To cover the cost of retirees living longer, the CalPERS board next month is expected to approve the third rate hike in the last two years, phasing in the increase to soften the blow on state and local governments.

The new rate hike would not begin until fiscal 2016-17 to allow employers time to plan after receiving rate projections next year. When fully phased in by 2020-21, the new rate hike and the previous two would raise rates roughly 50 percent above current levels.

In the first rate increase in March 2012, CalPERS lowered its investment earnings forecast from 7.75 to 7.5 percent, but critics say that’s still too optimistic. In a second rate increase last April, CalPERS adopted new actuarial methods that pay off debt sooner.

Now to reflect new longevity estimates (two more years for males and 1½ years for females) CalPERS plans a third rate hike. Employers have been told a longevity rate hike is likely, but the jump may be larger than some expected.

As CalPERS reviews economic and demographic assumptions, usually done every four years, the board has leaned toward a new investment allocation that, if adopted next month, is unlikely to change the earnings forecast and trigger yet another rate hike.

A staff report to the board last month said a rate increase resulting from changes in the other assumptions, mainly longevity, will have a “significant impact” on employers at a time when their budgets are strained.

“Concern has been raised that the contribution increases may be too much for employers to bear,” said the report from Alan Milligan, California Public Employees Retirement System chief actuary, and David Lamoureux, deputy chief actuary.

There is no easy way out. Delaying action on the longevity change could lead to a “qualified” actuarial valuation reflected on the financial statements of CalPERS and state and local governments. Delaying a rate increase boosts the long-term cost.

Following current CalPERS policy, staff recommends a five-year phase in of the rate hike to pay off the new longevity debt over 20 years. For each $1 million in debt or “unfunded liability” the interest payment is said to be $1.2 million.

Two alternatives given to the board phase in the rate hike over seven years and pay off the debt over 30 years. With a 30-year payment period, for each $1 million in debt the interest payment nearly doubles, jumping to $2.2 million.

For the pension fund, the longevity rate hike would drop the funding level, now 74 percent, four points to 70 percent, and liabilities, now $329 billion, would increase $22.6 billion. (The unfunded liability, not covered by projected assets, is $57 billion).

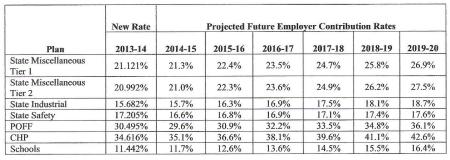

For employers, the staff report has a chart showing estimates of the rate increases in the first and fifth year when, under current policy, the longevity rate hike is phased in over five years and the debt paid off over 20 years.

If the new longevity estimates are combined with a previous six-year projection of CalPERS rates for the state and schools (annual actuarial valuation, p. 61), it’s possible to get a rough look at what the total employer rate might be in 2020.

The employer rate for most “miscellaneous” state workers, now 21 percent of pay, could be around 32 percent in six years. Employees currently contribute 8 percent of pay, which only increases if agreed to in labor contract bargaining.

The employer rate for the California Highway Patrol, now 35 percent of pay, could be around 55 percent in six years. The employer rate for non-teaching school workers (the largest CalPERS group), now 11 percent of pay, could reach 20 percent.

In the giant CalPERS system, there is a wide variation among the 1,581 local governments with more than 2,000 plans. For example, the estimated year-five longevity rate increase for a common miscellaneous plan is a range, 2.4 to 4.8 percent of pay.

A slide shown the board had a 40-year estimate of the impact of the longevity rate hike on a sample local miscellaneous plan. The current employer rate, 15 percent of pay, would increase to nearly 22 percent and remain there for a decade before dropping.

(The blue line in the slide is the staff recommendation, the green line is one of the alternatives with a 20-year payment period, and the yellow line is no rate change to cover the increased longevity.)

For one large city, Sacramento, the proposed longevity rate hike would cost an estimated $12.2 million by the fifth year, the equivalent of 102 full-time positions, Leyne Milstein, Sacramento finance director, told the CalPERS finance committee last month.

“Mr. Milligan provided several charts that alluded to the percentage impact,” she said. “What I wanted to share with you is really that dollar impact.”

A chart Milstein gave the committee showed the five-year $12.2 million cost potentially reducing 34 police officer positions ($135,000 each), 30 firefighter positions ($131,000) and 38 miscellaneous employee positions ($97,000).

“I would believe well into the fifth year that we are talking about filled positions and more than likely actual layoffs,” she said.

Milstein said Sacramento had deficits for eight years, budget cuts for six years and reduced 1,200 general fund positions. She said revenue for the $370 million general fund is expected to grow 3 percent a year, just enough to keep up with growing expenses.

A recent city budget forecast, Milstein said, includes a voter-approved ½ cent sales tax that expires in 2020, previously announced CalPERS rate hikes, 1 percent salary growth and no increase in health costs.

Milstein said she understands the need to raise rates to cover the cost of retirees living longer. She said the board should consider some of the alternatives that ease the financial blow.

“We need to be reasonable in how we get there, given what we and other local government agencies and the state have gone through over the past seven or eight years,” she said.

Several board members thanked Milstein, the only local government representative who spoke to the committee during the public comment period.

“One of my complaints to CSAC and the League is we don’t see enough of you here to talk,” said board member Richard Costigan, referring to the California League of Cities and the California State Association of Counties.

For employees, the proposed longevity rate hike could trigger a contribution increase of 0.5 to 1 percent of pay for some new hires in local government and schools, mainly police, firefighters and other safety workers.

Gov. Brown’s pension reform that took effect last year, AB 340, requires these new hires to pay at least half of the pension “normal cost,” benefits earned during a year. Employers continue to pay all of the debt or “unfunded liability” from previous years.

The pension contribution paid by new employees is adjusted if the normal cost changes by more than 1 percent. The longevity rate hike is expected to change the normal cost for most miscellaneous workers by less than 1 percent of pay.

But the normal cost for most safety plans is expected to increase by 1 to 3 percent of pay, triggering a contribution increase.

The requirement to pay at least 50 percent of the normal cost only applies to new hires covered by the reform in local governments and schools. Milligan told the board changes in state worker pension contributions must be bargained in labor talks.

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at Calpensions.com. Posted 6 Jan 14

January 6, 2014 at 2:24 pm

“The new rate hike would not begin until fiscal 2016-17 to allow employers time to plan after receiving rate projections next year.”

This is about as good as it gets for California tax revenues. Aren’t they potentially deferring higher costs to a recession?

“To cover the cost of retirees living longer.

Sounds a lot better than “to cover the cost of past retroactive pension increases and pension underfunding by past taxpayers.” In 10 years, retired public employees and the one percent may be the only people for whom life expectancy isn’t going down.

January 6, 2014 at 5:25 pm

I find this article interesting as it appears to be written in a deliberately obtuse way. Throughout the article, it mentions “the employer” as if it is some amorphous entity. The “employer” is government, and the government is the private sector taxpayers who generate new tax monies to pay for the “employer” costs. Why create that barrier in this article and not just come out and say taxpayer costs will undoubtedly be affected if “the employer” passes the costs along to them rather than require increased contribution levels? C’mon, don’t treat us as children and try to remember the journalistic ideas you once espoused when you were in school. Report, do investigation, and leave the agenda in your old denim backpack with the peace signs on it.

January 6, 2014 at 11:29 pm

I think the long-term average employer contribution should be no more than 10%. Sometimes 5%, sometimes 15%, but averaging to 10%. These contribution levels above 20% just infuriate the public.

January 7, 2014 at 12:36 am

As I figured for the comments section in the last thread, the CalPERS shortfall (with the 18 month old information provided at the CP website) works out to about $2,600 per California resident. Throw on top of that the CalSTERS shortfall. Throw on top of that for us unfortunate San Jose residents our own local county and city pension shortfalls and we are talking real money. A private pension under ERISA would have to provide a plan to restore plan assets in a window much shorter than the 20-30 years proposed here. My only complaint about the raised pension rates is that they are spread out too slowly: let governments and our see-no-evil-politicians deal NOW with the fruits of the substantial pension augments in a time frame where voters can act upon them.

January 7, 2014 at 3:27 am

Most people don’t pay for their home upfront, Chillin. The payments are spread out so that the buyer can pay the mortgage. Its no different with pension plans.

