’s qualifications were a high school degree and “knowledge of the organization”; I should have strangled that manager! Believe me I wanted to fire him, but by the time I learned this I had moved to a different department. This illustrates another problem with state service. Too often people care about the job and not the work. Too often friendship and loyalty, and of course that old favorite “upward mobility” drive management’s personnel decisions. I want to make it clear that I never indulged in that stuff and I know many others who did not. But, sadly we were in the minority, by far.

May 6, 2014 at 3:57 pm

Its all relative. I started as a part-time secretary at $1.85/hr. There was no SS and no CalPERS at my municipality, at that time. My starting full-time salary was $10,800. A post PEPRA worker now must work four years longer than a pre-PEPRA colleague for the same benefit. My money says they will work the four more years, keeping the door closed to new workers that much longer.

May 6, 2014 at 5:01 pm

SDouglas47, the BLS doesn’t break the ECEC down by state just regions. The lastest report (Dec 2013) states in the first paragraph:

EMPLOYER COSTS FOR EMPLOYEE COMPENSATION – DECEMBER 2013

Private industry employers spent an average of $29.63 per hour worked for total employee compensation in December 2013, the U.S. Bureau of Labor Statistics reported today. Wages and salaries

averaged $20.76 per hour worked and accounted for 70.1 percent of these costs, while benefits averaged $8.87 and accounted for the remaining 29.9 percent. Total compensation costs for state and local government workers averaged $42.89 per hour worked in December 2013. Total employer compensation costs for civilian workers, which include private industry and state and local government workers, averaged $31.57 per hour worked in December 2013.

However, this report does get the average comp down to around 85K, which is double the 46K used above. I researching the latest 25 job openings in San Jose (excluding PD and FD) four are P/T and two have salary blank. The other 19 average starting pay is 68K.

My comment about using the 46K as a comparison is flawed simply because of the SSA cutoff. The report makes it look like the two retirement amounts are not that far out of line. However, new retirees in CA and both state, county and local levels are making far more than the report seems to indicate. Of the three recent (within last two years) I know of they range from 32K – 136K. All three did wait until 62. Arguing about how much the average worker makes is irrelevant to the over all picture. We wouldn’t even be having this discussion if public pensions weren’t eating the public treasury alive. This is not a CA problem alone – every state has similar short falls.

Also, every state seems to think they can pass new taxes based on supporting the school system or sewer system or corporate only taxes, etc. There would be nothing wrong with the schools or a need for more new taxes if they didn’t have full retirement at 50/55 and 3% COLAs. In the private sector anyone retiring at 55 gets their pension reduced from the amount they would have received at 65, even 62 is reduced, similar to SSA.

Additionally, if you think there isn’t a problem now – then just wait until the next recession when the state wants more money from the private sector and see what happens.

May 6, 2014 at 8:06 pm

You poor man. Do you even have a life?

May 6, 2014 at 8:34 pm

The state doesn’t raise taxes on the private sector alone. We from the public sector are taxpayers too–something you will not be able to deny. If the state does raise taxes, we will do the same as you–we will pay. People like you should be banished to another state/country of your choice for six months at a time.

May 6, 2014 at 9:31 pm

SeeSaw, I have already banished myself to another state. Couldn’t take anymore of the dysfunctional govt in CA.

I realize the public sector is a small part of the overall picture. However, I’m still trying to figure out why the majority of public employees that aren’t getting in on the big payouts are not condemning the huge payouts to managers, fire capts and police execs and others. If you can find time take a basic math course and start adding up how much all these early FULL pensions are costing and don’t forget to add COLAs. Once you actually add up all these numbers you’ll see that the current rate increase (cost of pensions) over the last ten years is not sustainable.

Add the millions of illegals on welfare that don’t pay taxes and are not supporting the public employee benefits yet drawing from the same pool and you’ll see why it will be impossible to convince the rest of the taxpayers, in the private sector, to support yet more taxes to balance the budget – school, sewer, water or other.

Since I left the Beholden State there has been a huge change in public opinion on public employee costs. It’s only a matter of time until public outcry overcomes anything the public unions say. The courts are already starting to bend.

http://www.nbcsandiego.com/news/local/City-Can-Change-Retiree-Health-Benefits-CA-Supreme-Court-258047741.html

May 6, 2014 at 10:28 pm

Oh pray, tell us–in what lovely red state have you taken up residence? If it is so wonderful to be away from CA, why are you still so obsessed with what it happening here?

