The CalPERS board last week tentatively approved an employer rate hike of roughly 50 percent over the next half dozen years, replacing a policy that kept rates low during the recession with a plan to reach full funding in 30 years.

While giving unanimous “first reading” approval to the proposal by Chief Actuary Alan Milligan, the board asked for more information before final approval scheduled next month.

“Any addition to the schools (rate) is likely to result in layoffs to employees,” said the board president, Rob Feckner, who represents the largest group of CalPERS members, non-teaching employees in 1,488 school districts.

Feckner’s request for options for a “longer horizon” for phasing in the rate increase, softening the blow to employers, was joined by Treasurer Bill Lockyer’s representative, Grant Boyken, and board member Michael Bilbrey.

The proposal for a new actuarial method would show state and local government employers the new rate plan in their next annual valuation report. But a five-year phase in of the rate increase would not begin until fiscal 2014-15 for state and school employers.

The rate increase would not begin to phase in until fiscal 2015-16 for the local governments in the giant California Public Employees Retirement System, 1,567 public agencies with 2,044 retirement plans.

“Contributions that we need for the system really depend on the funded status of the plan and matters that are unrelated to their (employers) financial ability,” Milligan told Feckner. “Having said that, I will take a look at what we can do in the way of providing options.”

The CalPERS funding level has not recovered from a $100 billion loss during the deep economic recession and, under the current rate policy, is not projected to reach full funding in 30 years.

The CalPERS investment fund, expected to provide about two-thirds of future pension payments, peaked at $260 billion in the fall of 2007, dropped to $160 billion in March 2009 and was back up to $256 billion last week.

The total CalPERS fund had 101 percent of the projected assets needed to cover future pensions in 2007. The funding level dropped to 60.8 percent in 2009 and in the last valuation (as of June 30, 2011) was back up to 73.6 percent.

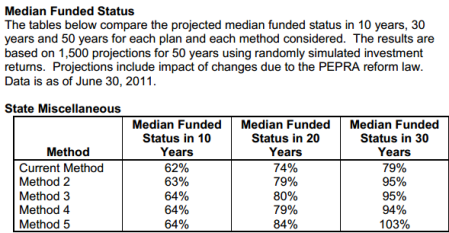

Under the current rate policy, the funding level in 30 years is projected to reach 79 percent for most state workers, 86 percent for most local governments and 82 percent for non-teaching school employees.

A funding level of 80 percent is adequate, some experts think. But CalPERS officials, shaken by the huge investment loss five years ago, worry that another deep recession could drop funding low enough to make reaching full funding impractical.

“Some academicians have said if you go much below 55 (percent) you never can recoup or regain your status,” said board member Henry Jones. “The option of looking at not having that happen is therefore very important.”

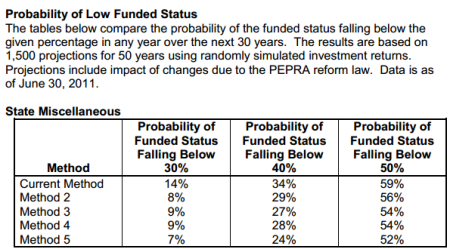

Board member George Diehr said he was concerned that even with the proposed rate increase, the CalPERS funding level would still have a high probability of dropping below 50 percent in the next 30 years.

“I think falling below 50 percent creates a high risk of political attacks, changes to the defined benefit (pension) system that might be not just what happened, the reform that was just passed, but more likely what happened in San Diego or San Jose,” Diehr said.

Gov. Brown’s pension reform, AB 340, took effect in January, giving new hires smaller pensions and raising some employee contributions. Voters in San Diego and San Jose approved more sweeping pension reforms last June.

Both measures attempt to cut pensions earned by current workers in the future. The San Diego measure switched new city hires from pensions to a 401(k)-style individual investment plan widely used in the private sector.

Even with the proposed new rate policy, the CalPERS funding level has a 52 percent probability of dropping below 50 percent during the next 30 years, according to 1,500 projections of randomly simulated investment returns.

“They make some significant changes,” Diehr said, “but I think a fiscal conservative would say they don’t go far enough.”

He asked Milligan for an estimate of rate increases needed to lower the probability of a 50 percent or lower CalPERS funding level during the next 30 years to 40 percent, 30 percent “and if it doesn’t crash your software, 20 percent.”

Diehr said CalPERS has been “too protective” of employers who raise pension benefits. He said employers should take the responsibility for any sharp increases resulting from higher benefits, whether through reserves or borrowing.