January 7, 2014 at 3:56 am

Quoting…”There is no easy way out. Delaying action on the longevity change could lead to a “qualified” actuarial valuation reflected on the financial statements of CalPERS and state and local governments. Delaying a rate increase boosts the long-term cost.”

Sure there’s a “way out”… Do EXACTLY what’s both legal and routine in Private Sector Plans… materially reduce the pension accrual rate for the future service of CURRENT workers.

Public Sector workers are NOT “special” and deserving of a better deal than the taxpayers that pay their way.

January 7, 2014 at 4:09 am

Quoting Spension…”I think the long-term average employer contribution should be no more than 10%. Sometimes 5%, sometimes 15%, but averaging to 10%. These contribution levels above 20% just infuriate the public.”

Finally, a bright statement….. FAIR to Taxpayers…to which I agree wholeheartedly.

And noting (from the article) that Taxpayers NOW pay (even BEFORE the upcoming increases) 21% and 35% of pay to fund CURRENT “miscellaneous”-worker and Police pensions, we should be focusing our efforts on very material reductions in the pension accruals of all CURRENT workers.

January 7, 2014 at 4:20 am

Government pensioners need to contribute increases to their “own plan” out of their “own pocket” not the employer’s or more to the point, the working people of this state, who by the way, must pay their own way when it comes to retirement contributions!

January 7, 2014 at 6:14 am

TL, Vallejo’s cost for public safety pension benefits, prior to SB400 and according to CalPERS, was about 12% of payroll. Post SB400 the 3@50 pension plan cost Vallejo about 16% of payroll (the taxpayer portion). Because the benefit was made retroactive it cost Vallejo/taxpayers about 27% of payroll. In the current fiscal year Vallejo is paying 47.4 of payroll toward pension benefits according to CalPERS. Next year (FY 2014/15 beginning July1) Vallejo will be paying 52% of payroll toward pension benefits.

In other words, for every 100k of payroll Vallejo sends 52K to CalPERS to cover the pension cost. Because the average safety employee earns about 120K in pensionable salary (which doesn‘t include the entire salary: overtime pay, medical benefits, insurance costs, or the cost of retiree medical benefits (average safety employee cost is over 225K), Vallejo/taxpayers will contribute on average, $62,400 dollars to each employees retirement account. Police Captains earnings 200K per year will have OVER 100K contributed to their CalPERS fund beginning July 1st 2014.

What will the cost be when the CalPERS rate increases by 50%? And how will Vallejo avoid a second bankruptcy (or Stockton, San Bernardino, Desert Hot Springs – Oakland is already bankrupt but still clueless) Vallejo has already deferred every expense imaginable: reduced staffing, reduced building maintenance, reduced social programs, reduced vehicle replacement for public safety, and their roads are rated the worst in the entire bay area (51 on a pavement index scale of 1-100). And like pensions the cost of road repair grows exponentially when you get below 80 percent.

January 7, 2014 at 6:19 am

Instead of pontificating about why public workers think they should be considered special, TL, maybe you ask why private sector rank and file workers were treated like crap and had their pensions frozen and ended throughout the years since 1985. Why aren’t you screaming for fair treatment for the private sector workers!

January 7, 2014 at 6:24 am

You buy public services just like you buy groceries and gas, JB. All are necessary for your existence. Government workers contribute to their pensions through the fees they receive for serving you. Those who are already retired do not get any more increases, except for COLAS when the CPI indicates that they are falling below the cost of living–and then the increases, for most pensioners are to a maximum of 2%.

January 7, 2014 at 7:02 am

The demise of the private sector DB pension system was ugly… read http://www.retirementheist.com .

The fact that the private sector has raided and corruptly destroyed its DB pensions renders any argument based on comparison for destruction of the public DB system unpersuasive.

A rational system would consist of a combination of Social Security, DB, and DC plans. That was the intention when DC plans were started. Of course some systems (like California Safety and I think CalSTRS) stayed out of SS.

The employer contribution to SS is 6.2%, I think. I think a rational system is for employer contributions totaling 10%, with the choice of 6.2% SS and 3.8% DB, or 10% DB, long term average, allowing some ups and downs. Then DC with up to 4% employer match. Employee contribution of 6.2% SS and 3.8% DB, or, 10% DB.

So the average employer outlay would be 10-14%, where the difference of 4% would be a match if the employee contributed too.

The average employee outlay would be identical, but of course 401(k) or IRA contributions could be higher for the employee.

28% of salary, the usual average of above, should provide an excellent retirement.

January 7, 2014 at 8:13 am

SeeSaw,

If you need 60-70 percent of your working wage during retirement, for people retiring in their sixties, why do you think public employee union members deserve as much as 90-100 percent replacement income in the form of pensions, at age 50-55? Plus lifetime medical benefits at age 50-55?

Should everyone else just suck it up at the expense of your largesse, to keep your union happy, at the expense of taxpayers reduced services at increased costs? Are you at all concerned that your self-centered agenda is negatively impacting our local communities, social programs – AND IS BOUT TO BLOW A BIG HOLE IN EDUCATION FUNDING?

WE CAN’T AFFORD YOU!

January 7, 2014 at 4:48 pm

Captain, a study years ago came out saying that a retired worker needs to have 60-80 percent of their active salary to maintain their current lifestyle. My own lifestyle is quite frugal, and, yes, 70% of my gross pension check is going to the taxes and medical insurance premiums. The only thing that saves me, is the fact that I saved in a 457, like a madman, before I retired–it buys our groceries. Next, my spouse received a defined benefit pension from the carpenter’s union. It is less that his ABC medical insurance premium. And, lastly, he gets SS benefits.

I was 72 years old when I retired from my public sector job. I know only one miscellaneous employee from my former place of work who retired in his early 50’s. He began when he was 18 years old and made his way to management. He did not have the 3% at 50 plan–only safety workers had that. I do not know any safety workers with the 1999 plan who retired in their early 50’s.

FYI, you are not paying one cent for me right now. I had an account already in place with CalPERS when I retired, Yes, it will be depleted in three to four more years. Then my employer will continue to be charged for the percentage of my retiree dollar that is not covered by the Plan’s investment earnings–I will be in my 80’s by then.

You think you can’t afford your public servants? You obviously don’t understand the workings of a healthy economy. I wish everyone around me had a million times more than I, so I would not have to worry about anyone.

You can stop referring to “my” union. I have no “union”. Get real and think about the fact that the unions out there are trying to hold on to middle class lives for the workers.

Call me “self-centered” one more time, Captain, and I am going to plunge a little pin, for you, in my “voo-du doll”.

January 7, 2014 at 5:53 pm

Spension, Your comments are getting a bit more rational ….congratulations. In your last comment above all but the following paragraph was well on the mark:

Quoting… “The fact that the private sector has raided and corruptly destroyed its DB pensions renders any argument based on comparison for destruction of the public DB system unpersuasive.”

That paragraph is a distortion of the facts. The need for very material (50+%) reductions in the DB Plans for CURRENT Public Sector workers has nothing to do with what has happened in the Private Sector.

The very material (50+%) reductions (in FUTURE Service accruals for CURRENT workers) are needed because (by any reasonable metric) all Public Sector DB Pension plans are grossly excessive, unaffordable and grossly unfair to taxpayers who are called on to pay for all but the 10-20% of total Plan costs actually paid for by the workers (INCLUDING all the investment earnings on those contributions).

The appropriate goal should be near EQUAL “Total Compensation” from ALL sources, including cash pay, current benefits (healthcare, life insurance, disability insurance, etc,) as well as the TRUE value of annual accruals toward post-retirement pensions and healthcare subsidies.

Right now, PUBLIC Sector workers have a very material “advantage” over their Private Sector counterparts due primarily to post-retirement pensions and benefits that are ROUTINELY multiples greater in value at retirement. THAT must change, and not just new workers, but for the FUTURE Service of all CURRENT Public Sector workers.

January 7, 2014 at 6:11 pm

It is the pensioner’s funds that go into the plan, TL. They get those funds from the salaries that they earned working for you. Your belief that you, alone, pay for all this stuff is pure BS–you are always trying to convey the idea that only private sector workers support this country with their taxes. Well, I got news for you! The public sector workers are paying the same taxes and the same fees for their public services as you! If you succeed in bringing down the salaries and benefits of public workers to a level that suits you, you are participating in bringing down this whole country!