May 7, 2014 at 12:02 am

Mike Genest,

I frequently see the claim that public sector workers are overpaid because every time there is a opening, there are “hundreds of applications”. I remind that several years ago, McDonalds had a nationwide hiring push to fill 60,000 jobs. There were over a million applicants.

Overpaid?

What I saw frequently for “skilled trades” (electrician, mechanic, etc.) was not very many outside applicants, and experience and qualifications had to be “stretched” to meet specs. The man who replaced me when I retired was an exception. Boss was very pleased…for about six months. It seems when he hired on, no one told him about “furloughs” and he decided to take his chances on the outside again. We have seen quite a few move from private sector to public…and back to private, depending on economic and employment cycles.

May 7, 2014 at 12:51 am

Quoting SDouglas47 … “The crucial factor is retirement age. Under the “old” formula, if a worker starts at 20 and retires at 50 (30 years service), his pension will be about 33%, not 75%. ”

That EXACTLY the way it should be because the Taxpayers should fund reasonable pensions that begin at age 65. Fully actuarial reductions (of 4-6% PER YEAR) should reduce the payout forEACH YEAR that you retire and elect to begin collecting before age 65.

THAT’s the way it’s done in Private Sector Plans and there is no reason for Public Sector workers to get a better deal …. on the TAXPAYER’S dime.

May 7, 2014 at 12:58 am

” My comment about using the 46K as a comparison is flawed simply because of the SSA cutoff”

Your comment was: ” Come on no full time workers start at 46K in California.”

Many not only START at less than 46k, they retire with a FINAL salary of 46k or less. Some MUCH less, as SacBeeLogin notes.

The $100,000 examples often used are the outliers. They make the news. Sensational. Man bites dog.

As I noted, the average state pay is $68 to 70k. (The $85k you mentioned is TOTAL compensation, salary plus ALL benefits)

Your ECEC data on private sector employees shows average pay of $20.76 per hour (29.63 with benefits) That’s $43k a year. We can all understand why many are upset at the difference in “average” wage. I saw an ad locally for fork lift driver for about $20 an hour. If that “average” private sector worker desires the “average” public sector wage, he will need to get an engineering or accounting degree and licenses, or he can start out as a CalTRANS road worker and, maybe, work his way up to Superintendent. This typically takes an average 15 to 20 years. IF you can make it. And there is no overtime pay for superintendents.

If you have the PDF version of ECEC, the first paragraph, as you noted, gives the average private and public compensation. The fourth page, fourth paragraph clearly states:

“Compensation cost levels in state and local government should not be directly compared with levels in private industry. ” etc. etc. apples and oranges, as they say.

May 7, 2014 at 2:17 am

“That EXACTLY the way it should be”

You crack me up, TL. As usual, you missed the point entirely.

The statement was:

“both replace 75 percent of the final salary after 30 years of service,”

This SUGGESTS that under either formula, the worker could retire at 50 with 75% of pay. It is bonehead misstatements like this that leads to all misunderstanding out there.

May 7, 2014 at 4:01 am

SDouglas47, I missed nothing. Public Sector workers who begin collecting retirement benefits before age 65 should get full actuarial reductions of 4%-6% for EACH YEAR before age 65 …. just as is done in virtually all Private Sector Plans.

You’re NOT deserving of a better deal on the Taxpayer’s dime.

May 7, 2014 at 4:03 am

SDouglas47ste?? did you change your name? if you did please change it completely as its confusing enough.

If you didn’t then you’re the one that brought up the BLS ECEC not me. I quit reading their reports years ago because of that exact reason – they give you an opening and then retract most of what they said in the later parts of the reports.

Which then brings up your statement:

Using this data, several studies show that CA state workers make less in salary than *equivalent* private sector workers, and with the benefits they are ” roughly equal”.

So how did you come to that conclusion if you can’t compare public to private?

I’m not sure which 100K examples you are referring to, as I never mentioned this amount in above posts. Are you referring to starting salaries or starting pensions?

May 7, 2014 at 5:33 am

Sully,

Battery low so I used another tablet and the “ste” snuck in there.

They don’t use the overall averages. THAT is the apples to oranges. They use the more specific data comparing type of work, education requirements, age of worker, size of company, etc. They compare equivalent workers in many categories, then make a weighted average. Most recent, most accepted numbers show California state workers about ten percent behind equivalent private sector workers in cash pay, and “roughly equal” when benefits are added.