“In the end, what it might come to, as the head of Human Resources in the city of Palo Alto has suggested, they may need to seek legislation to go after the other lever here that we can’t touch — and that’s the liabilities themselves, the pension benefits which drive the liabilities,” Diehr said.

Milligan’s proposal would end the current complicated rate policy that uses a radical 15-year period for “smoothing” investment gains and losses, a “corridor” to limit smoothed values and rolling “amortization” that refinances debt each year.

The chief actuary wants to use a “direct” policy that would determine the rate increase needed to reach a funding level of 100 percent in 30 years, then phase in the rate increase over five years.

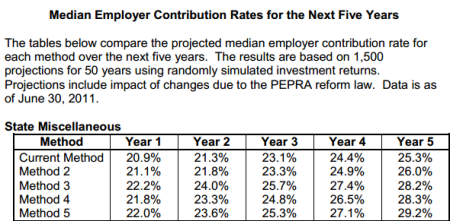

Under the five-year phase in (“Method 5” in the charts), the current employer rate for most state workers, 19.7 percent of pay, would increase to 29.2 percent, schools from 11.4 percent of pay to 18.9 percent, and public agencies from 14.9 percent to 23 percent.

Dan Pellissier, president of California Pension Reform, told the CalPERS board the proposal would undo “nearly a decade of fiscal negligence” that Milligan’s predecessor, Ron Seeling, said in 2009 was “unsustainable.”

“Method 5 would produce the dramatic changes in CalPERS funding policy needed to protect the beneficiaries and reduce the long-term cost of benefits for all,” he said.

Pellissier, a CalPERS pensioner with 24 years of service credit, said he was concerned the board had failed in its fiduciary duty to protect assets. His group unsuccessfully tried to put a pension reform initiative on the statewide ballot last year.

CalPERS is considering other changes that could increase rates: Later this year completion of a risk-reduction study that may result in more conservative investments, and next year factoring in longer life spans and a review of the earnings forecast.

At least one board member, J.J. Jelincic, disagrees with critics who say the CalPERS earnings forecast, 7.5 percent a year, is too optimistic and conceals massive debt. He asked Milligan for the probability of reaching 120 percent funding.

Jelincic cited a 2011 report that the 100 largest corporate pension funds had an average earnings forecast of 8 percent. “Our return assumption is not unreasonable,” he said.

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at https://calpensions.com/ Posted 25 Mar 13

_________________________________________________________

Here are excerpts from charts attached to a proposal for a new actuarial method presented to the CalPERS Pension and Health Benefits Committee last week. Chief Actuary Alan Milligan is recommending “Method 5.” The excerpts are for the fund that covers most state workers, “state miscellaneous.”

_________________________________________________________

March 25, 2013 at 1:20 pm

Taxpayer should revolt.

With Public Sector workers earning no less in “cash pay” than their Private Sector counterparts, WHY are they STILL accruing pensions that are multiples greater than what the Taxpayers typically get, and 80-90% paid for by Taxpayer contributions and the investment earnings thereon …. earnings that would have stayed in the Taxpayers pockets to to fund THEIR (much smaller) retirement in the absence of the need to fund these grossly excessive and unjust pensions.

March 25, 2013 at 2:42 pm

Quoting …”At least one board member, J.J. Jelincic, disagrees with critics who say the CalPERS earnings forecast, 7.5 percent a year, is too optimistic and conceals massive debt. He asked Milligan for the probability of reaching 120 percent funding. Jelincic cited a 2011 report that the 100 largest corporate pension funds had an average earnings forecast of 8 percent. “Our return assumption is not unreasonable,” he said.”

His last sentence shows just how incompetent he is to be on this Board. Does he even KNOW that Private Sector Plans use MUCH MUCH lower (in the 5-6% range) interest rates for discounting Plan liabilities …. NOT the asset earnings assumptions (a GASB-allowed quirk which virtually all financial economists agree that it materially understates Plan liabilities … and hence funding requirements) ?

March 25, 2013 at 6:02 pm

It is important to keep in mind that to stay even in a given year, CalPERS must earn 7.5% on the “present value of promised payments,” not the present value of assets. If it earned 7.5% on assets, but earns zero on the deficit, the unfunded deficit will grow by 7.5% per year compounded

If total present value of liabilities is, say 420 million dollars, and the plan earn 7.5% on 260 million in assets(PVA), the deficit would grow in that year by 7.5% of the 160 million dollar deficit.

So the longer the delay in increasing rates, the faster the deficit grows. Deficits earn zero per year.