January 7, 2014 at 6:23 pm

No SeeSaw, not to a level that “suits me”,to a FAIR level, meaning EQUAL TO the much lower level that comparable Private Sector workers get.

GREED run rampant through all of your comments.

January 7, 2014 at 7:52 pm

Tough Love, I can’t return the complement. You remain as wedded to overstatement as ever, for example…

“all Public Sector DB Pension plans are grossly excessive, unaffordable and grossly unfair to taxpayers who are called on to pay for all but the 10-20% of total Plan costs actually paid for by the workers (INCLUDING all the investment earnings on those contributions).”

1)There are plenty of public sector DB pension plans in the US that are just fine, thank you. You never never address that FACT, probably because you seek to get all US retirement funds in the hands of the Wall Street money managers (like you) and out of the hands of more honest public servants.

“The appropriate goal should be near EQUAL “Total Compensation” from ALL sources, including cash pay, current benefits (healthcare, life insurance, disability insurance, etc,)”

No, sorry, there are many reasons why this is not an appropriate goal, including:

1)The private sector encourages the employment of undocumented workers, whose compensation drags down the averages. The averages must be suitably adjusted to only portray legal employment.

2)The high cost of health care is due to the US’s uniquely corrupt and ineffective health care system, which is primarily the fault of the corrupte US private sector (see Bitter Pill by Steven Brill). In fact, Medicare is the leanest and meanest healthcare alternative, but still, we are a failure compared to the majority of OECD nations. The proper solution is to fix the US’s health care system.

“Right now, PUBLIC Sector workers have a very material “advantage” over their Private Sector counterparts due primarily to post-retirement pensions and benefits that are ROUTINELY multiples greater in value at retirement.”

1)The pension and post-retirement $ benefits (excluding healthcare) are only a factor of 1.26-1.78 higher, and that is in California where DB pensions are too high. In most of the US there is much closer to parity.

2)Of course private sector executives in the US get amazingly high benefits, based principally on their taxpayer bailouts, outrageously high charges for US-taxpayer-subsidized medical payments, US taxpayer funded defense contracts, etc. If any private sector firm receives not a cent of taxpayer money or bailout promise, perhaps those high benefits could be justified. But at the current time, taxpayer money subsidized gross excess in the private sector. So your claim that the public sector is the only place where taxpayer funds go awry is simply wrong.

January 8, 2014 at 2:27 am

Spension, Everything I have stated is true…

(1) when two equally situated (in cash pay, service years, and age at retirement) Public/Private Sector workers are compared,the pensions and benefits of the PUBLIC Sector worker will ALWAYS be multiples greater in value at retirement… sometimes only 2x, usually 3x-4x,and for safety workers,usually 4x-6x.

(2) yes…..near EQUAL Public/Private Sector “Total Compensation” from ALL sources, including cash pay, current benefits (healthcare, life insurance, disability insurance, etc,), and post-retirement pensions & benefits, is indeed the appropriate goal. Public Sector workers are not entitled to any better deal (let alone the MUCH MUCH better deal they always have today) on the Taxpayers’ dime.

(3) an ineffective healthcare delivery system in no way justifies granting Public Sector workers better (Taxpayer-funded) heathcare than that granted Private Sector Taxpayers. Any argument to the contrary, focusing on the healthcare delivery system’s ills, is an intentional distraction from that specific point.

(4) when the True value of annual PUBLIC pension accruals is included (using reasonable and appropriate assumptions similar to those now employed by Moody’s and the GASB), and NOT (as is often done in “studies” funded or conducted by Public Sector Union-supported groups) only the government entity’s actual (usually very insufficient) annual “contribution” into the pension Plan, the Public Sector Plans are ALWAYS multiples (2x-6x as noted in #1 above) greater in value at retirement than those of equally situated Private Sector workers.

January 8, 2014 at 5:48 am

For anyone who would like an unbiased look at how the Public Sector Union/Politician cabal destroy Cities, here’s some recommended reading:

http://unionwatch.org/the-fall-of-pacific-grove-part-1-how-pension-enhancements-created-unmanageable-debt/

January 8, 2014 at 4:28 pm

To see the system Tough Love supports and profits from, read:

http://www.retirementheist.com

Of course Pacific Grove, the first link and actual reference Tough Love provides in months, is a mess. To claim that is characteristic of the entire US public sector pension system is false. Indeed plenty of US public sector entities have modest and well funded DB plans, like, Wisconsin, Washington, and North Carolina.

California’s pension debt and promises have indeed gotten out of hand. Tough Love is neither serious nor fact-based in his approach to solving California’s problems.

Tough Love’s numbers are just wrong. Read a real reference like the report at:

http://www.fixpensionsfirst.com/comparing-public-and-private-employee-compensation-and-retirement-benefits-in-california/

January 8, 2014 at 4:48 pm

The real world (i.e., the private sector) is required through actuarial standards to use mortality tables that assume mortality improvements (i.e., people living longer). Not so, apparently, for CalPERS which lives in a world of its own.

January 8, 2014 at 5:49 pm

Don’t be ridiculous DW! CalPERS does have actuaries and investment officers. It is not the largest Public Pension plan in the world by accident.

January 9, 2014 at 2:59 am

SeeSaw, Yes, CalPERS indeed has actuaries, but the “actuarial standards” they follow (while legal in the PUBLIC Sector only per GASB) are materially less stringent than those that MUST be followed by actuaries signing off on Private Sector Plan valuations.

January 9, 2014 at 3:35 am

spension Says:”To see the system Tough Love supports and profits from …Of course Pacific Grove, the first link and actual reference Tough Love provides in months, is a mess. To claim that is characteristic of the entire US public sector pension system is false.”

Spension, again this is a blog about California pensions systems. Where did Tough Love state Pacific Grove was representitive of ALL US pensions systems. Of course it isn’t, and he didn’t. And, Yes, Pacific Grove is characteristic of the California public employee retirement system, CalPERS or otherwise. And, Yes, the California public employee pension systems are a mess.

January 9, 2014 at 3:40 am

In other news: Securities and Exchange Commission looking into CalPERS stock purchases

“According to an internal memo and a fired employee’s challenge of her termination by CalPERS, some staff at the fund contend that the purchases – and a subsequent decision not to rescind them – calls their managers’ qualifications and judgment into question.

“We wanted to reverse (the trades),” said Ted Nishio, a retiree who worked in CalPERS’ Division of Enterprise Compliance who said he was fired after he told his boss that the fund should quickly act. “But the higher ups said, ‘Let it be.’ ”

– and this comes from an organization with a division pushing & touting the virtues of their Corporate Governance Program which monitors the actions of – apparently everyone but themselves.

Read more here: http://www.sacbee.com/2013/12/28/6031076/security-and-exchange-commission.html

January 9, 2014 at 5:38 am

“Berryessa Chillin’ Says:

As I figured for the comments section in the last thread, the CalPERS shortfall (with the 18 month old information provided at the CP website) works out to about $2,600 per California resident. Throw on top of that the CalSTERS shortfall. Throw on top of that for us unfortunate San Jose residents our own local county and city pension shortfalls and we are talking real money. A private pension under ERISA would have to provide a plan to restore plan assets in a window much shorter than the 20-30 years proposed here. My only complaint about the raised pension rates is that they are spread out too slowly: let governments and our see-no-evil-politicians deal NOW with the fruits of the substantial pension augments in a time frame where voters can act upon them.”

– And if the San Jose Unions had their way they would have switched to CalPERS to “SAVE 500 MILLION over 10 years”. That was there cost saving plan because CalPERS is the KING of debt deferral. The truth is those claimed savings were really a deferral of debt that lowered payments while increasing overall cost well beyond anything prudent. The San Jose Unions proposed cost savings, promoted mostly by the Public Safety Unions, were really a nightmare disguised as a solution.

January 9, 2014 at 5:51 am

Chillin’,

The smoothing policy used by CalPERS is a sham. They have extended payments on unfunded liabilities out so far, for work that has already been consumed, that future generations will be paying for work that was performed before they were born. Some people are referring to this as “intergenerational theft” and I don’t disagree. I equate it to buying a used car with about one year of life left and financing it over 15-30 years.