The numbers are what they are. Even The Heritage Foundation agrees on the CASH pay:

“The most important variables in the list are state and local government status. After controlling for observable skills and a detailed list of personal characteristics, state workers in California earn about 10.2 percent less in wages than private-sector workers. ”

Although Heritage claims that “correctly” valuing health and pension values AND allowing an extra 15% value for job security brings public compensation to 130% of private.

$100,000 examples are very common around these boards. $100,000+ pensions are around two percent of all retirees, but they are used so often as examples, many readers think they are normal. Salaries OR pensions. It’s a good provocative number used to rile up the masses.

That’s why it is welcome to see the $46,000 example. Its less than the average, but. MOST of the people I worked with were much closer to $46k than they were to the “average” $68k. And that’s not starting salary, that’s final, pensionable salary. Many people are surprised to hear this. As in:

“Come on no full time workers start at 46K in California.”

May 7, 2014 at 5:40 am

TL, PEPRA requires the new hire, miscellaneous worker to go to age 67 to get a full retirement, so it is actuarialy reduced each year the worker retires before such age. You are not going to affect those that are covered pre-PEPRA.

May 7, 2014 at 6:02 am

One more time.

What Ed SHOULD have said is that under either formula AT FULL RETIREMENT AGE, a worker with 30 years service would receive 75% of final pay.

By leaving out the “full retirement age” caveat, he leaves the mistaken impression that one could retire as young as age 50 with a 75% pension.

NOT TRUE

I’m not talking about what should be. I am talking about misinformation that is taken for fact. A miscellaneous worker CANNOT retire at 50 with 75%.

Like “public safety workers can retire at 50 with a full pension”

NOT TRUE! only those who have 30 years service AT AGE 50. This is about 1% of retirees.

Like “SB400 was a fifty percent increase in pensions.”

NOT TRUE . in very rare cases, SOME safety retirees did get a fifty percent increase. In MOST cases, when the worker retires at full retirement age, the increase is 3% to 10%.

Like ” no full time workers start at 46K in California.”

NOT TRUE

May 7, 2014 at 6:17 pm

SDouglas47,

You are right about those caveats. The CalPERS report was more careful at comparing apples to apples: same retirement age, same number of years of service, same starting salary. (They don’t mention any pay increases over the course of the 20-year career.)

Using Ed’s scenario, one employee started their career at age 33, the other started their career at age 37.

The miscellaneous worker that retires at age 50 with 75% of their pay, a scenario cited in many “pensions are bad” articles, started his or her career more than 18 years before they were born.

May 7, 2014 at 11:46 pm

” started his or her career more than 18 years before they were born.”

LOL!!

Don’t tell TL. He’ll plug that into his spreadsheet!

Add the 18 year pre-birth income, cash pay NO LESS than private sector while working, pension multiples of 2 times a private sector worked with the SAME pay, SAME retirement age (6 times for GED ticket writers). And I heard some public sector retirees continue to draw a pension for as much as 18 years AFTER they die.

With all this taxpayer supported largesse, a public sector doctor could end up making TWICE as much as a private sector custodian.

May 8, 2014 at 12:07 am

Speaking of “misleading”, here is a quote from Jon Ortiz:

” Let’s take a miscellaneous employee, a common classification that covers everyone from DMV office staff to local school custodians. Say the employee retires at age 55 after 20 years of service with a final salary of $92,200.”

As Rush Limbaugh says “Words mean things.” And I guarantee you many readers take that statement to mean that DMV staff make $92k a year, …………….and routinely retire at 55.

That’s why I was pleased to see the $46k example in this article. Probably still more than a custodian or DMV clerk earns.

I can’t post on the Bee anymore, but I did send Mr. Ortiz an e-mail.

May 8, 2014 at 1:18 am

That’s why all these hypotheticals are misleading, SD47. I was a supervisor at my municipality and I retired with 36.4 years service credit and a final salary of less than $50,000. And, I don’t get fully-paid health care.

May 9, 2014 at 2:47 am

pretty sad ………

August 9, 2014 at 4:28 am

What is disappointing and short-sighted is the Governor and CalPERS moving former Classic members out of the formula they had for years. The downturn in the economy California has gone through lead to staff layoffs. Many of these individuals had sought work at other government entities. The employment process in the government sector is a very long process. I know of jobs in a few counties took far longer than the six months to fill. Given the length it takes to get hired, Classic members lose benefits they have had.

This needs to be rectified to allow former Classic members they once had.