March 25, 2013 at 6:23 pm

Further to my earlier post; here in pacific grove, its plan has 120 million in the present value of liabilities and 60 million dollars in an unfunded deficit and 20 million in principal (at an APR of about 7.5%) Its annual payment to Calpers is about one million dollars per year and the employees pay about one hundred thousand dollars per year. But last year PG paid out about six million dollars to its retirees. It paid 1.6 million for pension bonds and its unfunded deficit grew by over eight million dollars.

March 26, 2013 at 3:15 am

This is a big problem that needs to be dealt with now. At the least d by now no further unfunded liability should accrue. There should be a fair plan to spread the unfunded liabilty to both entities but no further liability occur. until then I refuse to take responcibilty for any government government pension debt.

March 26, 2013 at 5:31 am

Tom, What you want can ONLY be obtained by the WORKERS (not the Taxpayers) being the backstop for investment losses …..via higher employEE contributions.

Given the historical level of insatiable greed form the Union & workers, as well as their “Taxpayer-be-damned” attitude, FAT CHANCE that will even happen.

March 26, 2013 at 12:20 pm

In view of the massive transfer of wealth that has occurred from working and middle class folks to the 1% (done in part by reducing private sector workers’ benefits and pensions), rather than attacking the people who stll have somewhat decent benefits, we should be insisting that private sector come up to the level of the public -sector. Emploees and employers should contribute to a pension plan that goes with you if you change jobs. Sort of Social Security on steroids.

March 26, 2013 at 5:52 pm

Quoting ….”we should be insisting that private sector come up to the level of the public -sector.”

Sure “we” should be. But since YOU are very likely a Public Sector worker already receiving (or promised) sure a rich pensions, YOU really have no incentive n to work toward that end.

But if the Taxpayers take away yours … (to the extent it’s now greater than OURS … which is quite a bit), I’d bet you would indeed than have an incentive to work for the betterment of ALL of us (non-1 percenters), and NOT just yourselves.

So …. first we need to take YOURS away.

March 27, 2013 at 12:50 am

“Jelincic cited a 2011 report that the 100 largest corporate pension funds had an average earnings forecast of 8 percent. ”

Tough Love said ” Does he even KNOW that Private Sector Plans use MUCH MUCH lower (in the 5-6% range) interest rates for discounting Plan liabilities”…

Look at this link…

http://www.pionline.com/data-store

The 3 private sector DB plans downloadable without paying use expected rates of return of 8.5% (3M), 7.8% (Abbott Labs), 8.0% (Aetna).

This page…

http://www.milliman.com/expertise/employee-benefits/products-tools/pension-funding-study/

notes:

`Companies continued to lower their expected rates of return on plan assets, to an average of 7.5% for 2012, as compared with 7.8% for 2011, 8.0% for 2010, and 8.1% for 2009. This represents a significant drop from the average expected rate of return of 9.4% back in 2000.’

However, the private sector uses a different *discount rate* than their *expected rate of return*. From the last link,

“The median discount rate decreased to 4.02% at the end of 2012, from 4.78% in 2011 and 5.44% in 2010, continuing the decline from 7.63% at the end of 1999. Discount rates were 233 basis points higher at the end of 2008. The drop in rates over the past three years greatly accelerated the erosion in funded status.”

CalPERS uses, I think, the same number for both the expected ROR and the discount rate.

That private sector DB plans use different discount rates and rates of return, while public ones use the same, is discussed here:

http://online.wsj.com/article/SB10001424052748704358904575477731696162858.html

“Corporate plans use a discount rate based on corporate bond yields. But government plans use their expected return rate on all investments as their discount rate.”

What is left unsaid is that corporate plans still assume a pretty high rate of return. But they hedge things a bit by assuming a lower discount rate.

Still, the heart of the pension mess IMO has been the raising of public benefits, say in 1999, when the market was high (and doing so retroactively back to 1991, at least in California). Nobody who understands that the securities markets are volatile would ever have allowed that.

The time to be careful with assets is during a boom.

March 27, 2013 at 4:13 am

Quoting Spension …”What is left unsaid is that corporate plans still assume a pretty high rate of return. But they hedge things a bit by assuming a lower discount rate.”

The discount rate used in Private Sector Pension Plan valuations are dictated by Gov’t regulation. These Plans have no choice as to the rate used. With few exceptions, financial economists believe that the lower liability discount rate used by Private Sector Plans (and even LOWER ones) are MUCH more appropriate for valuing the high level of “guarantees” associated with Pension Plan liabilities. They invariably believe that the (GASB-allowed) practice of Public Sector Plans of discounting liabilities using the investment return assumption is inappropriate and materially understates Plan liabilities.