Girard Millar, a pension expert who now runs the Orange County Pension System, wrote about CalPERS smoothing policy. Here is the link for those who may be interested: Pink Slips and Pension Red Ink: http://www.governing.com/columns/public-money/Pink-Slips-and-Pension-Red-Ink.html

Here is an excerpt:

“How high will this flood crest? Local employers are now skeptical that they have been told the full truth about how high their pension costs will ultimately surge. Unlike the vast majority of public pension funds, CalPERS uses a 15-year actuarial smoothing process that camouflages the genuine economic impact of market fluctuations. I have no issue with normal industry-standard actuarial smoothing periods of 5 years, in light of the average length of a business cycle — which is 6 years based on 14 recession cycles in the past 84 years. But the CalPERS process is opaque and flunks the transparency test that taxpayers, public managers and municipal bond investors are entitled to expect. As I have explained before, such extraordinary “smoothing” practices deserve SEC investigation as an “artifice and device” to conceal relevant financial information from the investment community — as well as the employers who must now bear the financial brunt of unsustainable pension benefits.”

That extended CalPERS smoothing has a great deal to do with the mess you see today. Thankfully some of the CalPERS shenanigans are about to end but not because CalPERS had anything to do with it. CalPERS is incapable of policing itself. CalPERS is CORRUPT!

January 9, 2014 at 5:54 am

Because I should have ended with this story, I will. In other news: Securities and Exchange Commission looking into CalPERS stock purchases

“According to an internal memo and a fired employee’s challenge of her termination by CalPERS, some staff at the fund contend that the purchases – and a subsequent decision not to rescind them – calls their managers’ qualifications and judgment into question.

“We wanted to reverse (the trades),” said Ted Nishio, a retiree who worked in CalPERS’ Division of Enterprise Compliance who said he was fired after he told his boss that the fund should quickly act. “But the higher ups said, ‘Let it be.’ ”

– and this comes from an organization with a division pushing & touting the virtues of their Corporate Governance Program which monitors the actions of – apparently everyone but themselves.

Read more here: http://www.sacbee.com/2013/12/28/6031076/security-and-exchange-commission.html

January 9, 2014 at 7:25 am

Tough Love said on January 7 at 5:53 pm `all Public Sector DB Pension plans are grossly excessive, unaffordable and grossly unfair to taxpayers who are called on to pay for all but the 10-20% of total Plan costs actually paid for by the workers (INCLUDING all the investment earnings on those contributions).’

He did not say `All *California* Public Sector DB Pension Plans.’

Tough Love has repeatedly argued that all DB plans are unsustainable due to unholy collusion between unions and politicians, *everywhere*, no matter what, not just California.

I think DB plans are factually the most efficient retirement system that exists, when run well. California’s are not run well, but other States and public entities do just fine.

January 9, 2014 at 4:08 pm

My non-partisan pension reform group in Marin County (I repeat non-partisan) did the first-of-its-kind financial study of our county and its cities and towns. We tried to find a comparable DB plan (similar population, etc.) that was working in California to use as a model of success. Very tough job! We did find Danville (SF Bay Area), but few others. Our study is called “Pension Roulette.” It demonstrates (using CalPers numbers not ours) the threat of unfunded pension and healthcare costs to our community. Check it out and if you’d like tools to conduct a similar analysis in your community, contact us. http://www.marincountypensions.com

January 9, 2014 at 4:16 pm

Spension, I have agreed with you that DB Plans do in fact have certain advantages over DC Plans, the primary advantage being mortality sharing ….. thereby eliminating the need for each individual DC Plan participant to save enough to provide for a retirement period longer than his/her life expectancy.

However, as I have stated before, I believe that advantage is FAR outweighed by demonstrated inability of elected officials (colluding with the Public Sector Unions) EVERYWHERE to act NOT in the best interest of the Public Sector workers, but in the best interests of all taxpayers …….by the granting of DB Plans benefits MUCH MUCH more generous (and hence MUCH more costly) than any DC Plans these same politicians would be able to grant their workers.

That has happened because ONLY under DB Plans can the true cost of the Plan be hidden and understated and then unfairly passed on to future taxpayers .The results, easily observed EVERYWHERE* is a combination of significantly underfunded DB Plans that are always multiples more generous than those granted their Private Sector counterparts ……. all while these Public Sector workers earn no less in cash pay.

* EVERYWHERE, because per the studies of numerous economists and university scholars, the “official” DB Plan funding ratios are roughly 1/3 higher than they would be if calculated with more reasonable and appropriate assumptions. Hence, even the few Plans with finding ratios close to 100% are significantly underfunded.

January 10, 2014 at 9:55 pm

“EVERYWHERE, because per the studies of numerous economists and university scholars, the “official” DB Plan funding ratios are roughly 1/3 higher than they would be if calculated with more reasonable and appropriate assumptions. Hence, even the few Plans with finding ratios close to 100% are significantly underfunded.”

Not according to Table I of http://crr.bc.edu/wp-content/uploads/2013/07/slp_32.pdf .

January 10, 2014 at 11:36 pm

Spension, Evidently you have trouble reading.

Table 1 in your link show a 73% “official” funded ratio for 2012 (the last year shown)…..and these “official” ratios (being based on the aggressive 7.25%-8.00% “official” Plan liability discount rates) are 1/3 higher than they would be using the liability discount rates Moody’s and the GASB are now using.

And even if we look at the referenced Appendix with the 126 Plans included in that 73% “official” average, only 4 of the Plans show “official” funded ratios over 100% (2 in the State of Wash., 1 in NC, and 1 in Wash. DC),and all 4 would be well below 100% if restated with the Moody’s/GABS liability discount rates.

So it looks like you FAILED to disprove my statement …. I challenge you to try again.

Enjoy, here it is again:

“EVERYWHERE, because per the studies of numerous economists and university scholars, the “official” DB Plan funding ratios are roughly 1/3 higher than they would be if calculated with more reasonable and appropriate assumptions. Hence, even the few Plans with finding ratios close to 100% are significantly underfunded.”

January 11, 2014 at 3:07 am

Uh… Tough Love… no evidence for a 1/3 higher problem due to new GASB rules.

If you are saying that `safe’ bond rates should be used, I disagree. That is bad methodology.

`Only 4′?? you say *EXACTLY ZERO*, so you are wrong.

January 11, 2014 at 5:31 am

spension, It actually looks like my “1/3 higher” was an understatement as it appears to be MUCH worse. I must have taken the 1/3 from an older study.

The following Study (see link below) states that (using 2012 Plan data) the average “official” Public Sector pension Plan funding ration is 73% and under a more appropriate “fair market valuation” it is 39%. That 87% higher, not 1/3 higher.

Here is a summary paragraph from the study:

“A Market-Valued Approach

This fair-market valuation shows the tremendous impact that the choice of a discount rate has on funding health. It demonstrates the extent to which current funding practices undervalue the retirement promises made to public employees. According to official reporting, the overall funded ratio of state plans included in this report is 73 percent – a far cry from the 39 percent level that a fair-market valuation has revealed.”

And here is a link to the full study:

http://www.statebudgetsolutions.org/publications/detail/promises-made-promises-broken-the-betrayal-of-pensioners-and-taxpayers

________________________________

Oh, and since you’re again assigning to me things that I did not say, please show me exactly where I said “EXACTLY ZERO” Plans?. I didn’t, I said the following:

“EVERYWHERE, because per the studies of numerous economists and university scholars, the “official” DB Plan funding ratios are roughly 1/3 higher than they would be if calculated with more reasonable and appropriate assumptions. Hence, even the few Plans with finding ratios close to 100% are significantly underfunded.”

And with changing the 1/3 to 87% (from the study linked above) it’s even WORSE than I initially stated.

January 11, 2014 at 6:04 am

spension Says: “Uh… Tough Love… no evidence for a 1/3 higher problem due to new GASB rules.”

– Spension, do you understand how the new GASB rules (68) will impact state,local, and special district balance sheets?

Spension says: “If you are saying that `safe’ bond rates should be used, I disagree.”

– Do you know that CalPERs uses safe bond rates to discount the liability/cost of cities that want out of the CalPERS system. It pencils out to at least a doubling of the cost of current unfunded liabilities which are discounted at 7.5%. Pacific Grove wanted out of CalPERS and then CalPERS changed their policy to make it cost prohibitive.

That is just one reason why I consider CalPERS “The Hotel California” – You Can Check In But You Can Never Leave.

CalPERS is CORRUPT. The CalPERS BOARD needs to be replaced by people that aren’t union members.

January 11, 2014 at 5:08 pm

Aye, Captain. Calpers “termination” rate is good to note. The game is just getting underway as the public is starting to pay attention to a badly broken pension system that threatens taxpayers and public employees. My guess is that if you asked the public employees in Detroit if they knew what was ahead, they would have been glad to do something about it . . . rather than be in position they find themselves today. Instead, they were obviously lead to believe everything was fine. It is crystal clear that there are a frightening number of municipalities that are on the same road to financial disaster as Detroit, Vallejo and Stockton. How far down the road is not the issue. Marin County is quick to tell you that it has the second highest credit rating in California in response to my group pointing out we have hundreds of millions in pension and healthcare debt. So, what’s the point? It means that it can borrow money to fund its debts? Great solution! More debt. I suggest everyone look into whether your city, town, or county has pension obligation bonds. These “tools” don’t work and I believe they can help mask the terrible debt coming down the road. I did a quick survey of the 26 towns where mayors oppose Chuck Reed’s initiative. I’m not done with my research, but quite a few have these bonds.

January 11, 2014 at 6:13 pm

spension, Here’s an update from StateBudgetSolutions…

http://www.statebudgetsolutions.org/publications/detail/state-budget-solutions-fourth-annual-state-debt-report

Clearly it DISPROVES your often-stated position that while California has DB pension problems, that many other State’s Plans are well run. They’re not …. they’re ALL in the toilet when “properly” valued.

The StateBudgetSolutions approach is to use a 3.225% 15-year Treasury rate to discount Plan liabilities. University scholars and economists seem to agree that this is appropriate (on the basis that the discount rate should be matched to the risk of non-payment and has noting to do with the expected return on invested assets).

While almost nobody (except perhaps the Public Sector Unions and those Plan participants) believes the 7.25%-8.00% discount rates used by these Public Sector Plans is appropriate, there are those (Warren Buffet included) who believe that a rate somewhere in the 5%-6% range is not unreasonable for use in discounting Plan liabilities. In fact, that is what Moody’s is currently using in their credit-worthiness evaluations. The 1/3 higher (overstated Public Sector pension Plans “official” funding rations) in my quote from my earlier comment (vs the 87% higher from the StateBudgetSolutions studies) came from a study that used discounts in the 5%-6% range.

The bottom line (as Captain says) is that CalPERS (and all other) “official” funding rations are very materially overstated.

January 12, 2014 at 6:19 pm

“properly valued” = semantics

If a pension system continues to pay out the required benefits over time, with marginal changes in the contribution rate, it is “funded”.

A “risk free rate” is an arbitrary measure. One of the things government does is assume the risk which would be devastating for individuals, or, more correctly, spread the risk.

January 12, 2014 at 8:57 pm

SDouglas47, No, not semantics. By “properly valued” I simply meant that by NOT discounting Plan liabilities using the SAME rate assumed for the expected return on assets (generally 7.25% – 8%), but by using a discount rate (along with other valuation assumptions) deemed reasonable by those who are both unbiased, knowledgeable, and trained in how to choose such assumptions..

Quoting …… ”If a pension system continues to pay out the required benefits over time, with marginal changes in the contribution rate, it is “funded”.”

Sorry, but by making the above statement, you are clearly showing that you have absolutely no financial education.

And a “risk free” rate (in the context used) simply means the rate the US Treasury is paying on new issues of the indicated duration (BECAUSE, US Treasuries are treated as “risk free”).

P.S. Perhaps the WORST way to learn proper finance/economics is by listening to what your Unions tell you.

January 12, 2014 at 10:20 pm

State Budget Solutions, Tough Love? An organization funded by far-right folks who think Obama was born in Kenya? Nothing they publish is worth a millisecond of consideration. Fix Pensions First, which also gets lots of right-wing funding, consistently values California public pensions *WAY BELOW* your inflated estimates.

Remember, everyone: Tough Love comes from an industry which profits from the destruction the public pension system…

In fact, nobody does a really good job at valuing public pensions. Accounting for the great reduction of mortality risk as well as the long term effects of continuous contributions is not done by the benighted pension actuarial profession.

Nonetheless, California promised way too much. Nobody wants to see any public employee get average employer pension benefits beyond 10% of their salary, of which 6.2% or so are Social Security.

Another 4% or should be it.

January 12, 2014 at 11:00 pm

This is not news. CalPERS has said they would be doing this for over year now. Can’t anybody read? Also, using the city of Sacramento in the example is an unfortunate misstep since the city has already offered to pony-up as much as 1/2 a billion – pinky-fingers up everyone…1/2 a billion dollaaaaars for the new arena paid for by parking meters…yeah, yeah, that’s the ticket!~ Nothing to see here, move along now, private industry is working…huh?

So Lynne, aren’t you concerned about how much money Sacramento taxpayers will gamble on a cas— Arena for a bunch a mill—billionaires who are supposed to be rich enough to pay all the expenses for a private enterprise that according to definition is a “monopoly” or at worst a “cartel” business enterprise AKA Basketball Team Franchise?

Look! A Unicorn!

Made you look…

January 12, 2014 at 11:39 pm

Toughlove, stop with the “anonymous” quoting of people, name names. When has Warran Buffet said or believed that returns would be 5-6%? He just made a killing on his returns! Who are the “University scholars and economists”? Stop pretending to quote people and things and start naming names. It is easy enough to google and youtube people to find out what they said last week, month, year or five years ago.

You are parrot and nothing but a parrot. If I had listened to people like you I would have bought real estate in 2007 and 2008. I would have believed that I could always refinance and I would have believed that the Iraqi’s would greet us as Liberators and that the OIL (Operation Iraqi Liberation later changed) belonged to the people of Iraq, right before we (the US) sold it to the highest bidder.

Now go ahead, name names.

Art Laffer Vs. Peter Schiff

Art Laffer – “well, when you are forecasting the economy, or the weather, or the sex of an unborn baby…Peter is just way off base…this is an economy driven by good trade policy good..”

January 13, 2014 at 12:49 am

P.S. Perhaps the WORST way to develop a convincing argument is by being presumptuous and condescending.

1. I don’t have a union.

B. We all understand the concept of a risk free rate, it is ONE way to evaluate and compare pension systems. It is NOT a definitive indication that a pension system is “unsustainable” in the real world.

January 13, 2014 at 2:11 am

Quoting spension…………. “In fact, nobody does a really good job at valuing public pensions. Accounting for the great reduction of mortality risk as well as the long term effects of continuous contributions is not done by the benighted pension actuarial profession.”

Actually, the conservative US-Govt-regulated PRIVATE Sector Plans are valued (by their actuaries) quite accurately.

Had the methodology REQUIRED of PRIVATE Sector Plans been required of PUBLIC Sector Plans, the huge current underfunding in virtually all PUBLIC Sector Plans would be considerably smaller (if it existed at all) …. but not for the reason you think.

No, these cities would have found that the ONLY way to fully fund their Plans (per Regulatory requirements) WITH AVAILABLE RESOURCES would have been to grant Plan benefits no more than half as generous as the one routinely promised today.

January 13, 2014 at 2:29 am

Quoting Billie…”Tough Love, stop with the “anonymous” quoting of people, name names. When has Warran Buffet said or believed that returns would be 5-6%?”

You should read carefully BEFORE speaking. I never said that Warren Buffet said investment returns woulds average 5-6%. I said that he believes that the interest rate used in discounting PUBLIC Sector Plan liabilities should be in that range.

In fact, the rates used in valuing the remaining DB Pension Plans of employers under the Berkshire Hathaway umbrella (Mr.Buffet’s company) use liability discount rate in that range. Private Sector companies are REQUIRED to use rates that currently fall in this range.

Billie, a suggestion…. save OUTSIDE your very generous promised Public Sector pension ….. considering the growing likelihood your pension won’t be paid as promised.

January 13, 2014 at 3:04 am

Quoting SDouglas47 …… “We all understand the concept of a risk free rate, it is ONE way to evaluate and compare pension systems. It is NOT a definitive indication that a pension system is “unsustainable” in the real world.”