March 27, 2013 at 2:58 pm

Tough Love, and documentation or web links to justify `financial economists believe that the lower liability discount rate used by Private Sector Plans (and even LOWER ones) are MUCH more appropriate for valuing the high level of “guarantees” associated with Pension Plan liabilities’?

The recent Stanford study used lower values for *both* rate of return *and* discount rate. Don’t recall they saying anything about using a high rate of return and a low discount rate.

High rate of return and low discount rate might be better, might not, I don’t know. But private sector plans *do* assume future rates of return similar to public plans, >7.5%. They just don’t discount them as much.

Historically, there have been huge shenanigans in the management of private sector plans… corporate raiders in the 1980’s drained them for private gain. Also, non-public unions who controlled pension funds were similarly corrupt. It might be that public sector plans are the most honest, although perhaps that is like being the most honest guy in the prison yard.

In any case, the assumption of smooth discount rates or rates of returns is heavily flawed. The real issue is the huge volatility in all securities markets. That California public pensions `blew the top’ in 1999, due to total ignorance of volatility, was a far bigger deal than any minor mistake in discount or return rates.

If anything, benefits should be slightly cut when the markets are high. Saves funds for the inevitable downturn, which is the time to make very modest increases, if you’ve saved the funds for it. The original Keynsian idea, which has been distorted into deficit spending because no-one scrimps during the boom.

March 27, 2013 at 3:44 pm

Spension …here’s you documentation:

http://www.heritage.org/research/reports/2013/03/official-education-spending-figures-do-not-incorporate-full-cost-of-teacher-pensions

March 27, 2013 at 5:03 pm

Thanks… looks like that article traces back to:

http://pubs.aeaweb.org/doi/pdfplus/10.1257/jep.23.4.191

Novy-Marx (haha) and Rauh suggest using the US Treasury rate for a discount rate, which is well below what US private corporations use.

I disagree with using the concept of smooth multipliers, however. Volatility dominates, so the projection rates of failure are more appropriate.

What was interesting to me in the above tables was how insensitive the failure rates were to increasing contribution rates. 14% versus 7% of less than 30% funded is in the noise.

April 2, 2013 at 7:10 pm

I am a public employee and retired getting a pension. I only get $150,000 annually with 3% increases for the rest of my life. I only get life time health coverage care (free) for me and my wife. My two children must pay for health coverage. I think my kids should get my pension when I die and my health coverage. Don’t be mad, I’m just sayin. . .

April 8, 2013 at 1:20 am

Jason,

I retired from a private company. No pension, just 401k which will last for maybe 10 years if I withdraw $25,000 a year. I have to pay for my health care $10,000 a year.

I think you should share your pension with me, because I paid for it.

May 1, 2013 at 1:12 am

Did anyone stop you from getting a state job Sam? Exactly, what do you have to say now? You chose not to work for the state, so you don’t deserve a dime. You’re lazy and looking for handout.

July 31, 2013 at 9:44 pm

Great article, great discussion (for the most part). Unbreak (the nest) egg: return my 30 years of contributions with a 8.0% ROR, and let me roll them into a tax deferred plan. I will living in Belize quicker than you can say, “Taxpayer should revolt.”

July 16, 2015 at 5:13 pm

I am life long Californian considering taking a position with a public agency and stumbled in here looking for some perspective on PERs and the article did that for me. I will likely not pursue the position based on some of the actuarial data presented here, thank you for that.

I read the comments and most were quite insightful but for those who say they are paying for the retirements PERS offers its retirees, maybe you do, maybe you don’t, it depends largely on which among the 2044 collective bargaining agreements which pay in to PERS are in place where you live. For the average state worker, you are correct, we all pay for that but so don’t the tourists who travel to California, the motorists who drive here and the businesses who do business here.

More to the point, those retirements were negotiated in good faith by bargaining parties, sometimes school districts or state and county officials, sometimes city officials who you elected or hired to do that work in your particular area.

No matter which of the more than two thousand agreements we are talking about they were negotiated by learned people on both sides of the table often at the expense or instead of other benefits or in exchange for other concessions at that time.

It makes me sad to think there are people who believe tax payers should revolt over the idea that deals they made or that were made on their behalf are subject to opinion of some members of our communities who were either not smart enough or stupid enough to seek out a job or career which provided a defined benefit pension whether in the public or private sector,