Well here’s a “real world” way to evaluate the health of PUBLIC Sector pension Plans ………

Let’s NOT run with the 15-yr Treasury’s 3.225% “risk free” liability discount rate used by the StateBudgetSolutions study which resulted the average of the “official” Public Sector Plan funding rations (73%) being overstated by 87%. Instead, lets run with the result of using liability discount rates in the 5-6% range (considered appropriate by Mr.Buffet, Moody’s, GASB, and required of Private Sector Plan valuations) which concluded that the “Official” funding ratios are only 1/3 overstated. That 1/3overstatement would bring the “official” 73% average Public Sector Plan funding ratio down to 55%

Now for the Real World” meaning of that (appropriately calculated) 55% funding ratio ……………….

The U.S. Gov’t,in it’s regulation of Private Sector Plan considers a funding ratio below 60% to be SO POOR (and with such a high probability of eventual failure), that the Plan CANNOT credit any additional pension accruals to Plan participants until (and if) the ratio grows to above 60% at some future time.

January 13, 2014 at 7:41 am

More whoppers by the fraud-is-the-right-of-the-private-sector-investment-business supporter Tough Love. The Government does not regulate private sector pensions at all… they’ve largely been drained by the fraudsters of the American private sector.

Pulitzer-sharing Wall Street Journal reporter Ellen Schultz wrote a book about how private DB pensions were drained by the tricks and fraud of the private sector. No comparison to the fraud-ridden private sector management of pensions is worth a darn:

http://www.retirementheist.com

State Budget Solutions is a potemkin organization that just documents whatever conclusion its political donors want.

BTW, upwards of 25 public pension systems have >100% funding.

Click to access morningstar-report2013.pdf

`Risk Free’ rates are extremely different rates than are appropriate for pension evaluation. Tough Love is innumerate, and usually confuses trillions, billions, and millions. He thought private sector payouts for post-retirement benefits were not more than $10 million, but in fact over 200 private sector payouts exceed $100 million (highest over $250 million). For companies that get huge taxpayer bailouts and which survive on taxpayer funded activities, like defense and healthcare.

Tough Love never opposes taxpayer funding of $250 million pensions for private sector individuals; they are the type of people that pay his salary.

January 13, 2014 at 4:41 pm

Quoting spension, …” The Government does not regulate private sector pensions at all… ”

Really?

Never heard of ERISA and it’s many updates since 1974, the last major regulatory update being the Pension Protection Act of 2006?

——————————

and quoting …… “BTW, upwards of 25 public pension systems have >100% funding.”

Yes, of the 1000’s in the country, and then only on Plan’s “official” basis using valuation assumptions that, as discussed in earlier comments, result in funding ratios that are likely AT LEAST 1/3 overstated.

—————————–

And quoting … ” Tough Love is innumerate, and usually confuses trillions, billions, and millions. He thought private sector payouts for post-retirement benefits were not more than $10 million, but in fact over 200 private sector payouts exceed $100 million”

Twisting my words again? As I said earlier, the HUGE Private Sector executive payouts we hear about are never

“pensions”, but almost invariably the exercise of stock options. rewarding their CEO’s for good stewardship. When the shareholders make big money, the boss is handsomely rewarded (and the”Taxpayers” never pay for even one DIME of it … while they DO pay for the grossly excessive PUBLIC Sector pensions).

————————————————–

spension, you’re getting more and more desperate in SEARCHING for a supportable point….ANY supportable point ….. to distract from the well demonstrated (by myself and many others) need to reduce Public Sector pensions, and NOT just for new workers.

—————————————————

January 13, 2014 at 6:19 pm

In 2011, Lockheed Martin had over $17 billion in government contracts.

Its CEO received over $27,000,000 in compensation. (Including over $3.7 million in ” Change in Pension Value and Deferred Compensation Earnings” , whatever that is.

Do you really think ” the”Taxpayers” never pay for even one DIME of it …”?

January 13, 2014 at 7:16 pm

SDouglas47,

So what…it’s a HUGE company producing a very complex range of products. That’s the way the Private Sector works …..they say “here’s what it will cost”. If the gov’t feels it’s overpaying, it can shop elsewhere.

Taxpayers don’t have that option when it comes to paying for the grossly excessive PUBLIC Sector pensions, and benefits.

January 13, 2014 at 8:33 pm

Tough Love, as you know the private sector pensions evade regulation, as documented by Ellen Schultz:

http://www.retirementheist.com

You give know reliable documentation for the 1/3 underfunding… just a potemkin organization (State Budget Solutions). Using the bond rate for present values is obviously wrong.

As for $250 million post-retirement benefits given to Jack Welch et al… money is fungible. And you better believe taxpayers pay the lion’s share of that bill, through regulatory fraud and defense/healthcare contracts held by the companies that pay those exorbitant benefits in the private sector.

I call a spade a spade, and public pensions in California are too high. I’ve offered the only serious solution. But Tough Love, you can never face the fact that the public pension system is high in California due to emulation of the private system, where greed is a god.

January 14, 2014 at 1:48 am

Quoting spension, …. “I call a spade a spade”

So do I, and my “spade” says you’re irrational support of the grossly excessive taxpayer-funded pensions & benefits afforded ALL Public Sector workers everywhere is because either you or a family member is riding this Public Sector pig-fest.

January 14, 2014 at 1:32 pm

No, Tough Love, you irrationally support Madoff, Goldman Sachs misrepresenting products to customers, the $24 trillion bailout, $400 million post-employment packages to guys like Jack Welch with taxpayer funds, Boesky, Milken, Enron, because for you the private sector can never do wrong.

You irrationally support the draining of the private pension system as described by Ellen Schultz, WSJ reporter and Pulitzer winner.

I support modest, well run public DB plans. They are far better than letting the corrupt US investment industry touch the management of pensions. For California I’m the only one with the practical solution of sovereign default; Iceland got through that just fine. Sovereign default is the only legal way to reduce existing pension payouts.

January 15, 2014 at 4:32 am

spension, I see you’re back to your same old DISTRACTION tactics

You need to focus ……,the subject isn’t Madoff, isn’t Wall Street’s evil practices, and isn’t CEO pay…..and CERTAINLY isn’t your biggest distractive tactic, “sovereign default”

It’s the grossly excessive Taxpayer-funded pensions granted ALL Public Sector workers everywhere…and the huge, immediate need to materially reduce them for CURRENT (NOT just new) workers..

January 15, 2014 at 4:50 pm

Uh… covered yourself in disgrace and embarrassment again, Tough Love. You argue for DC plans, which puts retirement money in the hands of those who charge first-class air tickets for their poodle and its hair dresser off as fees for managing the DC plan.

The disgusting practices of Wall Street are *PRECISELY THE REASON* why modest, public run DB plans are more economical.

You never provide real, hard, believable numbers to justify your claims, Tough Love. More of your DISTRACTION tactics.

January 15, 2014 at 8:01 pm

Spesnion, The title of this article is …”CalPERS plans rate hike, third in last two years”….

It’s the financial mess California’s Public Sector Pension system is facing …. it’s NOT something like …..” What has Wall Street done to screw us lately”.

____________________

spension, STILL trying to DIVERT attention from the need for immediate and very material reductions in the pension accrual rate for all CURRENT workers….. just as California’s Little Hoover Commission has recommended.

January 15, 2014 at 9:20 pm

Sorry, Tough Love, are you saying your solution does NOT involve DC plans?

Of course the California pension system needs reductions in future payouts, I’ve said that MANY MANY times. Your claims that I divert attention from that are just false.

And to reduce payouts to retirees and those already vested, Sovereign Default is the only obviously legal technique, which I support. You have no serious alternative, Tough Love.

Meanwhile you make false accusations that I get some sort of DB pension or something. Totally false, just a figment of your imagination, if you had an imagination.

January 15, 2014 at 9:42 pm

Spension and Tough Love, It’s been interesting watching your exchange. I’m part of a nonpartisan group that is focused on solving the problem. A major goal was transparency. We put together a first-of-its-kind study on the financial health of Marin County and its 11 cities and towns. Not a single politician has challenged our findings, which demonstrate that every entity in the area is on the same road as Stockton, Detroit, San Bernardo and others that has led them to bankruptcy and/or service insolvency. Our biggest critic has taken the same tack as Spension by pointing to Wall Street, the1%, etc. He even tried to claim our group was funded by the Koch Brothers. 🙂 Now he wants to see our core groups’ retirement savings — in other words, because he didn’t like our message, he wants to focus on the messengers. Among my issues is paying for someone’s retirement with my meager retirement. Their retirements should be paid for before they retire. Taxpayers should only be paying for services they are receiving, not paying for services from the past. This makes no sense. Check out our study called Pension Roulette at http://www.marincountypensions.com It compares private and public sector compensation. One of you will love it.

January 15, 2014 at 11:56 pm

Quoting Spension… “Sorry, Tough Love, are you saying your solution does NOT involve DC plans?”

I never said that DC Plans MUST be part of the Public Sector pension reform solution ……. although I think that’s the BEST solution because it ends the ability of our Union-bought-off elected official to collude with the workers in gaming the system at taxpayer expense.

The goal must be to VERY materially reduce the cost of Public Sector pensions (by AT LEAST 50%) because they are NOW unnecessarily WAY too generous …DEFINITELY for the FUTURE Service of ALL Public Sector workers EVERYWHERE…..and where the sponsoring gov’t is financially in a state of “service insolvency”, those reductions should include PAST Service accruals as well (and NOT wait for formal bankruptcy or “sovereign default” as you set as a pre-condition to action) before addressing the problem.

Although making such reductions within the framework of the existing DB Plans is not as PERMANENTLY effective as a switch to DC Plans, it can work just fine….if our self-interested, taxpayer-betraying elected officials don’t reverse the reforms.

January 16, 2014 at 12:30 am

David Wren, I took a peak at your referenced site…..no surprises for me. I’m well versed in pension funding and design (and know all the math).

Even a decade ago, I knew these extraordinarily generous pension granted Public Sector workers (everywhere) would one day bite us big-time.

———————————–

Now you can wait for spension the attack-dog to tell you that you’re full of it, don’t know what you’re talking about, and likely a paid Wall Street shill.

January 16, 2014 at 1:02 am

No doubt, David Wren, that pension promises got way too high. My view is that the promises were made because of bad math, mainly. Of course there is pressure from the Unions to get more, but that is the American way… hospital administrators have experienced way higher wage and compensation growth than public service unions over the past 30 years… unions just do what other greedy elements of America do. But it was the actuaries who botched the calculation and advised the politicians to let the raises go through. They were wrong.

The goal of many interest groups (including Tough Love) is mainly to get the pension funds invested where they can steal a slice, like in DC plans.

As documented by Ellen Schultz of the Wall Street Journal, the US private sector stole most of the private DB pension funds. And now they argue that the poverty of the private DB system is an argument to turn over the public sector DB funds to them. Talk about self-dealing and fraud.

The basic model of careful, thoughtful public servants administering a modest DB plan still works in a number of jurisdictions around the country. That is the solution, not the yahoos of DC plans.

Hard to call Marin County an impoverished place, or an uneducated place. But they botched their systems too. WIsconsin didn’t. Washington didn’t. North Carolina didn’t.

The real way out is to try to negotiate reductions for future service and for past vested service. Those negotiations will fail. And then Counties and Cities should prepare for bankruptcy, and do it in some cases. California should prepare a roadmap for Sovereign Default. If those serious plans don’t lead to willingness to negotiate across the board reductions absorbed by all debt holders (bond holders, state contractors, pensioners), go into Bankruptcy & Default and do it that way.

Guys like Tough Love want to protect their friends and industries from the consequences of default, while putting all the burden on only pensioners and unions. I say everybody gets a big haircut, including pensioners and also Wall Street.

January 16, 2014 at 2:12 am

Quoting spension…” But it was the actuaries who botched the calculation and advised the politicians to let the raises go through”

At least with respect to CA’s SB400, that’s BS. The Plan actuaries warned what COULD (and ultimately DID happen) if the markets soured.

And Union-run CalPERS ignored their warnings and suppressed their report. Heck why not. From THEIR perspective, It’s HEADS and the workers “win”, or TAILS and the TAXPAYERS’ lose.

These grossly excessive “promises” weren’t made “because of bad math”. They were made because the Unions bribed our self-serving elected officials with campaign contributions and election support in exchange for favorable votes on pay, pensions, and benefits.

————

And spension, the Pension Roulette study linked by David, agrees with just about everything I’ve said So I guess EVERYBODY must be wrong … but YOU.

————————-

And whoa … next comes your true colors….

Quoting spension…”The real way out is to try to negotiate reductions for future service and for past vested service.”

Did you catch that “NEGOTIATE” the VERY MATERIAL (likely 50+% pension reductions needed) … with a UNION ? Oh yea, THAT would be productive … when pigs fly.

January 16, 2014 at 2:34 am

David Wren, I just went through the first 15 or so pages of Pension Roulette. My complements … very nice, accurate and thorough work.

Just 2 comments on that section of the report……….

(1) Your group repeated the misconception that an 80% funded ratio (with appropriate assumptions) constitutes (the bottom level of) a “healthy plan”. Please see the following write-up from the American Academy of Actuaries, perhaps the most definitive source on this issue. Here is the link:

http://actuary.org/content/actuaries-debunk-myth-80-pension-funded-ratio-alone-constitutes-%E2%80%98actuarially-sound%E2%80%99-recommen

(2) The report identified 4 elements of the pension formula/process for which advantages on the Public Sector side (multiplicatively) result in Public Sector pensions often 2-3 times greater in value than those typically received by Private Sector workers (where both the Public and Private Sector workers make the same cash pay).

What your report neglected to point out are often WIDE differences in what is included in “Pensionable Compensation”. As an extreme example of that point (and it’s abuse), the Contra County Unions are now suing the County to overturn a new law seeking to prevent end-of-career pay (and hence pension) “spiking”. Their justification …. well, everyone that retired before us got to do so, so we should too. Amazing … You can’t make this stuff up !

January 16, 2014 at 3:36 pm

Tough Love, provide some evidence of `bribes’, remembering that in your industry, Madoff & Boesky & Milken all ended up in the slammer.

And I completely disagree… the math used is and was faulty. The dominant feature of the stock market is fluctuation, not smooth growth… yearly gains of 5-10% (depending on stock asset class) but standard deviations of 20-40%. The fluctuations dominate, not the smooth growth.

Want to see your hilarious cherry picking? You cover your self in embarrassment. You pick:

”The real way out is to try to negotiate reductions for future service and for past vested service.”

and criticize that. Well, the next sentence is.

“Those negotiations will fail.”

The only way the negotiations will succeed is if there is a very real plan and threat for bankruptcy and/or sovereign default at the state level.

Tough Love’s plan? No plan at all. None. His plan is not to solve the problem, and merely agitate for moving retirement plans into his corrupt DC industry.

January 16, 2014 at 5:02 pm

Tough Love, thank you for your comments about our report and the link! I think you can see why our data and report was not challenged by any politician. Our goal was to provide facts and some logical analysis — and avoid spinning anything. We are working on a follow up study that should create some more worthwhile discussion … and hopefully some action. We did not touch on pension spiking in the report, but are well aware of this practice. While pension spiking should (and I believe does) upset most taxpayers, I believe that actuaries do not account for this common practice — so underfunding pensions is automatic. Does this make sense? We have a “rockstar” actuary in our group plus two CPAs, two attorneys (one labor), a pension plan consultant, and a couple of financial guys and others with experience. We are a truly nonpartisan, too. As you can imagine, those who do not like our facts, have sought to align us with the Tea Party and try and attack our membership. This tactic backfires immediately when people learn the backgrounds of the members of our group.

January 16, 2014 at 6:22 pm

I looked at your report David Wren… there is a lot of good basic analysis. But I would in fact challenge some `facts’…

1) I don’t in any way agree that retirement at age of 50 or 55 is appropriate; I think retirement age of 63 or 65 is appropriate. However, it is unclear what your assumptions are in, for example, the bars of chart #1 on page 17. What are the assumptions for durations of employment and date of retirement? Is every public employee assumed to retire at the earliest age possible? (it looks that way). What I would say would be `accurate’ would be to take the real-world distribution of employment durations and retirement ages. A typical tactic to synthesize `facts’ is to take a worst case analysis of those you don’t like, and an average case analysis of those you do like, and compare them. Or, to cherry pick the data any which way to make the point you set out to make. For example, private sector retirement benefits for executives (say, for Jack Welch) have soared in the past 30 years, sometimes beyond $400 million. It would be inaccurate to use only Welch as a private sector comparison. But it is also inaccurate to omit what has happened to post employment executive benefits from averages. At the moment, it does look like your report makes statistically inaccurate comparisons.

2)Comparing at all to the private sector averages has another flaw… private sector systems have been subject to fairly gruesome raiding and mismanagement by the private sector. Wall Street Journal reporter Ellen Schultz wrote a book (The Retirement Heist) about that. For her other work, she shared a Pulitzer Prize.

It may be, David Wren, that you regard any criticism as your work as evidence someone is a pro-Union `Occupy’ 47% sponger. The mirror image of those who claim you are a Tea-Partier. So that detracts from the seriousness of your effort too.

January 16, 2014 at 8:40 pm

David Wren, The following link includes a description and access to an EXCEL spreadsheet analysis tool that novice users can experiment with ….. costing out typical Public Sector pensions. It is provided by Ed Ring, executive director for the California Public Policy Center:

http://californiapublicpolicycenter.org/a-pension-analysis-tool-for-everyone/

While not of the detail actuaries would use (with double decrements out to age 120) it is very “understandable” for the intended audience and quite accurate.

And most importantly, it can very easily be used to debunk the omissions, half-truths, distortions, misstatements and outright lies coming from the Public Sector Unions/workers (incorrectly) minimizing the TRUE value of their pensions..

One place where it could be particularly valuable would be in a presentation getting a point across (with “what-if” scenarios) to an audience.

———————————-

Should you choose to experiment with this spreadsheet, note that it is set up to get the green-highlighted cell to zero. While Mr’.Ring seems to suggest trial-and-error inputs to get that cell to zero, getting the green cell to zero can accomplished MUCH more easily using EXCEL’s “goalseek” function.

January 16, 2014 at 8:45 pm

spension,

Quoting from DavidWren’s earlier comment… “Our biggest critic has taken the same tack as Spension by pointing to Wall Street, the1%, etc. He even tried to claim our group was funded by the Koch Brothers.”

Give it a rest!

January 17, 2014 at 12:31 am

“omissions, half-truths, distortions, misstatements and outright lies”

Pretty much describes the CPPC pension analysis tool article.

It looks very much like ToughLove math.

For most safety workers, CHP specifically, the old formula was 2% @ 50. The “new, improved” formula was 3% @50.

OK so far.

BUT, the new 3% @ 50 formula is a constant 3% from 50 on up, it remains at 3%.

The old 2% @ 50 formula was graduated: 2% at 50 increased by increments to 2.7% at 55.

In the example given, the benefit factor of a 55 year old with 30 years service would be 81%, NOT 60%.

In EITHER case, an officer who began his career at age 22 would be able to retire at 55 with……90% of final pay.

The only retirees who saw a 50% increase in pensions were those who retired at age 50. Not common because the average age of recruits is mid to late 20s.

……………..

The same math works on many miscellaneous employees who were given those “huge obscene retroactive union thug pension increases” by the infamous SB400.

“2% @ 60” is the descriptive name of a range that GRADUATES from 1.092% @ 50 to 2.418% @ 63 or over.

“2% @ 55” is the descriptive name of a range that graduates from 1.1% @ 50 to 2.5% @ 63 or over.

Simplifying the benefit increases leads to huge exaggerations in the effects of SB 400. Anyone who retires (or, more correctly, begins to draw a pension) at age 50 or 63, the two extremes of the formula, sees only about a two or three percent increase in their pension.

I say “begins to draw a pension” because it has been pointed out to me that many state workers who worked at least five years (minimum for vesting), then went to the private sector, could, and often do, begin to draw their pension at age 50, even though they are likely still employed in the private sector. (These people are NOT eligible for retiree health insurance)

This brings down the “average retirement age” listed by CalPERS to 60 for public sector employees, although in my experience, few public sector workers retire until well into their 60s. I seldom worked with firefighters, but most of the CHP officers I knew also retired in early to mid 60s, though Calpers lists their average “pension age” as 57.

In my case, a 3% increase in retirement formula was welcome, although it was more than nullified by the failure of wages to keep up with CPI since 1999.

Good for the taxpayer, not so good for me.

IF the legislature had passed an automatic annual CPI increase INSTEAD of SB400, I would have been much better off. Rough estimate; about 7% higher pension.

January 17, 2014 at 1:00 am

Another Tough Love evasion of the central point.

January 17, 2014 at 3:39 am

Quoting SDouglas47… “In my case, a 3% increase in retirement formula was welcome, although it was more than nullified by the failure of wages to keep up with CPI since 1999. ”

Have you considered that perhaps the Taxpayers finally realized how OVERCOMPENSATED you were ….. and wage “increases” lower than the CPI were an attempt to being some “compensation-fairness” (re Private Sector compensation) to the table ?

And interestingly, you dwell on the specifics of just how big your retroactive pension increases were…… but don’t address or question the APPROPRIATENESS of pension increases applied RETROACTIVELY to PAST years of service for which you provided absolutely zero incremental “consideration” … and were nothing but a theft of Taxpayer “wealth”.

January 17, 2014 at 3:51 am

Spension, While the misdeeds of the1% and “Wall Street” are many, those issues are at most, 3-rd or 4-th order related to Public Sector pensions. They are separate and apart from the very clear and INDEPENDENT need to address (via very material reductions) the grossly excessive pensions currently promised virtually all Public Sector workers.

Your tying of these issues together and insisting that pension reform cannot and should not be addressed without simultaneously addressing the misdeeds of Wall Street and the1%, is simply YOUR contribution toward slowing these very needed pension reforms.

Who do you think you are fooling?

January 17, 2014 at 2:08 pm

I have not once used the phrase `1%’. That is your construction, Tough Love, and also David Wren’s, who falsely claims to be non-partisan,,, using that phrase proves he is not at all non-partisan.

Anyone, like you, Tough Love, who argues for a conversion to DC plans wants excessive fees to go right to the Wall Street Fraudsters.

That is a 0th order effect.

Anyone who does comparisons to the private pension system runs up against another 0th-order effect of private sector fraud. What happened to the huge pension overfundings in *PRIVATE* sector DB plans in 1999? Huh? Do you know Tough Love? Read Ellen Schultz’ book to find out… Did the private sector behave responsibly, and hold on to the overfunding for the inevitable downturn in the stock market? Nope, they used the politicians they bribed to change ERISA to allow them to spend out the alleged overfunding.

So if you ever compare to the private sector pension system, which you do all the time, Tough Love, and which David Wren did too, you run up hard against a 0th order effect of private sector malfeasance.

I’ve never denied that the public sector raised pensions too high in 1999 (and earlier). That is a fact. It is a similar fact that the private sector shredded its DB system in 1999, which is never discussed by Tough Love or by David Wren. And since you don’t discuss that, you cover yourself with embarrassment and eliminate your credibility.

January 17, 2014 at 4:20 pm

OVERCOMPENSATED ??

Now your just making me feel bad.

Actually, I was just pointing out the gross exaggerations of CPPC, and others, continually referring to the “50% increases” in pension formulas.

January 17, 2014 at 4:25 pm

Another common feature of CPPC math and ToughLove math:

” The three examples provided here are chosen because they clearly illustrate some of the key financial issues that challenge the solvency of pensions today.”

………………..

The “examples” all include an employee with a final salary of $100,000 a year. No wonder the “average” taxpayer is incensed. These “examples” are so ubiquitous they make it appear that they are typical.

Try using the SEIU office and clerical workers, with an average salary of $38,000, or IUOE maintenance workers, $45,000 average.

And don’t compare JUST the present value of pensions of “average” private sector workers. Compare total compensation of similar workers.

…….

Similar jobs:

Private…….$4,200 mo salary

employer pension contribution….$200. (401(k))

employee pension contribution…$200

Net take home pay………$4,000 mo

retirement investment….$400 mo

Public employee…$4,000 mo salary

Employer pension contribution…$400 mo

Employee pension contribution ..$400 mo